Outlook on Ethereum staking market: Potential opportunities in a dynamic competitive landscape

Ethereum staking market potential opportunities amidst competition.Author: Jiawei@IOSG

TL;DR

-

Shapella has released liquidity, and the pressure on withdrawals has been alleviated in the short term. Long-term outlook is optimistic towards pledge rates;

-

The Ethereum pledge market will present a dynamic competitive pattern driven by event orientation, price war and target customer differentiation;

-

DVT will enhance the robustness and stability of the Ethereum validator set;

-

The influx of institutional investors helps to diversify the Ethereum validator set;

-

Although the pledge track has a long history, it may still impact the existing pattern due to changes brought about by some important events, thus bringing hidden investment opportunities.

Introduction:

After Ethereum transitioned to PoS in September last year, there were two important protocol upgrades this year: Shapella and Cancun. The former mainly supports validators’ withdrawals, making Ethereum pledge a closed loop; the latter will introduce Data Blob as an early layout of data sharding.

Now, more than a month has passed since Shapella was successfully implemented. Due to the activation of withdrawals, there have been some changes and turning points in the market. The author of this article mainly based on recent primary market observations, puts forward a few thoughts on the Ethereum pledge track, and explores investment opportunities in this field.

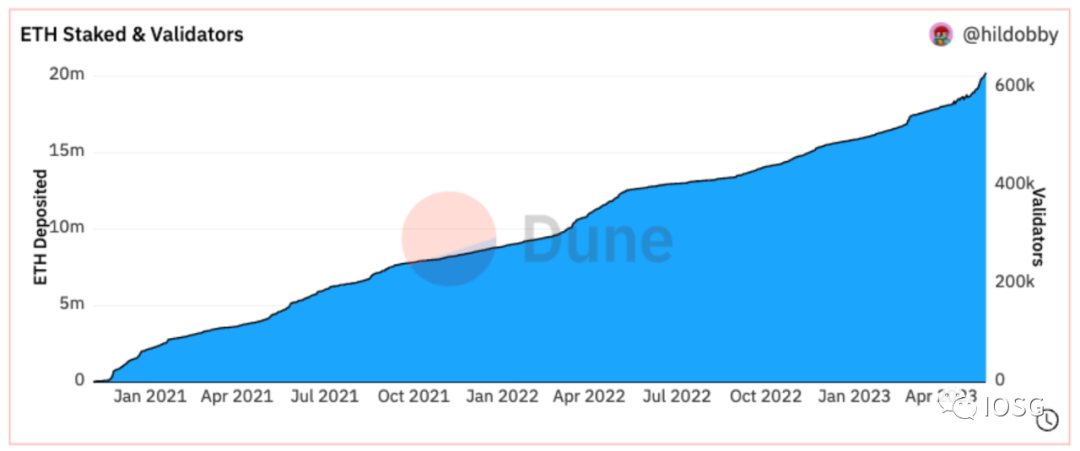

Source: Dune Analytics@hildobby

We quickly browse the market situation. Since the activation of Beacon Chain pledge in December 2020, Ethereum pledge has developed well, with more than 600,000 validators and about 20 million Ethereum (currently worth more than 36 billion US dollars) pledged as of the writing of this article, and the network’s pledge rate is close to 17%.

