Data behind the seven production-reducing coins: the average price of coins rose by 143%, and the mining revenue rose by an average of 77%

Analyst | Carol Editor | Bi Tongtong | PANews

Recently, the "reduction in production" coins, led by Bitcoin, have risen successively, and the "reduction concept" seems to sound the bull horn.

This year's reduction in production mainly includes BTC (hereafter referred to as the original token to refer to the blockchain) and its fork coins BCH, BSV, BTG, BTG, Ethereum's fork coin ETC, anonymous coins DASH, ZEC, XZC, SERO There are also ZEN (Horizen) and Flo (Flo Network).

The general significance of production reduction is to control inflation and stabilize value, thereby promoting the stability of the blockchain network. There are also opinions that reducing production can make cryptocurrencies have attributes similar to precious metals such as gold, in exchange for scarcity for use value and storage value.

- When the epidemic strikes and companies are blocked, what can the blockchain do?

- Bitcoin detonated the market, but left too many "irrational" designs?

- Canaan Technology surged over 80% to close at $ 8.04

Based on this, one of the basic expectations of currency people for reducing production is the rise in currency prices. From the perspective of BTC's production reduction, its currency price has indeed increased significantly after the two previous production reductions. It is expected that in May of this year, BTC will usher in the third production cut in history, and now the BTC production cut may have a wide-ranging impact on "moving the whole body."

In addition, among the cryptocurrencies that will be reduced this year, BTC, BCH, BSV, ETC, DASH and ZEC are among the top 30 in market capitalization (ranked by CMC on February 10), which is significant in the "Eighth Eighth Effect" In the cryptocurrency market, changes in these head assets may also have a greater impact on upstream and downstream industries such as mining and trading.

PAData analyzes the currency price, on-chain transactions, and mining situation before and after BTC's two production reductions in history, and focuses on analyzing the changes in currency prices, on-chain transactions, and mining data of each mainstream production-reduction currency since this year to observe production reductions. The impact of this will provide a reference for a series of production cuts this year.

BTC halved twice, the price of the currency rose significantly, and the number of transactions on the chain rose steadily

Historically, BTC has experienced two production cuts. The first occurred on November 28, 2012, the block reward was halved from 50 BTC to 25, and the second occurred on July 10, 2016, the block reward was halved from 25 BTC to 12.5.

According to statistics, when the first production cut in 2012, the Bitcoin price was 12.2 US dollars, and the increase in the first half of the production cut was about 134.62%. In the six months after the production cut, the price of bitcoin reached $ 128.8, an increase of about 955.74%, the highest reached $ 230.7, and the highest increase was about 1799.98%.

For the first time, the price of Bitcoin has risen significantly. But in the second production cut, the "halving market" was much milder.

When the second cut was made, the price of Bitcoin was 650.3 USD, which increased by 51.30% in the first half of the cut. About a month before the production cut, the "half quotation" came out of a small peak. In mid-June, the currency price reached $ 767.4. However, when the halving was approaching, the price of the currency reversed somewhat. Even in early August after the halving, the price of the currency fell to 527 US dollars, returning to the starting point of the rise in the price of the currency before halving. Adjustment period. Within half a year after the second halving, the price of the currency rose to 892.5 USD, an increase of approximately 37.24%, the highest increase to 11354.5 USD, and the highest increase was approximately 164.604%.

Although the currency price increased significantly after the production reduction, the number of on-chain transactions in the Bitcoin network has steadily increased before and after the two production reductions. When the first production was reduced, the number of transactions on the Bitcoin chain was 37,300 times that day, and rose to 50,800 times after half a year, an increase of approximately 36.11%. Within half a year after the production reduction, the daily transactions of the Bitcoin network generally fluctuated above the average.

