Lybra V2 is about to go online, analyzing V2 functions and product expansion.

Lybra V2 is launching soon, with analysis of functions and product expansion.Author: Yuuki, LD Capital

Introduction:

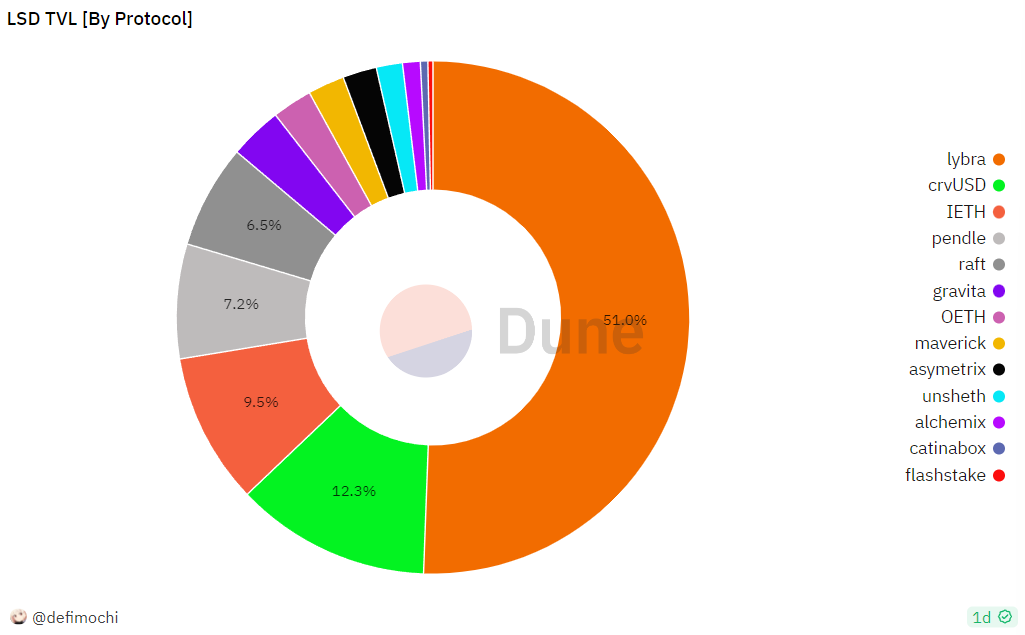

Lybra currently has a TVL of 328 million, exceeding the total of mainstream LSDFi protocols such as crvUSD, Pendle, Raft, and Gravita, and has become the largest LSDFi protocol. Currently, during the upgrade of Lybra V2, the following analysis mainly focuses on the existing problems solved by Lybra V2 and the protocol expansion it has made.

Lybra has a market share of over 50% in the LSDFi track

- Looking at the latest developments of THORChain from both the bullish and bearish perspectives liquidity exchange and lending.

- Aside from the lack of tokens, why is it said that Coinbase’s Base chain does not violate US laws?

- Base and Optimism reach a ‘shared revenue’ agreement, pioneering the ‘Layer2 Economic Alliance’.

Source: Dune@defimochi, LD Capital

Main text:

Lybra V2 is currently undergoing code audits by Cod4rena and Consensys, and the final audit by Halborn is about to be completed; it is confirmed to be launched at the end of August. The main functional updates include the launch of peUSD to support non-rebase LST, the launch of Arbitrum, the introduction of LBR War to control token emissions through governance (similar to Curve War), the introduction of early unlock fines and dLP fines, thus introducing LBR burning and eUSD price stabilization fund.