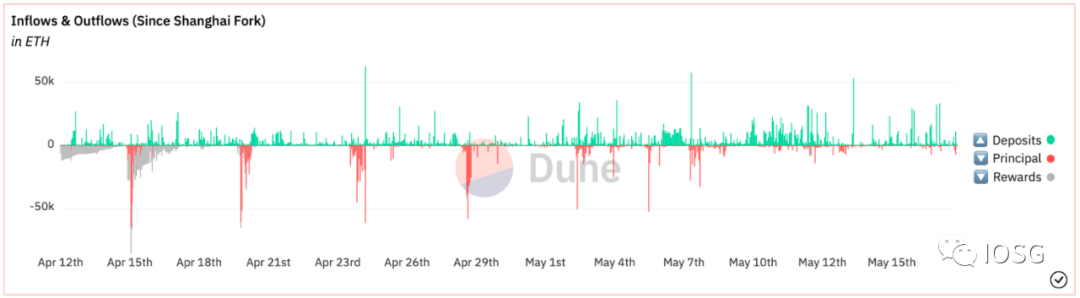

Source: Dune Analytics@hildobby

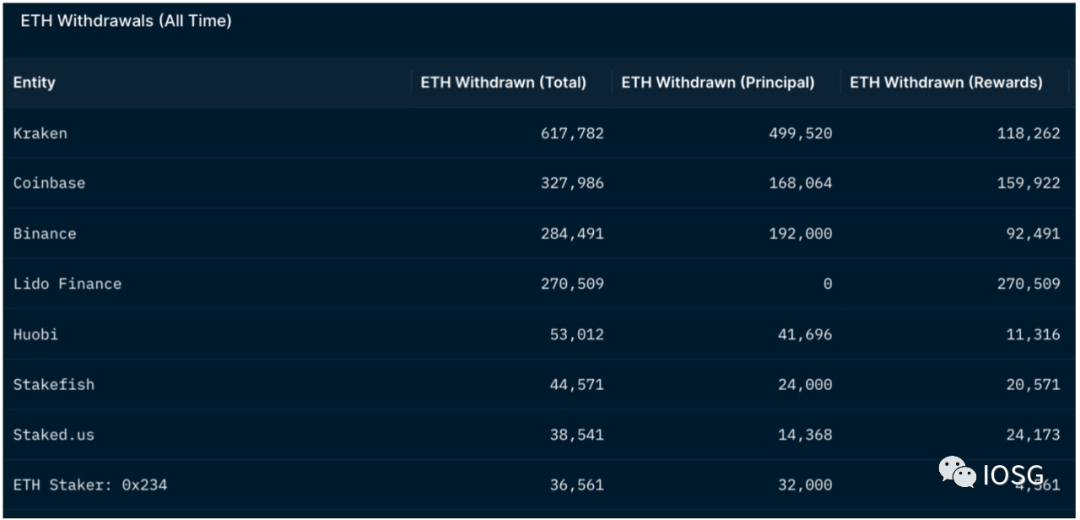

Currently, liquid pledge accounts for 35.9% of all pledge categories, with Lido alone taking up 31% of the entire pledge market. After CEX such as Kraken and Coinbase made large withdrawals, CEX still occupies 22.7% of the market share.

Source: Dune Analytics@hildobby

As Shapella activated the withdrawal channel for staked tokens, market selling pressure was inevitably generated. As we can see from the chart above, after Shapella, the outflow of ETH was significantly greater than the inflow. Withdrawal pressure was quickly relieved, and the net inflow of ETH has exceeded 1 million coins to date. This is basically consistent with the market expectations before Shapella. Due to the release of liquidity, I believe that Ethereum staking is still an attractive asset management target in the medium and long term, therefore, I remain optimistic about the rise in staking rates.

Post-Shapella —— Ethereum staking market will present a dynamic competition pattern

Currently, Lido is the only major player in the entire staking market, mainly due to its first-mover advantage and the moat built around the head effect. However, I do not believe that Lido will be the end of the liquidity staking race, or the entire staking race. Shapella is a turning point and the basic premise for other staking protocols to compete with Lido.

This chapter mainly discusses event-driven, price war, and target customer differentiation.

Event-driven

Source: Dune Analytics@hildobby

Some direct or indirect external events may lead to changes in the staking market structure.

For example, custody staking services provided by centralized exchanges accounted for more than 40% of the market share in 2021, but with the development of liquidity staking, its market share has been squeezed and has shown an accelerating trend recently. We speculate that this may be due to the following two points:

1. After FTX’s collapse in November last year, users’ trust in centralized and custody solutions declined.

2. In February of this year, under the regulatory pressure of the SEC, Kraken announced the termination of staking services to U.S. customers, which caused its withdrawal operation and will further cause users to worry about staking service providers in specific jurisdictions.

Source: Nansen

After Shapella, early pledging users were able to withdraw and turn to other pledging services – the fact that the top three entities in the withdrawal queue were centralized exchanges reflects this.

PriceWar

In a free market with sufficient liquidity, the business logic of traditional business models is reflected. Due to the high degree of homogenization of the pledging market, competitive advantages naturally manifest in factors such as price differentials. Users can now withdraw from their original pledging service and freely choose other platforms, and competition among pledging service providers will become more intense.

