Comprehensive Explanation of Dolomite, a Currency Market Protocol Based on GMX

Explaining Dolomite, a Currency Market Protocol based on GMX.Written by: Peng SUN, Foresight News

Maximizing capital efficiency and continuously expanding reproduction is the core of building the DeFi world with LEGO blocks. Dolomite, a currency market protocol on Arbitrum, has proposed a way to achieve LP token reproduction and has fully integrated the GMX LP token GLP. The protocol has just completed a $2.5 million financing round with participation from NGC Ventures and Coinbase Ventures, among others. Today, Foresight News will introduce Dolomite to you and see how it integrates and releases the value of LP tokens.

I. Background

The story of Dolomite began in 2018 as a DEX on the Loopring protocol. Since October 2022, Dolomite has successively launched margin agreements, DEX, and DeFi lending functions, supporting more token protocols through its virtual liquidity system to maximize capital efficiency. This non-rent-seeking model allows users to hedge investment portfolios, conduct leveraged trading, and unlock LP token rights. Dolomite’s margin agreement is modified based on the dYdX smart contract, and its core storage repository has undergone security audits by Open Zeppelin, Bramah Systems, and Anbi Labs (SECBIT), while the module (Modules) storage repository is being audited by Zokyo. At the same time, Dolomite uses Chainlink price oracles to provide price feeding services.

The company behind Dolomite is Leavitt Innovations. According to LinkedIn, the Dolomite team has a total of 9 employees, with co-founder Corey Caplan graduating from Lehigh University with a dual degree in computer science and business, co-founder and COO Adam Knuckey also graduating from Lehigh University, and Kai Masters serving as a frontend engineer, among others.

- Exploring the middleware Babylon Chain: Inspired by Eigenlayer, borrowing “Bitcoin security” for other POS chains

- Understanding ZK Cross-Chain Protocol Lagrange in 3 minutes

- Putting AI into NFT: Humans.AI – Let artificial intelligence live on in the Web3 gene pool “Digital Immortality”

Currently, Dolomite has integrated Abracadabra’s magicGLP, PlutusDAO’s plvGLP, and GMX’s GLP. According to Dolomite’s roadmap, Dolomite will also integrate other protocols.

II. Dolomite’s Virtual Liquidity – GLP as an Example

Dolomite combines GMX’s “full account transfer” with the protocol’s own virtual liquidity, allowing users to continue to stake GMX and esGMX on Dolomite while using GLP as collateral for their borrowing position.

