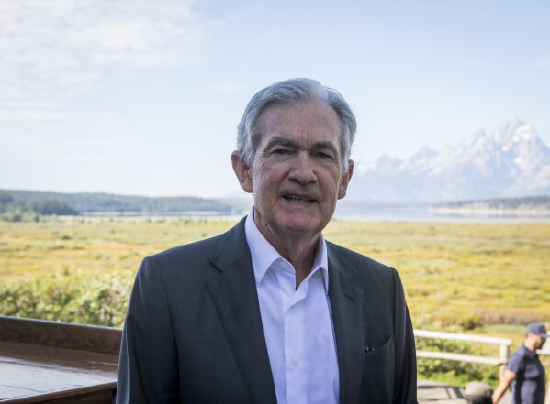

Quick look at the Jackson Hole annual meeting Powell maintains possibility of raising interest rates, Lagarde says rates will be kept at necessary high levels to control inflation.

Jackson Hole annual meeting Powell maintains possibility of raising interest rates, Lagarde says rates will be kept high to control inflation.Author: Sina Finance

From August 24th to 26th, the 2023 Jackson Hole Global Central Bank Annual Meeting was held with the theme of “Structural Changes in the World Economy”. Central bank officials from around the world gathered in Jackson Hole, Wyoming to attend the annual symposium hosted by the Kansas City Fed. During the conference, investors will search for clues about the outlook for interest rates from their speeches.

European Central Bank President Christine Lagarde said that in order to bring inflation back to target levels, the cost of borrowing will be set at the necessary high level and maintained at that level for a necessary long time.

Federal Reserve Chairman Jerome Powell said in his speech earlier on Friday that the Fed is prepared to raise interest rates further if necessary and intends to keep rates at a high level until the inflation rate convincingly approaches the 2% target.

- LianGuai Daily | Hong Kong police take action against money laundering activities, including cryptocurrencies; Social platform OnlyFans has purchased about $20 million worth of ETH.

- Weekly Preview | Hong Kong Exchange HashKeyExchange begins to serve retail investors; Optimism and Hedera will unlock tokens worth tens of millions of dollars

- Review of the PEPE dumping incident Is it a case of uneven distribution of profits or a premeditated run?

European Central Bank President Lagarde: Set interest rates at the necessary high level to control inflation

Lagarde said that in order to bring inflation back to target levels, the cost of borrowing will be set at the necessary high level and maintained at that level for a necessary long time.

Lagarde described an “uncertain era” and said it is important for central banks to provide anchors for the economy and ensure that price stability is consistent with their respective mandates.

“In the current environment, for the European Central Bank, this means setting interest rates at a sufficiently restrictive level and maintaining them for a necessary long time to bring the inflation rate back to our medium-term target of 2% in a timely manner,” Lagarde said in her speech in Jackson Hole, Wyoming on Friday.

Cleveland Fed President Mester: Insufficient tightening is a worse mistake

Cleveland Fed President Loretta Mester said in an interview that insufficient tightening is a “worse” mistake compared to slightly over tightening.

She said that policy actions have put the Federal Open Market Committee in a “restrictive zone,” and now the task is to “calibrate to ensure that we are on a sustainable and timely path to a 2% inflation rate.”

Chicago Fed President Goolsbee: FOMC is on the path to a soft landing

Chicago Fed President Austan Goolsbee said that the Fed has already made progress on the path to a soft landing.

“Lowering inflation without causing a severe recession is usually not an option for central banks,” he said in an interview. “This would be a major victory for the Fed and everyone else. There is almost no precedent. But we have already made progress on this path and we have been receiving good news. We just need to continue to receive good news.”

ECB Board Member Holzmann: May Need to Raise Interest Rates Further

According to Austrian media Die Presse, Robert Holzmann, a board member of the European Central Bank (ECB), stated that it may be necessary to “more or less” continue raising interest rates to bring inflation in the euro area back to the target level.

There are “no signals yet that the alarm can be lifted” regarding consumer prices, Holzmann, who also serves as the governor of the Austrian central bank, told the newspaper in an interview published on Friday. “My guess is that we should raise interest rates a little more. But it will be determined by the data.”

Former US Treasury Secretary Summers: Fed May Need to Raise Rates at Least Once More

Summers said that the Federal Reserve (Fed) may need to raise rates at least once more. He also warned that there is not enough focus on the impact of the US fiscal deficit.

“My best estimate is that we will need to raise rates further,” Summers said in an interview. He said that the current “brewing” economic slowdown is not significant, and some estimates show that the US economy is growing at a rate of over 5% this quarter.

Gross: Powell’s Implication is That Rates Will Be “Higher and Longer”

Following Federal Reserve Chair Jerome Powell’s speech at the Jackson Hole Symposium, Bill Gross posted on social media platform X (formerly known as Twitter) that US 10-year Treasury yields could rise to 4.50% in the future, while short-term rates are expected to remain relatively stable.

Gross said that the implication he got from Powell’s speech is that rates will be “higher and longer” in a somewhat subtle message.

Cleveland Fed President Mester: More Work to Be Done

Loretta Mester, President of the Federal Reserve Bank of Cleveland, said that the core inflation rate is still too high, and policymakers must be cautious as they strive to steadily bring it down to 2%.

“We may have more work to do,” Mester said in an interview. “I think it’s very important that we be cautious now. We have to be very careful. We don’t want to overtighten. We also don’t want to undertighten.”

Mester said that her outlook has not changed much since June, when she expected two more rate hikes this year and no rate cuts next year.

Powell: Will Raise Rates When Necessary and Maintain High Rates

Jerome Powell, Chairman of the Federal Reserve, stated that if necessary, the Fed is prepared to raise rates further and intends to maintain rates at a high level until the inflation rate convincingly approaches the 2% target.