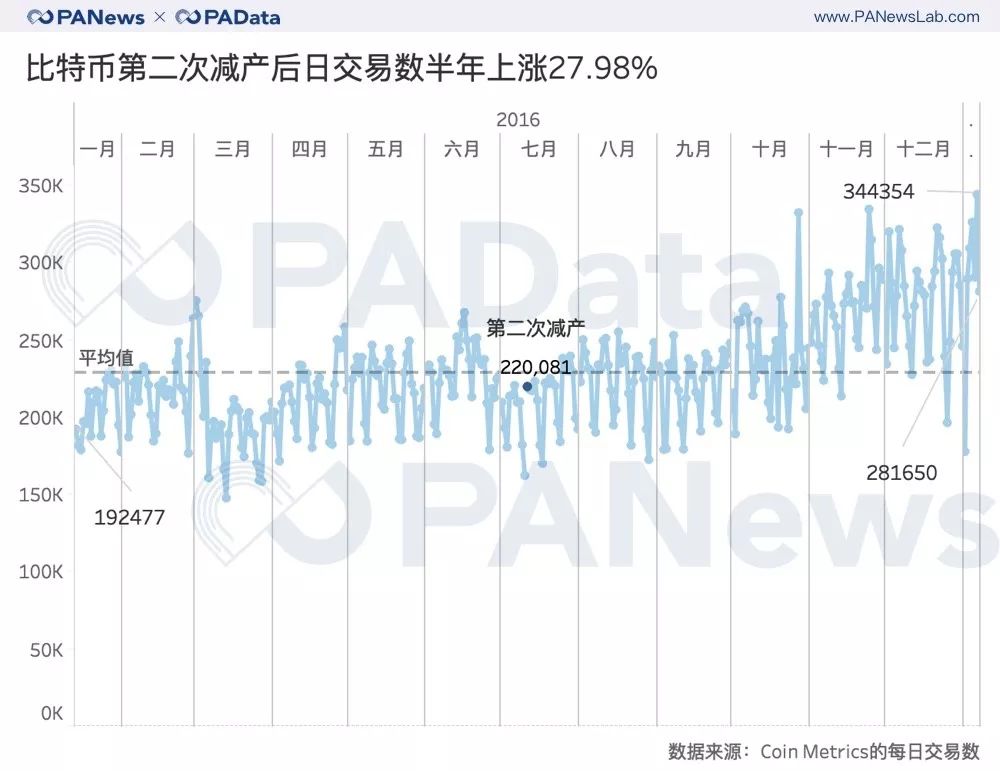

However, during the second production reduction period, the daily transactions of the Bitcoin network always fluctuated around the average value, and the half-year increase was also lower than the first half. The total number of on-chain transactions on the day of the second production reduction was about 220,800 times, which rose to 281,700 times after half a year, an increase of about 27.98%.

The second halving caused a 13% drop in mining profits

The reduction in production directly affects the mining income of miners. According to the statistics of BitInfoCharts, at the time of the first production reduction, BTC miners can earn $ 3,655 per T of computing power per day. During the first half of the production reduction, the miner's income was basically stable. After the reduction in production, the mining revenue has dropped significantly, from 3,655 USD / T to 1,778 USD / T, and the total decline over the three days is about 51.35%. But since then, mining profits have rebounded rapidly, rising by 53.43% in 180 days, up to 13352 USD / T, and the highest increase is about 256.31%.

However, the situation of Bitcoin's second production reduction in 2016 was not the same as the first, and the mining revenue of miners showed a cliff-like decline. After the second cut, miners can earn $ 0.764 / T per day, which is about 63.95% lower than the highest $ 2.119 / T before the cut. In the following six months, the mining income of the miners did not recover quickly or even reached a new high, but stabilized at a level of about 0.7 USD / T, which fell from 0.764 USD / T to 0.669 USD / T within half a year, a decline of about 13.00%.

Block rewards are just one component of the miner's income, and the other part is the transaction fee. The block reward is reduced, but if the transaction fee rises, it can make up for the decrease in income brought by half.

