In-depth explanation of Aerodrome’s core mechanisms, the generation of flywheels, and development prospects.

Explanation of Aerodrome's core mechanisms, flywheel generation, and development prospects.Author: 0xMingyue Wu on Blockchain

As described in the official documentation of Aerodrome, Aerodrome Finance is the next generation AMM designed to be the central liquidity hub for Base, combining a powerful liquidity incentive engine, vote-locking governance model, and user-friendly experience [1]. Since the official launch of the Aerodrome protocol on August 31, the protocol has attracted nearly $200 million TVL in just 24 hours, with the native token $AERO’s liquidity mining yield approaching 1000% annualized without compounding. According to Defillama data on September 2, the total TVL of Base chain on September 2 was $379 million, while Aerodrome TVL reached $196 million, accounting for 51.7% of the total TVL of Base chain, which can be said to occupy “half of the country” of Base. What “magic” mechanism allows a Dex to achieve such great success in such a short period of time? This article will start from Ve(3,3) (the core mechanism of Aerodrome) to introduce the core mechanism of Aerodrome, the generation of flywheel, and the development prospects in a simple and understandable way.

1 Game Theory and Flywheel: Ve(3,3)

The Ve(3,3) mechanism originated from Fantom co-founder Andre Cronje’s Solidly protocol, but due to design flaws in the mechanism, the protocol is already approaching a “failed” state. Velodrome, the largest Dex protocol on the Optimism chain, has improved the flaws of the Solidly protocol, and Aerodrome inherits the latest features of VelodromeV2. The core mechanism of Aerodrome, Ve(3,3), can be divided into two parts: Ve&(3,3). Ve comes from Curve’s veCRV model, and (3,3) comes from OlympusDAO’s 3v3 game. The combination of the two attempts to balance the holder and trader in the supply, bringing more protocol income to projects that join the Ve(3,3) protocol (especially initial projects), while improving the efficiency of reward distribution when leasing liquidity [2]. The following will introduce the ve and (3,3) mechanisms respectively.

1.1 veNFT, Evolution of veCRV

ve is short for Voting Escrow, which is the process of exchanging Curve’s governance token CRV for VeCRV by pledging and locking, in order to obtain more rewards as an LP. It was first introduced by Curve to strengthen incentives for long-term token holders.

- LianGuai Daily | French data regulatory agency inspects Worldcoin office; CyberConnect to introduce new proposal and appoint experts to audit cross-chain bridges.

- Game Revelation of the Whole Chain A Comparison of the Value Chains of Web2 and Web3 Games

- Intent-centric Narrative Outlook Unlocking New Scenarios for Cryptographic Applications

In the Aerodrome protocol, there are two protocol tokens, 1) $AERO, and 2) $veAERO. $AERO is the protocol token used to reward liquidity providers and is an ERC20 standard. Locking $AERO can obtain $veAERO. $veAERO is wrapped in veNFT, which is an ERC721 (also known as NFT) standard. The number of $veAERO obtained from locking $AERO is determined by the lock-up time of $AERO (following a linear correspondence). The maximum lock-up time is 4 years, and locking for 4 years can obtain a 1:1 ratio of $veAERO. Similarly, if locked for one year, only 1/4 of the locked $AERO amount can be obtained. If the lock-up time is very short (such as one week), only 1/208 of the locked $AERO amount can be obtained. After the lock-up time expires, users can withdraw all of their locked $AERO.

Aerodrome will emit a certain amount of $AERO each week, and the holders of $veAERO will vote to determine which liquidity pool the $AERO emissions will go to.

1.2 (3,3) Game

(3,3) comes from the (3,3) game theory of OlympusDAO (derived from the Nash equilibrium theory). This term comes from the standard notation in game theory, which is used to describe an important feature of a game: the strategies and payoffs of the game participants. In this notation, the first number in parentheses represents the number of strategies available to the first participant (usually the actor), while the second number represents the number of strategies available to the second participant (usually the opponent).