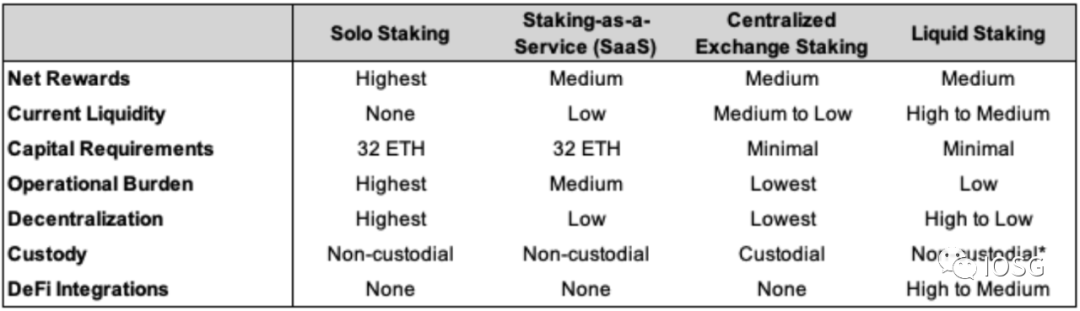

Source: GSR

For example, because SaaS platforms focus on institutional users and Solo Staking has a higher threshold for ordinary users, the latter two in the table are the main choices. Centralized exchanges charge higher pledging service fees and also have opacity. The advantage of liquidity pledging lies in good liquidity. As mentioned above, stETH can be virtually used as hard currency in most mainstream DeFi applications, and can even be exchanged directly for ETH without waiting in the withdrawal queue. Users will flexibly consider the choice of different pledging schemes.

Going further into the field of liquidity pledging, Puffer offers lower entry barriers for node operators and pledgers compared to its competitors Lido and Rocketpool. Among them, Puffer only charges pledgers a fee of 2.5%, which is 1/4 and 1/6 of Lido and Rocket Pool, respectively. Assuming similar rewards (currently the rewards of each protocol are around 5%, which is almost the same), the amount of fees charged may be one of the factors that determine user choices.

At the same time, the degree of integration of LST in various DeFi protocols is also a factor to consider. This represents the implicit Lego yield.

