Exploring THORChain’s lending module Revealing the hidden impact of Terra LUNA.

Unveiling THORChain's lending module and the impact of Terra LUNA.

Author: Yilan, LD Capital

Introduction

Upon a closer examination of Thorchain’s new lending module launched on August 22nd, we discovered a shadow of Terra LUNA. The similarity between them lies in the fact that the collateral deposited by users is converted into RUNE. The inflation and deflation of RUNE is determined by the fluctuation of the RUNE-collateral exchange rate. In other words, just like how LUNA absorbs the volatility of UST, RUNE absorbs the volatility of the RUNE-collateral exchange rate through inflation and deflation. However, there are differences in their implementation (RUNE participating in lending, with destruction and minting during loan opening and closing; LUNA participating in stablecoin anchoring, with destruction and minting conducted by arbitrageurs when UST becomes unanchored) and the underlying risk volume (LUNA has no upper limit on minting, while RUNE has an upper limit on inflation and deflation, and only 50% of the collateral for synthetic assets is RUNE). Furthermore, the lending protocol has implemented strict risk control and risk isolation measures, so the overall risk is relatively small and will not generate systemic risks similar to Terra LUNA, even if a negative spiral occurs, it will not affect other functions of Thorchain.

I. Understanding Thorchain’s Lending Mechanism

The distinctive features of Thorchain’s lending include no interest, no liquidation risk, and no time limit (during the initial period, the minimum loan term is 30 days). For users, it essentially means being long BTC/ETH with short USD collateral assets; for the protocol, it essentially means being short BTC/ETH with long USD. Debts are denominated in TOR (Thornchain’s USD equivalent), so users are similar to buying BTC OTM calls during the gold standard period, with the protocol/RUNE holder as the counterparty.

Opening a new loan will have a deflationary effect on $RUNE assets, while closing a loan will have an inflationary effect on $RUNE assets. BTC collateral will be converted into RUNE first, then destroyed, and finally minted into the assets required for the RUNE exchange. In this process, the difference between the value of the collateral and the debt, minus the transaction fees, corresponds to the net destruction value of RUNE.

If the collateral appreciates at the time of repayment, and assuming the price of RUNE remains unchanged, more RUNE needs to be minted to exchange for the required assets, which will result in inflation. If the price of RUNE rises, it is ideal to not mint as much RUNE. If the price of RUNE falls, inflation will be more severe. If the collateral depreciates at the time of repayment and the price of RUNE remains unchanged, users may choose not to repay (thus not generating minting).

- Interpreting the Road to Web3 Gold Mining in the Central African Republic

- Quick look at the Jackson Hole annual meeting Powell maintains possibility of raising interest rates, Lagarde says rates will be kept at necessary high levels to control inflation.

- LianGuai Daily | Hong Kong police take action against money laundering activities, including cryptocurrencies; Social platform OnlyFans has purchased about $20 million worth of ETH.

If the value of RUNE relative to $BTC remains unchanged during loan opening and closing, there will be no net inflationary effect on $RUNE (the amount destroyed is equal to the amount minted, minus the exchange fees). However, if the value of the collateral relative to RUNE increases between loan opening and closing, there will be net inflation in the supply of $RUNE.

In order to address the issue of inflation, lending control measures have been put in place – if minting causes the total supply to exceed 5 million RUNE, there is a circuit breaker design. In this case, reserves will intervene in redeeming loans (rather than further minting), the entire lending design will stop and be withdrawn, but other aspects of THORChain will continue to operate normally.

Therefore, the impact of the entire lending process on the inflation and deflation of RUNE is significant, but there are limits to both inflation and deflation in the case of a lower overall lending cap. When the RUNE-collateral ratio continues to rise indefinitely, the maximum deflation will be the maximum opening amount, which is currently 15 million * 0.33 (0.33 is the lending lever, might change), that is 4.95 million (may increase in the future). In the case of the RUNE-collateral ratio falling indefinitely, inflation is also controlled within 5 million by the circuit breaker.

