Under the narrative of re-collateralization, how to value EigenLayer?

How to value EigenLayer under re-collateralization?Author: Alex Xu

Introduction

With the completion of the Ethereum Shanghai upgrade, many LSD projects have experienced rapid growth in their business. The number of users and net worth of LSD assets have also increased significantly. On the other hand, with the upcoming Cancun upgrade at the end of the year and the opening of the OP stack, today is also the Year of Rollup. Various services related to the Rollup module, such as DA layer, shared sorter, and RaaS service, are also emerging. Based on LSD assets, EigenLayer proposes the concept of Restaking, aiming to provide services to numerous Rollup and middleware providers. This year, the attention on EigenLayer continues to rise. In March, it completed a large financing of $50 million with an estimated valuation of $500 million. The OTC price of its token is rumored to have reached an astonishing $2 billion, comparable to the valuation level of public chain projects.

In this article, the author will clarify the business logic of EigenLayer and calculate the valuation of the EigenLayer project, attempting to answer the following questions:

- What is Restaking service, who are the customers, and what problem does it try to solve?

- What are the obstacles to promoting the Restaking model?

- Is the valuation of $500 million or even $2 billion for EigenLayer expensive?

- zkSci How is zero-knowledge proof applied in scientific research?

- How to Report Being Scammed When Buying USDT Virtual Currency, Lawyer Teaches You

- Blockchain User Activity Survey Ethereum Still Reigns, Who is Using Litecoin and Tron?

Business Logic of EigenLayer

Before formally clarifying the business of EigenLayer, let’s introduce a few frequently mentioned terms:

- Middleware: Refers to the services between the underlying blockchain infrastructure and Dapps. In the Web3 field, typical middleware includes oracles, cross-chain bridges, indexers, DIDs, and DA layers.

- LSD: Liquid Staking Derivatives, such as Lido’s stETH.

- AVS: Actively Validated Services, which provide security and decentralized guarantee for projects through a distributed node system. The most typical example is the PoS system of public chains.

- DA: Abbreviation for Data Availability, which mainly refers to other projects (such as Rollups) being able to back up their transaction data on the DA layer to ensure that all historical transaction records can be accessed and recovered from the DA layer when needed.

Scope of Business

EigenLayer provides a token-based economic security leasing market.

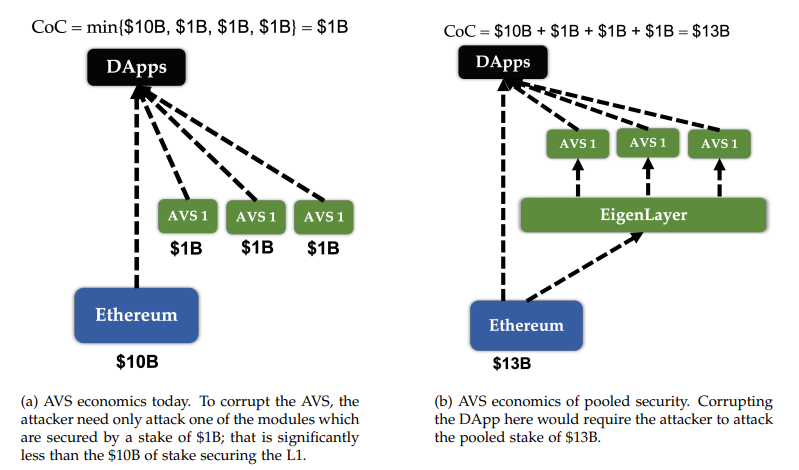

The so-called token-based economic security refers to the participation of the main service providers (validators) of various Web3 projects in the form of token staking to ensure that the project has a permissionless and decentralized nature while operating smoothly. If validators fail to fulfill their obligations, the staked tokens will be forfeited.

