MakerDAO chooses Solana as the application chain? It’s too early to draw a conclusion, at least 3 years are needed to achieve it.

It's too early to conclude that MakerDAO has chosen Solana as the application chain. It will take at least 3 years to achieve this.Author: Jiang Haibo, LianGuaiNews

After shifting its focus to RWA (Real-World Assets), MakerDAO has become one of the most profitable DeFi projects. However, co-founder Rune Christensen’s bold improvements to Maker often provoke questioning and discussion.

On September 1st, Rune published an article titled “Explore a fork of the Solana codebase for NewChain” on the MakerDAO forum, exploring the possibility of creating a new application chain called NewChain based on the Solana codebase. This directly led to Ethereum co-founder Vitalik selling his MKR tokens that he had held for several years.

- Arbitrum vs. Optimism A new round of Red vs. Blue battle begins with Layer3.

- In-depth explanation of Aerodrome’s core mechanisms, the generation of flywheels, and development prospects.

- LianGuai Daily | French data regulatory agency inspects Worldcoin office; CyberConnect to introduce new proposal and appoint experts to audit cross-chain bridges.

Rune’s Views and Impact on NewChain

Regarding the creation of a new chain, Rune believes that the main purpose is to be able to recover through a hard fork in the event of governance attacks or technical failures. In addition, according to the timeline of the Endgame, it is expected that in the first phase, which is the beginning of 2024, a new stablecoin (NewStable) and a new governance token (NewGovToken) will be launched. If this economic model operates on its own chain, it will also bring greater benefits through tokenomics, such as reducing MEV and reducing value loss in transaction costs (paying gas fees with their own governance tokens or stablecoins).

As for why Rune favors Solana, it is mainly because Solana has high code quality, its ecosystem remains resilient even after the collapse of FTX, and there are application chains built on Solana like Pyth.

In addition to Solana, Rune also mentioned Cosmos in the article and subsequent replies, thinking that it seems to be the only choice besides Solana, with a large number of high-quality developers, but it is less efficient and has higher maintenance costs compared to Solana. As for new public chains like Aptos and Sui, Rune directly stated that they are not suitable after a simple study.

Regarding the impact of this matter, LianGuaiNews believes that it is not as significant for the following reasons.

- Rune’s article was published under “General Discussion” and is currently only in the discussion stage, not a formal survey or vote for imminent voting and implementation.

- Regarding the implementation time, according to the timeline of the Endgame, NewChain is in the fifth stage, which is the final stage. It is estimated that it may take at least 3 years or even longer to achieve, and there is still a long way to go with a lot of uncertainty.

- Even if Maker protocol is rebuilt using NewChain, all user-facing products and systems will remain unchanged and still be retained on Ethereum or other blockchains. It is only using NewChain to build the backend of the Maker protocol and SubDAO, improving security and the ability to capture token value.

Under this discussion article, different proposals have also been put forward, such as Flashbots’ EVM-based Rollup proposed by Hasu, as well as the Substrate framework of the Polkadot ecosystem and the Rollup framework of Eclipse proposed by others.

Vitalik’s Counterattack and Optimism towards Rai

As one of the most representative projects in the Ethereum ecosystem, Maker has various Raas (Rollup as a service) solutions, such as Base and Worldcoin, adopted by application chains within the Ethereum ecosystem. However, Rune’s ambition is not limited to this. In addition to being able to pause, he also hopes to capture as much value as possible from the ecosystem and use NewChain as a bridge to expand to other Layer 1 solutions.

This move may be considered a “betrayal” by the Ethereum ecosystem and has directly led to dissatisfaction from individuals such as Ethereum co-founder Vitalik. Vitalik sold the last 500 MKR through the Cow Protocol. Vitalik’s first purchase of MKR occurred in January 2018 when he exchanged 21.34 WETH for 14.28 MKR. His most recent transfer was in April 2021 when he donated 100 MKR to India’s Covid relief fund.