Specifically, if a user overcollateralizes with 200% collateral and borrows 50% of the required assets, the other 50% will be minted based on the RUNE-collateral ratio when redeemed. This step is essentially similar to LUNA, but under the mechanism of Thorchain Lending, because only 50% of Rune back is available, the product capacity is also smaller, so the overall risk is relatively small and will not produce systemic risks similar to Terra LUNA. This risk is isolated, and even in the event of a negative spiral, it will not affect other functions of Thorchain.

1. How to understand that the lending design is similar to a deep out-of-the-money, resettable strike price call option for users

When Alice provides 1 BTC, she also obtains 50% cash (in the case of a collateral ratio of 200%) and the opportunity to purchase 1 BTC with this cash.

If, at the time of repayment (assuming one month later), BTC has risen, Alice repays the debt (i.e., the value of 50% of the BTC one month ago), spending the BTC price from one month ago to purchase this BTC. If it has fallen significantly, exceeding 50%, Alice chooses not to repay, and the protocol will not generate inflation caused by minting RUNE (for Alice, her long position fails).

2. How to understand the absence of borrowing interest

It can be seen as users paying multiple swap fees instead of an interest rate, and it is essentially a CDP product. If borrowing interest is charged, this product will be less attractive to users.

The entire process of lending is as follows:

Users deposit collateral in native assets (BTC, ETH, BNB, ATOM, AVAX, LTC, BCH, DOGE), in the initial stage, the collateral is limited to BTC and ETH. The amount of collateral that each debt position can accept (debt ceiling) is determined by the hard cap (15 million), lending lever, and pool depth coefficient. Overcollateralization generates debt, and the proportion of debt that can be obtained is determined by the collateral ratio (CR).

Borrowing: Alice deposits 1 BTC, this BTC will first be swapped for RUNE in the BTC-RUNE swap pool, and these RUNE will enter a V BTC pool and be destroyed while being converted into a synthetic asset Thor.BTC. The collateral for the synthetic asset is constant product liquidity, always 50% of the asset is RUNE, and the remaining 50% is RUNE. Then the synthetic asset Thor.BTC is sent to an internal module, where a dynamic collateral ratio (CR) determines how much loan can be obtained, and the token Thor.Tor (similar to USD) is generated as a means of accounting for the loan. The steps taken here are purely for internal accounting purposes, and then a USDT loan is generated and given to Alice for her use.

Loan Repayment: When Alice repays the loan, she sends all USDT or other Thorchain-supported assets to the protocol and converts them into RUNE. RUNE will be minted into Tor. The protocol checks whether the user has repaid all loans valued in Tor. If all loans are repaid, the collateral will be released and converted into derived collateral (Thor.BTC). This derived asset will be minted into RUNE and then swapped back to L1 BTC. RUNE is minted during this process.

It should be noted that these swap and convert processes will incur fees (at least 4 swap fees per loan), so the total amount of repayment needs to be slightly higher to cover these swap fees. Although there is no interest, the multiple fees can be seen as a substitute for interest. Despite the significant wear and tear, the RUNE-form fees generated are destroyed, which is a real deflation.

3. How to understand no liquidation and no repayment time limit

Since the debt denominated in TOR stablecoin is fixed, although borrowers can choose to repay with any asset, they will actually be converted into RUNE through the market. Liquidity providers and depositors do not directly lend their assets to borrowers. The pool is only a medium for exchanging collateral and debt, and the entire process is a gambling behavior, which is why there is no liquidation. The protocol needs to use RUNE to fully repay enough TOR to help users retrieve their collateral. If the price of the collateral drops significantly, users can choose not to repay (and this part of RUNE will not be reminted, resulting in net burn). In fact, the protocol does not expect users to repay. If the price of the collateral rises and the price of RUNE falls, repayment by users will cause inflation.

4. How to understand the deflation and inflation of RUNE as a transaction medium

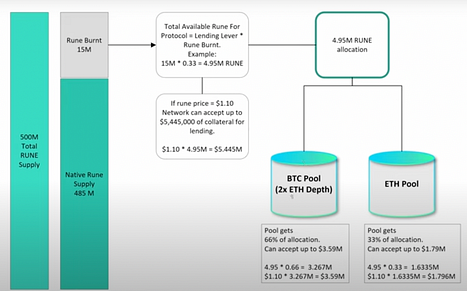

First of all, the total upper limit of all lending pools is determined by multiplying the RUNE Burnt part in the gray area in the figure below by the Lending lever, and the 15 million RUNE Burnt is the result of the protocol burning non-upgraded BEP2/ERC20 RUNE in the past. Therefore, it can be seen that the protocol currently has a space of 15 million to inflate before reaching the maximum supply of 500 million RUNE.