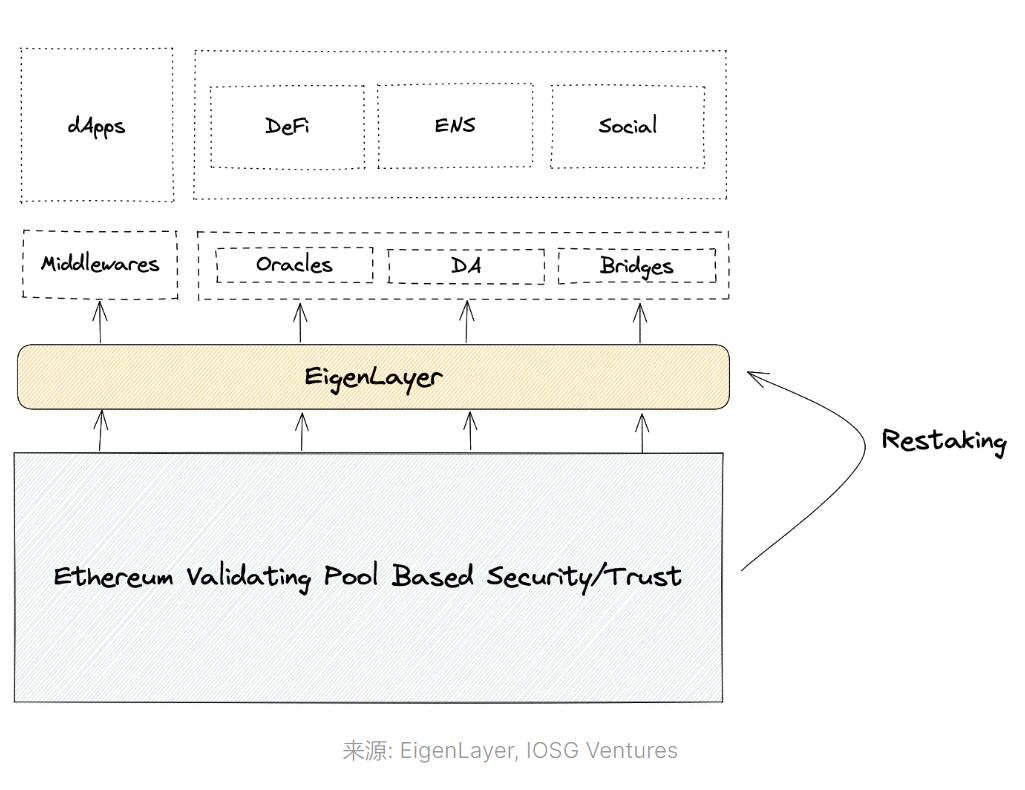

As the platform provider, EigenLayer raises assets from LSD asset holders on one hand, and on the other hand, uses the raised LSD assets as collateral to provide convenient and low-cost AVS services to middleware providers, sidechains, and Rollups with AVS demands. EigenLayer itself provides demand matching services between LSD providers and AVS demanders, and the specific security guarantee for staking is entrusted to specialized staking service providers.

In addition, the parent company behind EigenLayer has also developed a DA layer, providing data availability services for rollups or application chains that require DA layer services. This product is called “EigenDA”, and EigenDA will collaborate with EigenLayer in business.

The pain points EigenLayer hopes to solve are:

1. For various project parties: reduce the high cost of independently building their own trust network, directly pay for the staking assets + node operators on the EigenLayer platform, without the need to build their own.

Source: EigenLayer Whitepaper

2. For Ethereum: expand the use cases of Ethereum LSD, making ETH a network security collateral for more projects and increasing demand for ETH.

3. For LSD users: further increase the capital efficiency and returns of LSD assets.

Business Users

Users served by EigenLayer involve three parties, each with their respective needs:

1. LSD asset providers: the main need of these users is to obtain additional returns on Ethereum LSD assets beyond the basic PoS rewards, and they are willing to provide their LSD assets as staking assets to node operators, facing potential penalty risks.

2. Node operators: obtain LSD assets through EigenLayer and provide node services to project parties that require AVS services, extracting revenue from node rewards and fees provided by project parties.

3. AVS demanders: refers to project parties (such as a Rollup or cross-chain bridge that uses LSD assets as collateral for node operators) who need security provided by AVS but want to reduce costs. They can purchase such services through EigenLayer without building their own AVS.

The main demanders of EigenDA are various Rollups or application chains.

Details of EigenLayer’s Business

Users can stake tokens on the Ethereum network, including stETH, rETH, and cbETH tokens, to EigenLayer’s marketplace. Staking service providers are responsible for matching users’ tokens with corresponding security network demanders and providing AVS services to these project parties. The underlying assets of AVS are the tokens staked by users on EigenLayer, and project parties need to distribute a certain “security fee” to users.

