Why are Layer2 tokens not used for paying network GAS?

Why not use Layer2 tokens to pay network GAS?Author: Andrew Huang

Translation: Huohuo, Plain Language Blockchain

Why you shouldn’t use the native token of your protocol as the gas token for Rollup?

At @conduitxyz, we have been fortunate to discuss with hundreds of teams and protocols on how to launch their own Rollup. The most common question we received is, “Can we allow our users to pay gas fees with our native token?”

- Is an encrypted market maker the ‘behind-the-scenes dealer’?

- a16z Why It’s Said that Stateless Blockchain Cannot Exist

- a16z Research on the Impossibility of Stateless Blockchain

Our answer ⬇️

Not suitable without net demand for tokens.

If you plot the token flow, there will be no net demand. Users buy your token to connect to your Rollup. When they pay gas fees, the sequencer server sells these tokens, attempting to cover the data availability (DA) cost, which is priced only in ETH.

If your token gas fees cannot cover the data availability (DA) cost, then your protocol will foot the remaining DA cost. Essentially, you are subsidizing usage on your Rollup but still need to pay the DA cost in ETH.

In the long run, cross-domain interoperability and MEV may become the primary revenue model for Rollup sequencer servers. By mandating your Rollup users to acquire your token, you make it harder for those builders/searchers to extract MEV on your chain.

Unlike holding only one token (ETH), they need to hold N tokens on N Rollups, greatly complicating their token inventory strategy.

In fact, for some systems like Optimism’s Superchain, using your own token as the gas token may render you incompatible, undermining access to your chain and isolating your Rollup from the wider ecosystem.

Lastly, this adds a cumbersome user experience burden. All users hold ETH because it is the native token of Ethereum. Requiring them to first purchase your token to use your Rollup adds another barrier to using your application.

It may be reasonable in the following cases:

If interoperability is not important to you, and your token has net demand (or is a stablecoin), then it may be feasible. An example could be @eco, whose core users are not native crypto users.

Requiring their users to acquire Ether in addition to @ecostablecoin would add additional user experience burden. Essentially, this is the opposite of the experience for native crypto users.

Perhaps a more sustainable approach is to recycle the surplus sequencer server revenue obtained from your Rollup back into the protocol’s token through buybacks.

This could create a more sustainable demand for the protocol token from the trading volume on the Rollup and help achieve stronger alignment of incentives between users and the protocol.

Of course, you can also use meta-transactions, relayers, or account abstraction to mimic the way users pay gas fees with the protocol token.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- a16z Crypto Partner discusses NFT Royalties How it Works, Evolution, and Solutions

- Why is data availability sampling important for blockchain scalability?

- How can NFT wearable devices lead the future of digital fashion?

- In-depth Analysis How did the blockchain data tool Dune rise rapidly?

- In-depth Analysis The Smart Architecture of the Next-Generation Blockchain

- Summary of Token2049 Asia Blockchain Week Events in Mid-September (Part II)

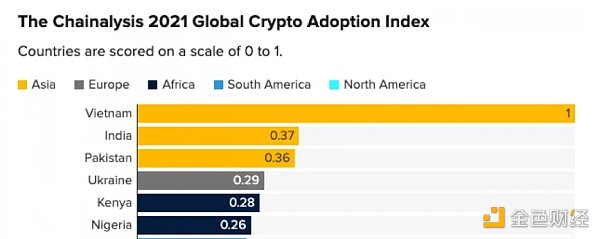

- NFT completely cold? Analyzing the actual transaction data of the past two years