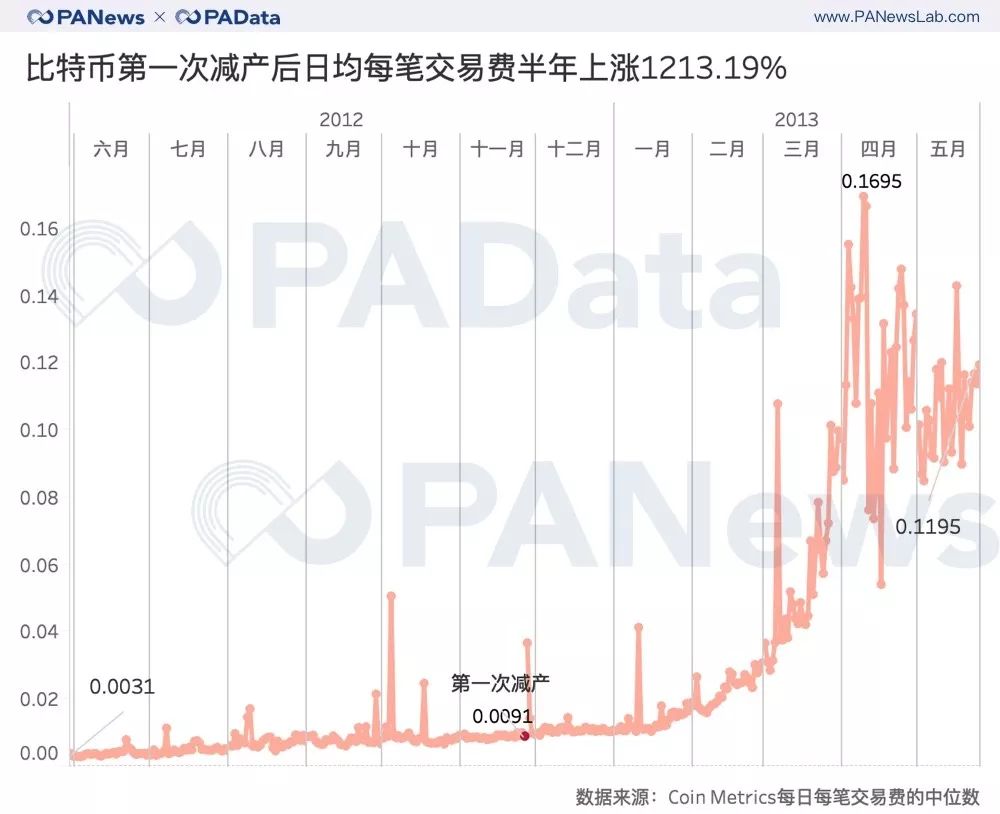

According to statistics, the average daily transaction fee for each transaction when Bitcoin was cut for the first time was approximately 0.0091 USD, which rose to 0.1195 USD in the first half of the year after the reduction, an increase of 1213.19% and a maximum increase of 1762.64%.

During the second production cut, the average daily transaction fee of the Bitcoin network was about $ 0.1707, and some extreme conditions were eliminated before the production cut, and the average daily transaction fee was relatively stable. Within half a year after the production reduction, the average daily transaction fee rose to US $ 0.3416, an increase of approximately 100.12%, and the highest increase was approximately 287.46%.

Although the average daily transaction fee is denominated in U.S. dollars, it is bound to be affected by the fluctuation of the currency price. However, according to the currency price corrected by Coin Metrics, the average daily transaction fee increase is significantly higher than the currency price increase over the same period. This is explained from the side. After the production cut, the transaction fees under the currency standard have increased.

According to PAData's earlier analysis (referring to "Uncovering the Data on the 2019 Bitcoin Chain"), in 2019, transaction fees accounted for about 2.8% of the miner's income. From this perspective, the rise and fall of the currency price is the decisive factor affecting the miner's income after halving, and whether the stability of the miner's income will be related to the stability of the network.

Looking at the currency price, the number of on-chain transactions, and the mining income trend in the two halving periods in Bitcoin history, we can see that the second "halving effect" is much lower than the first, and the performance is the second The halving price of the currency rose much lower than the first time, and there was a callback after the halving. The daily transaction times increased less than the first time. The average daily transaction fee increased less than the first time, and the daily mining revenue showed a negative growth.

This year, the production price of currency has been reduced by 143%.

