Topping the list with a 15.4% airdrop ratio, taking stock of 19 potential projects invested by Binance Labs that have not yet issued their own tokens.

With a 15.4% airdrop ratio, Binance Labs leads the list of 19 potential projects it has invested in, which have not yet issued their own tokens.Author: Biteye Core Contributor Lucky

Editor: Biteye Core Contributor Crush

Community: @BiteyeCN

- Robinhood Bot Comprehensive and Fast New Trading Robot

- Bear market forces on-chain innovation. Are these newly popular projects worth paying attention to?

- ABCDE Why Should We Invest in GRVT (Gravity)

According to the summary by overseas KOL Ardizor, among the active VCs in the industry, Binance Labs tops the list of “Which VCs Love Airdrops More” with a 15.4% airdrop rate on investment targets, far surpassing a16z, Coinbase, Muticoin, and other major VCs.

In the cryptocurrency and blockchain industry, investment and incubation are key factors driving innovation and development, and Binance Labs can be said to be one of the important participants in this field.

In order to find gems in the investment landscape of Binance, this article will delve into various aspects of Binance Labs, including its introduction, advantages, investment layout, and then focus on the projects in Binance’s investment landscape that have not yet been launched but have certain airdrop expectations.

01. Overview of Binance Labs

Binance Labs was established in April 2018 and is the venture capital business unit within Binance. Its main tasks are to identify, invest in, and empower promising blockchain entrepreneurs, startups, and communities. In addition to direct investments, Binance Labs also invests in an 8-10 week incubation program (MVB) to provide advisory support, financing, and resources.

Binance’s incubation program has held six seasons, and in the latest season, Binance invested in four projects that performed the best in the 6th season of MVB, namely AltLayer, KiloEx, Kinza, and Sleepless AI, covering DeFi, infrastructure, and Web3 games.

In April of this year, Binance Labs stated in an interview with The Block that their investment theoretical return rate has exceeded 10 times, which is closely related to the advantages of Binance Labs and the selection of projects.

Advantages of Binance Labs:

– Global influence: Binance Labs’ investment landscape has covered 25 countries and invested in over 200 projects.

– Financial support: According to Binance’s year-end report for 2022, Binance Labs will provide at least $1-2 billion in funding for the cryptocurrency industry.

– Value creation services: In addition to financial support, it also provides general consulting, operational support, and joint development of technology/products.

– Rich resources: As part of the world’s largest cryptocurrency trading platform, Binance Labs has abundant resources and a massive network, which are key factors for its successful incubation and investment in projects.

Binance Labs considers the following five attributes when selecting projects:

– The first attribute is product innovation. Are you building something entirely new that users will benefit from?

– The second attribute is a sustainable business and token model. In the long run, is your business model profitable, and is your token incentive mechanism built in the right way?

– The third attribute is traction. How many users does your project have at the current stage? What is the revenue generated? If you are in the pre-launch stage, we would like to know your actual expectations.

– The fourth attribute is the quality and persistence of the team. Can you and your co-founders dedicate full-time to this project if needed?

– The last attribute is technology. Is the technology you are building feasible and realistic? We will review the content you have already built and the content that can be built based on your project roadmap.

From the above, we can summarize Binance Labs’ investment philosophy into five attributes: product innovation, sustainable business and token models, adoption rate, team persistence, and technological feasibility.

02. Focus Track Layout of Binance Labs Investments

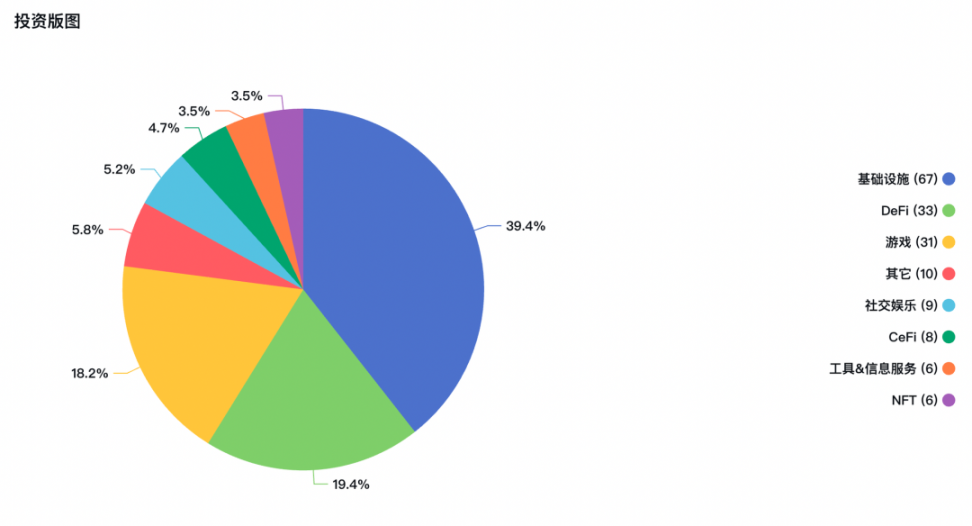

Binance Labs’ investment layout is very extensive, covering most of the Web3-related tracks, including public chains, protocols, infrastructure, NFTs, blockchain games, metaverse, DeFi, and CeFi, among others. According to the year-end report for 2022, Binance Labs will provide at least $1-2 billion in funding for the cryptocurrency industry recovery plan.

