2023 Financing Semi-Annual Report: Primary Market Sluggish, Infrastructure and Tools Leading the Way

Financing Report 2023: Slow Primary Market, Focus on Infrastructure and ToolsAuthor: BlockingNews, Zen

July quietly arrived, and more than half of this year has passed. Unlike last year, when the market entered a bear market and kept falling, causing the industry to mourn, for practitioners in the cryptocurrency and Web3 industries, the first half of 2023 was a period of rising, lively and mixed feelings, with the market trend sometimes able to boost confidence and sometimes seeming to crush hope. From the LSDFi narrative to the Shanghai upgrade, from the meme craze to Wall Street’s entry, in twists and turns and shocks, bitcoin finally temporarily stabilized above $30,000 again in the middle of the year.

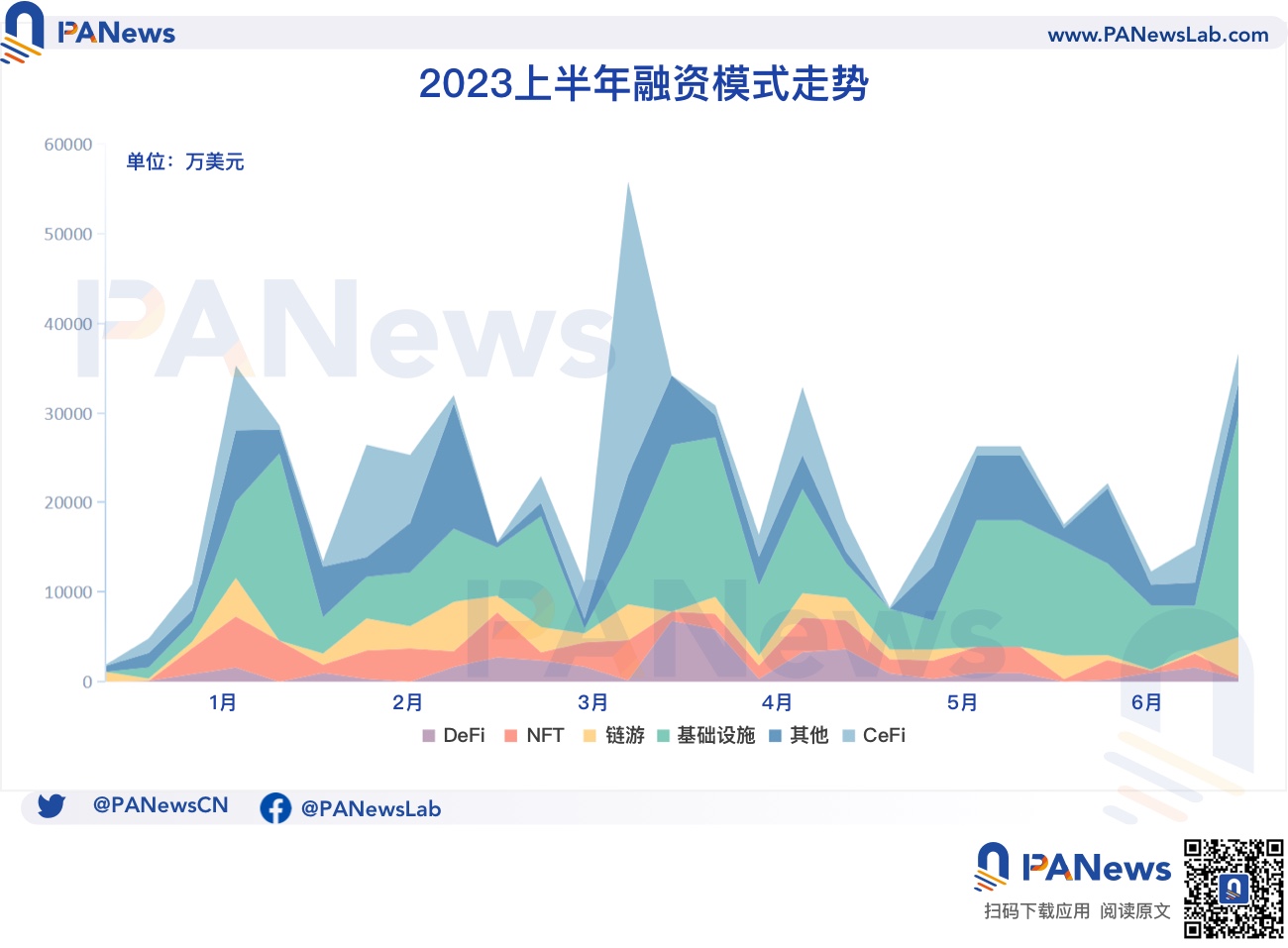

In the past six months, the AI sector has been very popular in the technology field, just like the blockchain industry that received countless favors and massive investment one or two years ago. However, in this industry, which is still unclear in its development, and in the background of the “monkey market” that jumps up and down in the market, the first-level market of the blockchain in the first half of the year is also difficult to stabilize, with significant differences in financing situations between different months, and sometimes even between the performance of consecutive weeks.

According to BlockingNews statistics, there were a total of 689 investment and financing events in the first half of 2023, a decrease of 18.9% compared to the same period last year, and a decrease of 14.7% compared to the second half of last year. The total financing scale exceeded $5.97 billion, a decrease of 74.3% compared to the same period last year and a decrease of 47.9% compared to the second half of last year. Among the financing in the first half of the year, more than $2.36 billion flowed into the infrastructure and tool track, accounting for 39.1% of the total, and there were 209 financing events, accounting for 30.29% of the total, both of which were the highest in various vertical fields.

- Tether CTO: AI will choose Bitcoin over centralized cryptocurrencies

- Hong Kong has too many smart people, there are no more “leeks” in the currency circle.

- NFT’s Darkest Hour: Can These 24 Positive Developments Boost the Market?

First half of the year financing overview

