“Fortune” interview with Sister Wood: Will ARK win the first Bitcoin spot ETF?

"Fortune" interview with Sister Wood: Will ARK get the first Bitcoin ETF?Author: Anna Tutova; Translation: Odaily Planet Daily Azuma

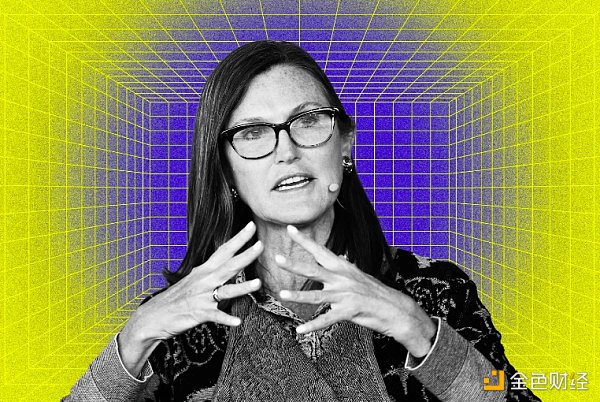

On July 6, Fortune magazine published an interview with Cathie Wood, CEO of ARK Invest, focusing on the currently highly anticipated Bitcoin spot ETF. In the interview, Wood reviewed the history of ARK Invest’s past submissions and emphasized that she did not believe that BlackRock had an advantage over ARK Invest in the application process.

Last week, I met with Cathie Wood at the ImPower Fund Forum summit held in Monaco and had the opportunity to sit down and chat with her. ARK Invest, which she leads, focuses on disruptive innovation industries and is known for its bold investments in Crypto and Web3.

- Lightning Labs launches AI Bitcoin tool that enables sending Bitcoin on the Lightning Network

- What is Bitcoin Recursive Mnemonic?

- How is the market searching for logic in the old-school DeFi as COMP and MKR continue to rise in recent days?

Recently, ARK Invest has been making headlines in the media multiple times due to its re-submission of an application for a Bitcoin spot ETF to the US Securities and Exchange Commission (SEC). Cathie Wood said that the application was submitted after the SEC had previously rejected applications from ARK Invest and other similar companies, which could give ARK Invest the opportunity to launch the first Bitcoin spot ETF in the United States and seize the market first-mover advantage.

In our conversation, Cathie Wood shared her views on the potential of Bitcoin, regulatory environment challenges, and the future vision of digital assets. To keep the full text concise and clear, the interview questions and answers in the following text have been edited to a certain extent.

-

Q1: Can you describe how you initially came up with the idea of founding ARK Invest?

Cathie Wood: Before ARK Invest was founded, especially after the technology and telecom collapse and the 2008-09 economic crisis, I saw that the traditional asset management industry was moving away from innovation and towards a preference for passive and benchmark-sensitive strategies. I said, “No, we have to focus on innovation, because there are five major technologies that are evolving now.” This includes DNA sequencing, robotics, energy storage, artificial intelligence, and blockchain technology, all of which are developing simultaneously.

These innovations will bring explosive growth – what we call super-exponential growth – and we believe that people have not yet understood this. They will overturn the traditional world order, so we want to focus on change and educate more people to realize this. We have an open research ecosystem and are also providing our research results for free. We are happy to see people commenting on our research, especially comments from the front-line innovation field, which can give us more feedback and test our assumptions.

-

Odaily Planet Daily Note: Grayscale filed a lawsuit against the SEC in June 2022. Previously, Grayscale’s application to convert GBTC into a Bitcoin spot ETF was rejected by the SEC, which claimed that there was fraud and manipulation in the Bitcoin spot market. Grayscale argued that any fraudulent behavior in the Bitcoin spot market would inevitably affect the price of Bitcoin futures, but the SEC has approved some Bitcoin futures ETF applications, rendering this logic invalid.

-

Q4: If the SEC ultimately approves a Bitcoin spot ETF, how much do you think it will change the development of the cryptocurrency industry?

Cathie Wood: We have been worried that the SEC will drive innovation out of the United States. Innovation has always been in the DNA of the United States, which is why we are pleased that the judiciary and legislative branches are both involved.

So this (approval of a Bitcoin spot ETF) may mean that once we fully implement the rules, we will stop driving innovation away and bring back more innovation. This will also become a global phenomenon, and we are very excited because many other innovation centers are trying to achieve this goal, and we also want to do it because it is a global movement.

-

Q5: Do you think the SEC will favor BlackRock? That is, approve their application but reject yours.

Cathie Wood: We don’t think so. We know that their application materials have a supervisory sharing clause, but ours doesn’t. However, as far as I know, it won’t take too much time for us to modify our application materials, and all institutional applications are moving in this direction.

-

Odaily Planet Daily Note: The interview with “Fortune” was conducted last week, but it was not released until today. Shortly after the interview was completed, ARK Invest modified its application materials and added a supervisory sharing agreement similar to BlackRock’s.

-

Q6: Currently, there are other cryptocurrency news that are receiving attention, such as the recent launch of EDX Markets, and other large institutions such as Citadel Securities and Fidelity have also begun to delve into cryptocurrency. What do you think about this?

Cathie Wood: Yes, I think some events from last year to now have disrupted the pace of institutional development, such as the turmoil surrounding FTX, and some lawsuits, especially the SEC’s lawsuit against Coinbase. But I think we have seen the worst of it, and the results are interesting: we find that institutions want to learn more and are becoming more accepting. So, you can see that they want to be prepared for new asset classes.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- In the first half of the year, it lagged behind BTC. What kind of “danger” and “opportunity” will ETH face in the second half of the year?

- Foresight Ventures: The Best Attempt at a Decentralized AI Marketplace

- 2023 Financing Semi-Annual Report: Primary Market Sluggish, Infrastructure and Tools Leading the Way

- Tether CTO: AI will choose Bitcoin over centralized cryptocurrencies

- Hong Kong has too many smart people, there are no more “leeks” in the currency circle.

- NFT’s Darkest Hour: Can These 24 Positive Developments Boost the Market?

- Azuki “Bringing Collapse” NFT Market, taking stock of bad debt caused by NFT lending protocols.