Product Progress

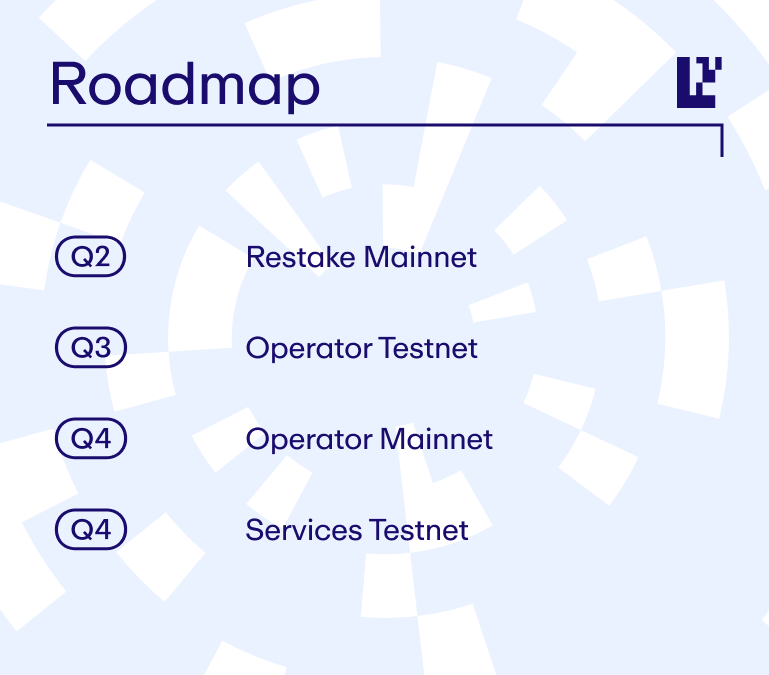

Currently, EigenLayer has only launched the restake function for LSD and has not yet developed staking for node operations and AVS services based on LSD assets. In the two LSD deposit activities that have been opened, deposits quickly reached the limit (depositors mainly sought EigenLayer’s potential airdrop rewards). Users can also directly deposit 32 units of ETH to participate in restake. With the deposit restrictions in place, EigenLayer has accumulated approximately 150,000 staking ETH.

Image source: https://app.eigenlayer.xyz/

According to EigenLayer’s official roadmap, the main task for the third quarter is the development of the Operator Testnet, and the development of the AVS Service Testnet will officially begin in the fourth quarter.

https://docs.EigenLayer.xyz/overview/readme/protocol-features/roadmap

The first clear user of EigenDA is the Mantle project, which is a rollup project forked based on the OP virtual machine. Mantle is currently using the test version of EigenDA.

Tokenomics

EigenLayer is a project with its own token, but its token information and token model have not been determined or disclosed yet.

EigenLayer’s Team and Funding Background

Core Team

Founder & CEO: Sreeram Kannan

Sreeram Kannan is an associate professor in the Department of Computer Engineering at the University of Washington. He is also the founder and controlling shareholder of Layr Labs, the parent company behind EigenLayer. He has published more than 20 papers related to blockchain. He completed his undergraduate studies in telecommunications at the Indian Institute of Science, obtained a master’s degree in mathematics and a Ph.D. in information theory and wireless communications from the University of Illinois at Urbana-Champaign, and then worked as a postdoctoral researcher at the University of California, Berkeley. He is currently a faculty member at the University of Washington and serves as the head of the UW Blockchain Lab.

Founder & Chief Strategy Officer: Calvin Liu

Calvin Liu majored in philosophy and economics at Cornell University. After graduating, he worked for many years in data analysis, corporate consulting, and strategic work. He worked as the Head of Strategy at Compound for nearly 4 years before joining EigenLayer in 2022.

COO: Chris Dury

Chris Dury holds an MBA from the Stern School of Business at New York University and has extensive experience in project management for cloud service products. Prior to joining EigenLayer, he served as the Senior Vice President of Product at Domino Data Lab (a machine learning platform) and held various managerial and director roles at Amazon AWS, leading multiple cloud service projects for game developers. He joined EigenLayer in early 2022.

Data source: https://www.linkedin.com/comLianGuainy/eigenl/

The EigenLayer team is growing rapidly, with more than 30 employees, most of whom are based in Seattle, USA.

Layr Labs is the parent company behind EigenLayer, also founded by Sreeram Kannan (founded in 2021). In addition to EigenLayer, it also has two other projects, EigenDA and Babylon (both of which provide cryptographic security services, but mainly serve the Cosmos ecosystem).