The activity of the first-level market in the first half of the year is basically synchronized with the sentiment and heat of the second-level market, showing a strong positive correlation. At the beginning of the new year, the bear market in the cryptocurrency market dropped to freezing point, and the number of investment and financing events announced in the first two weeks of the year did not exceed 10, and the total financing scale was all below $50 million. However, as the industry rebounded, during the period from mid-January to late April, when the small bull market trend appeared, the first-level market heat saw a sharp rebound, and all tracks entered the best market in the first half of the year in April. According to the data from the Blocking column “Financing Weekly Report,” the average number of financing events announced each week during this period reached 30, and the average financing scale exceeded $270 million per week.

It is worth mentioning that during the entire bull market of cryptocurrencies, whenever the secondary market experienced a correction, the heat of the primary market would significantly decrease, but with a slight delay in its response. For example, in a correction that occurred in early March this year, the price of Bitcoin dropped to around $20,000 again, but then began to rise sharply again from March 12th. By March 20th, the price of Bitcoin had rebounded to more than $28,000, while the primary market was quite bleak during the same period. According to Blocking’s “Financing Weekly” column, from March 13th to 19th, only 22 investment and financing events were announced, with a total funding size of $110 million, far below the weekly average during the entire period.

The week between January 16th and 22nd had the most investment and financing events announced, with 42 events and a total financing size of $350 million, of which there were 22 in infrastructure, tools, and blockchain/Web3 application categories. The week of March 20th to 26th had the largest single-week financing amount in the first half of the year, exceeding $558 million, with 26 investment and financing events. Decentralized finance (DeFi) had an outbreak during that week, receiving more than $320 million in financing, of which the multi-asset investment platform eToro alone raised $250 million at a valuation of $3.5 billion, making it the largest single financing event in the first half of this year.

Below are the performance of each sector:

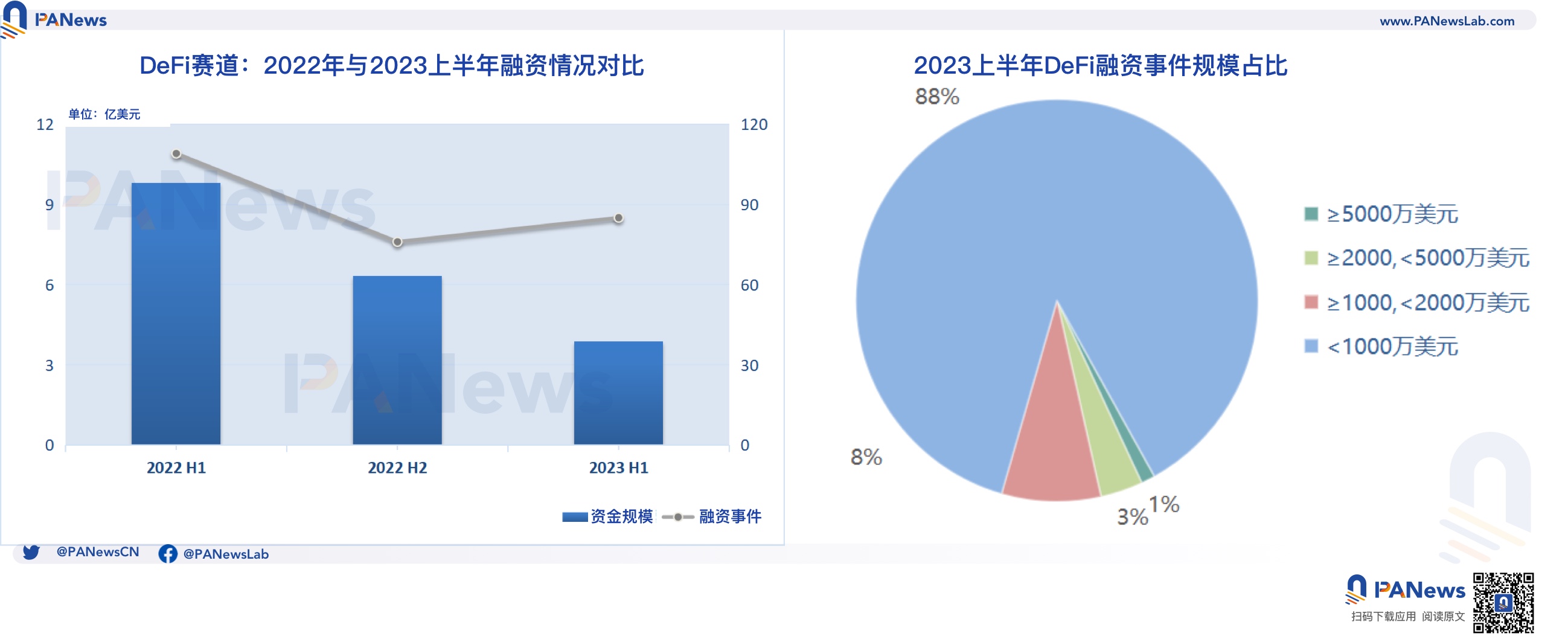

DeFi: No reduction in project numbers, but fewer large financing events

In the first half of the year, the DeFi sector had a financing amount of over $384 million, a decrease of 60.5% YoY and 38.8% MoM, with a total of 85 financing events announced, a decrease of 22% YoY and an increase of 11.8% MoM. The financing amount of this sector mainly concentrated on projects below $10 million, accounting for 88% of the sector’s total financing amount, with only 4 projects receiving financing amounts over $20 million, accounting for about 4%. The project that received the largest financing was EigenLabs, the developer of the centralized finance (DeFi) platform EigenLayer, which raised $50 million in a Series A financing led by Blockchain Capital. Other investors included Electric Capital, Polychain Capital, Coinbase Ventures, etc.

Just like the NFT and Metaverse tracks, in the first half of this year, there were no blockchain gaming projects that raised more than $50 million, and 18 projects with funding amounts between $10 million and $50 million, accounting for approximately 21%. The largest scale financing was the $40 million raised by Icelandic game developer and publisher CCP Games, led by Andreessen Horowitz (A16z), with participation from Makers Fund, Bitkraft, Kingsway Capital, Nexon, Hashed, and others. This funding will be used to create a AAA blockchain game based on its flagship game, Eve Online.

