How should investors hedge their risks during the “storm” of encryption?

How can investors hedge risks during the encryption "storm"?Author: BlockingBitpushNews Asher Zhang

With the SEC’s lawsuits against Binance and Coinbase, the cryptocurrency market has experienced a huge shock. In the panic, how should investors hedge? Behind this crisis, who is the biggest beneficiary in the cryptocurrency market? In the short term, has the risk in the cryptocurrency market ended? In the long run, what huge opportunities does the cryptocurrency market face after the crisis?

US regulatory crackdown, how investors can hedge

Since the SEC’s lawsuit against Binance and Coinbase, there is no doubt that Binance and Coinbase have been hit hard, and funds have begun to panic and flee; compared with Binance, the outflow of funds in the Binance market is more severe.

According to a report by “Blocking”, data from blockchain analysis companies Nansen and Glassnode show that from Monday to Thursday last week, Binance, Coinbase, and Binance US had a net outflow of US$3.1 billion through the Ethereum network, and a net outflow of US$864 million in Bitcoin (BTC). Binance’s net outflow of Ethereum in four days was US$2 billion. This indicator includes ETH and all Ethereum-based tokens. At the same time, Bitcoin net outflow was US$838 million (31,868 Bitcoins). Coinbase’s net outflow of Ethereum reached US$1 billion, and the total net outflow of Bitcoin was US$25 million. Binance US had a total net outflow of US$75 million in Ethereum. Since the SEC lawsuit, about US$4 billion has flowed out of Binance, Coinbase, and Binance US.

- Uniswap v4: What’s Next for the Top DEX?

- Evening Reading | USDT Faces Serious Selling Pressure: Are Market Makers Exiting?

- Is USDT facing severe selling pressure due to market makers exiting?

In addition to the significant outflow of funds from Coinbase and Binance, in the lawsuit against Binance, the SEC listed 10 cryptocurrencies as securities, including BNB, BUSD, SOL, ADA, MATIC, ATOM, SAND, MANA, AXS, and COTI. In the lawsuit against Coinbase, 13 cryptocurrencies were listed by the SEC as securities, including SOL, ADA, MATIC, SAD, AXS, CHZ, FLOW, ICP, VGX, NEXO, and more. Under long-term regulatory actions, 67 tokens have been listed by the SEC as securities. Among them, there are two tokens with a market value of more than tens of billions of dollars, namely BNB and XRP. There are 10 tokens with a market value of between 1 billion and tens of billions of dollars, including SOL, ICP, TRX, ATOM, NEAR, and other public chain native tokens. There are 11 tokens with a market value of between 100 million and 1 billion dollars, including well-known projects such as SAND, MANA, and AXS, as well as public chain native tokens such as ALGO and LUNC. There are a total of 31 tokens with a market value of less than 100 million dollars. Judging from the market performance, the tokens named by the SEC have generally had a large decline.

As an investor, how to avoid risks? According to “Blocking” report, after the SEC sued Coinbase and Binance, the trading volume of the top three decentralized exchanges (DEX) increased by 444%. Especially, during June 5th to June 7th, the daily trading volume of Uniswap V3 (Ethereum), Uniswap V3 (Arbitrum), and Blockingncakeswap V3 (BSC) accounted for 53% of the total DEX trading volume in the past 24 hours, an increase of more than $792 million. In addition, the trading volume on DEX Curve, which supports stablecoin trading, soared by 328%.

After the SEC sued centralized exchanges, the demand for DEX has significantly increased, and DEX may gradually become the center of the cryptocurrency trading stage. From the perspective of token performance, only Bitcoin is the most resilient in the cryptocurrency market, and Bitcoin is also a non-security token recognized by the US’s major regulatory agencies, and its risks are relatively small in all aspects.

After the battle, Bitcoin may become the biggest beneficiary

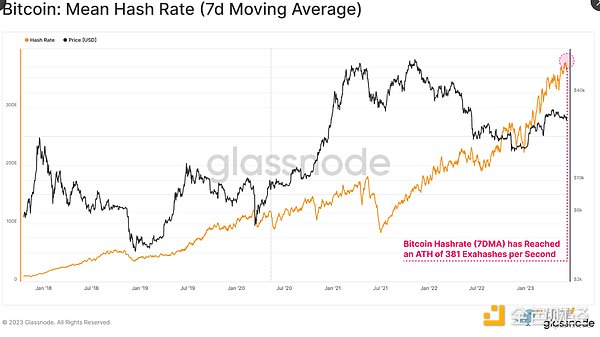

Since the beginning of this year, the “New Culture Movement” of Bitcoin has developed vigorously; followed by the US SEC regulation of the cryptocurrency market, which has once again hit most cryptocurrency assets in the market, especially PoS-based public chain tokens. After the public chain battle, Bitcoin seems to be the biggest beneficiary.

According to “Blocking” report, Jack Dorsey, the founder of Twitter, tweeted on June 6th that there are currently only three expandable anti-censorship technologies: Tor, Bitcoin, and the Nostr protocol, and they are all in a niche market state, indicating that most people in the world don’t really care about censorship issues. Admittedly, these technologies are currently not available or not easy to use, but someday the situation will change. In addition, Pierre Rochard of Riot Platforms commented on Coinbase’s regulatory incident that Coinbase should transform its business back to focusing on Bitcoin, and Jack Dorsey forwarded and commented, 100% agreeing with this statement. Barry Silbert, founder and CEO of DCG, also tweeted that in the SEC’s successive lawsuits, no PoW token was listed as a “security”, and I believe BTC, LTC, XMR, ETC, ZEC.