Funding Situation

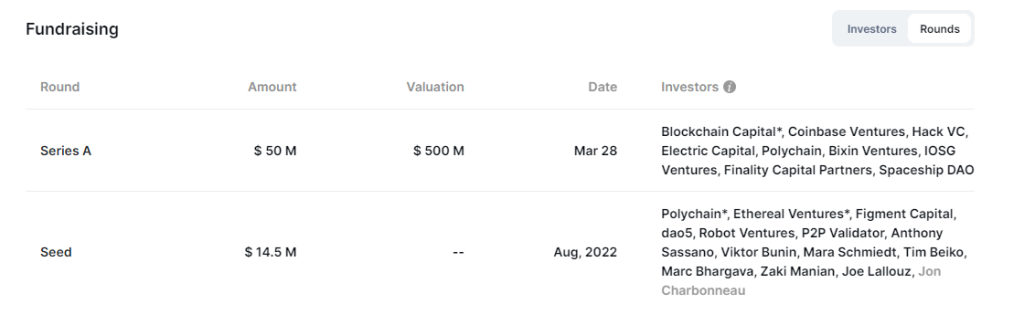

Currently, EigenLayer has conducted two public fundraisings, including a $14.5 million seed round in 2022 (valuation unknown) and a $50 million Series A round in March 2023 (valuation of $500 million).

Some well-known investment institutions include:

Data source: rootdata.com

In the same period, Layr Labs, the parent company, also completed nearly $64.48 million in equity financing. For details, see the filing with the SEC: https://www.sec.gov/Archives/edgar/data/1936115/000156761923004289/xslFormDX01/primary_doc.xml

Market Size, Narrative, and Challenges of Restaking Business

Market Size Forecast

EigenLayer has proposed the novel concept of restaking and offers “cryptoeconomic security as a Service” to provide services to middleware (oracles, bridges, Da layers) as well as sidechains, app chains, and rollups. The aim is to reduce the decentralized network security costs for these projects (compared to building their own trust networks).

In theory, any project that requires token staking for admission, maintains network consensus through game mechanisms, and aims to remain decentralized is a potential user. The specific size of this market is difficult to estimate accurately at present, but optimistically, it may reach a market size of billions of dollars within three years.

