Decoding Decentralized Order Book The Best Combination of Pricing Quality and Fund Security

Decoding Decentralized Order Book Optimal Combination of Pricing, Quality, and Fund SecurityWritten by: ELLA, KEONE

Translated by: Deep Tide TechFlow

Since the peak of the DeFi Summer, crypto traders have been trading on DEXs like Uniswap and CEXs like Binance. However, DEXs are primarily implemented in the form of AMMs, while CEXs are primarily implemented in the form of limit order books (LOBs). Traders often find that AMMs offer simple pricing and avoid entrusting assets to centralized participants, while CEX LOBs provide better pricing due to more accurate liquidity from active market makers.

Although there are other trade-offs between the two types of exchanges, such as liquidity mining on AMMs and richer information trading on LOBs, these trade-offs can play a role in deciding which platform to trade on, but pricing is the most important factor. Therefore, the natural question is, why not decentralize centralized exchanges? Decentralized LOBs would be a game-changing factor that could achieve the advantages of non-custodial dapps and provide better pricing offered by a complete order book.

- LianGuai Daily | Coinbase, Block, and Apple release quarterly reports; X Company is seeking data partners to establish a trading platform.

- Ether Futures ETF Applications Pile Up, Is the Gear of Crypto ETF’s Fate Starting to Turn?

- Developer’s Guide How to Build Products on the Base Mainnet?

Let’s dive into the details.

Automated Market Makers: Native Crypto Liquidity

AMMs are on-chain programs (smart contracts) that allow users to swap assets between pairs. They achieve this by maintaining paired liquidity pools that serve as the exchange facility. The price of the assets is typically determined by the well-known first-generation AMM curve formula x*y=k, pioneered by DEXs like Uniswap v1/v2 (constant product market makers). There are other types of AMMs, such as constant sum market makers, constant mean market makers, and (more generally) constant function market makers, but the concept of maintaining an invariant formula to fairly determine asset conversion rates remains the same.

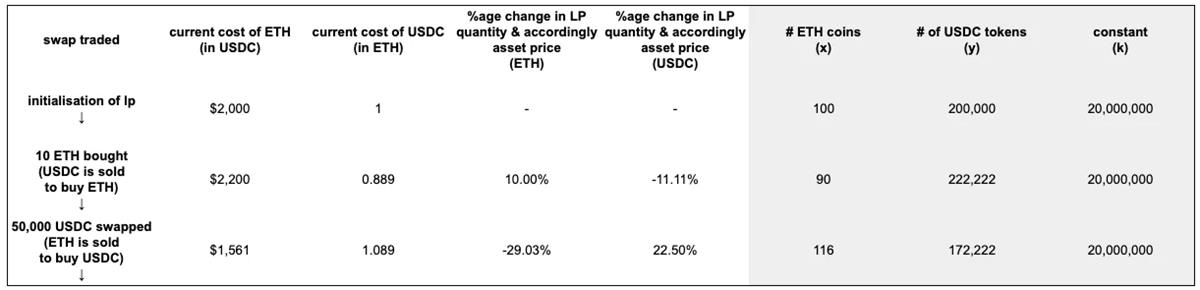

Here is a simplified example of how AMM pricing works in UniV2 (assuming no fees):

When conducting AMM trades, users typically provide liquidity within a specified price range, which can be relatively narrow or span the entire range from 0 to infinity. Regardless of the approach, there is a problem of inefficient capital utilization:

- For narrow ranges, more capital can be utilized when the price is within the range, but the price is only within the range in few cases;

- For wide ranges, capital is spread out, and most of the capital cannot be utilized at any given time.

Due to the constantly changing prices, capital on AMMs can only be fully utilized when liquidity providers use narrow ranges and update them frequently. However, frequent updates require a significant amount of gas fees on the Ethereum mainnet, so providers rarely update their ranges.