Comparison of Lybra V2 and V1 functionality

Source: Lybra, LD Captical

In Lybra V1, the protocol attracted market attention with its innovative mechanism design for interest-bearing stablecoins and accumulated a large amount of TVL. However, it also exposed the following four issues:

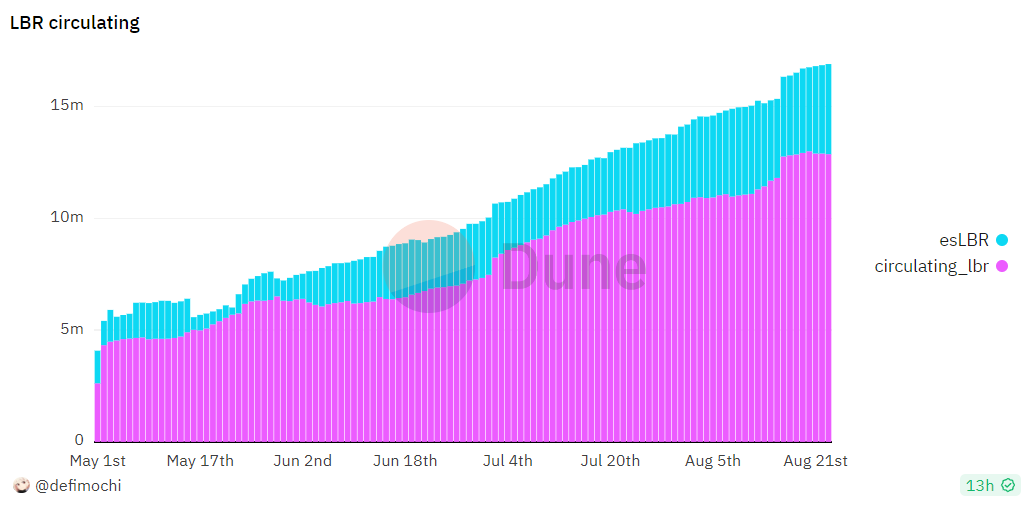

1. Imbalanced risk of eUSD minting income: In Lybra V1, 1.5% of the interest generated by the collateral provided by the minters was deducted as protocol revenue, and the remaining portion was converted into eUSD and distributed to eUSD holders to achieve the function of interest-bearing stablecoins. This resulted in a loss of 1.5% interest income for the eUSD minters while bearing the contract risk. In order to incentivize minting behavior, esLBR subsidies are needed, which will cause serious inflation of LBR circulation. From early May to now (August 23), LBR circulation has increased from 4.33 million to 12.87 million, an inflation of 297%. LBR+esLBR has increased from 5.42 million to 16.9 million, an inflation of 312%.

Severe inflation of LBR

Source: Dune@defimochi, LD Capital

2. Holding eUSD can earn interest, which makes minters more willing to hold eUSD (giving up holding eUSD means giving up all collateral income), and the market has a strong purchasing intent (compared to non-interest-bearing stablecoins such as USDT, holding eUSD can earn an annualized return of 7%-10%). In addition, the protocol continues to buy eUSD for interest distribution, resulting in a long-term premium of eUSD.