The above text also introduces the role of RUNE in the entire lending process (you can review the mechanism part in the previous text). Opening a new loan will have a deflationary effect on the RUNE asset, while closing a loan will have an inflationary effect on the RUNE asset.

If the collateral increases in value during repayment and the price of RUNE remains unchanged, more RUNE needs to be minted to exchange for the required assets, which leads to inflation. If the price of RUNE rises, it is ideal to not need to mint as much RUNE. If the price of RUNE falls, inflation will be more severe. If the collateral decreases in value during repayment and the price of RUNE remains unchanged, the user may choose not to repay (no minting is generated).

If the value of RUNE relative to BTC remains unchanged during loan opening and closing, there will be no net inflationary effect on RUNE (the amount burned is the same as the amount minted minus the exchange fees). However, if the value of the collateral relative to RUNE increases between loan opening and closing, there will be a net inflation of RUNE supply.

In order to solve the inflation problem, loan control measures have been put in place – if minting causes the total supply to exceed 5 million RUNE, there is a circuit breaker design. In this case, the reserve will intervene in loan redemption (instead of further minting), the entire loan design will stop and cease to be used, but other aspects of THORChain will continue to operate normally.

If calculated with the parameters in the graph, currently the total amount of all debt pools is only 4.95 million RUNE. That is, all debt pools can accept collateral equivalent to 4.95 million RUNE.

The entire Reserve’s RUNE Burnt is the buffer of all debt pools and the last resort for inflation. The total amount of RUNE Burnt in the Reserve (currently) will be allocated according to the depth of each debt pool. The deeper the depth, the more Reserve buffer will be allocated. For example, if the depth of the BTC lending pool is twice the depth of the ETH lending pool, then the value of Rune Burnt * Lending lever * depth factor in the Reserve is the maximum collateral limit that can be assumed in this lending pool. Therefore, when the price of RUNE rises, the amount of collateral that can be accepted in this pool will also increase. It can also be seen that the Lending lever and the price of RUNE jointly determine the upper limit of collateral that the lending pool can accommodate.

The THORChain protocol and all RUNE holders are counterparties to each loan. The burning/minting mechanism of RUNE means that RUNE condenses/dilutes (among all RUNE holders) when debts are opened and closed. When the RUNE-collateral ratio falls, inflation occurs, and vice versa deflation occurs.

5. Is the CDP protocol a good on-chain liquidity absorption model?

For the Lending introduced by Thorchain, it is a disguised liquidity absorption model that makes RUNE an indispensable medium in the borrowing and repayment process, thereby increasing the scenarios for burning and minting.

So, is this liquidity absorption model advantageous? Let’s take a look at some other on-chain liquidity absorption models.

CEX is the most obvious beneficiary of liquidity absorption models because, as a custodian, these funds can generate more income in many cases (after the reserve requirement is disclosed, this income is reduced compared to before). How to protect the security of user custodial funds is also something that regulatory frameworks need to clarify, and regulators usually expect exchanges to have full reserves.

The situation on-chain is completely different.

DEX needs to provide high incentives to LP after liquidity absorption. Therefore, the purpose of liquidity absorption is to deepen liquidity and cannot directly generate profits from the “deposits” provided by LP. Instead, it forms a liquidity moat through a large reserve.

Pure Lending, similar to Aave or Compound, requires paying interest costs for liquidity absorption. The entire model is no different from traditional lending, such as the need to actively manage loan positions and have repayment time limits.

By comparison, the CDP model of absorbing funds is a healthier model. Due to the volatility of the collateral assets, most of the over-collateralized CDPs in the market are users over-collateralizing certain assets to obtain a certain stablecoin or other assets. In this process, the CDP protocol actually obtains more “deposits”. And there is no need to pay interest on these deposits.