BTC will usher in the third halving this year, and DASH will usher in the sixth halving this year, but in addition, BCH, BSV, ETC, etc. are all halving for the first time. Although each cryptocurrency has its own characteristics, considering that many of the production-reducing coins are forked coins of BTC, and the current market value of BTC always remains above 60%, which has a strong impact on other cryptocurrencies, so BTC ’s The impact of historical output reduction may be of some reference. So, how has the mainstream production-reducing currency performed since entering the year of production reduction? What are the possible future trends?

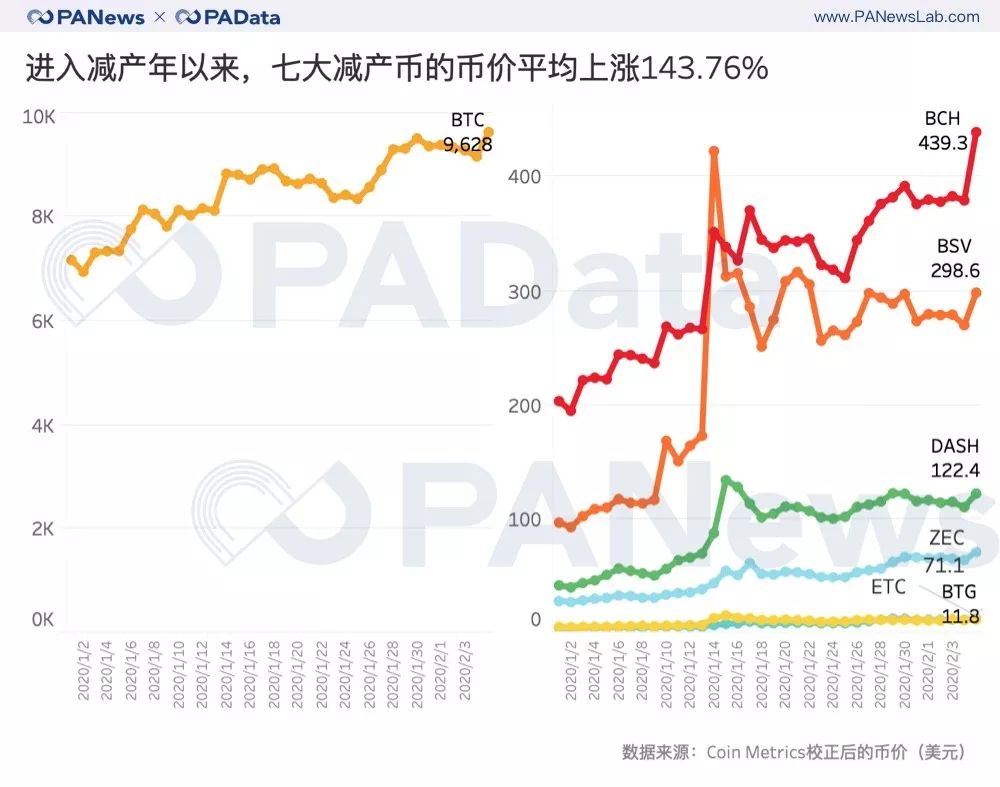

Since entering the production reduction year, affected by the concept of "reduction in production", the currency prices of the seven major production reduction coins have all risen. From January 1st to February 5th, within a month, BTC rose by 34.27% to reach 9,628 US dollars. As of press time, BTC had reached the US $ 10,000 mark, and the upward trend was obvious. And the current increase is still lower than the previous two cuts in the first half of the increase.

However, BTC is the smallest increase among production reduction coins this year. Its fork currency BCH rose 115.82%, BSV rose 208.45%, BTG rose 123.19%, and the two anonymous coins DASH and ZEC also rose 193.82% and 154.62%, respectively. Ethereum's forkcoin ETC rose 176.13%. The price of the seven major production-reducing coins rose by an average of 143.76%.

