Blockworks From the Blockchain Impossible Triangle to the Big Convergence

Blockworks Blockchain Impossible Triangle to Big ConvergenceAuthor: Mike Ippolito, Blockworks Newsletter; Translator: LianGuai0xjs

“Our dinner does not come from the benevolence of the butcher, the brewer, or the baker, but from their regard to their own interest.” – Adam Smith

The Blockchain Trilemma

This is an age-old problem in the crypto space that has become increasingly important today.

Originally proposed by Trent McConaghy and accepted by Vitalik Buterin, the blockchain trilemma describes a series of trade-offs that blockchain must make.

- Beyond Ethereum – Third Generation Blockchain Will Drive Mass Adoption

- MakerDAO chooses Solana as the application chain? It’s too early to draw a conclusion, at least 3 years are needed to achieve it.

- Arbitrum vs. Optimism A new round of Red vs. Blue battle begins with Layer3.

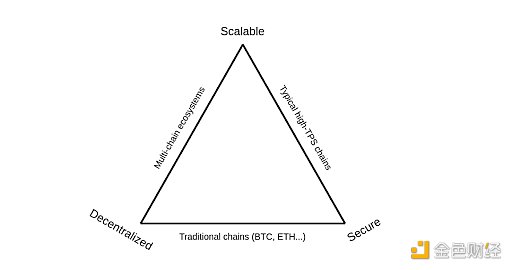

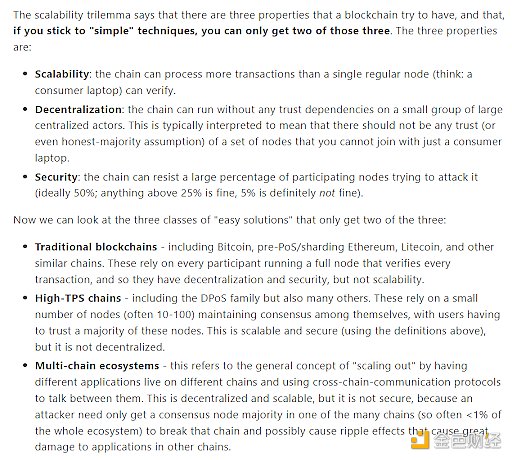

The scalability trilemma states that with a “simple” design, a blockchain can only achieve two out of three attributes: scalability, decentralization, and security.

Here are Vitalik’s own words:

Every existing blockchain was initially optimized for one or two attributes.

I bring up this trilemma again because some blockchains have matured enough and are attempting to “solve” this trilemma and strive for all three.

This has led to certain leading blockchain ecosystems, especially Ethereum, Cosmos, and Solana, converging in their architectures. (Note: There are other blockchains that could be applicable to this problem, but these are just some examples that I am most familiar with.)

So, how will this develop?

Which blockchain will “dominate” others? Or will multiple blockchains coexist with different trade-offs?

This is the question I want to explore today.

The Key Role of Validators

At a high level, a blockchain is a shared database where users can verify the integrity of computations happening on the network.

All blockchains exist on a spectrum that determines the level of decentralization of these databases.

In some blockchains, like Bitcoin, computation is heavily restricted (1MB blocks, 10-minute block time), to the point where even ordinary users can run full nodes and verify on-chain data.

On the other end, there are black boxes maintained by highly capitalized and complex entities, such as Binance.

Most of the differences between different blockchain ecosystems can be traced back to the role of validators.

Decisions about A) what validators should do, B) who validators should be, and C) the threshold for validation are crucial factors that determine the block space characteristics of a blockchain.

These decisions are so important that they have caused internal conflicts within blockchain ecosystems.

The most famous example is the Bitcoin block size debate that took place between 2015 and 2017, with the small block camp emerging as the winner.

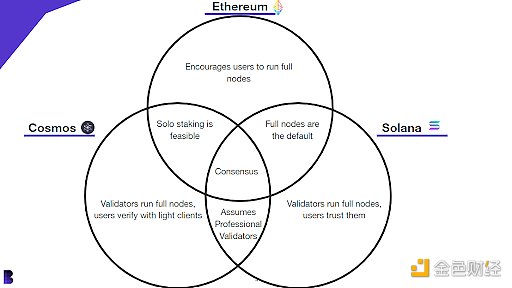

Ethereum, Cosmos, and Solana all occupy positions on this spectrum.

