Foresight Ventures: Can Asgard NFT AMM build a new rainbow bridge?

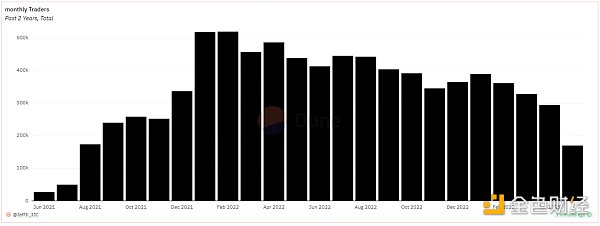

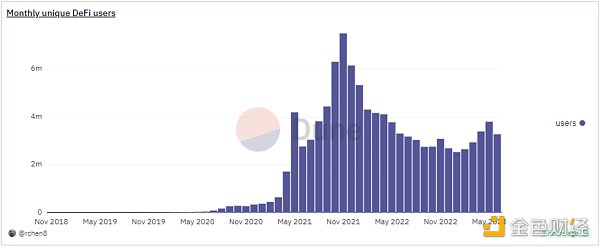

Foresight Ventures: Can Asgard NFT AMM create a new bridge?The author, Jeff@Foresight Ventures, discusses the eternal topic of how to improve the liquidity of on-chain assets while Asgard’s surrounding walls are as solid as a rock. The emergence of DeFi has opened up a rainbow bridge leading directly to Asgard, where liquidity has been fully released. Designing innovative trading models to improve NFT liquidity is also the direction of all NFT trading platforms. Although a mature unified pricing model has not yet appeared in the current NFT market, data on the trading volume of blue-chip NFTs shows that the “order book” model of the trading market accounts for more than 95% of the trading volume, while the various Marketplaces based on the AMM model account for less than 5% of the trading volume.Figure: Platform trading volume ratio, Resource: https://www.nftscan.com/marketplace, data cut-off time June 27, 2023Referring to the proportion of CEX and DEX transaction volumes of Fungible Tokens (FT), we are very much looking forward to the huge potential for NFT transaction volume based on the AMM transaction model. Unlike FT, NFTs have a wide variety of types, and pricing rules and trading habits determine that only some NFTs are suitable for using AMM to solve liquidity problems. Here, NFTs are divided into the following four categories based on their functionality: Picture Art Category (PFP)/Virtual Asset Category (Land Game Equipment)/On-Chain Assets (RWA)/On-Chain Identity (Domain Name/Tickets, etc.). According to their issuance and holder transaction needs, PFP and virtual asset NFTs are more suitable for the AMM transaction model at the current stage.Why do we have a long-term optimistic view of the NFT-AMM track? a) Large potential user base. From the perspective of the entire chain ecology, the users of DeFi are potential users of the NFT-AMM track. Currently, the monthly active users of the DeFi ecology are about 1 million, while the number of independent NFT traders is only about 200,000. Through the trading model of NFT-AMM, the scope of users injecting liquidity can be expanded from NFT holders and NFT trading users to all participants in the DeFi ecology.

Image: Defi Monthly Active Users, Resource: https://dune.com/rchen8/Defi-users-over-time, data as of June 27, 2023

- Decentralized Broker or Protocol? Analyzing the Two Paths to Build the Foundation of DeFi

- Field Investigation: The Darkest Hour Has Not Come, But NFT Will Not Die

- Interpreting the Latest Feature of Mirror – Collectable Embeds: Display, Spread, and Interact

Image: NFT Monthly Active Trader Count, Resource: https://dune.com/queries/2670914/4440079, data as of June 27, 2023

b) NFT assets have huge growth potential in terms of variety and quantity. NFTs continue to innovate in functionality and composability, and there is still a large potential for growth in the number of users. In May 2023, almost all transactions on Opensea came from the top 100 NFTs, while this proportion was only 65% in February 2022 (https://dune.com/mizmatcat/OpenSea), indicating that in a sluggish market, there is a great need for new types of NFTs to stimulate the market. In addition, asset-type NFTs for AAA games will also reach a peak in online launches in 2023-2024, providing ample space for active trading pairs of NFTs.

