Review of the PEPE dumping incident Is it a case of uneven distribution of profits or a premeditated run?

Review of the PEPE dumping incident Uneven distribution of profits or premeditated run?Author: Qin Xiaofeng

In the past two days, the Meme project PEPE has staged a “perplexing” market crash drama.

In the early morning of August 25th Beijing time, the PEPE team’s multi-signature address transferred more than 160,000 billion PEPE tokens (equivalent to 16 million USD) to four centralized platforms (OKX, Binance, KuCoin, and Bybit) for selling, causing the price of PEPE to plummet by more than 25% that day, and currently maintaining at 0.00000087 USDT.

According to CryptoNoddy’s monitoring, the reason for the massive sell-off is that the PEPE multi-signature wallet changed the threshold from 5/8 to 2/8, which means that only 2 private key holders need to sign a transaction to transfer team assets.

- What is Layer2, the source of controversy within the Ethereum community?

- Lybra V2 is about to go online, analyzing V2 functions and product expansion.

- Looking at the latest developments of THORChain from both the bullish and bearish perspectives liquidity exchange and lending.

Once the news came out, it caused a stir in the community. However, it was not until a full day of fermentation (August 26th) that the PEPE team came forward to respond. Odaily summarized the key points of the announcement: 3 former team members secretly deleted the multi-signature permissions and sold the tokens, and the remaining tokens are currently safe and will be planned for future destruction.

Former team members manipulating the market?

The announcement stated that since its establishment, PEPE has been plagued by internal disputes, and some members of the team have become bad actors due to arrogance and greed. Previously, due to the inability to sign transactions, differences of opinion, and the inability to contact them for several weeks, these people hindered the team’s progress in using the multi-signature wallet for donations or token purchases – the multi-signature was set to require 3/4 signers to be present for approval. On August 25th, the 3 former team members secretly returned and modified the multi-signature threshold, stealing 60% of the tokens, which is the 160,000 billion PEPE tokens, and sent them to the trading platform for sale.

The announcement stated that the remaining 100,000 billion tokens in the multi-signature wallet are safe and inaccessible to the former team members. The PEPE team stated that the prospects are bright after resolving internal conflicts, and they are currently planning to use the remaining tokens to purchase the PEPE domain name, with the remaining tokens being destroyed in the future.

(PEPE Announcement)

However, this seemingly transparent announcement has sparked further questioning in the community.

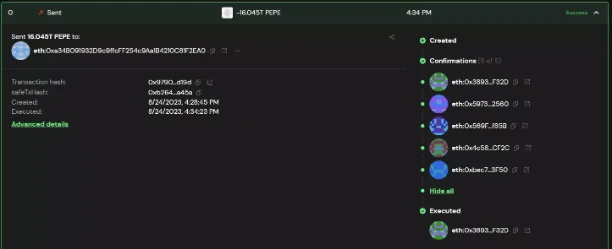

MCVERSE founder McOne’s investigation found that there were 5 addresses that approved the multi-signature. “There must have been more than 3 people involved. It looks like there are 5 signers.” As shown below:

CryptoNoddy also confirmed this finding and gave his speculation: “Unless each person controls two addresses. But this should be disclosed because these signers are essentially the same.” He also discovered that after the announcement was released, the multi-signature address of the PEPE team still retained the attacker’s signing authority – in other words, the attacker can still continue to withdraw tokens, so the remaining 100,000 billion tokens are not safe at all.

Many community users expressed distrust of the PEPE announcement:

-

“It’s just a made-up story.”

-

“How do we know you didn’t plan this from the beginning so that you could sell some PEPE and pocket the profits? The whole thing is suspicious, like a pre-set drama.”

-

“This is 100% nonsense. It took you so long to release this?”

-

“Destroy the remaining tokens and let’s see if what you said is true.”

-

…

Eventually, amid community questioning, the PEPE team transferred the remaining tokens to a new address: 0x9f5E46E4990dee30665b2e803BA134564D1e087F. At the same time, the PEPE team announced that the Telegram group had been disabled, the group owner’s Telegram account was hacked, and the group had been taken over by hackers. Currently, PEPE is restoring access or creating new accounts; during this period, all official notices from PEPE will be published through the X platform account, and the new Telegram group link will also be shared through the X platform (Twitter) account.