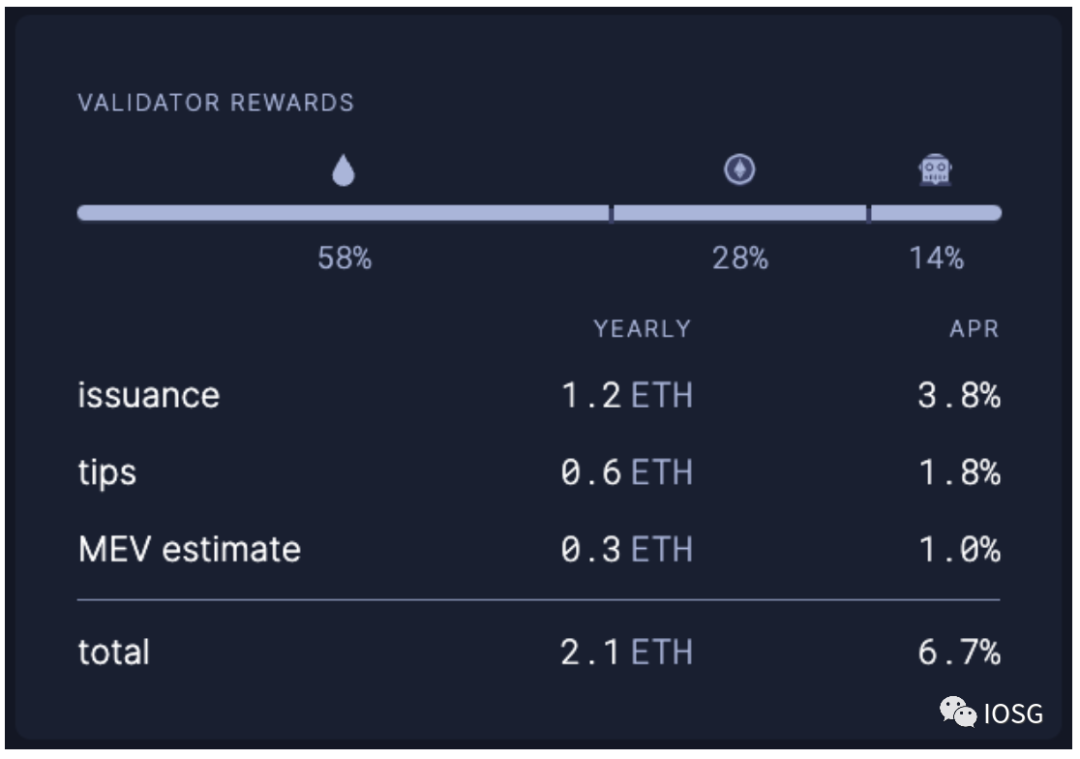

Source: ultrasound.money

In terms of pledging income, Ethereum’s pledging income consists of rewards from the consensus layer and the execution layer, the former of which decreases as more validators join. The latter is a dynamic income, consisting of Tips and MEV, and is directly related to the activity of the Ethereum network. The total income of using pledging services depends on the proportion of these rewards shared by the service provider and the user, for example, stakefish shares 80% of the execution layer rewards with users.

To meet the needs of competition, node operators can share as much execution layer revenue as possible to increase the protocol’s APR and attract users. Restaking, mentioned later in this article, is also one of the ways to increase APR.

Source: Messari

On the node operator supply side, Rocketpool launched the Atlas upgrade in response to the Shapella upgrade – compared to the previous 16 ETH, current node operators only need to invest 8 ETH to run verification services, further reducing the entry threshold for node operators (running two 8 ETH Minipools provides more than 18% more rewards than running one 16ETH Minipool). The above chart shows that the activation of Atlas has brought a certain degree of protocol growth to Rocketpool.

Target Customer Differentiation

In the field of liquidity staking, unlike Lido, Rocketpool and other protocols targeting native cryptocurrency users (To C), Alluvial, in partnership with Coinbase, Figment and other staking service providers, has launched an enterprise-level liquidity staking solution (To B).

After Shapella, the Ethereum staking exit channel gradually became clear, which may arouse the interest of traditional financial institutions in liquidity staking. Ethereum liquidity staking as an asset allocation strategy means having exposure to the industry beta represented by ETH, an annual staking yield of about 5%, and additional DeFi revenue from LST. If we consider the yield of Restaking, it may result in a cumulative staking yield of Ethereum exceeding 15%.

However, traditional institutions need to conduct due diligence on counterparty risks and complete a series of compliance processes such as KYC/AML. At present, Lido and other native cryptocurrency liquidity staking protocols cannot meet these needs. Because Lido and other liquidity staking protocols do not require permission from users and do not audit or check assets entering Lido, and assets are mixed together; traditional institutions are highly sensitive to this.

One solution is to adopt enterprise-level liquidity staking solutions like Alluvial, while another is to provide non-LST liquidity solutions from external partners.

Looking beyond staking itself, the Ethereum validator set provides the underlying trust that supports its ecosystem, and the influx of institutional investors helps make the Ethereum validator set more diverse, increase the game and improve stability.

DVT will improve the robustness and stability of Ethereum’s validation set

Source: Vitalik Buterin

On the roadmap, after Ethereum completes The Merge, there are still two major changes: one is to activate withdrawals of staked Ether in Shapella, and the other is to include EIP-4844 in Cancun to provide more data space for Rollup. Compared to the above two points, the impact of DVT (Distributed Validator Technology) on the user perception level is relatively small, but it is crucial for the robustness and stability of the underlying infrastructure.

Before implementing DVT, a single node corresponds to a single validator. When running validators, objective environmental network failures or configuration errors may cause Inactivity or Slashing to occur, resulting in missed rewards. DVT introduces a node cluster to maintain a single validator (many-to-one), for example, as long as the threshold of 5/7 active nodes is met, verification is performed, eliminating the possibility of single-point failures.

Source: rated.network

From a data perspective, Rated provides ratings for each staking service provider based on dimensions such as Proposal Effectiveness, Attestation Effectiveness, and Slashing Record. The overall Effectiveness level of Ethereum validators is about 96.9%, which has not yet reached the ideal level.

As becoming a Lido Node Operator requires DAO governance approval, while becoming a Rocketpool Node Operator does not require permission, it is speculated that the difference of nearly 2% in ratings between the two may be due to the varying abilities of Node Operators.