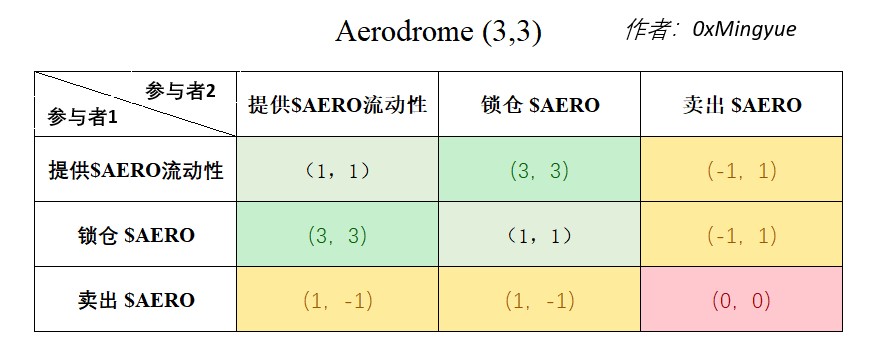

In the Aerodrome protocol, all protocol participants have three choices for their acquired $AERO: 1) provide $AERO liquidity; 2) lock $AERO and acquire $veAERO for long-term holding; 3) sell $AERO. To simplify the multi-player game, the following figure lists the different behaviors of two Aerodrome protocol participants and their corresponding gains.

Figure 1.1 Aerodrome (3,3) game

The first number in the parentheses represents the gains of participant 1, and the second number represents the gains of participant 2. The larger the number, the greater the gains, and negative numbers indicate losses. The above figure is drawn based on the author’s understanding and does not come from official documents.

In Figure 1.1, based on the different actions of the two protocol participants towards their acquired $AERO, there are a total of 9 possible outcomes, which can be broadly classified into 3 categories: 1) cooperation, where both parties lock the acquired $AERO or add $AERO liquidity to gain more tokens; 2) defection, where one of the protocol participants sells their acquired $AERO; 3) mutual defection, a typical case of “mine, sell, withdraw” mode, where both participants sell their acquired $AERO until the protocol is no longer profitable. For outcome 1) cooperation, both participants contribute positively to the protocol, as their cooperation enhances the protocol’s TVL and participation, and they both acquire more $AERO together; for outcome 2) defection, the defector gains temporary profits from selling the tokens, while the protocol contributors (liquidity providers/lockers) incur losses; for outcome 3) mutual defection, all protocol participants engage in the “mine, sell, withdraw” mode, quickly selling the acquired tokens, resulting in the rapid devaluation of the protocol. In Aerodrome, the “shovel” for mining (i.e., tokens used for providing liquidity) is usually the protocol-related token, which means that the liquidity providers’ interests will also suffer losses when the protocol value approaches zero. Therefore, for outcome 3) mutual defection, the editor of this article believes that neither party benefits.

In reality, the real market is often formed by countless protocol participants working together, which is more complex than the game between two protocol participants. For almost all ve(3,3) protocols, especially some ve(3,3) protocols without background, due to the huge annualized returns given to liquidity providers in the early stage, the “mine and sell” mode of the market force result 3) is the most common. Only those “star” projects that have gained sufficient market participation and have balanced points moved to result 1) cooperation between the two sides. This is also a dynamic equilibrium that will change with the addition of new market participants.

