Is RWA the next growth engine for DeFi?

Can RWA fuel DeFi's growth?Author: Axia8 Ventures Source: medium Translation: Blocking, Shanooba

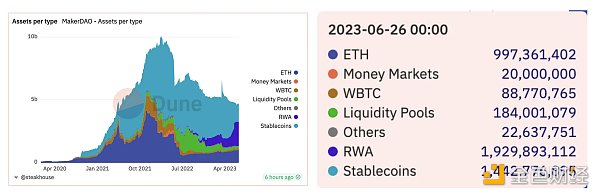

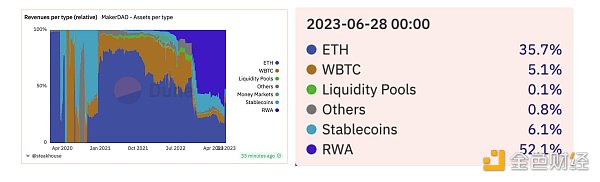

On June 21, 2023, MakerDAO purchased another $700 million in US Treasury bonds, bringing its holdings of US government bonds to over $1.2 billion.

For a long time, the market value of RWA has been small. Until October 2022, when MakerDAO purchased $500 million in US Treasury bonds, officially kicking off the rapid growth of the RWA market. Currently, RWA has surpassed stablecoins to become the largest asset class in MakerDAO’s assets, with a scale of 1.929 billion, accounting for 41.2%.

- $MATIC has been upgraded to $POL

- 1confirmation Partner: Reflections on the Crypto VC Landscape in the Bear Market

- Data Analysis of EigenLayer’s Second Round Deposit Progress

RWA can not only accelerate the growth of TVL but also increase MakerDAO’s protocol revenue. The latest data shows that RWA contributes more than 52% of MakerDAO’s revenue.

Meanwhile, another DeFi giant, Compound, has also entered the RWA field.

Compound founder Robert Leshner has established a new company, Superstate, whose mission is to create and distribute regulated financial products that connect the traditional market with the blockchain ecosystem. Superstate hopes to create and issue blockchain-based investment products registered with the SEC and compete with stablecoins in the future, becoming a reserve asset and settlement choice for cryptocurrencies.

The prospectus states that the fund is a “super-short-term government securities fund,” including U.S. Treasury bonds, U.S. government agency securities, repurchase agreements collateralized by securities issued by the U.S. government or U.S. government agencies, and other U.S. government securities, and allows shareholders to keep records of their ownership of the fund on Ethereum.

Defi’s next growth engine

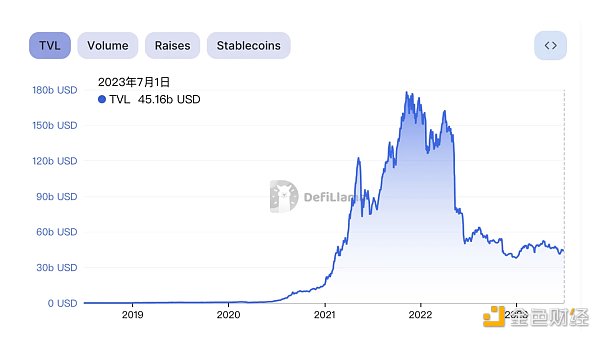

After Defi Summer, Defi TVL will reach ATH in early 2022, approaching $180 billion. As the market cools down, Defi TVL is currently stable at around $45 billion.

In the past few years, we have seen various innovations in Defi: the improvement of infrastructure such as Layer2 and cross-chain bridges has given Defi more possibilities; the emergence of various Defi applications such as Uniswap, Curve, Dydx, and GMX has brought Defi to a more humanized level; innovation in wallet fields such as account abstraction has continuously optimized and lowered the entry barriers for ordinary users.

However, from the asset side, Defi is currently facing a major dilemma: the on-chain acceptable/interoperable assets are limited to native crypto assets. Billions of off-chain RWAs are now blocked.

What factors affect the interoperability between RWA and cryptocurrencies?

-

Compliance – Compliance is the foundation for bridging RWA and crypto assets.

Off-chain to on-chain route: How can off-chain RWAs move to the chain in a compliant and trustworthy manner?

On-chain to off-chain route: How can on-chain crypto assets invest in off-chain RWAs?

-

Safety

The security of smart contracts/protocols is a prerequisite for RWA to enter the Defi field on a larger scale.

Top-tier venture capitalists, financial agents, and Defi protocols are increasingly focusing on RWA, which may herald the next Defi narrative.

In early 2021, we invested in Solv Protocol, aimed at expanding the boundaries of Defi and providing diversified, professionally managed assets in the safest and most visualized way, including fixed income products, structured products, index-linked products, etc. We firmly believe that Solv Protocol can become a bridge between RWA and crypto assets, bringing new value to both parties.

Solv Protocol has initiated the ERC-3525 semi-fungible token (SFT) standard, which is a universal standard for sophisticated financial instruments that may solve the problem of ERC-721 or 1155’s high cost.

With its excellent descriptive power of real-time data and static or animated images and the liquidity characteristics of ERC-20 tokens, ERC-3525 fills the gap in the powerful and versatile digital representation of RWA.

ERC-3525 is a generic, versatile, and highly scalable token standard that any developer with appropriate coding skills can easily implement in more scenarios.

-

Creating a SoulBound token (SBT) that uses ERC-3525’s token payment and quantification features for identity management

-

Issuing membership cards, reward cards, points cards, or club cards on-chain

-

Tokenizing and shard Web2 or Web3 digital wallets and transferring wallets to others

-

Creating virtual items, game items, e-books or on-chain magazines

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Who is the winner in the XRP ruling?

- An Analysis of a16z’s Core Investment Philosophy: Focusing on Non-Consensus

- Has the full-stack game engine MUD v2 abandoned the ECS architecture? Is ECS suitable for creating full-stack games?

- Coinbase’s Base releases mainnet for developers, aiming to launch publicly in August.

- Deep Analysis of MKR On-Chain Data: Slow Growth in Holding Addresses, Majority of Large Holders in Profitable Positions MKR On-Chain Data Analysis: Slow Growth in Holding Addresses, Majority of Large Holders in Profitable Positions

- Ripple wins brief legal victory, XRP token not a security?

- Ripple wins ruling that XRP is not a security