High Open and Low Close: Did the first leveraged BTC ETF in the United States disappoint the market?

Did the first US leveraged BTC ETF disappoint the market with High Open and Low Close?The first leveraged cryptocurrency ETF in the United States fell short of expectations three days after listing.

On June 27 (this Tuesday), the “2 x Bitcoin Strategy ETF” issued by US ETF issuer Volatility Shares officially landed on the BZX exchange under CBOE and began trading.

According to Odaily Star Daily monitoring, 110,000 shares were issued on the first day of launch, with an issue price of $15, net assets of $1.65 million, and a first-day trading volume of $5.5 million, making it the most traded cryptocurrency ETF on its first day of issuance this year. (Odaily Note: The first day trading volume of Southern Dongying BTC Futures ETF is only $830,000, and Samsung Bitcoin ETF is only $98,000.)

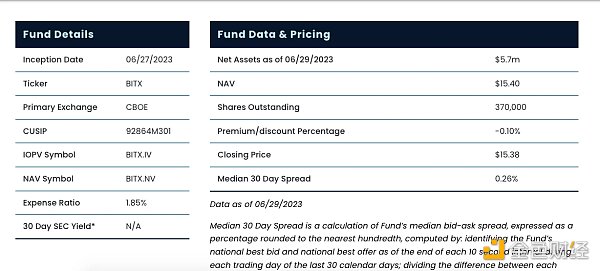

However, in the following two trading days, Volatility’s leveraged Bitcoin ETF trading volume began to plummet, with less than $300,000 per day – yesterday (29th) traded 21,768 shares, with a trading volume of $234,000; its ETF issuance gradually increased, with currently circulating shares of 370,000 and net assets growing to $5.7 million, as shown below:

- BlackRock and Fidelity’s insider application for Bitcoin ETF: The US wants to hand over the crypto industry to “its own people”

- Deep dive into decentralized proof, proof market, and ZK infrastructure.

- The “economic” logic behind the rise of Bitcoin

What is a leveraged Bitcoin ETF? According to the application filed by Volatility Shares with the SEC, the investment result sought by this ETF is equivalent to twice the daily excess return of the S&P CME Bitcoin futures roll index (referred to as the “roll index”). For example, if the roll index rises by 1% per day, the net asset value of the ETF needs to rise by 2%, and if the roll index falls by 1%, the net asset value of the ETF falls by 2%.

The “roll index” is used to measure the performance of the CME Bitcoin futures market and is rebalanced daily between the current month futures contract and the next month futures contract. If you don’t understand, just know that the CME Bitcoin futures daily roll index is actually similar to the CME Bitcoin futures index in terms of data and trends – both are influenced by the price trend of Bitcoin spot.

Therefore, the leveraged ETF issued this time is actually indexed to the same futures data as the Bitcoin futures ETFs previously issued.

In order to achieve the 2x return target, the ETF will set up a wholly-owned subsidiary with 25% of the total fund assets to invest in CME Bitcoin futures (become long); the remaining assets will be directly invested in cash, cash-like instruments or high-quality securities, including US government securities, money market funds, corporate debt securities, etc., which will be used for future liquidity provision or as margin.

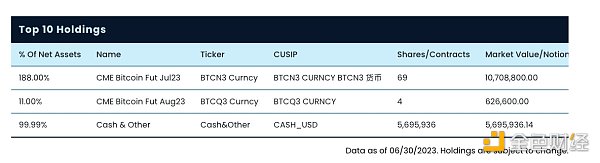

According to official website information, the leveraged ETF currently holds $10.708 million worth of CME Bitcoin futures expiring on July 23, $626,000 worth of CME Bitcoin futures expiring on August 23, and $5.69 million in cash equivalents. In terms of proportion, the total futures position is exactly twice the net asset value of the fund, which can meet the requirement of two times leverage exposure risk.

However, I still believe that the market size of this leveraged ETF will not grow significantly.

First of all, the issuing node is not good, and homogeneous products have no bright spots. The 2x leveraged ETF is essentially a futures ETF, and the US market has already issued multiple Bitcoin futures ETFs such as ProShare, VanEck, Valkyrie, and Hashdex. CME has also launched Bitcoin futures. As a latecomer, Volatility Shares seems a bit of a chicken rib and does not have much first-mover advantage, which can be seen from the trading volume in the past two days.

Furthermore, management fees are an important factor that directly affects investors’ choices, and Volatility Shares’ management fees are relatively high among a group of ETFs. According to the Odaily Planet Daily statistics, the Bitcoin futures ETF managed by Southern Dongying currently has the highest management fee in the ETF market, reaching 2%. ETF management fees launched in the United States and Canada in the past two years are generally around 1%. Volatility Shares’ management fee is as high as 1.85%, which is not attractive.

Finally, the failure cases of leveraged ETFs have sounded the alarm for Volatility Shares. As early as April 16, 2021, the world’s first cryptocurrency leveraged ETF-Beta Pro Bitcoin ETF (code: HBIT) had been listed on the Toronto Stock Exchange. After going online, the ETF market performed poorly, with an average daily trading volume of only 5769 shares (trading volume of $100,000) in the past year, and a total asset size of only $3.76 million. In mid-April of this year, the issuer Horizons finally shut down the ETF.

There are certainly limitations to the Canadian financial market itself, but at the same time, it also verifies that leveraged ETFs do not have high development potential, especially when compared with two spot ETFs launched in Canada at the same time-Purpose BTC Spot ETF ($851.3 million) and 3iQ BTC Spot ETF ($77.95 million), which are enough to prove that only cryptocurrency spot ETFs have attractiveness to investors. This is also the reason why a group of traditional investment institutions such as BlackRock, Fidelity, and ARK Investment are applying for Bitcoin spot ETFs in a concentrated manner.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Full Text of Bloomberg’s Interview with He Yi: “I’m the One Who Introduced CZ to Crypto Trading”

- Future Web3 New Chapter: Triple Impact of VSAP on Exchanges, Financial Markets, and TradFi

- Future of Web3: Triple Impact of VSAP on Exchanges, Financial Markets, and TradFi

- BlackRock’s Bitcoin ETF Key Dates and Timeline for Listing

- Can you make money by running a node? How to choose a public chain? We talked to a node operator.

- Victory belongs to the long-termists: June 2023 Secondary Market Trading Strategy

- Will the growth of the NFT market in 2023 come from new capital entering or from old capital circulating?