1.3 The Game of Interests of Ve(3,3) Core Participants from the Perspective of Prisoner’s Dilemma

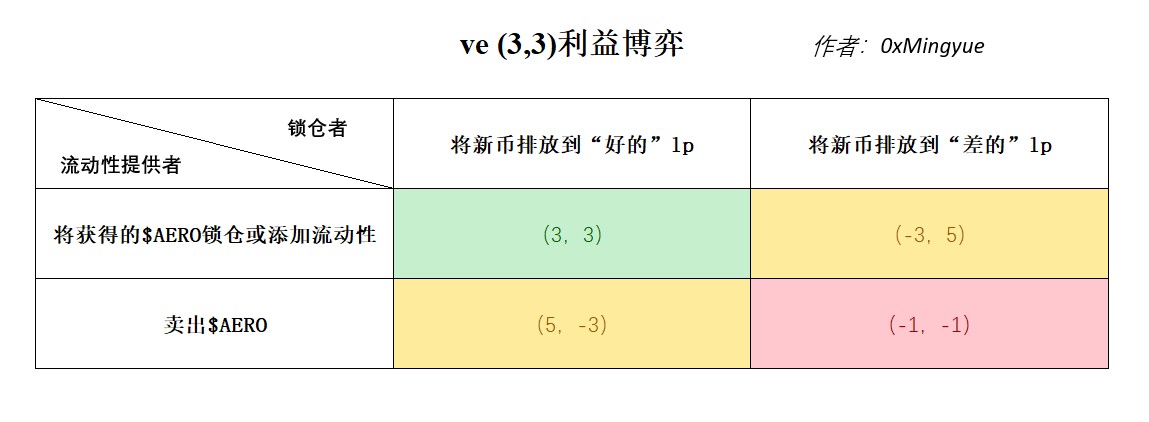

When a ve(3,3) protocol has proven its value in the short term and accumulated a large number of lockholders, the game has quietly changed. At this time, both liquidity providers and lockholders have upgraded to “stakeholders” of the protocol. For the situation of multiple protocol participants forming a complex market, this section divides all core game members of the protocol into two categories: 1) liquidity providers for $AERO; 2) lockholders of $AERO, long-term holders. The different behaviors of these two categories of members will also determine the fate of the protocol, as shown in the figure below.

Figure 1.2 Prisoner's Dilemma between Aerodrome Liquidity Providers and Lockholders

The first number in parentheses represents the profit situation of participant 1, and the second number represents the profit situation of participant 2. The larger the number, the more profit, and negative numbers represent losses. The figure is drawn based on the author’s understanding and does not come from official documents.

As shown in Figure 1.2, the different behaviors of these two core participants will also result in three completely different outcomes: 1) win-win; 2) one party profits; 3) both parties lose. 1) Lockholders cooperate with liquidity providers, and lockholders direct the newly emitted $AERO to liquidity providers who make positive contributions to the protocol. Liquidity providers either lock the newly obtained $AERO or continue to provide deeper liquidity, leading to positive development of the protocol and improvement of its fundamentals, resulting in a win-win situation for both parties; 2) Either lockholders or liquidity providers act maliciously, such as lockholders directing the emission of $AERO to malicious MEME tokens, or liquidity providers selling all the $AERO they have obtained, which benefits the malicious actor and leads to long-term zero value of the protocol; 3) Both lockholders and liquidity providers act maliciously, and the fundamentals of the protocol will rapidly deteriorate, leading to a rapid decline in the value of the protocol.

This situation is similar to the “prisoner’s dilemma”. For individual liquidity providers or lockholders, the most rational choice they make is to act maliciously. At this time, the Nash equilibrium point [3] in this game is the point where the entire system suffers the greatest loss, and the equilibrium point is far from Pareto optimality [4].

How to break the “prisoner’s dilemma”? From the perspective of lock-up participants, the ve(3,3) protocol usually establishes a whitelist mechanism at the protocol level to prevent lock-up participants from acting maliciously; from the perspective of liquidity providers, the protocol usually provides lock-up rewards for liquidity providers. When liquidity providers obtain a large amount of lock-up amounts and become the main force of lock-up participants, the relationship between liquidity providers and lock-up participants is no longer a zero-sum game. Liquidity providers will contribute more to the protocol for their own interests. At this time, the Nash equilibrium point is transformed into the Pareto optimal point where the protocol’s interests are maximized.

2 The Operation of the Flywheel: Upward Spiral and Death Spiral

The previous section explained the game theory of the ve(3,3) protocol. So what “magic” allows the Aerodrome protocol to attract $200 million TVL in just one day? In this section, I will explain the “flywheel” mechanism of Aerodrome.

2.1 The Flywheel Effect and the Secret of Attracting Funds

The name of the flywheel effect comes from the mechanical field. A flywheel is a rotating device that becomes more difficult to stop or change direction as its rotational speed increases. In business, this concept means that once a company or organization establishes some competitive advantages, these advantages will accumulate and strengthen like a rotating flywheel.

