Intent-centric Narrative Outlook Unlocking New Scenarios for Cryptographic Applications

Intent-centric Narrative Outlook for Cryptographic ApplicationsAuthor: Haotian

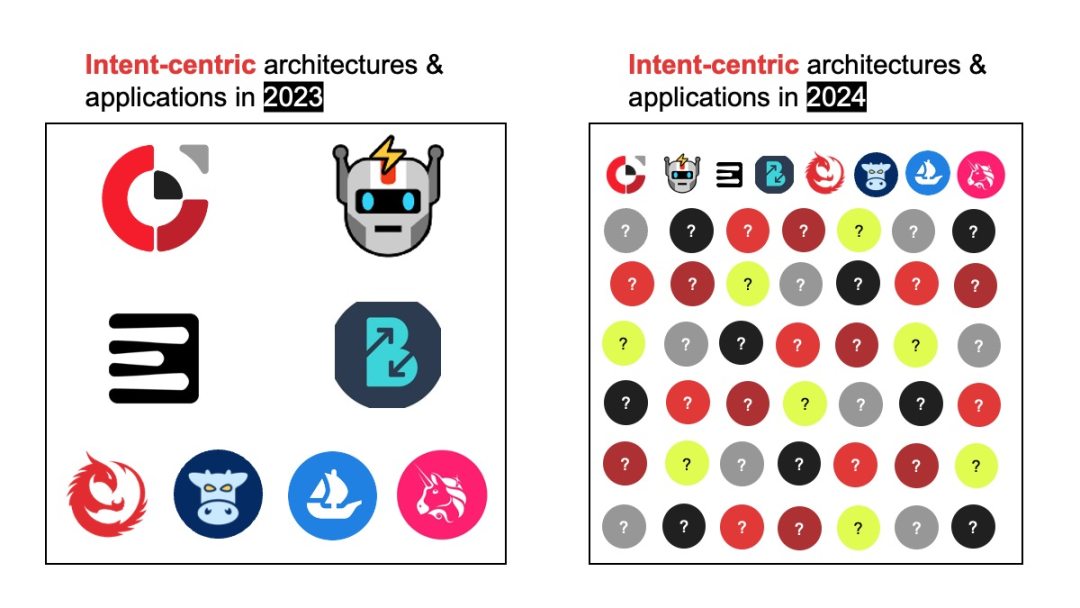

Everyone feels that Intent-centric is a grand narrative, especially with the support of AI. The Intent-based ecosystem seems to be on the verge of bursting out, igniting the “cool feeling” of the next bull market. But what’s the reality? Even the most basic intent narrative like the AA wallet can only silently cultivate behind the scenes, not to mention the seemingly cool but hard to implement AI+intent.

In this article, we will explore the predictable business changes brought about by Intent-centric:

Tips: I have already written a series of popular science articles on Intent-centric. If you want to gain a systematic understanding, you can go to the homepage highlights section to browse on your own.

- Under the narrative of re-collateralization, how to value EigenLayer?

- zkSci How is zero-knowledge proof applied in scientific research?

- How to Report Being Scammed When Buying USDT Virtual Currency, Lawyer Teaches You

1) Reordering the ecosystem structure of DeFi protocols and products, will Wallet become the true front-end entry?

Current wallets are only asset management (recharge + flash exchange, etc.) and display platforms, at the end of the DeFi ecosystem. Although wallets have DApp centers to connect applications, they are still far from the commercial vision of wallets collecting taxes. Most wallets only help users display assets, and there is still a long way to go before they can fulfill the future Crypto world entry described by wallets to investors.

Intent-centric may be an opportunity to reverse this situation for wallets.

The original interaction needs of users, such as bridge, swap, staking, withdraw, etc., are directly interacted with on-chain contracts in the form of instructions. Most DeFi protocols independently design front-end interaction pages for users to use, and wallets only play the role of Connect Wallet+Signature.

The intent process is essentially an offline pre-processing black box. Wallets can become the user’s intent pre-processing center, used to collect and pre-process user’s transaction needs, and then connect to all DeFi protocols for interaction. DeFi protocols no longer have to rely on front-end traffic. Only in this way can the commercial potential of wallets as an entry point for buying roads become apparent. Of course, to be a good Solver, wallets will face daunting challenges as well.

2) “Off-chain” pre-processing + on-chain integration paradigm will become mainstream, will UniswapX become the hub of DeFi transactions?

After the release of UniswapX, everyone felt that it was neither painful nor itchy, and it did not conform to the paradigm at all. And similar functions like cowswap and fusion, which already exist, are not well-received. But in my opinion, this is simply because the overall new architecture of off-chain + on-chain has not yet formed. Only when the off-chain pre-processing environment is mature and stable, will the market effect of UniswapX be apparent.

