BlackRock and Fidelity’s insider application for Bitcoin ETF: The US wants to hand over the crypto industry to “its own people”

BlackRock and Fidelity's Bitcoin ETF insider application: US wants to give crypto industry to "own people"Author: Koala Finance

BlackRock, founded in 1988 and headquartered in New York, is one of the world’s largest asset management groups with a fund management scale of $8.59 trillion at the end of 2022. Last week, the asset management giant threw out a heavyweight message – applying to the US Securities and Exchange Commission for a Bitcoin exchange-traded fund (ETF).

Following BlackRock’s lead in submitting the spot Bitcoin ETF application on June 15th, other asset management companies have also submitted similar applications, including Invesco, WisdomTree, and Bitwise. Another asset management giant, Fidelity Investments, has also officially submitted an application for a Bitcoin spot ETF today.

- Deep dive into decentralized proof, proof market, and ZK infrastructure.

- The “economic” logic behind the rise of Bitcoin

- Full Text of Bloomberg’s Interview with He Yi: “I’m the One Who Introduced CZ to Crypto Trading”

For fund management companies, creating, managing, and distributing funds is their “core business”, but BlackRock is different from ordinary funds because they have more than 1,300 ETFs globally! In the ETFs that have been applied to the U.S. Securities and Exchange Commission before, BlackRock’s record is 575:1, which means that the SEC has approved 575 ETFs launched by BlackRock and only rejected one in October 2014, with almost no defeat.

Frankly speaking, if the spot Bitcoin ETFs launched by BlackRock and Fidelity are really approved by the SEC, they will definitely be one of the most important milestones in the cryptocurrency industry. No wonder Bitwise Asset Management’s Chief Investment Officer, Matt Hougan, exclaimed after hearing the news, “The future of cryptocurrency is BlackRock, not Binance.” Galaxy Digital CEO Michael Novogratz also tweeted that BlackRock’s launch of a Bitcoin ETF may be the best thing that has happened in Bitcoin’s history.

But the problem is, did BlackRock and Fidelity just want to add a “cryptocurrency resume” to their long list of ETFs? The answer may be surprising to many people.

BlackRock has already “secretly” extended its tentacles into the cryptocurrency industry

In 2017, BlackRock CEO Larry Fink seemed to be pessimistic about Bitcoin, just like JPMorgan CEO Jamie Dimon and Buffett. At that time, he also publicly stated that “Bitcoin only shows how much the world needs money laundering.”

However, the actual situation is different.

According to insiders, Larry Fink has always “implicitly” allowed BlackRock employees to get in touch with cryptocurrencies, and even allowed employees to organize cryptocurrency forums. BlackRock also invited heavyweight figures in the cryptocurrency industry such as Ethereum co-founder Gavin Wood and ShapeShift founder Erik Voorhees to participate in discussions. One BlackRock employee who attended these meetings said about internal cryptocurrency organization exchanges:

“On the surface, it looks like a hobby of a group of people, but in fact, we have turned it into an educational group, trying to make everyone smarter.”

BlackRock’s senior leadership’s “implied” support met some employees’ interest in cryptocurrencies, although at that time, cryptocurrencies were not a high-priority business option within BlackRock.

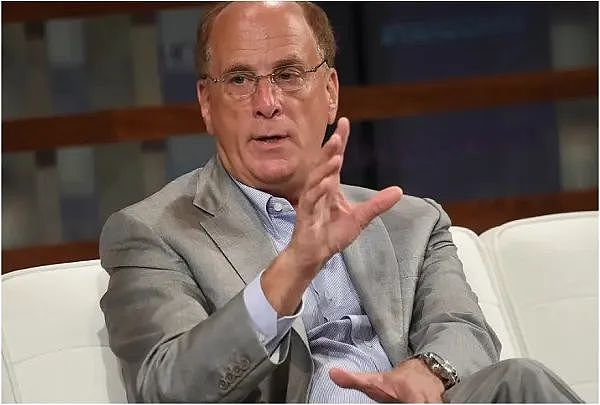

Above: BlackRock CEO Larry Fink

A year later, the BlackRock management decided to communicate regularly with the blockchain technology working group and jointly study digital assets. Soon, BlackRock began to try to “personnel layout” in the cryptocurrency industry. During this time, dozens of people left BlackRock, and almost all of them jumped to Coinbase, Circle, New York Digital Investment Group, and Galaxy Digital and other top cryptocurrency companies – at that time, no one knew why.