Long-term premium of eUSD

Source: Coingecko, LD Capital

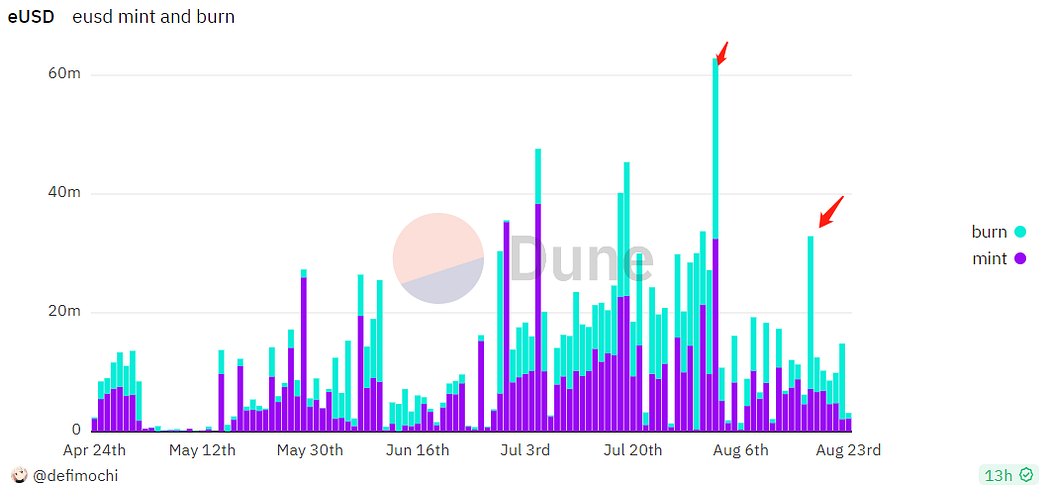

3. The interest generated from stETH collateral is converted into eUSD and distributed to eUSD holders. In order to maximize their profits, coin issuers usually choose the highest leverage ratio, resulting in a low collateralization ratio (CR) which makes the protocol vulnerable to liquidation. On August 2nd and August 17th, when there were significant drops in the price of ETH, large-scale liquidations of eUSD occurred, which not only caused losses to coin issuers but also increased the protocol’s bad debt risk.

eUSD’s high leverage ratio makes it prone to liquidation.

Source: Dune@defimochi, LD Capital

4. By converting the interest from the underlying collateral into eUSD and distributing it to eUSD holders, the interest mechanism of eUSD prevents Lybra from supporting non-rebase assets such as rETH and WBETH, which limits the expansion of the protocol’s collateral assets.

LybraV2 has made the following adjustments to address the above issues:

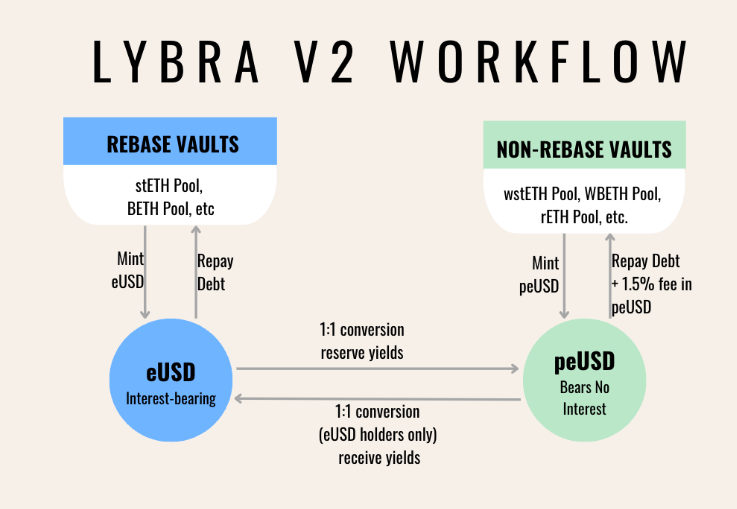

1. The limitations on the high subsidy, high leverage, and application scenarios of stablecoins are fundamentally caused by the interest mechanism of eUSD. In the LybraV2 version, the introduction of peUSD partially solves the above problems. peUSD is not an interest-bearing stablecoin. Its product form is similar to other CDP collateralized stablecoins, which specifically solves the problem of the inability to expand collateral assets of non-rebase LST and the integration of eUSD with other DeFi applications. It also does not have a high leverage tendency and premium. peUSD is designed to support multi-chain integration according to the OFT standard and will launch flash lending to improve product functionality.