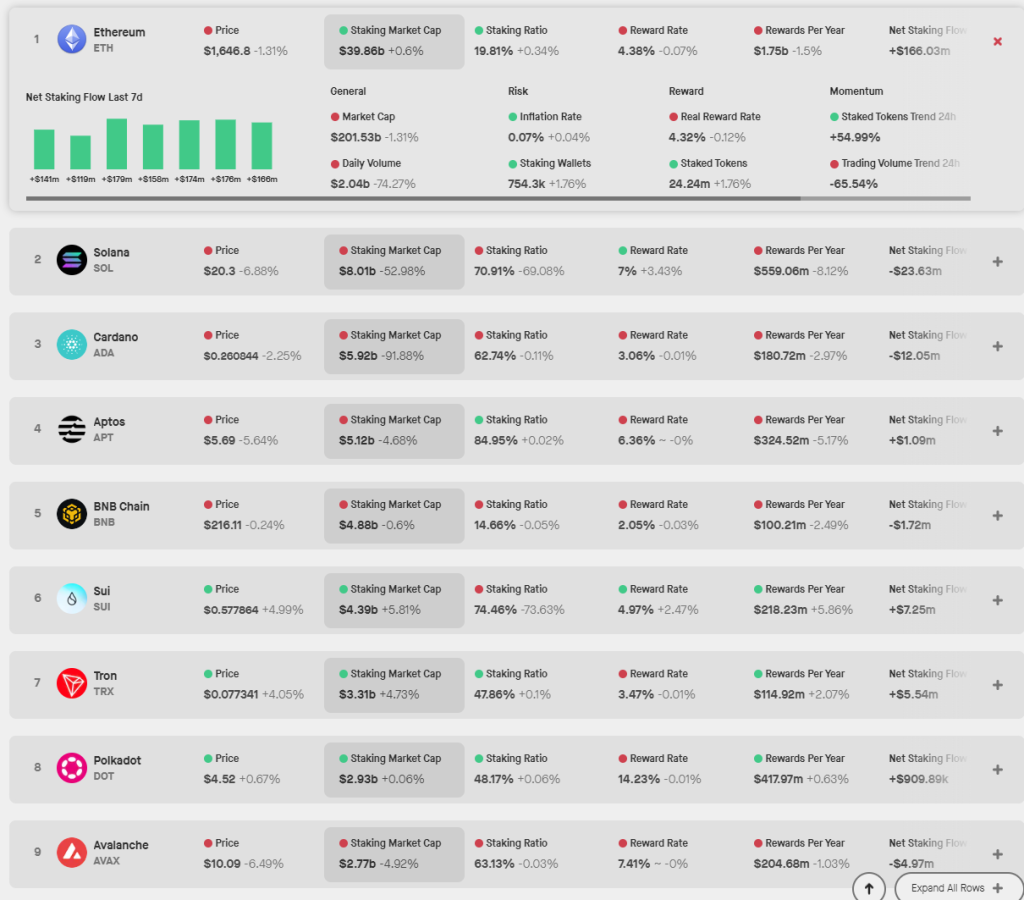

Considering that the current staked amount of Ethereum’s ETH is $42 billion, with a total market value of around $200 billion (as of August 30, 2023), the total funds on the Ethereum chain amount to $300-400 billion. Taking into account that EigenLayer’s main customers in the future will be relatively small and new projects, the staking business scale of EigenLayer’s service projects should be in the range of $1-10 billion in the short term, compared to Ethereum’s PoS staking scale of about $4 billion, which is in an absolute leading position.

Narrative Driving Project Business and Expected Growth

Demand side:

- The arrival of the Cancun upgrade and the opening of the OP Stack have accelerated the development of small and medium-sized rollups and app chains, increasing the overall demand for low-cost AVS

- The development of the modular trend in public chains, rollups, and app chains has increased the demand for cheaper DA layers outside of Ethereum, and the expansion of EigenDA has increased the demand for EigenLayer, with synergies between businesses

Supply Side:

- The increase in Ethereum staking rate and the rise in the number of staking users provide abundant LSD assets and a large holder base. They have a strong willingness to improve the capital efficiency and returns of LSD assets. In the future, EigenLayer also hopes to introduce LSD capital other than ETH.

Issues and Challenges

For the demand side of AVS, how much cost can be reduced by purchasing collateral assets and professional validation node services on the EigenLayer platform? It is difficult to say. Using Ethereum’s LSD assets as collateral does not mean that it directly inherits the security of Ethereum’s billions. In fact, the economic security of the project is determined by the total scale of leased Ethereum LSD assets and the quality of validation nodes. It may be faster and simpler than building AVS from scratch, but the cost saving ratio may not be significant.

If the project uses other assets as collateral for AVS, it will weaken the scenario of its own token. Although EigenLayer supports the combination of the project’s own token and EigenLayer hybrid staking mode, it still poses significant obstacles in the adoption of services.

The project may worry about being passive in long-term development due to its dependence on EigenLayer and may be “choked” in the future. Once the project matures, the project may switch to using its own token as the collateral asset for network security.

Using LSD collateral as secure collateral, the project needs to consider the credit and security risks of the LSD platform, adding another layer of risk.

Competitors

Restaking is a relatively new concept, pioneered by EigenLayer, and there are currently few followers of this model. However, for EigenLayer, the main comparison for its potential customers is whether to build a secure network on their own or outsource the security network to EigenLayer. Currently, EigenLayer still needs more customer examples to prove the superiority and convenience of its solution.