At this time, Larry Fink’s attitude towards cryptocurrencies also softened significantly. Interestingly, BlackRock launched an exchange-traded fund that holds stocks of companies involved in blockchain and cryptocurrencies that year. Then, it invested in Circle, the issuer of stablecoins, and established a partnership with Coinbase. It also announced that it will open up spot bitcoin exposure to US institutional clients through private trusts.

At the end of 2020 and the beginning of 2021, the price of Bitcoin soared to a historic high, and BlackRock customers began to frequently inquire about cryptocurrency risks. All of this seems to confirm an old saying: plans cannot keep up with changes.

When the time comes to the end of 2022, the US dollar stablecoin USDC issuer Circle announced that it will transfer some reserve funds to the “Circle Reserve Fund” established by BlackRock. All of these seemingly casual news are actually the result of BlackRock’s step-by-step strategy. A BlackRock employee who left the company between 2018 and 2022 later said that he was very surprised by BlackRock’s series of announced cryptocurrency cooperation and investment behaviors, because compared with the management philosophy led by Larry Fink before, BlackRock’s attitude towards cryptocurrencies has undergone a “180-degree turn”, and the speed of the change is astonishing.

From a conspiracy theory perspective, BlackRock should have already “secretly” extended its tentacles into the cryptocurrency industry, and now it seems that they are starting to harvest.

The US wants to hand over the cryptocurrency industry to “their own people?”

In fact, in addition to BlackRock, last week Citadel, Deutsche Bank, and Nasdaq all began to enter the cryptocurrency market. Deutsche Bank applied to the regulator for a license to provide custody services for digital assets such as cryptocurrencies, and Nasdaq is interested in the restart of FTX2.0. It is even rumored that Fidelity will soon submit an application for a spot Bitcoin ETF.

You will find that these institutions with backgrounds in US financial giants have chosen to enter the market in a bear market. Adam Cochran, a partner at CEHV, bluntly pointed out: “Entering the bear market, you can buy cheap tokens, and they are bullying the grassroots participants in the cryptocurrency community and the cryptocurrency industry.”

It is no exaggeration to say that “they” (as for who “they” are, please imagine for yourself) do not want to eliminate cryptocurrency, they just want to drive away the people who currently dominate the cryptocurrency industry, and then hand over this industry to their own cronies, such as Citadel, BlackRock, JPMorgan, Deutsche Bank…

As mentioned earlier, since 2018, many BlackRock employees have “jumped” to many leading cryptocurrency companies. Looking back now, is there a conspiracy behind this move, such as placing their own people in cryptocurrency companies, which has also aroused community attention.

At the time of writing, a BlackRock spokesperson declined to comment on this matter.

However, data does not lie-since BlackRock submitted an application for a spot Bitcoin ETF, the price of Bitcoin has successfully broken through the $30,000 resistance level and risen to near the highest level in 2023. Everything seems unexpected, but it is also reasonable. Coincidentally, just a few days after BlackRock actively applied for a spot Bitcoin ETF, Charles Schwab, Citadel Securities, Fidelity Investments, Sequoia Capital, Blockingradigm and other US investment giants jointly launched the EDX Markets digital asset market and will provide transaction services for four cryptocurrencies: BTC, ETH, LTC, and BCH.

From the application for a Bitcoin ETF, to the launch of a Bitcoin trading platform, all operations seem to confirm that “the United States wants to hand over the cryptocurrency industry to its own people.” How far can these traditional financial giants reach? Can the cryptocurrency community based on decentralized concepts withstand their impact? Perhaps only time can give an answer, let us wait and see!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Future Web3 New Chapter: Triple Impact of VSAP on Exchanges, Financial Markets, and TradFi

- Future of Web3: Triple Impact of VSAP on Exchanges, Financial Markets, and TradFi

- BlackRock’s Bitcoin ETF Key Dates and Timeline for Listing

- Can you make money by running a node? How to choose a public chain? We talked to a node operator.

- Victory belongs to the long-termists: June 2023 Secondary Market Trading Strategy

- Will the growth of the NFT market in 2023 come from new capital entering or from old capital circulating?

- Conversation with three senior KOLs: Bitcoin’s four-year halving cycle, the new narrative of the next bull market, and Ethereum’s “dominant” position