The PEPE team did not respond to other core questions of concern to the community. One is about the tokens sold by former members, whether they will be recovered and how, and who will bear the losses of the PEPE community. The second is who controls the new address where the remaining assets are located, whether the remaining multisig address is controlled by one person or several. The third is the future plan, when the remaining tokens will be destroyed, and the issue of token usage transparency.

Founder’s Identity Exposed, Suspected Insider Trading

Since PEPE is a project created by an anonymous team, there is no personal information about the three individuals involved in recent announcements. However, the recent dump has angered the community, and some “insiders” have voluntarily revealed more information.

KOL LianGuaiULY, who has over 150,000 followers, posted that the “truth about the multisig selling” announced by PEPE officials is a complete lie, and he claims that both he, Matt Furie, and the entire community have been deceived by the PEPE team.

He stated that the true identity of the PEPE founder is Zachary Testa, who currently resides in Arizona. Zachary is active on social media under the usernames z (@degenharambe) and Lord Kek (@LordKekLol). Zachary Testa was born in 1997, graduated from Arizona State University in 2018, and is now a professional photographer.

LianGuaiULY accuses Zachary Testa and his team of making huge profits through PEPE (even buying a Lamborghini) without giving any feedback to the original creator of “Sad Frog” (Pepethe Frog), Matt Furie. In addition, LianGuaiULY claims to have helped the PEPE team contact the listing team on Binance and the SushiSwap team, which allowed PEPE to be listed on Binance. LianGuaiULY also mentioned that Zachary Testa has had multiple violations in real life while doing photography, including multiple fines from the National Park Service for repeatedly flying drones in restricted areas, which led to being blacklisted by the public organization publiclandshateyou.

In addition, LianGuaiULY also condemned the project for insider trading and disclosed the address of a former PEPE member (0x22f6215b40434d9135b06f1c676fd9291936aac3). It is understood that this address spent 0.0183 ETH (36.73 USD) to buy 1.69 trillion PEPE tokens after the creation of PEPE, and then sold them at a price of 1001 ETH (1.73 million USD), achieving a profit of 54,725 times.

In fact, it has long been a public secret that the PEPE team member “Lao Shu Cang” was involved in insider trading. Just a few days ago, another address suspected to be a team member also cleared its holdings of PEPE tokens. According to the analysis by on-chain analyst Yu Jin, this address spent 0.03 ETH (about 60 USD) to buy 2.43 trillion PEPE tokens on April 15th, and sold 554.7 billion PEPE tokens (about 670,000 USD) in batches from May to July; On August 25th, when PEPE crashed, this address sold the remaining 1.88 trillion PEPE tokens (about 1.67 million USD), with a total profit of over 30,000 times.

LianGuaiULY also revealed that the PEPE official team holds PEPE tokens worth 16 to 17 million USD in at least 9 internal wallets – not limited to the remaining 10 trillion PEPE tokens currently announced. The reason why there has been no dumping of tokens is because they want to create short positions through centralized exchanges to obtain larger profits. Finally, LianGuaiULY called on everyone to report to the SEC: “When the amount of sanctions exceeds 1 million USD, the reward for the reporter can be 10% to 30% of the funds received.”

Faced with this disaster, the most important thing for PEPE now is to rebuild user confidence, and it is crucial to disclose more information in a timely manner to increase transparency.

“It needs to be made clear that the situation with PEPE is extremely optimistic in the long run. It is better to get rid of the bad actors who occupy a large proportion of the supply now than to wait for it to happen later.” On-chain analyst Yazan remains optimistic about the future development of PEPE, but he also calls on the PEPE team to take responsibility and guide the project to develop better. “We just hope to see people taking responsibility.”

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Aside from the lack of tokens, why is it said that Coinbase’s Base chain does not violate US laws?

- Base and Optimism reach a ‘shared revenue’ agreement, pioneering the ‘Layer2 Economic Alliance’.

- An Analysis of the ‘Nintendo’ of the Cryptocurrency World Treasure DAO

- PEPE plummeted by 16%, and the founder behind it was exposed a 97-year-old photographer who used the money from selling coins to buy a Lamborghini.

- Deep analysis of governance risks, capital risks, and protocol risks of LSD.

- AI FOMO sweeps the world profits surge 8 times, NVIDIA emerges as the biggest winner.

- Experience the Tu Dog hype type SocialFi platform friend.tech it may be boring and even ridiculous at times, but it has unlimited potential.