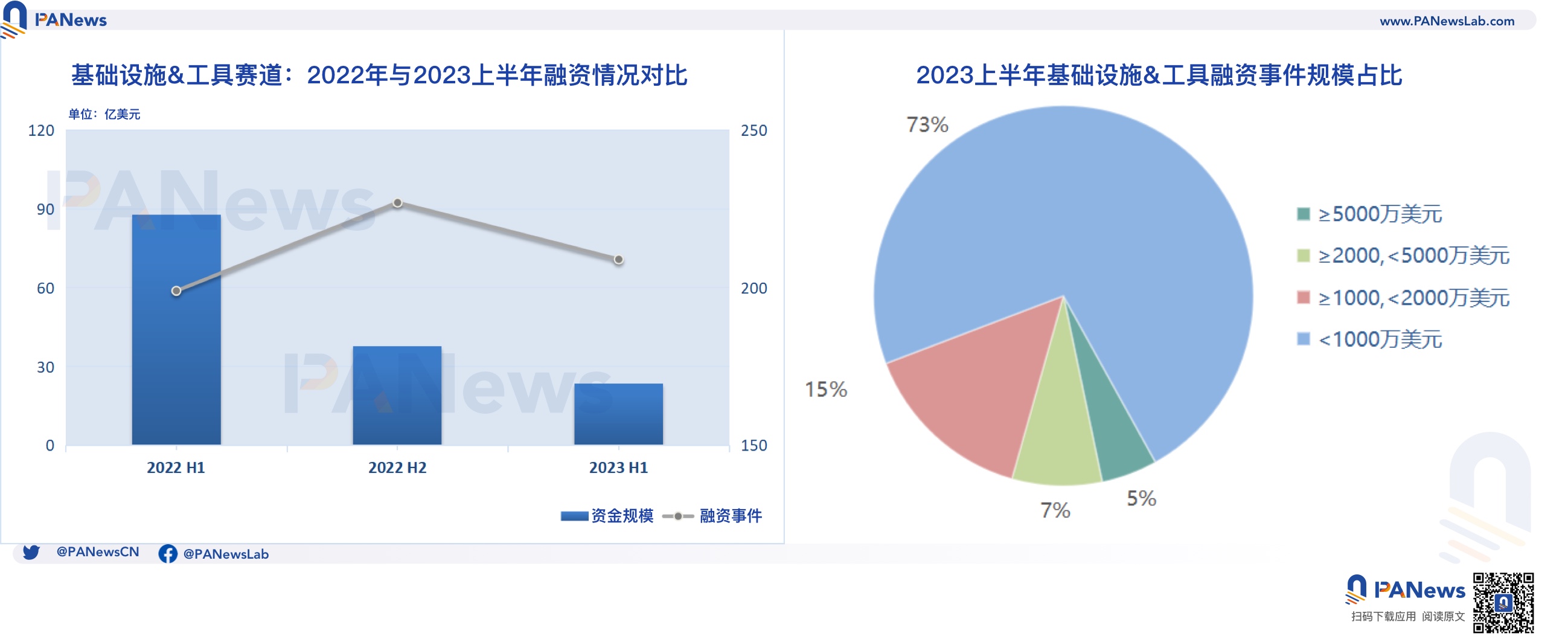

Infrastructure & Tools: Long-term Continual Leadership

In the first half of the year, the financing scale of the infrastructure and tools track exceeded $2.36 billion, a decrease of 73% year-on-year and 37.3% month-on-month; a total of 209 financing events were announced, an increase of 5% year-on-year and a decrease of 8% month-on-month. Blockchain is still in its early stages, and infrastructure construction and tool innovation may continue to be industry themes for a long time in the future. As a vertical field that has been leading the way for a long time, it had 51 financing events with a scale of more than $10 million in the first half of the year, accounting for approximately 27%; there were 10 projects with funding of $50 million or more, accounting for approximately 5%.

Among them, the project with the largest financing scale is Islamic Coin, a compliant Islamic encrypted project, which received a $200 million investment from digital asset investment company ABO Digital, bringing the total funds raised by the project to $400 million. In addition, the cross-chain interoperability protocol LayerZero Labs completed a $120 million Series B financing round with a valuation of $3 billion, with participation from a16z Crypto, Christie’s auction house, and Sequoia Capital; and Paris-based hardware wallet manufacturer Ledger raised most of the $109 million funding goal.