The “off-chain” here is actually a set of Solver pre-processing mechanisms, which also need to follow basic specifications such as openness, transparency, distribution, and permissionlessness, and is not a traditional off-chain client-server. The “off-chain” here can be seen as the structured extension of the existing smart contract framework;

For example, in the MEV scenario, miners sort out blocks based on the gas fee. MEV bots can profit by front-running. This is a point where the existing blockchain framework is powerless. Now, SUAVE wants to create a decentralized MEV-geth off-chain service node. Most of the potential transactions of MEV will be fully digested through this pre-processing before being submitted to the chain, reducing congestion on the chain.

In the SUAVE chain architecture of Flashbot 2.0, MEV-geth and MEV-relay are service nodes that are considered as “off-chain” extensions relative to the Ethereum mainnet, but they are actually independent chains themselves. This method of interacting with the main chain through pre-processing on other chains is essentially a structured approach to off-chain pre-processing. The popular Rollup layer2 solution is essentially based on this idea.

Based on this understanding, let’s take a look at UniswapX. In order to achieve gas-free transactions, resistance to MEV, and pool bidding mechanisms, it also needs to be based on a fair off-chain pre-processing environment. This off-chain environment can be a permissionless free node service model or even an independent sidechain. (This is just speculation, as the official details are not available yet)

If Uniswap’s off-chain pre-processing solution is implemented, assuming it is a chain dedicated to trading, combined with the entrance of Uniswap Wallet and Uniswap’s top-tier market position in the current Ethereum DeFi liquidity, the blueprint concept of UniswapX becoming the future DeFi trading hub makes a lot of sense.

3) Multiple implementation paths for Solvers: Super Smart Contract or AI

AA contract wallets are structured intents composed of smart contracts and proxy contracts that abstract user-paid gas, social recovery, conditional execution, etc. These intents are implemented through the combination of geeky features in Ethereum contracts and can be regarded as the simplest form of Solver.

In the future, Solvers will evolve into two levels. The closer level is Super Smart Contracts (SSC), which is similar to AA contract wallet implementation, but with more complex combinations.

For example, Anoma’s solution explores a Layer1.5 multi-chain structure. Pure transaction intents go through layer1, while privacy and security intents go through layer2, which integrates encryption algorithms such as zk-SNARK and ciphertext. The final transactions will be aggregated to the user’s client. This blockchain architecture may be the next-generation blockchain smart architecture after Ethereum, as it aggregates various technologies under the current blockchain framework into a new processing framework system.

The farther level is Automated Intelligent Generalized Computing (AIGC), which is the most anticipated feature after LianGuairadigm proposed the Intent-centric concept. In the future, users only need to chat with AIGC, and AI will automatically complete complex transactions for them. It sounds wonderful, but it will be difficult to implement.

On the one hand, AIGC’s semantic understanding model is difficult to achieve 100% accuracy in understanding user intentions. Users who have used chatGPT may have a similar feeling. On the other hand, after understanding the user’s intentions, AIGC also needs to have real-time computing capabilities for various DeFi protocol transaction depths, slippage data, etc. It also needs to be able to conduct real-time audits to identify security risks and fully understand the communication specifications between various chains and protocols in order to plan processes effectively. This not only tests the data capacity of the database but also requires the “intelligence” to achieve real-time learning, analysis, judgment, and application. It is estimated that only then can it cope with the complex DeFi environment.

However, the AI transformation of Solver can once again integrate the entrepreneurial power in the field of AI with blockchain. The advantage of AI lies in its technology, but it lacks a complete business loop. On the other hand, the direction of blockchain DeFi is the opposite. The intent track undoubtedly can attract a large number of AI talents, resources, and capital. Whether this path can be successful is not the main concern. It is about gathering the innovative power of AI+Crypto to drive the imagination space for new technologies and applications, which is large enough to support a new narrative.

Above.

We will find that these business changes have actually been happening silently for a long time. Some wallets are making efforts in the direction of AA, Uniswap is laying out on wallets, V4, and UniswapX, Flashbot2.0 has a new MEV plan, and of course, there are also some cool products recently seen that have applied AI to DeFi interactions. They are all doing what “Solver” does, and they are all looking for a step-by-step practical path that is intent-centric.

Of course, these may happen in the future, or perhaps it is just a hypothesis in the end.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Blockchain User Activity Survey Ethereum Still Reigns, Who is Using Litecoin and Tron?

- Trillion-level business opportunity In-depth analysis of the prospects of security tokens in Hong Kong

- Unable to guard against Why are a large number of encrypted Twitter accounts hacked and used to publish phishing links? How to prevent it?

- Tornado Cash founder arrested, what original sin did the mixer commit?

- Why are Layer2 tokens not used for paying network GAS?

- Is an encrypted market maker the ‘behind-the-scenes dealer’?

- a16z Why It’s Said that Stateless Blockchain Cannot Exist