They have made the most progress in different aspects of blockchain design mentioned by Vitalik in reference to the social scalability trilemma (Ethereum as a traditional blockchain design, Solana as a high TPS blockchain design, Cosmos as a multi-chain design).

However, it should be noted that I do not represent any of these ecosystems. The following are my personal views, which may be incorrect.

However, in any case, this is how I view the similarities and differences among validators in these different ecosystems.

Similarities and Differences Among Validators

Ethereum’s design choice is to make validators as generic, simple, and cheap as possible.

Ethereum’s design choice is to make validators as generic, simple, and cheap as possible.

This is because Ethereum believes that users of the network should also run full nodes.

From a traditional decentralized perspective (users can validate the blockchain), this is good, but it severely limits Ethereum’s performance.

This is why Ethereum has accepted a rollup-centric roadmap, although this brings significant trade-offs.

This is similar to Cosmos, where the hardware requirements for running nodes are relatively inexpensive (although not as cheap as Ethereum).

However, because Cosmos nodes must run both consensus and application code simultaneously, and are expected to actively participate in governance, the role of validators is more expensive and complex.

Due to this design decision, Cosmos primarily assumes that validators will be professional entities.

But this does not mean that Cosmos does not care about independent validators.

Based on my understanding (which may be wrong!), Cosmos’ vision is for professional validators to run full nodes, while users run light clients (which may eventually run on mobile phones, although it is not feasible today, but it is likely to be implemented in the future).

Solana also makes similar assumptions. Although the hardware costs for running validators on Solana are much higher today, unlike Ethereum or Cosmos, independent validators still have the possibility to participate (although this is not the default assumption).

In exchange, Solana achieves high performance and composability on the shared layer, making Ethereum’s rollup vision even more elusive on it.

Similar to Cosmos, the Jump team building Firedancer is also developing a light client implementation called Tinydancer.

In the end, you can see the future of Solana, A) as the hardware scale expands, and B) with the existence of light clients, the decentralized nature of its network will appear similar to Ethereum.

It is worth noting that, regardless of what crypto Twitter may make you believe, these design decisions are no more noble than others.

They are just more suitable for different parts of the blockchain scalability trilemma. So this does not mean that Ethereum cannot scale, or that Solana is not decentralized, or that Cosmos is not secure.

Convergence

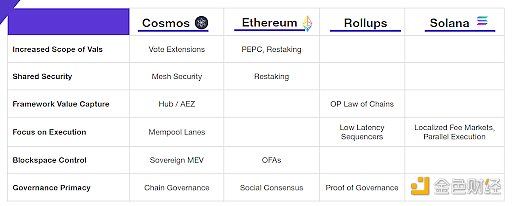

In the past few months, I have noticed that these different ecosystems are discussing many of the same issues.

This may not be obvious because they use different vocabulary and have slightly different implementations.

I have compiled some examples.

I believe this is because these ecosystems are trying to solve the scalability trilemma and the third attribute that was not fully optimized when they were established.

This addresses the problems that these blockchains have been trying to solve in other ecosystems for many years, and they face the same issues.

The most obvious area is Ethereum’s rollup.

With Ethereum rollup adopting a modular “stack architecture,” the rollup framework faces two tricky problems:

How do rollup frameworks (such as Optimism and Arbitrum) capture value for the modules they create and open source?

How to solve interoperability issues between different chains and how to coordinate software upgrades and other matters?

This is most evident in Optimism, where the team must find a way to capture value (rather than handing it over to Conduit) and coordinate upgrades and limit customizability (such as the rules of the Block La chain).

The convergence of Rollup and Solana is not so obvious, but it will ultimately manifest in the rollup’s understanding of a brand new problem in the crypto field: users.

Solana is truly the only blockchain focused on building for millions of concurrent users. Therefore, many innovations about the execution layer (such as parallel execution, native fee markets, and equity-weighted QoS) originate from Solana.

Even today, rollup is slowly realizing that users of specific applications (such as decentralized exchanges) care deeply about low latency.