At the beginning of its launch, peUSD supports rETH, WBETH, and eUSD as collateral, with a requirement of LST collateralization ratio greater than 130%, and eUSD is pegged to peUSD at a 1:1 ratio. The combination of eUSD and peUSD allows eUSD holders to retain the interest of eUSD while releasing liquidity. However, this may lead to circular borrowing arbitrage, and it is expected that the market will balance the premium of eUSD with the discount of peUSD. Overall, peUSD expands the protocol’s development in another dimension, but it will also face competition from other relatively homogeneous products such as crvUSD and Raft. One challenge for the protocol’s V2 version is how to reduce the liquidity cost of peUSD.

peUSD minting process diagram

Source: Lybra, LD Capital

2. The protocol introduces early unlock fines and dLP fines to burn LBR and maintain the stability of eUSD price. In LybraV2, esLBR unlocks after 90 days and can be traded on the secondary market. However, users can choose to pay a fine of 25%-95% of the total unlock shares to speed up the unlock process. The fine can be paid with a 50% discount using LBR or eUSD. The design of dLP fines is similar to the above. In V2, coin issuers are required to hold LBR/ETH LP with a value exceeding 5% of their coin positions in order to enjoy esLBR rewards. If the total value of LP held by the coin issuer does not meet the requirements, the reward portion will also be available as a fine, which can be paid with a 50% discount using LBR or eUSD.

The above two parts of the fine auction can generate some LBR and eUSD income for the protocol. The LBR income will be destroyed to reduce the supply of LBR, while the eUSD part will be maintained as a strategic reserve to anchor the secondary market price of eUSD.

The design of dLP can bind LBR/ETH LP with eUSD minters, reducing the participants required to maintain the protocol’s smooth operation. This may also help lower the LP incentives and reduce the inflation rate of LBR. The disadvantage is that it increases the participation threshold for minters.

3. In V2, a mechanism to suppress the premium of eUSD is added, mainly divided into two parts: first, when the accumulated platform fee exceeds 1000 eUSD and eUSD/USDC is greater than 1.005, the protocol will convert the excess eUSD into USDC and send it to the protocol’s reward pool (at this point, the earnings of eUSD holders will be distributed in the form of USDC); when eUSD/USDC is not higher than 1.005, the excess eUSD will be converted into peUSD and sent to the protocol’s reward pool. In general, the interest distribution for eUSD holders is changed to USDC and peUSD, thereby reducing the potential buying pressure from the protocol’s interest distribution in the secondary market. (Currently, the eUSD required for interest distribution to eUSD holders is obtained through the exchange of collateral income and protocol revenue, but in the long run, the protocol revenue is not sufficient to pay the interest of eUSD holders, so the protocol needs to buy eUSD from the secondary market for distribution; V2 changes the interest distribution for eUSD holders to USDC and peUSD, which in the short term increases the selling of eUSD from the protocol and in the long term reduces the buying of eUSD from the protocol.)

Furthermore, the eUSD portion accumulated in the premature unlock fine and dLP fine modules will also serve as a reserve for stabilizing the price of eUSD. When eUSD is at a premium, the protocol can choose to sell a portion of the eUSD to regulate the secondary market price.

It is also worth noting that in LybraV2, due to the support for multiple collateral assets, the emission share of esLBR in different collateral pools becomes a governable module. As Lybra currently holds a leading position in the LSDFi protocol, it may attract asset issuers (LSD protocol) to accumulate esLBR for Lybra protocol governance in order to expand the application scenarios of their LST, or increase the income for esLBR holders through market bribery.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- An Analysis of the ‘Nintendo’ of the Cryptocurrency World Treasure DAO

- PEPE plummeted by 16%, and the founder behind it was exposed a 97-year-old photographer who used the money from selling coins to buy a Lamborghini.

- Deep analysis of governance risks, capital risks, and protocol risks of LSD.

- AI FOMO sweeps the world profits surge 8 times, NVIDIA emerges as the biggest winner.

- Experience the Tu Dog hype type SocialFi platform friend.tech it may be boring and even ridiculous at times, but it has unlimited potential.

- What is the security foundation of the post-POS era? A quick look at the newly proposed theory in the Ethereum community, Proof of Validator

- An Overview of Scroll’s Early Ecosystem What Opportunities Exist for Leading Players in zkEVM?