Thorchain also belongs to this CDP model. So where is the collateral held? In fact, the collateral is exchanged for RUNE through the liquidity pool. Therefore, no one “stores” the collateral. As long as the THORChain pool is healthy and operating normally, any collateral deposited will be exchanged for RUNE, and then arbitrageurs will rebalance the pool as usual. This can be seen as the collateral being accumulated in Thorchain’s RUNE pool against other currency pairs.Because BTC and other collateral enter the circulation market instead of being held in the protocol, although the generated debt is 100% collateralized, the difference between the value of the collateral and the debt is determined by the value of RUNE, thus casting a shadow over the entire mechanism similar to Terra LUNA.

Capital Sink may be one of the goals that Thorchain lending wants to achieve, using users’ collateral assets to accumulate liquidity in the swap pool. As long as users do not close their loans and the price of RUNE does not fall sharply, the protocol retains assets, RUNE generates deflation, and a positive cycle is formed. Of course, the opposite will create a negative spiral.

6. Risks

Because BTC and other collateral enter the circulation market instead of being held in the protocol, although the generated debt is 100% collateralized, the difference between the value of the collateral and the debt is determined by the value of RUNE, thus casting a shadow over the entire mechanism similar to Terra LUNA. Due to the fact that the amount of RUNE burned when opening a loan may not be exactly equal to the amount of RUNE minted when closing a loan, both deflation and inflation can occur. It can also be understood that if the price of RUNE rises during repayment, deflation occurs, and vice versa for inflation. If the price of RUNE falls below the lending lever multiple at the time of opening the position, the circuit breaker will be triggered. Throughout the lending process, the price of RUNE plays a decisive role in deflation and inflation. When the price of RUNE declines, there is still a high risk of a large number of users choosing to close their loans and causing inflation. However, the protocol has strict risk control and risk isolation measures, so the overall risk is relatively small, and it will not generate systemic risks similar to Terra LUNA, and even if a negative spiral occurs, it will not affect other functions of Thorchain.

Lending lever, CR, and the choice of whether to open different collateral debt positions have become the three pillars of Thorchain lending’s risk control.

In addition, Thorchain has a history of being hacked, and its code complexity is high. Thorchain Lending may also have vulnerabilities that need to be paused or fixed.

Conclusion

The launch of Thorchain Lending generates network synergies, additional trading volume, and higher capital efficiency, driving the system to generate real returns and increase the total bonded amount. This allows Thorchain to potentially gain upward potential by reducing the circulating supply (when the RUNE-collateral ratio increases).

Capital sink (which may be one of the goals of Thorchain Lending) uses users’ collateral assets to provide liquidity in the swap pool. As long as users do not close their loans and the price of RUNE does not significantly decline, the protocol retains the assets and RUNE experiences deflation, creating a positive feedback loop.

However, in reality, reverse market trends can lead to inflation and negative spirals. In order to control risks, the use of Thorchain Lending is limited and its capacity is relatively small. In terms of overall deflation and inflation, considering the current capped volume, it will not have a fundamental impact on the price of RUNE (at most an impact of 5 million RUNE).

In addition, in terms of capital efficiency for users, the CR (Collateral Ratio) is also not high, ranging from 200% to 500%, and may ultimately fluctuate between 300% and 400%. From the perspective of leverage alone, it is not the best product. Moreover, although there are no borrowing fees, the multiple internal transaction fees can also be burdensome for users.

Only evaluating this one product, lending, does not represent the development of the entire Thorchain DeFi product matrix. There will be a series of analyses on other Thorchain products in the future.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Weekly Preview | Hong Kong Exchange HashKeyExchange begins to serve retail investors; Optimism and Hedera will unlock tokens worth tens of millions of dollars

- Review of the PEPE dumping incident Is it a case of uneven distribution of profits or a premeditated run?

- What is Layer2, the source of controversy within the Ethereum community?

- Lybra V2 is about to go online, analyzing V2 functions and product expansion.

- Looking at the latest developments of THORChain from both the bullish and bearish perspectives liquidity exchange and lending.

- Aside from the lack of tokens, why is it said that Coinbase’s Base chain does not violate US laws?

- Base and Optimism reach a ‘shared revenue’ agreement, pioneering the ‘Layer2 Economic Alliance’.