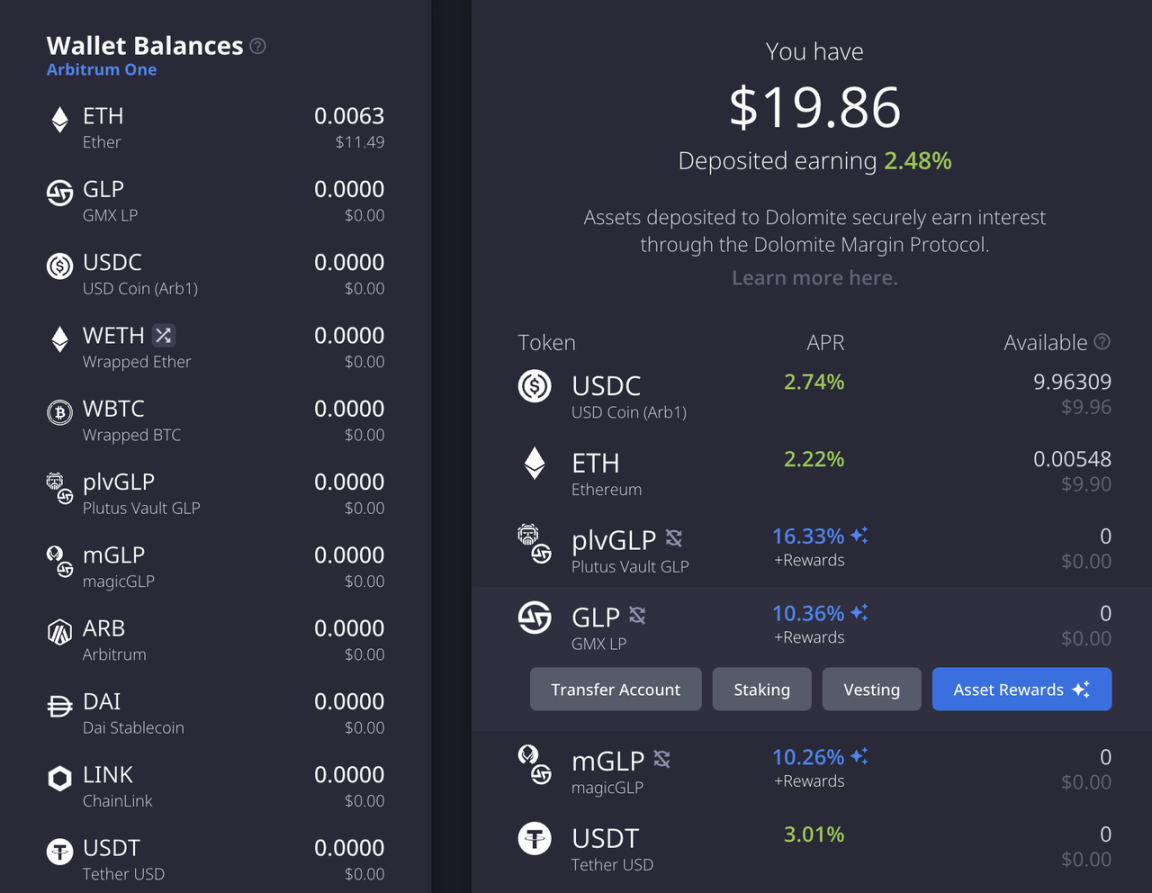

For any asset attempting to enter the Dolomite margin agreement, the tokens must first be deposited into Dolomite Balance. Currently, Dolomite Balance supports USDC, WETH, WBTC, GLP, plvGLP, mGLP, ARB, DAI, LINK, USDT, and ETH. Dolomite proposes a concept of virtual liquidity, which means that when tokens are deposited into Dolomite Balance, the operations performed on Dolomite will not result in any token transfer on the chain, but will cause changes to the internal ledger of the DolomiteMargin core smart contract. Simply put, assets deposited into Dolomite can earn interest generated by the protocol, and users can also use them for Dolomite liquidity pools, lending positions, and trading without changing the total amount of funds in their Balance, greatly increasing capital utilization.

Given the complexity and diversity of GMX and GLP, this section will focus on GLP to illustrate these characteristics. GLP is an LP token on GMX, which can be understood as an asset index composed of a basket of cryptocurrencies, including ETH, BTC, LINK, UNI, USDC, USDT, DAI, and FRAX, with ETH and BTC accounting for 55% and USDC accounting for 43%. After purchasing GLP, users will automatically participate in staking and can profit from traders’ losses, as well as receive esGMX rewards and 70% of the platform’s trading fees. However, the price of GLP tokens is subject to price fluctuations due to the volatility of BTC and ETH. At the same time, the counterparty of GMX’s open position users are actually users who stake GLP, so the price of GLP will also rise and fall with the profit and loss of trading users. In fact, GLP has intrinsic value and is backed by real assets, so hedging the price fluctuations of GLP and fully utilizing the value of tokens beyond staking is beneficial for both the GMX protocol itself and users. Moreover, GMX itself is completely composable.

Full integration of GLP: maintaining ownership of esGMX and Multiplier Points

Unlike other protocols that implement auto-compounding for GLP, Dolomite has fully integrated GLP, supporting the transfer of GMX and GLP staking revenue models to Dolomite, with the same interest rate, and the platform does not charge any revenue from the GMX ecosystem, but returns it entirely to the users.