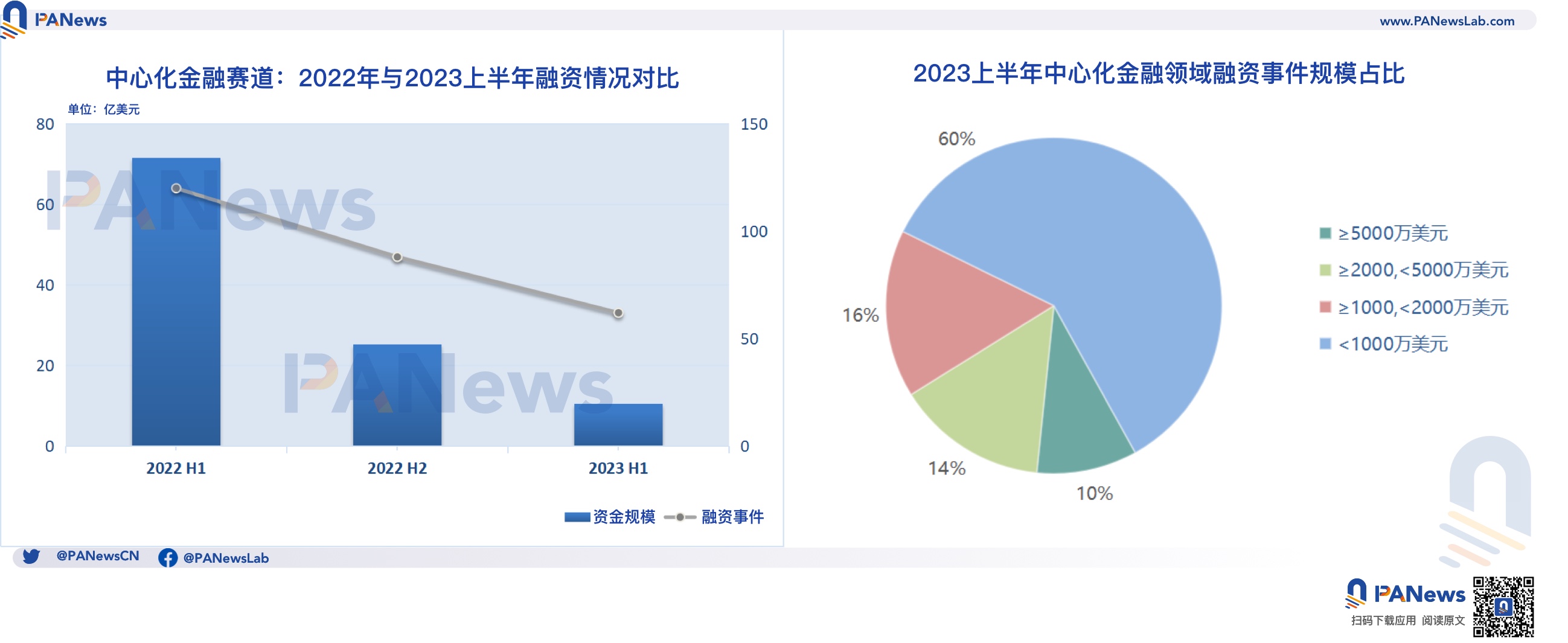

Centralized Finance: Highest Proportion of Financing in the Tens of Millions

In the first half of the year, the financing scale of other centralized finance fields exceeded $1.04 billion, a decrease of 20% year-on-year and 36.4% month-on-month; a total of 152 financing events were announced, a decrease of 48% year-on-year and 30% month-on-month. Decentralized finance is still the field with the highest proportion of large-scale financing, with 25 financing events of $10 million or more, accounting for nearly 40%, including 6 projects with a scale of $50 million or more, accounting for nearly 10%.

Aside from eToro’s $2.5 billion funding at a $35 billion valuation mentioned above, other projects that have received large amounts of funding include: Salt, a cryptocurrency lending institution heavily influenced by FTX, completed a $64.4 million Series A financing round; and Swiss digital asset company Taurus SA raised $65 million through equity financing, led by Credit Suisse Group, with Deutsche Bank AG, Pictet Group, and others participating.