That’s understandable, and they will turn to the leading ecosystem Solana for lessons and experience.

Ethereum and the Invisible Hand

Ethereum has both the privilege and the burden of being the largest and most successful crypto smart contract platform to date.

This means that Ethereum carries higher risks, so the protocol must be more cautious.

But as its development goes further, it also needs to solve the missing link of the impossible triangle (scalability) ahead of other blockchains.

I posed a question in this article: “Is a blockchain destined to swallow other blockchains?”

I think many people in the Ethereum community would say that Ethereum’s rollup roadmap allows it to simultaneously obtain the best of both worlds by simply copying the best attributes of other ecosystems.

I would hold the opposite opinion.

As Ethereum tries to solve the problems that Cosmos and Solana have been working on (such as interoperability, block space control, advanced execution), this blockchain will start to look more like Cosmos and Solana.

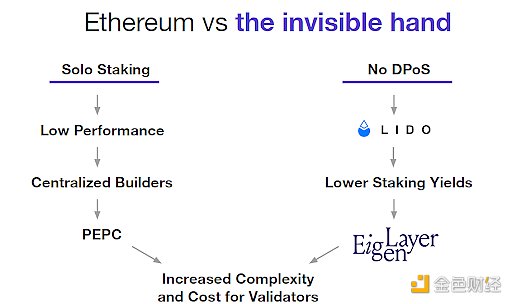

I believe that Ethereum has made value-based design decisions throughout its history that have ultimately been overturned by the free market, and there are numerous cases of this happening.

This is happening in real time, and Ethereum has made two major decisions:

1. Optimize independent validators

2. Do not adopt DPoS consensus

By keeping the requirements for validators very low, Ethereum has accepted other trade-offs, such as large centralized builders.

In order to formalize the relationship between proposers and creators at the protocol level, the protocol designers have been considering the idea of increasing the proposer’s control rights (PEPC).

Although PEPC has many advantages, it also comes with the cost of increasing complexity for validators.

Similarly, the lack of a native delegation proof of stake has led to the rise of liquidity staking protocols like Lido.

Over time, as risk-free interest rates decline in traditional finance, validators will choose to enter other profit-generating services such as EigenLayer, which will also increase the complexity for validators.

Endgame

Every protocol in the crypto space ultimately has to deal with the fundamental tension between decentralization, security, and scalability.

Today, I am more excited than ever that we have multiple ecosystems that have decided to tackle different parts of the trilemma.

This has resulted in richer ideas and solutions than if we had only one community.

As for how it will actually evolve, I believe there will be several layer1 blockchains (possibly four to five), some of which already exist.

I also believe that each ecosystem will continue to converge.

Ironically, because they have had the opportunity to see the mistakes made by other blockchains before them, each ecosystem may ultimately optimize more for its initially unoptimized properties.

Soon, each ecosystem will have to question its sacred authority, especially with the construction of more applications with product-market fit.

I doubt that every ecosystem will fully converge on its validator design specification, but I do believe there will be a greater emphasis on lightweight clients (ideally, a lightweight client that can run on an iPhone).

In the end, as modular design spreads throughout the crypto space, users and developers will question “what does it mean on Ethereum”.

Considering that in the coming months, an application will be able to be built using the Solana Virtual Machine (SVM), use Celestia for data availability verification, and settle on Ethereum.

You might ask, on which blockchain was that application built?

The future may be even more peculiar, more complex, and unfold on a larger scale than even the biggest crypto supporters imagine.

I intend to stay and see how it all unfolds.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- In-depth explanation of Aerodrome’s core mechanisms, the generation of flywheels, and development prospects.

- LianGuai Daily | French data regulatory agency inspects Worldcoin office; CyberConnect to introduce new proposal and appoint experts to audit cross-chain bridges.

- Game Revelation of the Whole Chain A Comparison of the Value Chains of Web2 and Web3 Games

- Intent-centric Narrative Outlook Unlocking New Scenarios for Cryptographic Applications

- Under the narrative of re-collateralization, how to value EigenLayer?

- zkSci How is zero-knowledge proof applied in scientific research?

- How to Report Being Scammed When Buying USDT Virtual Currency, Lawyer Teaches You