After users deposit GLP tokens, Dolomite will create a proxy treasury in the background. The proxy treasury will record the user’s balance in Dolomite and provide virtual liquidity to the user. After depositing GLP tokens, users can receive ETH, esGMX, Multiplier Points, Vesting, and other rewards on Dolimite. Consistent with the GMX page, users can also claim and compound asset rewards, and allow users to unwrap WETH rewards and deposit them into their Dolomite account. Of course, if this option is unchecked, WETH will be deposited into the user’s wallet.

However, compared with GMX’s Abracadabra, Plutus, Yield Yak, Beefy Finance, Redacted, Mugen Finance, and other compound interest pools, Dolomite cannot perform auto-compounding because it has fully integrated GLP, and users still need to compound manually, requiring a fee for each compounding.

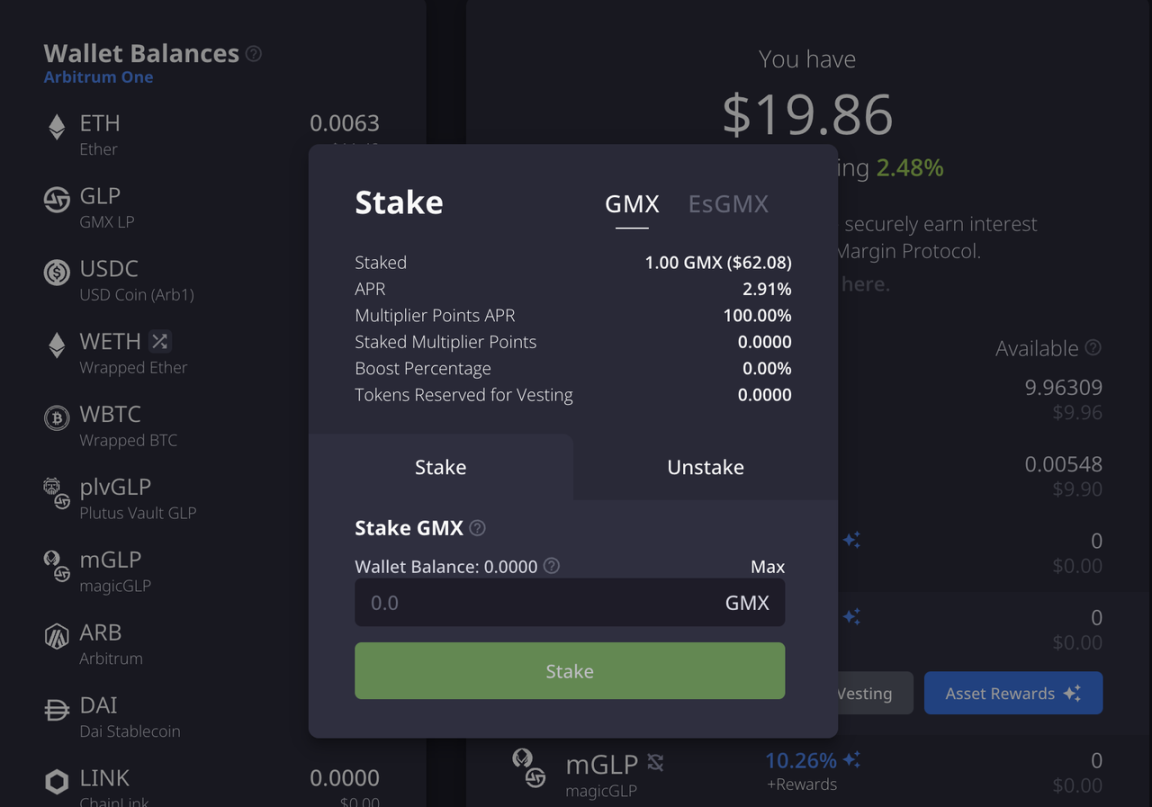

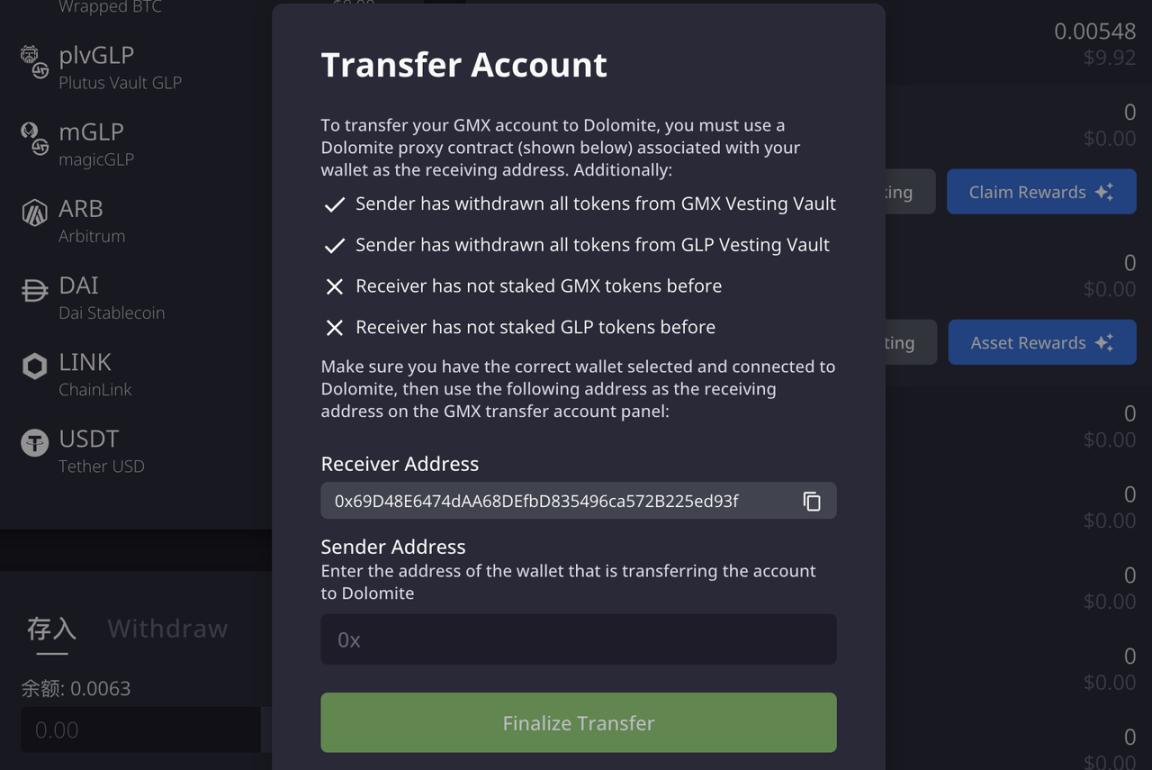

Users can also stake GMX and esGMX to earn rewards, with the difference being that staking GMX requires approval of the GMX token, while staking esGMX or converting it to GMX does not require token approval. For the former, users can directly stake GMX from their wallets to Dolomite (and vice versa), and the custodian will not hold any un-staked GMX. esGMX is usually non-transferable and is not extracted from the user’s wallet but from the custodian’s vault, and its conversion to GMX is also done through the custodian. To stake esGMX in Dolomite, a “Full Account Transfer” is required. Dolomite is the first protocol to support the transfer of the entire account to the currency market protocol, allowing GMX users to transfer all esGMXX, staked multiplier points, GLP, and staked GMX to a new account without losing any accumulated rewards or interrupting consecutive staking days. The support for Multiplier points also allows users to claim and compound in Dolomite, increasing the ETH yield.

It should be noted that each wallet address can only execute a full account transfer to Dolomite once. Before the account transfer, the sending GMX account needs to extract all tokens from the GMX Vesting Vault and GLP Vesting Vault, and the receiving Dolomite account cannot have staked GMX or GLP tokens before this. Otherwise, the transfer cannot be completed.