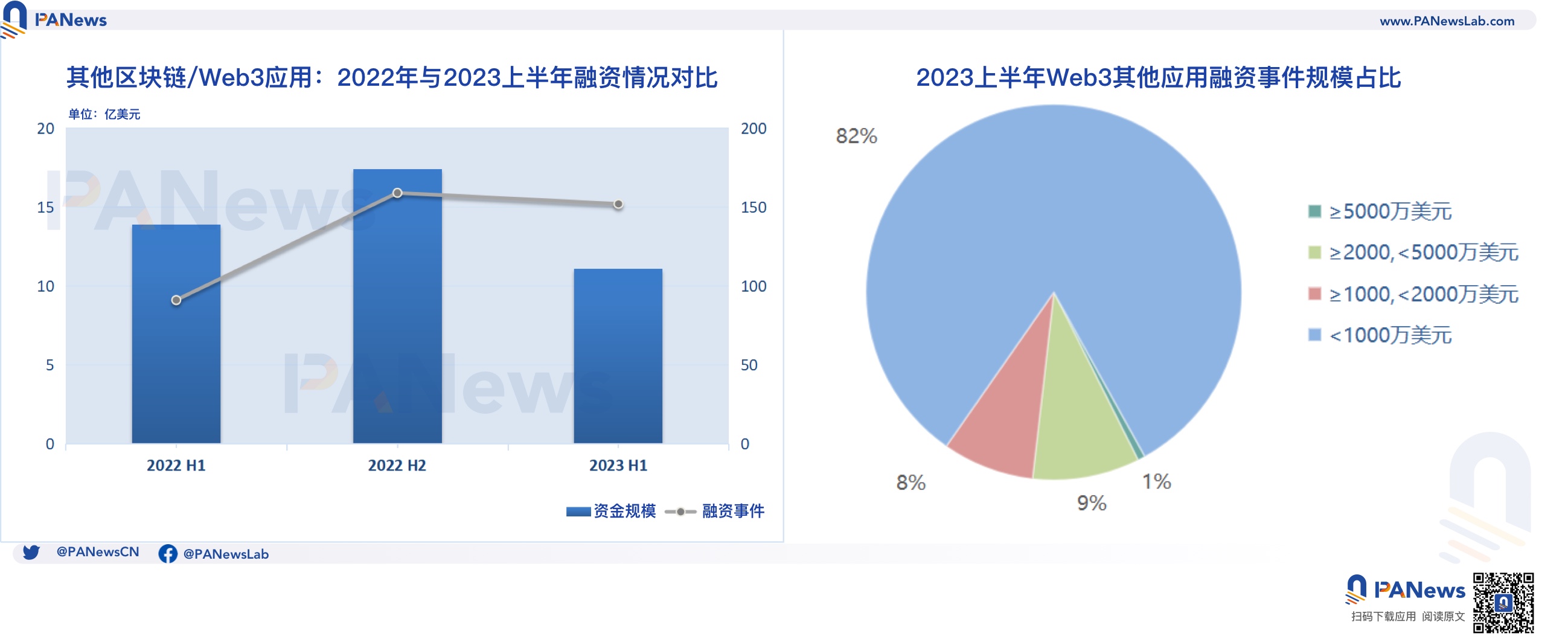

Other: Least affected by the bear market or gradually landing due to technological application

This category mainly includes projects that combine DAO, media, market, social, education, mining, real estate, carbon neutrality and other industries with blockchain and crypto technology. The total financing scale of these application areas in the first half of the year exceeded US$1.1 billion, a year-on-year decrease of 20% and a month-on-month decrease of 36.4%; a total of 152 financing events were announced, a year-on-year increase of 67% and a month-on-month decrease of 4.4%. Compared with last year, the number of projects that received financing has only slightly decreased, and the decrease in financing amount is the lowest among the six categories.

The projects in this category generally receive relatively small amounts of financing, with 125 financing events with a scale of less than 10 million, accounting for 82%. Chain Reaction, a blockchain chip start-up in Tel Aviv, raised $70 million, the largest financing in this field, led by venture capital firm Morgan Creek Digital.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Azuki “Bringing Collapse” NFT Market, taking stock of bad debt caused by NFT lending protocols.

- An Explanation of Bitcoin L2 Stacks: Creating Smart Contracts on Bitcoin

- BlackRock resubmits Bitcoin spot ETF application, designates Coinbase as monitoring partner

- Bitcoin sees a positive start in July, will it reach $40,000 soon?

- Bitcoin welcomes a good start in July, and analysts optimistically predict that it is “inevitable” for it to reach $40,000.

- Bernstein: Possibility of US approving Bitcoin ETF is quite high

- Weekly NFT Market Data Review: Total Market Cap / Floor Price Both Significantly Decreased, Azuki Elementals Boosted Trading Volume