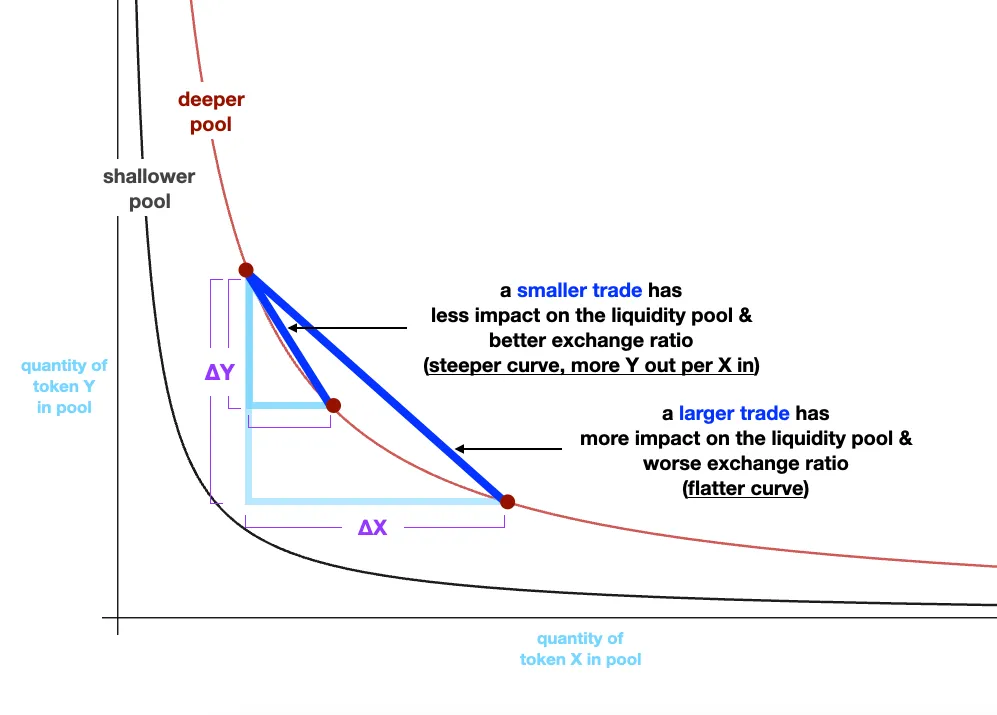

The result of this inefficient capital efficiency is a larger slippage for end users. The larger the transaction relative to the total liquidity, the greater the slippage, which is also affected by the depth of the liquidity pool. This can be seen intuitively from the diagram below, which is a typical x*y=k curve: the larger the transaction size, the further we move horizontally on the curve, resulting in a flatter diagonal line (worse price).

For larger transactions, more experienced traders often choose CEX.

(According to CoinMarketCap, as of August 3, 2023, for spot trading, Binance’s trading volume is 18.5 times that of UniV3 (on Ethereum).

Lessons from centralized exchanges

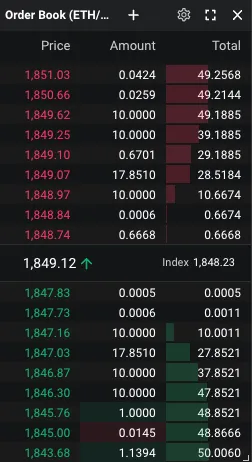

Centralized exchanges are almost always implemented in the form of limit order books. A limit order book is a list of buy and sell orders arranged in price and time order. These orders are executed based on price and time priority, meaning that the lowest ask price and the highest bid price are matched first, which incentivizes market makers to provide the best prices. This competition results in lower slippage for end users.

An example of an order book for ETH/USDC spot trading on Deribit.

The spread on the order book can be very small because market makers constantly adjust their orders based on supply, demand, and new information. This means that market makers send a large number of new orders to the exchange throughout the day.

Binance and Coinbase are still the two largest cryptocurrency exchanges by spot trading volume, while Deribit is the preferred choice for most institutional cryptocurrency options trading.

On-chain limit order books

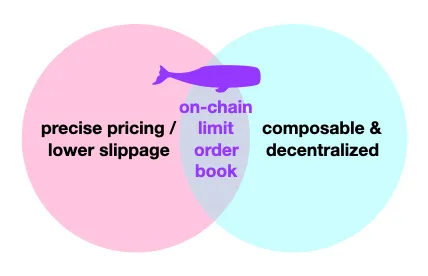

For frequent traders, striking a balance between execution quality and the risk of entrusting funds to a centralized entity can be tricky.

Decentralized limit order books have the potential to offer the best of both worlds between AMMs and centralized exchanges: excellent execution quality while retaining user assets.

Currently, the main challenge in implementing on-chain limit order books is the lack of an environment with cheap gas and abundant trading. Limit order books require cheap and frequent trading because market makers often adjust their quotes. The new generation of high-throughput (>2k) blockchains is gradually making fully on-chain limit order books more feasible. This has led to some notable examples of on-chain limit order books, including Econia (Aptos), DeepBook (Sui), and OpenBook/Serum (Solana).

The second obstacle to achieving full-capacity LOB is the large-scale operation of LOB on EVM. LOB compatible with EVM can not only provide decentralized transactions with low slippage, but also offer composability opportunities for a wider range of EVM applications.

Ultimately, if DeFi is to surpass CeFi, it needs to provide a comparable or better user experience. For traders, one important aspect of the user experience is execution quality. On-chain LOB is a crucial part in narrowing the execution gap between DeFi and CeFi.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- World Engine A sharding Rollup framework designed for full-chain games

- The inevitable outcome of Non-EVM public chains? Analyzing the reasons for the decline of ICP from multiple perspectives

- Latest developments in the Curve incident Has the crisis been resolved? Does the founder have to sell coins and pay off debts?

- OP Research Sociology Experiment of Currency and Global Citizens

- Exclusive Interview with 1inch Co-founder How does 1inch gradually innovate to grab food from the horse’s mouth in the liquidity battle?

- Extensive Article The Iron Curtain of Regulatory Control in the United States Has Fallen, What Tomorrow Will Crypto Face?

- Here is a list of cryptocurrency observations for the next week $LTC halving event, Evmos 2.0 launch…