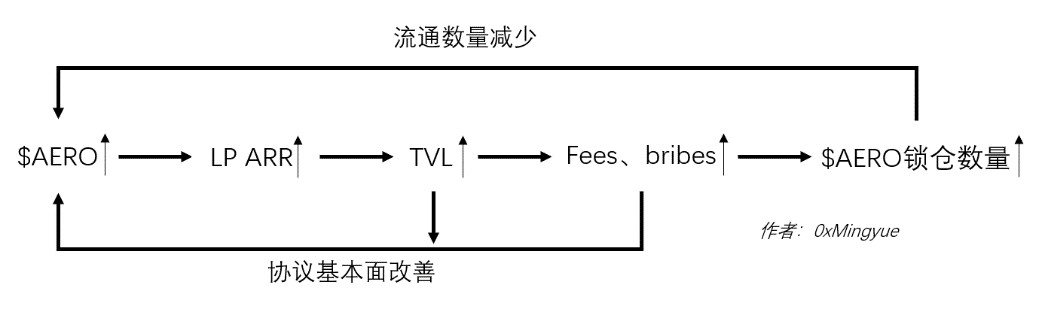

In Aerodrome, the fundamentals of the protocol (TVL, trading volume, and total bribes from external protocols) and the protocol token $AERO form the two levels of the flywheel. Imagine that when the price of the protocol token $AERO rises, liquidity providers increase their earnings and provide more liquidity; liquidity depth optimization leads to an increase in trading volume and an increase in protocol revenue, prompting more people to lock up $AERO to obtain protocol earnings; the protocol’s reputation increases, attracting more external protocols to participate in the operation of the protocol. And all of these (fundamentals) continue to drive the rise in the value of $AERO tokens, presenting an upward spiral trend, as shown in the following figure.

Figure 2.1 Aerodrome Forward Flywheel (Price Positive Feedback)

When Aerodrome was officially launched on August 31st, the Aerodrome team provided nearly 7% of $AERO emissions to the $AERO-USDC pool by controlling its $veAERO. Due to the extremely small amount of $AERO in circulation on August 31st, when the first $AERO transaction occurred and $AERO was priced, the lp APR (not APY, APR is the annual percentage rate without compounding) of the $AERO-USDC pool reached as high as 10,000% at 8:01 on August 31st (this number is observed by the author, theoretically, APR can be higher due to the very small pool and high rewards). At this time, due to the huge liquidity provider earnings and the tiny lp pool, $AERO became scarce, and liquidity providers purchased more $AERO to provide liquidity, thereby driving up the price of $AERO. The rise in the price of $AERO further increased the earnings of liquidity providers, and the forward flywheel was thus formed. In just one day on August 31st, the Aerodrome protocol attracted $200 million TVL, occupying a significant portion of the total locked value on the Base chain.

2.2 Upward Spiral and Death Spiral: How to Break?

When Aerodrome attracts attention with its upward spiral, it is worth considering when this spiral will end. We all know that money does not appear out of thin air, so in this mining feast (obtaining $AERO rewards by providing liquidity), how does money flow in the short term?

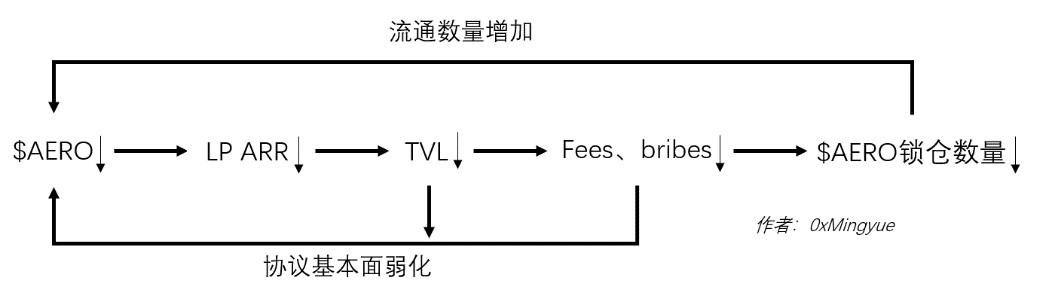

Since the $AERO tokens obtained by providing liquidity are linearly emitted, the amount of $AERO circulating in the market will gradually increase. When it reaches a critical point, smart market participants will find that as the depth of the $AERO-USDC liquidity pool increases, liquidity mining rewards are no longer profitable. At this point, these market participants choose to sell their $AERO holdings, resulting in a decrease in the price of $AERO. When the selling pressure and buying pressure reach a balance, the upward spiral is broken, and the price of $AERO no longer rises. At this point, the income of the $AERO-USDC liquidity pool also stops changing. As more $AERO is released over time, when the selling pressure exceeds the buying pressure, the price of $AERO will fall, leading to a downward spiral as shown in the figure below.

Figure 2.2 Aerodrome Negative Flywheel (Price Positive Feedback)

There are currently many ve(3,3) tokens in the market that are in a downward spiral, such as the CHRONOS protocol on Arbitrum, as shown in the figure below. Its project token $CHR has dropped from the opening high of $1.81 on May 4th to the current price of $0.0168 in four months, a decrease of up to 99%.