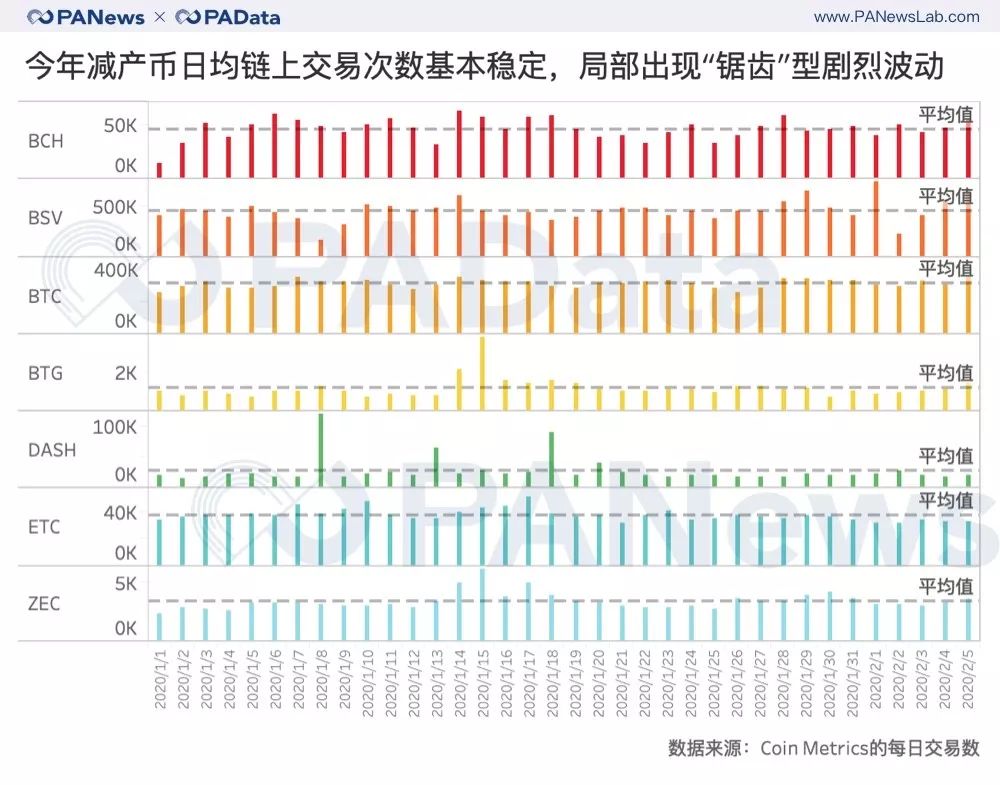

Although the currency prices are constantly rising, from the data on the chain, the current daily transactions are basically stable. Only BTG and DASH have a higher number of daily transactions on individual days, but they have immediately recovered to the average daily level. .

The average daily transactions of Bitcoin this year is about 314,100, which is close to the average level of last year (refer to "2019 Bitcoin Chain Data Review (Part 1)". The average daily transactions this year has increased by 44.18%, and the current increase has been Above the previous two halvings.

The average daily transaction times of BCH this year is about 45,500 times, an increase of 27.71%, BSV is about 461,600 times, an increase of about 61.92%, and BTG is about 12,200 times, an increase of about 43.53%. In terms of average daily transactions, BSV is the most active on-chain transaction in the Bitcoin fork. In addition, ETC's average daily transactions this year reached 37,600, a slight decrease of 2.52%, DASH and ZEC reached 26,900 and 33,400, respectively, with increases of -4.3% and 52.47%. In general, the average daily transactions of the seven major production-reducing coins have risen by 66.57% this year.