“While inflation has come down from its peak, which is welcome progress, it is still too high,” Powell said on Friday at the Jackson Hole Symposium in Wyoming. “We are prepared to further raise rates as appropriate and intend to keep our policy restrictive until we are confident that inflation is sustainably moving toward our target.”

This welcomed the slowdown in price increases caused by the tightening of monetary policy and the further easing of supply bottlenecks after the epidemic, but he also warned, “Although recent data is more favorable, there is still a long way to go in this process.”

At the same time, Powell hinted that the Fed may keep interest rates unchanged at the next meeting in September, as investors expect.

“Given how far we have come, we can be cautious at future meetings in order to assess incoming data and the evolving outlook and risks,” he said.

ECB Council Member Vujcic: More data needed to determine peak interest rates

ECB Council Member Boris Vujcic said officials need to see more data on inflation trajectories to determine if rate hikes have been sufficient.

“We are definitely in a restrictive area now,” the Croatian central bank governor said. “Whether we are in a sufficiently restrictive area remains to be seen. This can only be judged by the next inflation data.”

Although data shows that economic activity is cooling, “we have not seen this clearly in inflation rates,” Vujcic said. The question for the coming months is whether service sector inflation will ease sufficiently and “whether we will feel the impact of a slowdown in the labor market.”

Vujcic believes that the eurozone economy can avoid a “real recession” and a soft landing is still achievable.

Bank of Thailand Governor: Thailand needs to tighten fiscal policy stance

The Bank of Thailand hopes that the new government led by Sethaput will cooperate with monetary policy to streamline fiscal policy and avoid inflationary pressures.

This is one of the wish lists of the Bank of Thailand Governor Sethaput Suthiwartnarueput, who hopes to mitigate the impact of US rate hikes on the second largest economy in Southeast Asia. He said that after a cumulative rate hike of 175 basis points, the Bank of Thailand is close to the ideal interest rate level that can support economic growth and curb inflation.

“Whether it is monetary policy or fiscal policy, what is important is to normalize policies and carry out more adjustments,” he said in an interview.

ECB’s Nagel: Considering pausing rate hikes is “too early”

Joachim Nagel, a member of the ECB’s governing council, said he was not sure if inflation was sufficiently under control to stop rate hikes, and his decision would depend on more data in the coming weeks.

“Considering pausing rate hikes is too early for me,” Nagel, who is also the President of the German central bank, said on Thursday at Jackson Hole. He added that he would wait for more data before making a decision. “We should not forget that the current inflation rate is still around 5%, so it is still too high, and our target is 2%, so there is still some way to go.”

He said that although economic activity is slowing down, the core inflation rate remains stubborn and the labor market conditions are “very good”.

Nagel said he expects Germany to avoid a recession, reasoning that although the third quarter was weak, the outlook for next year will improve.

Boston Fed President Collins: The Fed may need to further raise interest rates, and rates may be close to their peak

Boston Fed President Susan Collins said the Fed may need to further raise benchmark interest rates and she is not prepared to signal that rates have peaked.

In an interview, she said, “We may need to add a little more, and now we may be very close to the level where rates can be maintained unchanged for a long time.”

She said, “I think it is very likely that we have reached a point where we can stand still for a considerable period of time. As for where the top of the interest rates is, I won’t make any implications.” Collins does not have voting rights on monetary policy this year.

ECB Governing Council Member Centeno: Downside risks have become a reality

ECB Governing Council member Mario Centeno said officials should exercise caution when deciding on the next steps, as previously identified economic risks have now become a reality.

The Portuguese central bank governor told the media that the ECB’s tightening monetary policy is taking effect, and the rate of inflation is falling faster than it is rising.

He said, “This time we must be cautious, because the downside risks identified in June have become true.”

Philadelphia Fed President: The Fed may have done enough on interest rate issues

Philadelphia Fed President Loretta Mester said the Fed “may have done enough” and should maintain interest rates at a restrictive level while assessing their impact on the economy.

In an interview, she said, “I think we have done enough, and now there are two things going on. First, the federal funds rate is in a restrictive area, so it is advisable to maintain it for a period of time. Second, we are continuing to shrink the balance sheet, reducing monetary policy accommodation.”

Mester said, “I think we will maintain policy stability for the remainder of this year” while monitoring economic data.

She said that if inflation declines faster than expected, “we may need to cut interest rates earlier rather than later”.

Bullard: Strong economy is changing the Fed’s plans

Former St. Louis Fed President James Bullard said that the summer’s economic activity heating up may delay the Fed’s plan to end interest rate hikes.

In an interview, he said, “This re-acceleration of economic activity may bring upward pressure on inflation, prevent inflation from falling, and thus affect the timing of the Fed’s policy adjustment.”

Former St. Louis Fed President James Bullard said that the “re-acceleration” of US economic growth this summer could delay the Fed’s plan to end interest rate hikes.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- What is Layer2, the source of controversy within the Ethereum community?

- Lybra V2 is about to go online, analyzing V2 functions and product expansion.

- Looking at the latest developments of THORChain from both the bullish and bearish perspectives liquidity exchange and lending.

- Aside from the lack of tokens, why is it said that Coinbase’s Base chain does not violate US laws?

- Base and Optimism reach a ‘shared revenue’ agreement, pioneering the ‘Layer2 Economic Alliance’.

- An Analysis of the ‘Nintendo’ of the Cryptocurrency World Treasure DAO

- PEPE plummeted by 16%, and the founder behind it was exposed a 97-year-old photographer who used the money from selling coins to buy a Lamborghini.