c) The AMM track of NFTs can serve as a bridge between NFT assets and FT assets. Similar to Defi tools, the innovative space of its composability represents the growth ceiling. The liquidity of FT assets was also limited to centralized exchanges in the form of order books before Defi emerged. AMM tools represented by Curve/Uniswap have liberated the activity range of on-chain assets and also gained new value recognition. Similarly, NFT assets need to use AMM tools to achieve new value recognition and create new pricing models. We envision that the NFT AMM model can innovate in the following directions:

-

Combine with derivatives: NFT derivatives are also a subdivision track of innovation gathering. In the article “IOSG Weekly Brief|From Commodity Speculation to Financial Speculation: The Symbolic Game of NFT Derivatives #174” by author Sally, trading demand is divided into the following categories: speculation (using small capital to earn NFT price fluctuation income), income leverage (increasing capital utilization rate by leverage), hedging risk, diversified investment portfolio and standardization. Driven by many market demands, by creating a leveraged speculative market, the NFT-AMM trading model can create dynamic games in the liquidity pool, providing dynamic on-chain data for the market to expand game space. We look forward to the combination with derivatives, and the NFT-AMM trading model may create new NFT pricing rules.

-

Combine with mortgage lending platforms: Mortgage lending platforms such as BendDAO/ParasBlockingce are still using traditional models, where users pledge NFT assets and calculate the amount of borrowing through the floor price. Even after Blur joined the battle, the competitive landscape did not change significantly. **We look forward to seeing that after the NFT-AMM model receives market and funding support, LP tokens can be used as a new type of interest-bearing, collateralized, and liquid asset proof.** By activating the liquidity of LP tokens, changing the existing pattern of the mortgage lending market, and attracting players who do not hold NFTs to enter the game by injecting liquidity.

-

Help project parties reduce liquidity management costs through NFT-AMM trading models. In particular, if game NFTs use only the order book trading model, the project party has to spend a lot of energy to pay attention to the floor price, and liquidity cannot be automatically managed. We expect that in the NFT-AMM model, the project party can inject corresponding assets into the pool, so as to dynamically and batch adjust the NFT liquidity strategy.

4. In the existing AMM market structure, many platforms are trying different approaches

Here we use a few examples to illustrate the existing product highlights and corresponding issues in the market.

a) NFTX is a platform that attempts to introduce the AMM model into NFT transactions by using NFT fragmentation as the basis for trading.

They hope to use fragmented NFT tokens as assets in liquidity pools, which users can pair with ETH and other assets to form trading pairs. This is a bold innovation and has attracted market attention in a short period of time. However, as the number of NFTs increases, users have found that this trading model can only increase the price volatility of NFTs and lose the most important scarcity attribute of NFTs. By sacrificing collection value for trading space, it gradually loses market recognition.

b) Based on Uniswap V1, Sudoswap and other platforms attempt to introduce Uni-V3 into the NFTAMM market.

Sudoswap attempts to introduce the Uni-V3 mechanism into the NFT liquidity market and innovatively proposes a diversified product curve applicable to NFT transactions to meet different user needs. Users can create liquidity pools in selected price ranges (usually around the floor price) to improve capital efficiency. The initial liquidity of the pool can only be decided by the creator, and only the creator can inject liquidity into the pool. Therefore, on the price curve, we can see that Sudoswap has created many sub-liquidity pools arranged according to the optimal transaction price, and the number and depth of sub-pools corresponding to each price range are also different, and the liquidity between pools is not interoperable.

c) Midaswap introduces the Liquidity Book model of Trader Joe V2 into the above AMM model.