Binance Labs places special emphasis on infrastructure, on-chain applications, data analysis, and security. These areas are not only the core of the cryptocurrency industry’s development but also the investment priorities for Binance Labs. From the following diagram, we can see the focus track layout of Binance’s investments:

– Infrastructure: It accounts for the largest proportion in Binance Labs’ investment portfolio, reaching 39.4%, serving as the cornerstone of the blockchain and cryptocurrency industry.

– DeFi and Gaming: They account for 19.4% and 18.2% of the investment proportions, respectively. These two areas not only have enormous market potential but also lead the industry’s innovation.

– Web3-related tracks: These include social entertainment, tools, NFTs, metaverse, etc. These areas are considered the next growth points for the cryptocurrency industry.

03. Inventory of Unreleased Projects

We will inventory the projects worth paying attention to in the Binance investment portfolio that have not yet been released, focusing on the four major sectors of infrastructure, Web3, DeFi, and gaming.

(Risk Warning: The following projects are only unreleased and have investments, and the specific project fundamentals cannot be guaranteed. Cryptocurrency projects are high-risk. Users can use the following list as a reference and further DYOR.)

Infrastructure:

1. Polyhedra: Raised $25M

Polyhedra is an early-stage company that focuses on full-stack infrastructure based on ZKP technology, with a focus on interoperability, scalability, and privacy. It generates SNARK proofs faster through a distributed approach and then develops zk full-stack projects (zkBridge, zk-DID, zk-NFT) based on this. The zkBridge test network has already been launched, with an airdrop expected;

2. AltLayer

AltLayer is an open and decentralized protocol for developers to launch custom Rollups for applications.

This protocol provides a no-code Rollups-as-a-Service dashboard built on top of its core network Beacon Layer, allowing for the rapid customization of Rollups with fraud/zk proofs for security from the underlying L1/L2. It has received funding from the Binance MVB in the sixth quarter.

3. DappOS

DappOS is an intent-driven operating protocol designed to make dApps as user-friendly as mobile applications.

As a Web3 unified operating protocol, it builds a layer between users and cryptographic infrastructures such as public chains and cross-chain bridges, enabling users to verify and execute in the decentralized world simply by interacting with dappOS. This allows anyone to easily access decentralized applications without complex processes or in-depth knowledge of encryption.

4. Mind Network: Funding $2.5M

Mind Network is a composable data protocol that allows developers to interoperate data across platforms. The vision of Mind Network is to become the decentralized knowledge graph that intelligently connects everyone and everything on Web3. The roadmap of Mind Network indicates that the token will be launched in the third quarter of 2023.

5. LayerZero: Funding $315M

LayerZero is an interoperability protocol focused on data messaging between chains. LayerZero’s data transmission method based on oracles and relayers makes the protocol more lightweight, with certain security guarantees in performance. The current network utilization of the protocol is good, with an airdrop expected.

6. Celestia: Funding $56.5M

Celestia is the first modular blockchain network that advocates dividing the functions of a single public chain, such as consensus, settlement, and execution, into different layers, and then improving performance by optimizing functional layers. It also allows specialized blockchain hosting applications to be deployed on top of it, optimizing scalability, flexibility, and interoperability.

7. Web3Go: Funding $4M

Web3Go is a data intelligence network that provides a set of native AI digital asset tools and real-time data infrastructure.

This network enables users to produce various native AI digital assets, including transaction information flows, trading strategies, trading bots, entertainment, education, and social intelligent assistants. By verifying asset ownership on the blockchain, it provides creators with a fair, self-hosted, trustless ecosystem.

Web3

1. LianGuairagraph

LianGuairagraph is an on-chain creator platform that helps creators with content distribution, sharing, and business establishment, enhancing growth and profit potential using permissionless protocols.

LianGuairagraph is leveraging novel on-chain mechanisms such as turning posts into collectibles, sending newsletters to wallet addresses, profiting from recurring memberships, and building and nurturing their communities using decentralized social protocols such as Farcaster, Lens, and XMTP.

Not only did it receive investment from Binance Labs in October 2022, but it also received investment from the first batch of Base Ecology Fund in September this year.

2. Tabi: $10M Financing

Tabi is a cross-chain NFT platform that provides NFT issuance, trading, auction, and customized in-store services. It aims to connect creators and users in a decentralized manner. Tabi has already confirmed that it will conduct airdrops and convert users’ on-chain activities into “experience points” that can be used to redeem future airdrop rewards and profits.