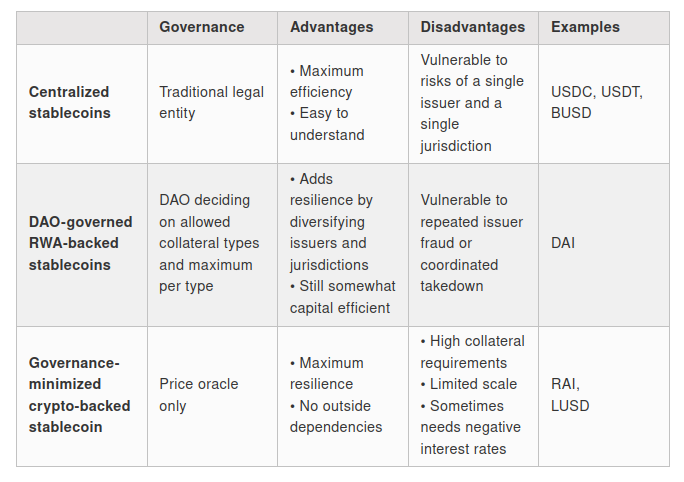

When someone quoted Rune’s tweet about NewChain in the Reflexer Discord, Vitalik stated that Maker’s DAI used to be the representative of the third type of stablecoin (collateralized by cryptocurrency assets) in the image below, but it seems to be evolving in a completely different direction. The Rai community can engage in more active governance to support various non-major ETH collateral (excluding Lido’s wstETH).

Due to Reflexer’s native token being designed as a minimally governed token, the project cannot support other collateral besides ETH through simple governance. Liquity and other projects also face this issue and must make improvements in order to compete in the LSDFi market.

Vitalik has long been optimistic about Reflexer and has expressed his positive views on Reflexer multiple times. During the USDC unpegging period in March of this year, he collateralized ETH to mint RAI and then used RAI to purchase USDC.

What is possibly more important about this project is its strategic significance for Ethereum, as it innovates in both the mechanism of stablecoins and the functionality of governance tokens. From the perspective of collateral, it is a project that only uses ETH (potentially expanding to LSD) as collateral. The stablecoin RAI is not pegged to the US dollar and has lower volatility than ETH, making it a new type of stablecoin. The design of minimal governance also aligns more with the “Code is Law” rule. If Reflexer’s governance functionality can be enhanced, it would make sense for the price of FLX to rise.

However, for ordinary users, the advantages of RAI can also be seen as disadvantages. Its price is neither as stable as centralized stablecoins nor as volatile as ETH. Its use cases as a stablecoin are limited, and FLX lacks the functionality to capture value.

As of the afternoon of September 4th, the price of Reflexer’s governance token FLX has risen by 75% in the past 24 hours due to Vitalik’s endorsement, reaching $14. However, it is still a 99% decrease compared to its initial price of $1400.

7 Functional Requirements for NewChain

In fact, this is not the first time Rune has expressed his views on NewChain. As early as May 2022, the plan and key features of NewChain were listed, which also mentioned the need to be able to use hard forks as a governance mechanism to recover from disasters.

On January 31st of this year, Rune also made a Maker improvement proposal, which was approved on March 27th, explicitly listing 7 requirements for NewChain’s functionality.

- NewChain must support native staking compatible with the “Sagittarius Engine,” and the node’s equity must be managed by the Maker governance mechanism.

- NewChain should support charging “state rent” for data stored on the blockchain to encourage effective data management.

- Gas fees and state rent should be paid using NewStable, while equity should be completed using NewGovToken.

- NewChain must have native MEV capturing functionality.

- NewChain must have a chain shutdown function triggered by voting with NewGovToken, and must be restarted through a hard fork. As Maker and SubDAO’s functionality becomes more complex, the hard fork adds an additional layer of security.

- The protocol should have built-in ZK rollups.

- New token economics and core governance processes should be natively built into the new chain protocol.

This also indicates that Rune’s ambitions are not limited to the Ethereum ecosystem. Even when using Ethereum’s Layer 2 solution, it is still necessary to pay the fees for submitting the packaged transactions to Layer 1. These fees can only be paid with ETH and the value generated cannot be captured by the new governance token or stablecoin.

Summary

Maker originated from the Ethereum ecosystem. Due to its increasingly complex functionality, it needs to become an independent application chain to be able to recover through a hard fork in extreme situations. In terms of the choice of solution, Rune hopes to capture as much value as possible, including gas fees, and expand to other Layer 1 solutions. Solana becomes a more likely choice and has therefore faced opposition from Vitalik and others.

However, it should be noted that this solution is currently only in the discussion stage. NewChain is in the final stage of the Endgame and is expected to take at least 3 years to achieve. Before that, Maker still has a lot of work to do and may choose other solutions due to technological iterations.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Game Revelation of the Whole Chain A Comparison of the Value Chains of Web2 and Web3 Games

- Intent-centric Narrative Outlook Unlocking New Scenarios for Cryptographic Applications

- Under the narrative of re-collateralization, how to value EigenLayer?

- zkSci How is zero-knowledge proof applied in scientific research?

- How to Report Being Scammed When Buying USDT Virtual Currency, Lawyer Teaches You

- Blockchain User Activity Survey Ethereum Still Reigns, Who is Using Litecoin and Tron?

- Trillion-level business opportunity In-depth analysis of the prospects of security tokens in Hong Kong