Users can provide liquidity by selecting a price range in Midaswap. Since the price is fixed in each Bin, all LPs’ trading pair positions are aggregated into the same liquidity pool in this model, thereby improving the depth of the liquidity pool. LPs only need to add liquidity unilaterally to obtain ERC721 LP tokens as liquidity certificates. By cleverly using the tokenid of the ERC721 LP token to lock the NFT liquidity added by LPs in the liquidity pool, two innovative functions can be achieved: NFT liquidity is aggregated in a Pool without losing the original scarcity attribute of NFTs, which is compatible with the strengths of NFTX and Sudoswap. At the same time, Midaswap is exploring the cross-platform combination of LP tokens and NFT lending protocols to achieve cross-platform collateral lending or liquidity mining according to project needs.

5. In the innovation of the above products, users will give market feedback with on-chain data. Although we believe that there are still some issues that have not been fully resolved, there has been a significant improvement compared to the monotonous market a year ago.

Here are some areas that still need improvement:

a) Due to the isolation of liquidity pools from each other, liquidity dispersion is more prominent in NFT transactions. In the AMM design of the above platform, NFT liquidity pools of the same series are composed of multiple trading pools, mostly around the floor price. This leads to no interconnection of liquidity between each trading pool, and each independent liquidity pool may be breached when the price fluctuates or the oracle is attacked. Since liquidity and trading depth are only improved locally, users can only trade in small pools, so this model cannot support large-volume sales/purchases.

b) The floor price still directly affects the price range of the liquidity pool, and there is no way to form a new pricing model. Discrete liquidity causes LPs to create liquidity pools only by referring to the market floor price, and the pool can only passively track the floor price of the Order Book platform, missing the opportunity to become a new pricing model.

c) Similarly to the above problem, when the price range of the trading pool excessively depends on the floor price, the trading pool is vulnerable to manipulation attacks. Since the trading pools are not interconnected, when there are large buy/sell orders, the price is easily attacked, causing the trading strategies of the trading robots on the platform to be disrupted.

d) The asset pool lacks diversity, and composability needs to be improved. The purpose of introducing the AMM model is to introduce more on-chain assets into the trading pool, thereby stimulating greater trading demand. However, the existing AMM model can still only use ETH or another type of ecological asset as the trading pair, losing the possibility of other assets entering the NFT trading market to be LP.

6. After summarizing the above problems and market pain points, we predict that the future NFT-AMM popular projects should have the following characteristics or effectively solve the following problems.

a) Allow for more asset and user types to be accommodated, where users who do not hold NFTs can also inject their assets into the liquidity pool.

b) Combine with other Defi tools, bridge multiple Defi platforms through LP tokens, and introduce Defi user assets through various interest calculation methods.

c) Have composability with NFTFi assets, that is, recognize assets with collateral lending/options/futures and other platforms, increase collateral categories, and improve fund efficiency.

d) Form a new pricing model, that is, increase user sweeping efficiency through AMM, no longer relying solely on the oracle feed price, and form their own pricing power.

Seven, although existing market products are not perfect, we remain optimistic that a perfect solution for NFT liquidity and composability will emerge.

Heimdall’s roulette has already started to tremble, hoping that NFT AMM can build a new rainbow bridge.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Decoding RWA: The Most Valuable Encryption Narrative in Compliance Context

- Concerns arise over the association between TUSD and Prime Trust as issues with the minting and redemption system emerge.

- Guide to landing Web3.0 in Hong Kong Cyberport: How to receive a subsidy of 1.3 million and a free office?

- Guide to landing Web3.0 in Hong Kong Cyberport: How to obtain 1.3 million subsidies and a free office?

- Understanding Ethscriptions in one article: principles and advantages and disadvantages

- Delphi Digital: Polygon releases new vision, intertwining OP/ARB stack and cross-chain security

- Speculation about the development of NFTs in the next two years: 99.999% of old NFTs will tend towards zero value, and Grail NFTs have the opportunity to outperform ETH.