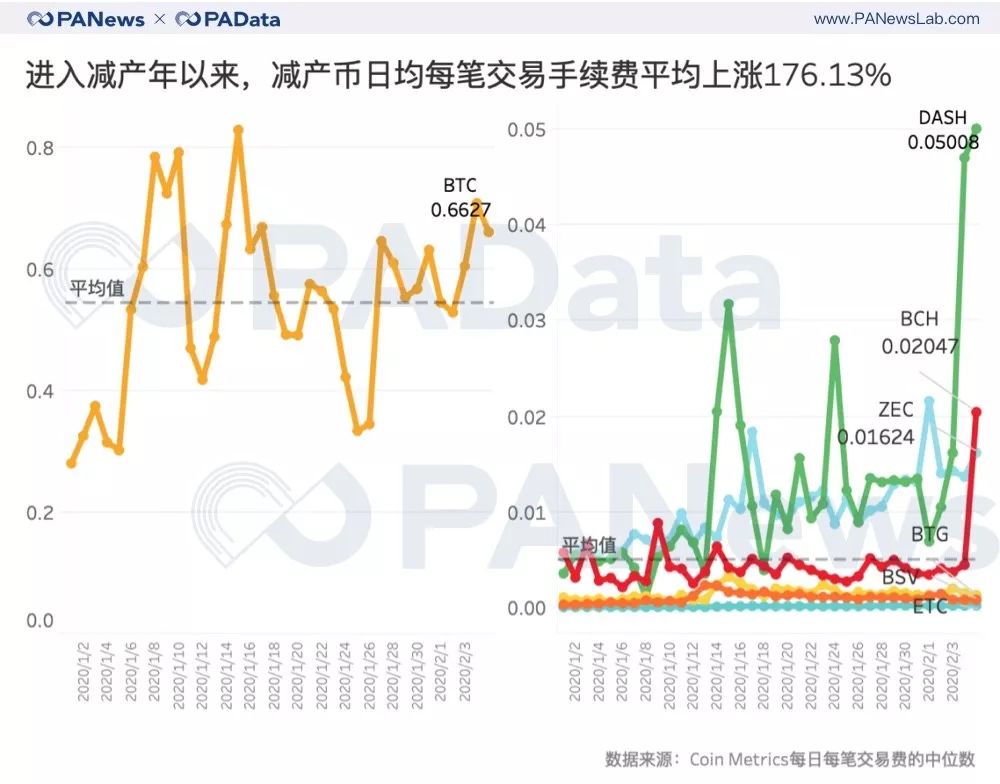

Reduced production currency transaction fees rose by more than 176%

Judging from the average daily transaction fees, the average (median) transaction fees of the seven major production-reducing currencies this year have increased by 176.13%. Among them, BTC rose from 0.2815 US dollars to 0.6627 US dollars, an increase of 135.46%, the increase has exceeded the level at the time of the second production cut, and it is also much higher than the increase in the price of currency.

In addition, the daily average transaction fee of BCH increased by 251.73%, BSV increased by 144.96%, BTG increased by 24.62%, ETC increased by 176.13%, DASH and ZEC increased by 1286.29% and 207.11%, respectively. Among them, the daily average transaction fee increase of BCH, DASH, and ZEC is much higher than the increase of the currency price, which may indicate that the current transaction fees of the three public chains have increased compared to previous ones, especially DASH, and the transaction fee increased during the same period. Is more than 6 times the increase in currency prices. In addition, the average daily transaction fee increase of BSV and BTG is much lower than the increase of currency price, and the increase of ETC is equivalent.