Recently, Lido has integrated and tested DVT service providers such as Obol Network and SSV Network. Lido has also introduced a DVT module in the V2 Staking Router, which includes Obol’s distributed validator cluster and SSV nodes.

It can be foreseen that DVT, as the underlying infrastructure, will become the industry standard for the staking track in the future, but it is almost imperceptible from the perspective of ordinary users.

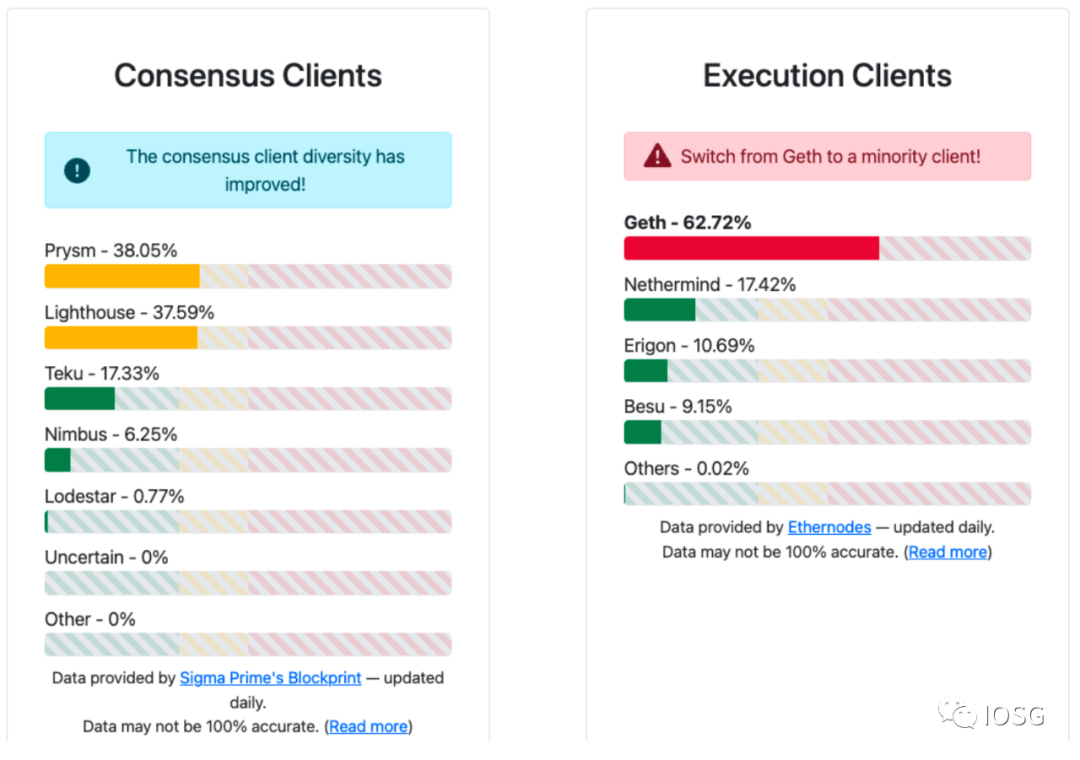

Source: clientdiversity.org

In addition to DVT, diversity in consensus layer and execution layer clients is equally important.

Conclusion

Source: David Hoffman

In 1997, Robert Greer proposed three types of assets:

1. Capital assets: assets that can generate value/cash flow, such as stocks and bonds;

2. Convertible/Consumable assets: assets that can be consumed, burned, or converted once, such as oil and coffee;

3. Value storage assets: assets with scarcity that continue to exist in time/space with value, such as gold and Bitcoin.

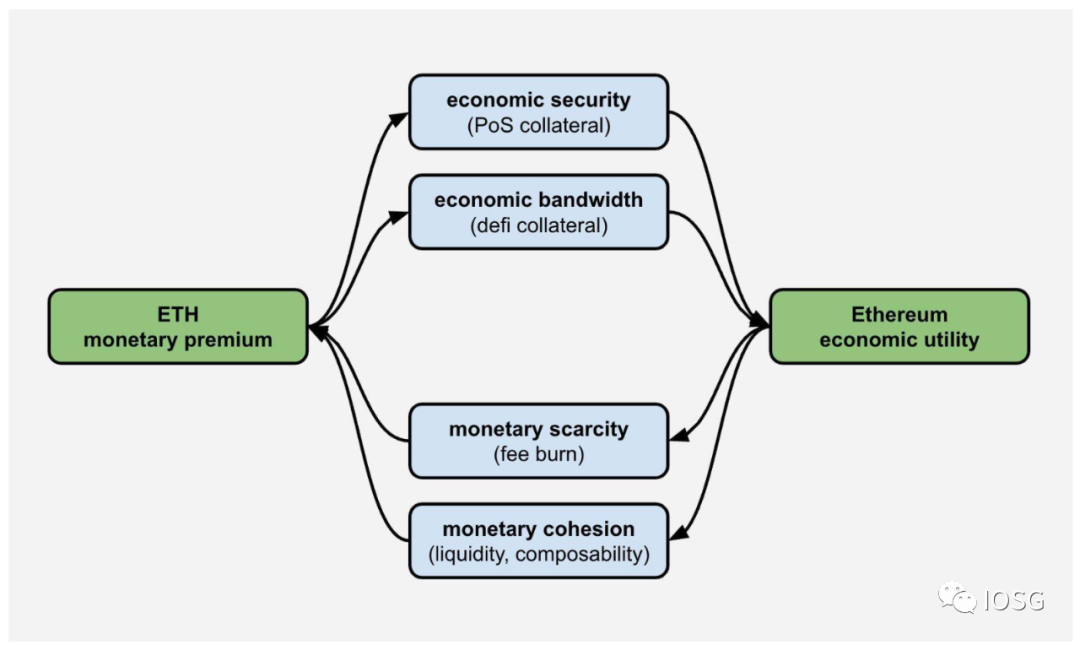

David Hoffman pointed out in 2019 that Ethereum can serve as all three types of assets: staked ETH as capital assets, Gas as consumable assets, and ETH locked in DeFi as value storage assets.

Source: Jon Charbonneau

In February of this year, Jon provided a more detailed breakdown in the table above:

1. Staked or re-staked ETH, including liquidity staking tokens such as stETH, represents assets that can generate value/cash flow as capital assets;

2. Gas expenses for Layer1 and Layer2, as well as DA spending in Layer2 on Layer1, can be consumed or burned once, serving as consumable assets;

3. Reserve assets such as DAO treasuries, Ce/DeFi collaterals, and NFT transactions, as well as MEV valuations, token trading pairs, and other exchange media, continue to exist in time/space with value and serve as value storage assets.

Source: Justin Drake

From 2019 to 2023, as the Ethereum ecosystem continues to flourish, the utility of ETH is constantly expanding – as evidenced by its use as an NFT pricing unit, as a Gas Token for Layer2, MEV, and LST and derivatives based on LST, and even through Restaking to extend economic security to middleware and return value to stakers.

After Shapella, changes to the Ethereum staking protocol have come to a temporary halt, and more likely to come are application-level stories. The author believes that although the staking track has been around for a long time, it still has the potential to impact the existing pattern and bring hidden investment opportunities with some important events.

Reference

https://www.gsr.io/reports/a-guide-to-ethereum-staking/

https://blog.stake.fish/ethereum-consensus-and-execution-layer-rewards/

https://blog.obol.tech/what-is-dvt-and-how-does-it-improve-staking-on-ethereum/

https://consensys.net/blog/ethereum-2-0/what-is-staking/

https://www.galaxy.com/research/insights/how-to-watch-shanghai-the-completion-of-ethereums-merge-upgrade/

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Putting AI into NFT: Humans.AI – Let artificial intelligence live on in the Web3 gene pool “Digital Immortality”

- Exploring Web3 Loyalty: Addressing Challenges and Dilemmas After Project Airdrops

- BladeDAO’s Decentralized Vision: Players don’t have to compromise, together build a transparent, fair and safe gaming world.

- Head DEX protocol iZUMi Finance on ZkSync: based on UniSwap V3 improvement, creating a new DL-AMM mechanism

- Weekly Preview | ACDE Conference may determine the scope of Cancun upgrade; Tokens of projects such as Avalanche and RON will be partially unlocked

- Quickly learn about 18 new projects in recent times: DeFi, games, and tools

- Recap of ETHGlobal Lisbon Hackathon: Quick Look at 5 Promising New Projects