In the GMX token economic design, esGMX needs to stake the same proportion of GMX or GLP to be converted to GMX. Dolomite’s mechanism for converting esGMX to GMX is identical to the GMX interface, and the Vesting-enabled esGMX tokens will be converted within 365 days. In Dolomite, the virtual liquidity system ensures that GLP is always in the “staked” state, while also not affecting the use of GLP virtual liquidity for lending and other activities. For example, after depositing 100 GLP tokens, you can optionally use 50 GLP virtual liquidity as collateral for a loan position, borrow assets such as ETH, WBTC, and USDC, and engage in spot trading, leverage, or liquidity staking activities.

Delta Neutral GLP

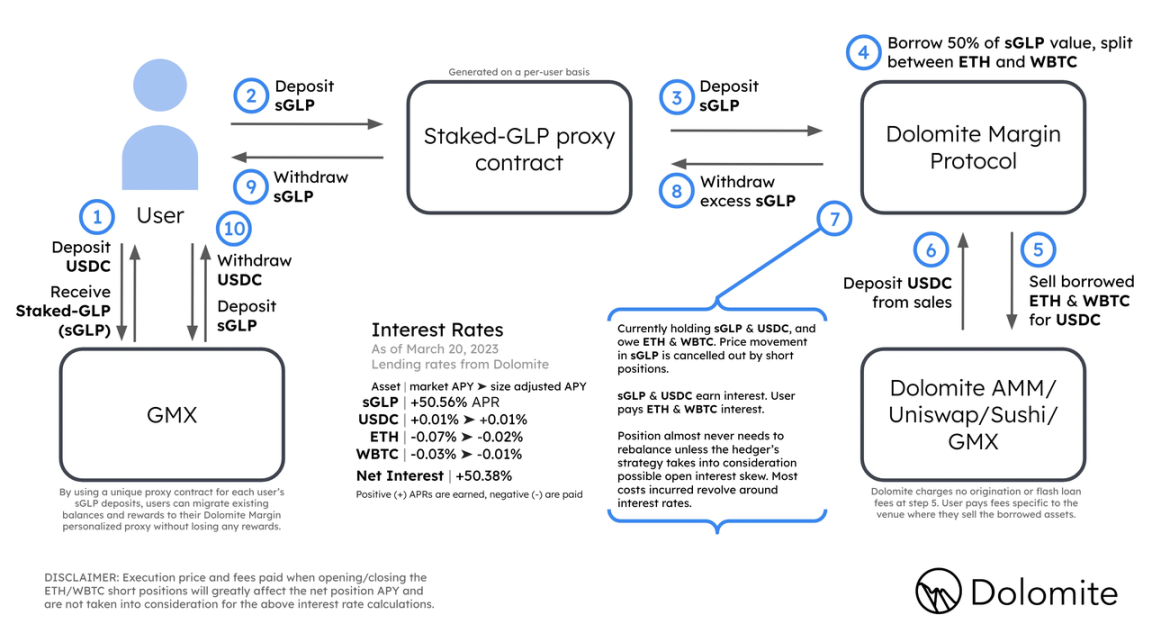

After Dolomite provided a virtual liquidity system, what strategies can users use GLP to generate profits?

Delta Neutral is a more common hedging strategy for GLP price fluctuations, and Dolomite also hedges risk through this strategy, retaining the income generated by GLP. For example, users can deposit $1,000 worth of GLP as collateral, borrow $500 in ETH and WBTC, and then exchange it for USDC. Once the prices of ETH and BTC fall, the USDC portion of the income will offset the GLP loss and transaction fees for borrowing ETH and WBTC.