Valuation Deduction

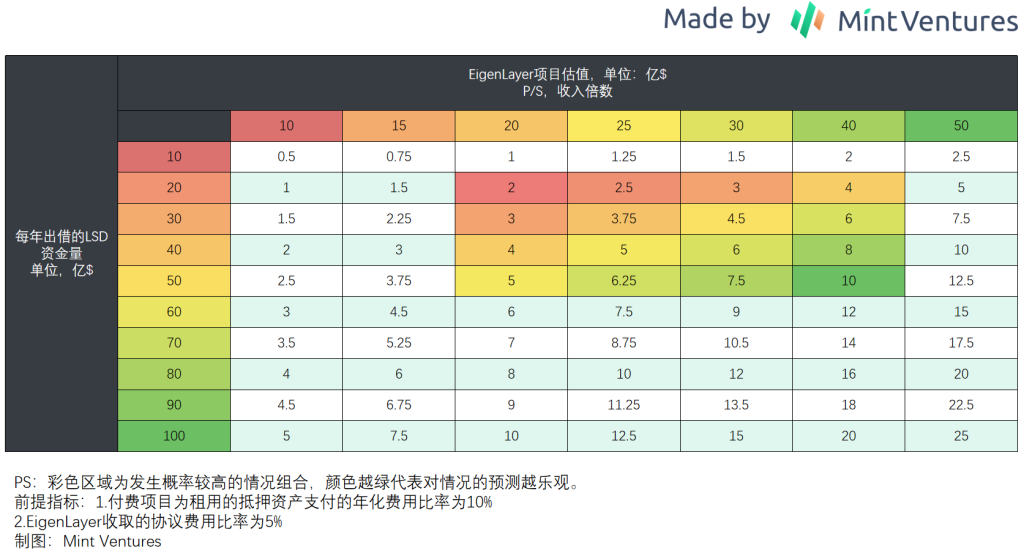

As a new business project, EigenLayer lacks clear benchmark projects and benchmark market value. Therefore, we estimate the project’s valuation through the projected annual protocol revenue and PS.

Before making a formal estimate, we still need to make a few assumptions:

- EigenLayer’s business model mainly involves collecting security service fees from AVS service users. 90% of the service fees go to LSD depositors, 5% to node operators, and EigenLayer’s commission rate is 5% (consistent with Lido).

- AVS service users pay an average of 10% of the LSD capital they lease as security service fees each year.

The reason for choosing 10% is that the annual rewards provided by mainstream PoS projects for PoS stakers are generally in the range of 3-8%. Considering that most users of EigenLayer are relatively new projects, the initial incentive ratio will be higher. Therefore, the author selects 10% as the average security service fee ratio.

The PoS reward ratios of major L1s, data source: https://www.stakingrewards.com/

Based on the above assumptions, the author has derived the following project valuation ranges based on the amount of LSD assets lent by EigenLayer and the corresponding PS. The colored areas in the valuation represent the author’s higher probability valuation ranges, with greener colors indicating more optimistic predictions.

The reason why the author considers the range of “LSD asset lending volume of 2-5 billion” and “PS of 20-40x” to have a higher probability of valuation is because:

- Currently, the market value of staked tokens on the top ten public chains is about 73 billion US dollars. If we include Aptos and Sui, it is nearly 82 billion. However, most of the staking in these two projects comes from unreleased team and institutional tokens. During the cautious period, I excluded these two outliers. The author assumes that EigenLayer’s LSD share can account for about 2.5%-6.5% of the total staking market (note that this is a rough estimate), corresponding to a market value of 2-5 billion. As for whether a share of 2.5%-6.5% is reasonable, it is up to the readers to decide.

- A PS value of 20-40x is based on Lido’s current PS of 25x (as of August 30th data, using fully diluted market value as the base). A newer narrative may enjoy a higher premium at its initial appearance.

Based on the calculations above, a valuation range of 200-1,000 million US dollars may be a reasonable valuation range for EigenLayer. For primary investors who value the project at 500 million, considering the various restrictions on token unlocking, they may not have left themselves much margin of safety. If there are indeed investors who want to buy EigenLayer tokens at a valuation of 2 billion US dollars OTC, as rumored, more caution is needed.

Of course, it should be noted that the above valuation is a deduction of the valuation of the entire EigenLayer project. The specific market value of the token should be determined based on its specific capturing ability in the business, such as:

- What percentage of the protocol’s revenue will be attributed to token holders?

- In addition to buybacks and dividends, does the token have relatively rigid use cases in the business, increasing demand for it?

- Will EigenDA share the same token as EigenLayer, providing more scenarios and demand for the token?

If the empowerment of points 1 and 2 is insufficient, it will further weaken the intrinsic value of the EigenLayer token, and if point 3 has unexpected surprises, it will add value to the token.

In addition, the market value of EigenLayer at its launch also depends on the market bull/bear environment at that time.

Let’s wait for the market’s answer.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Trillion-level business opportunity In-depth analysis of the prospects of security tokens in Hong Kong

- Unable to guard against Why are a large number of encrypted Twitter accounts hacked and used to publish phishing links? How to prevent it?

- Tornado Cash founder arrested, what original sin did the mixer commit?

- Why are Layer2 tokens not used for paying network GAS?

- Is an encrypted market maker the ‘behind-the-scenes dealer’?

- a16z Why It’s Said that Stateless Blockchain Cannot Exist

- a16z Research on the Impossibility of Stateless Blockchain