Figure 2.3 $CHR Token Price Candlestick Chart

Although Aerodrome has a seemingly reliable team and a partnership with Base, its token $AERO may still struggle to escape the downward spiral. How can this downward spiral be broken? In fact, Aerodrome’s parent protocol, Velodrome, has already provided an answer, and the core of this answer is to increase the lock-up rate and firmly link the interests of protocol participants with the development of the protocol. Since the launch of the Velodrome protocol on June 1, 2022, with the outstanding business capabilities of the Velodrome team and the cumulative total of 7 million $OP tokens provided by the Optimism Foundation, the protocol has maintained a high lock-up rate through various bonus activities. According to data from the official Velodrome Discord[5], on September 2nd, the lock-up rate of the protocol was still as high as 79.03%.

3 ve(3,3) Development Plan: Regaining the Upward Spiral

For the core health indicator of the VE(3,3) token – lock-up rate, this section will discuss some methods for the protocol to increase the lock-up rate and regain an upward spiral.

3.1 Providing Lock-up Rewards

Providing a one-time reward to the protocol’s lock-up participants is the simplest and most direct method, as Velodrome did. Since its launch on the Optimism network in June 2022, the protocol has provided new lock-up participants with nearly 15% of their lock-up returns, funded by the Optimism Foundation. So far, Velodrome has been successful, with its TVL on the Optimism chain surpassing all star protocols such as Uniswap and Curve.

3.2 LaunchLianGuaid: Empowering Lock-up Participants

When I speculated in June this year why Binance did not list the token of the star project Velodrome on the Optimism network, the co-founder of Velodrome said something in the Discord community that surprised me – when some centralized exchanges expressed their desire to list the $Velo token and seek cooperation with the team, the team’s response was: we welcome you to list $Velo, but we will not provide support. At first, I was puzzled by the team’s behavior, but later I realized that CEX’s price manipulation often attracts a large number of short-term speculators to enter the protocol. They do not participate in the operation and game of the protocol, but only engage in price speculation. However, for the VE(3,3) token, price speculation is fatal – price speculation leads to an increase in circulating tokens and a decrease in lock-up volume, which often means the death of the protocol after the price declines from a high level.

This also made me realize the grand narrative of the VE(3,3) protocol. A successful VE(3,3) protocol firmly holds the pricing power in its hands, which can serve other protocols and act as an alternative liquidity solution. It is a new type of impermanent loss compensation scheme that rewards liquidity providers with protocol tokens. In a favorable market environment, it will have a new coin listing place comparable to mainstream CEX – LaunchLianGuaid.

VE(3,3) provides certain protocol token rewards to liquidity providers, which enables VE(3,3) DEXs to have the ability to list new coins by default – newly listed protocols do not need to hire any market makers, they only need to import VE(3,3) protocol rewards into their token’s liquidity pool, and users will provide liquidity to that pool. In this way, the VE(3,3) protocol can also empower lock-up participants through LaunchLianGuaid, thereby increasing the protocol’s lock-up rate and improving its health.

4 Summary and Outlook

This article starts with the ve(3,3) mechanism and briefly introduces the ve(3,3) game mechanism. It then discusses the inherent principles of the upward spiral and downward spiral caused by the flywheel effect of this type of protocol, and provides some methods to solve the downward spiral of the protocol. The vision of ve(3,3) is so grand, and different ve(3,3) protocols often make slight modifications to its mechanism. Due to my limited resources and abilities, there may be errors and incomplete descriptions in this article. I welcome valuable feedback from readers.

I have learned from various channels that there are still many ve(3,3) protocol participants who do not know how to maximize their profits by participating in such protocols. Additionally, there are already many external protocols flourishing based on the ve(3,3) protocol, such as Sonne finance, Tarot, Extra finance, fbomb, USDR, etc. I still hope to write an article on how these protocols are developing and growing based on the ve(3,3) protocol, as well as the current development status of these protocols. Stay tuned!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Under the narrative of re-collateralization, how to value EigenLayer?

- zkSci How is zero-knowledge proof applied in scientific research?

- How to Report Being Scammed When Buying USDT Virtual Currency, Lawyer Teaches You

- Blockchain User Activity Survey Ethereum Still Reigns, Who is Using Litecoin and Tron?

- Trillion-level business opportunity In-depth analysis of the prospects of security tokens in Hong Kong

- Unable to guard against Why are a large number of encrypted Twitter accounts hacked and used to publish phishing links? How to prevent it?

- Tornado Cash founder arrested, what original sin did the mixer commit?