3. Lifeform

Lifeform is a decentralized visual digital identity (DID) solution provider. Its core technologies include hyper-realistic 3D avatar creation tools, visual DID protocols, secure and innovative contract solutions, Web3 native decentralized identity systems, and metaverse engine software development kits (SDKs). It has completed three rounds of financing, and the latest round of financing has reached a valuation of 300 million.

4. Playbux: $2M Financing

Playbux is an e-commerce metaverse platform based on blockchain networks. The project was shortlisted in the fourth season incubation program of Binance Labs. Its product aims to become an easily accessible Shop&Earn metaverse platform. It allows users to consume and earn cashback from over 20,000 global merchants.

Games

1. Xterio: $55M Financing

Xterio is a global cross-platform instant play-to-earn developer and publisher that is committed to connecting millions of people worldwide through deep engagement in the gaming world enhanced by digital ownership. Xterio’s focus is on developing Web3 native universes that can expand across all media and platforms.

2. Fusionist: $6.6M Financing

Fusionist is a game world with collectible NFTs consisting of three types of games: colonization, conquest, and unity. Players manage their own planets, collect rare resources, upgrade technology, scan blueprints to manufacture mechas, and establish production pipelines. They engage in PvP and PvE battles, build fleets of starships for interstellar wars, and conquer the galaxy.

The founding team consists of senior professionals from Tencent Games, Electronic Arts, and Mardon Games. Participating players will receive token airdrop rewards.

3. Ultiverse: $4.5M Financing

Ultiverse is a social game metaverse that connects Web3 with AAA-quality immersive fully VR-compatible virtual worlds. By empowering players with different economic abilities, Ultiverse aims to create MetaFi, with an expected airdrop.

4. Tatsumeeko: $7.5M Financing

Tatsumeeko is an MMORPG that can be played on Discord. It combines casual games, Japanese role-playing games, and creative building games with social elements and user-generated content, creating a platform-agnostic, community-driven modern fantasy MMORPG-lite.

5. Heroes of Mavia: Raised $5.5M in Funding

Heroes of Mavia is an MMO strategy game that incorporates fantasy elements from the popular mobile strategy base-building game Clash of Clans.

Players can build and develop their bases on the island of Mavia, train armies, and engage in battles with other players. As their bases and armies grow stronger, they can attack more challenging opponents and earn tokens as rewards. These tokens can be used to upgrade the base itself and create special super units called Heroes. The project also includes land NFTs and has airdrop expectations.

6. Sleepless AI: Funding

Sleepless AI is a virtual companion game based on AI blockchain. It utilizes AIGC and LLM to create a rich story-based gameplay experience with organic character interactions. The project is currently developing three games, with the first game being “HIM”.

DeFi

1. Helio: Raised $10M in Funding

Helio is an open-source liquidity protocol for borrowing and earning on HAY – a new BNB-backed, over-collateralized, and a new category of crypto assets called “destablecoins” (where “de” represents decentralized). The Helio protocol is built on the BNB chain and consists of a dual token model and mechanism that supports instant swaps, asset collateralization, borrowing, yield farming, and staking.

2. Bracket Labs

Bracket Labs has launched the Bracket Protocol options market, aiming to simplify traditional options and structured products. Buyers can trade multi-currency contracts on this platform. The innovation of this platform lies in the fact that users can interact directly on a decentralized, permissionless, non-custodial platform without the need for a margin account. There is no forced liquidation, and buyers always receive the full value of their claims. Currently, BracketX is live on the Arbitrum testnet.

04. Summary

In conclusion, Binance Labs, as the investment and incubation arm of Binance, the world’s largest cryptocurrency exchange platform, has become an indispensable player in the blockchain and cryptocurrency industry.

Its global influence, financial support, value creation services, and abundant resources enable it to successfully incubate and invest in projects.

For users, the bear market can be considered the best time to discover potential projects. Without the FOMO and false APY brought by the bull market, it is easier to identify project teams that are serious about their work. Players can prepare for the bull market by tracking the data growth of promising projects.

The above project list can serve as a research and reference for interactions. However, it is important to note that in the cryptocurrency market, projects that truly meet user needs and succeed are rare. Most projects carry higher risks than potentials. Therefore, when participating in projects, it is necessary to manage risks and ensure the security of funds.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Interpreting the Future Path and Star Projects of LayerZero’s Cross-chain Innovation

- Analysis of 10 Tips for Web3 Entrepreneurship The period of bonanza for bottom-up project development has passed, and marketing is becoming more important.

- Overview of the first six investment projects of the Base Ecosystem Fund

- One out of a hundred, taking stock of the first batch of investment projects by the Base Ecology Fund.

- Nima Capital sells tokens and sells luxury homes, previously invested in these 16 projects.

- With 8 years of experience and managing over 540 million dollars, how does CoinFund, a cryptocurrency fund, choose its track and invest in projects?

- Investment institution Rug? Nima Capital sells tokens to sell luxury homes, previously invested in these 16 projects