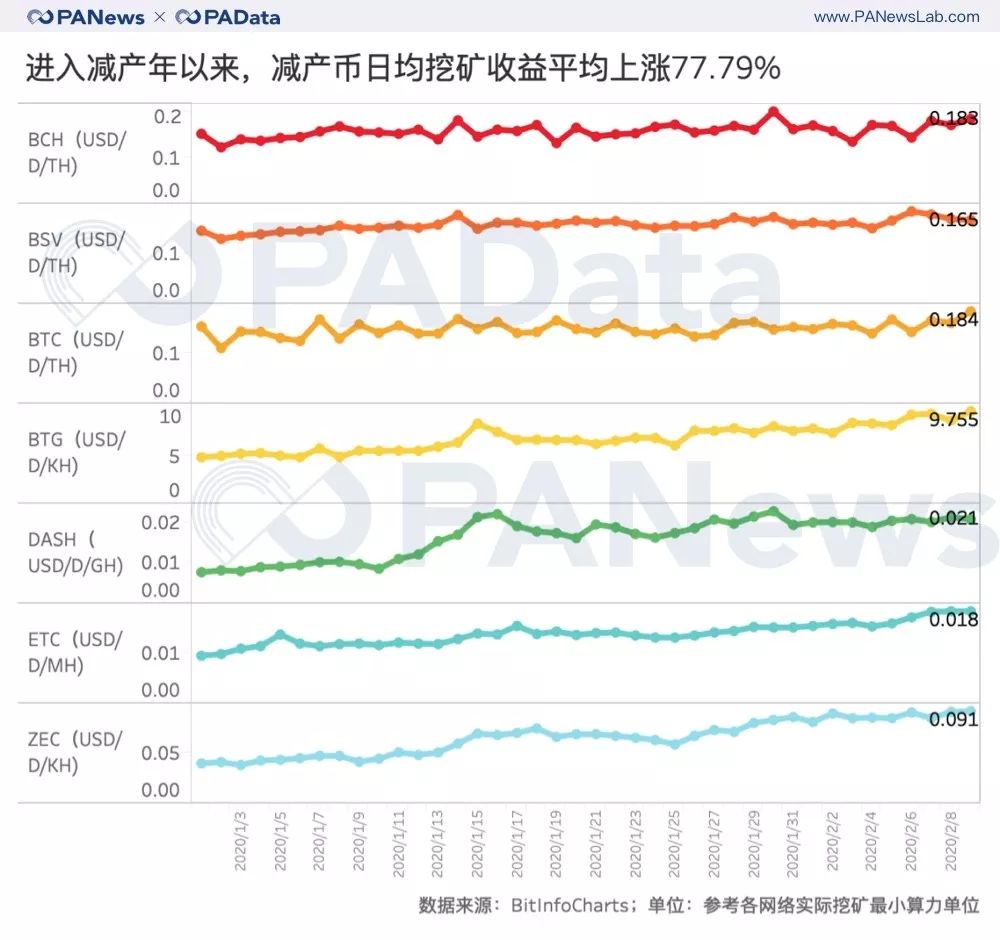

Due to the impact of reduced production, the price of the currency has risen one step ahead, but the block reward has not decreased, so the mining income of miners has increased significantly. Since entering the production reduction year, the average daily mining revenue of the seven major production reduction coins has increased by an average of 77.79%.

Among them, BTC rose from $ 0.154 per T per day at the beginning of the year to $ 0.184 on February 10, an increase of about 19.48%. BSV's mining revenue growth rate is lower than BTC's, only 14.58%. On February 10th, there was no T computing power to make a profit of 0.165 US dollars.

The highest increase in mining revenue was from two anonymous coins. DASH increased from 0.008 USD per G per day at the beginning of the year to 0.002 USD per day on February 10, an increase of 168.23%. ZEC made a profit per K per day at the beginning of the year. 0.040 US dollars rose to 0.091 US dollars on February 10, an increase of about 129.87%. In addition, the mining profits of BTG and ETC also increased by more than 90%, reaching 98.31% and 92.83%, respectively.

It is worth noting that after the second production cut, BTC saw a cliff-like decline in mining profits, and failed to return to the reduced production level within six months. However, the country is currently affected by the new crown epidemic. The three major ASIC miners such as Shenma Mining Machine, Bitmain and Canaan Jianan will have issued announcements to postpone production, delivery, and after-sales time. The computing power may mainly come from the stock market, and the limited growth of computing power may add more uncertainty to BTC's production reduction.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Flexible policies can encourage innovation, an interview with Hester Peirce, a "crypto old godmother"

- US Treasury Secretary: FinCEN will release new crypto regulatory requirements

- Opinion: Bitcoin mining main force is shifting from China to the US and Canada

- Crypto supporter Andrew Yang withdraws from 2020 U.S. presidential race

- Free and Easy Weekly Review | How Selfish Mining Strategies Affect Every Half Coin

- Donation, medical treatment, rescue, community prevention and control, can blockchain become a new weapon to fight the epidemic?

- People's Network: Blockchain technology helps make charity more transparent