Leveraged GLP

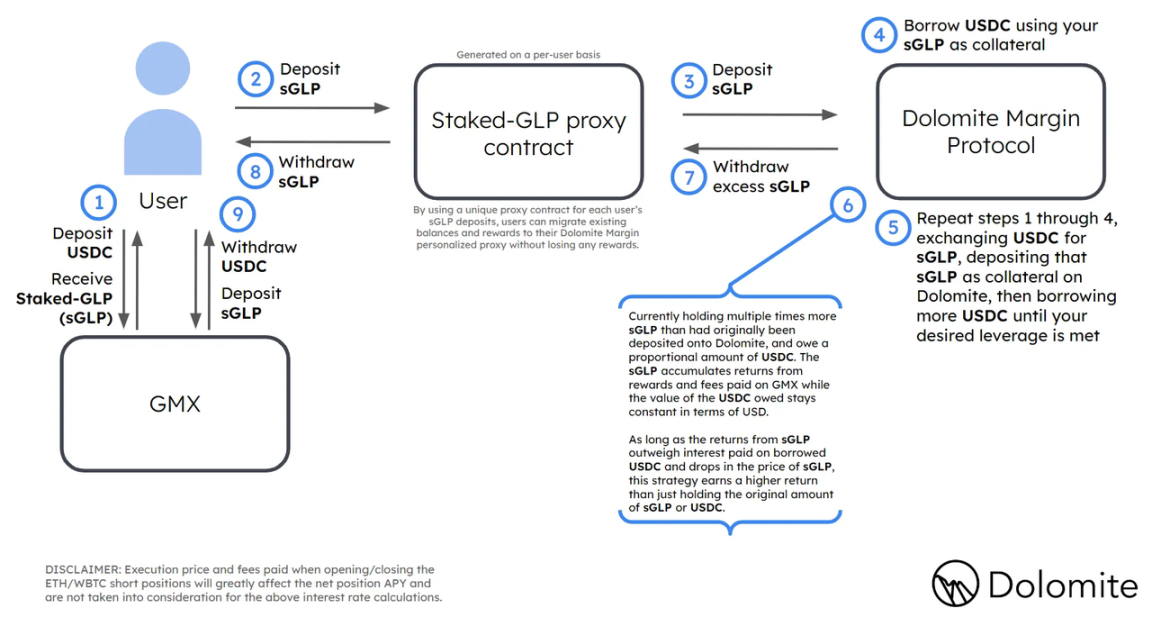

On the other hand, Dolomite users can also increase their risk exposure to GLP by borrowing USDC or other assets to purchase GLP and then re-collateralizing these borrowed assets to borrow more assets and recycle them again. With this strategy, users can hold more GLP and earn higher returns, but each cycle of borrowing and lending increases the leverage ratio.

Currently, Dolomite uses over-collateralized loans, with a minimum collateralization rate of 115% (86.9565% LTV), and WETH, DAI, USDC, and USDT all follow this standard. The minimum collateralization rate for GLP is 120% (83.3333% LTV), which means the maximum leverage ratio can reach 5 times. However, this strategy carries the risk of liquidation due to a drop in ETH and WBTC prices.

III. Conclusion

Dolomite is somewhat innovative. On the basis of GMX composability, it ensures that users fully benefit from the GMX and GLP ecosystem through “Full Account Transfer”, which is more attractive to users than other protocols that charge 10-20% of profits. At the same time, Dolomite unlocks the value of liquidity tokens such as GLP through virtual liquidity, providing users with hedging, borrowing, leverage, and other DeFi activities. Dolomite’s vision and ambition are not limited to GLP alone, and the team is trying to support more protocols in the future and will turn to DAO governance. Arbitrum has just launched its currency, and currently GMX dominates the market. It is expected that the Arbitrum ecosystem will become more prosperous in the future, and Dolomite, as a currency market protocol, provides GLP holders in the Arbitrum ecosystem with a new choice and is also worth looking forward to in the future.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Exploring Web3 Loyalty: Addressing Challenges and Dilemmas After Project Airdrops

- BladeDAO’s Decentralized Vision: Players don’t have to compromise, together build a transparent, fair and safe gaming world.

- Head DEX protocol iZUMi Finance on ZkSync: based on UniSwap V3 improvement, creating a new DL-AMM mechanism

- Weekly Preview | ACDE Conference may determine the scope of Cancun upgrade; Tokens of projects such as Avalanche and RON will be partially unlocked

- Quickly learn about 18 new projects in recent times: DeFi, games, and tools

- Recap of ETHGlobal Lisbon Hackathon: Quick Look at 5 Promising New Projects

- Token issuance of Sui’s ecological project faced setbacks including token unlocking delay and team unlocking, resulting in a difficult start.