From the on-chain data, according to Glassnode data, HODLing is still the main market trend, as firm HODLers remain steadfast in adversity and send Bitcoin Supply Last Active Bands to new ATH. Supply lasting for more than 1 year: 68.4%; supply lasting for more than 2 years: 55.5%; supply lasting for more than 3 years: 40.1%; supply lasting for more than 5 years: 28.9%. The most noteworthy thing is that we can observe a significant increase in the duration of more than 2 years, because a large number of tokens purchased during the miners’ migration period from May to July 2021 have been stagnant and aged beyond the maturity threshold.

CryptoChan (@0xCryptoChan) also tweeted that the daily inflow of chips from long-term holders on the off-chain to the exchange accounts for more than 0.025% of the total chips held by long-term holders, marked by red bars; and less than 0.025%, marked by blue bars. This percentage has been relatively stable in the past one or two months, and long-term holders remain calm in the face of the recent regulatory wave in the United States.

Under the regulatory wave, what kind of “danger” and “opportunity” will the crypto market face

In the SEC indictment, the SEC accused CZ of publicly claiming that the Binance.com platform does not serve Americans, but in fact CZ instructed Binance staff to assist certain high-net-worth American clients in evading controls-by changing IP addresses through VPNs or setting up offshore companies for KYC; In addition, CZ actively recruits American investors to trade on the Binance platform through his social media and other internet posts, in order to retain American investors. In addition, the SEC also accused Binance of misappropriating customer assets through Merit Peak and Sigma Chain. From the SEC indictment, the SEC’s charge materials quoted a lot of internal statements from Binance and relevant executives, which may not be unfounded. In the short term, Binance may face the possibility of frozen assets by the US SEC.

Overall, the lawsuit between Binance and the SEC is expected to be protracted and may even reach the US Supreme Court; but if the SEC really freezes Binance’s assets, Binance’s liquidity may face rapid loss, after all, the United States is accustomed to long-arm jurisdiction. Once Binance is in crisis, it will cause huge negative news for the entire crypto market, and the crypto market is expected to experience an overall decline; although Bitcoin is likely to remain strong, it is still expected to experience a certain degree of decline. According to the “Blocking” report, a federal judge postponed the temporary restraining order against Binance.US, and the SEC and Binance.US will continue to negotiate. It seems that there is a certain turning point in the market, but the risk of freezing Binance’s US assets cannot be said to be completely eliminated. From a technical chart perspective, the current MA200 is an important support level below Bitcoin, and its price is around $23,600.

In the medium to long term, the recent SEC lawsuit may ultimately accelerate US regulatory legislation against the crypto market. In addition to Binance, the SEC has also sued Coinbase, a US-listed company with a large number of users in the United States. The lawsuit against this exchange may stimulate Congress to take active action in cryptocurrency regulation. The call from all parties in the market is getting stronger. According to the “Blocking” report, Coinbase CEO Brian Armstrong said in an interview that there is a power struggle between the US SEC and CFTC, and Coinbase has been “caught in” the territorial dispute between the two institutions. Because the two sides failed to reach an agreement on the status of cryptocurrencies as securities or commodities, the industry needs clarity. To make this clear, Congress must intervene and enact legislation. Before legislation is enacted, the cryptocurrency industry will rely on case law, which will appear in the SEC’s lawsuit against Coinbase last week.

The US legislative institutions have also gradually realized the seriousness of the situation and began to hold hearings, which can also be regarded as providing some preparation for legislative work. According to the “Blocking” report, Patrick McHenry, chairman of the US House Financial Services Committee, announced that a hearing on the theme of “The Future of Digital Assets: Providing Clarity to the Digital Asset Ecosystem” will be held at 2:00 pm Eastern Time on June 13 (2:00 am Beijing time on June 14). Circle co-founder and CEO Jeremy Allaire announced the testimony to be delivered at the digital asset hearing of the US House Financial Services Committee, which strongly urged the acceleration of legislation. Jeremy said: “The measures taken by the U.S. government in the next few years will have a significant impact on the competitiveness of the U.S. dollar in the following decades. The stablecoin bill is a critically important legislation and the first step in creating a regulatory framework. It will also have a significant impact far beyond the digital asset market. Now is the time for the United States to lead in setting global rules. With the correct regulatory framework, stablecoins and blockchain networks can expand to support billions of users and trillions of dollars in payment activity.”

Summary

Overall, the core targets of the SEC’s regulation are two: one is centralized exchanges such as Binance and Coinbase, and the other is most PoS-based tokens; this has led to a surge in DEX trading volume, while Bitcoin and other PoW-based public chain tokens have performed relatively strongly. In addition, with the SEC’s lawsuit against Coinbase, etc., due to the importance of the case and the fierce market controversy, congressional legislation has become urgent. Ultimately, whether it is congressional legislation or court rulings, it will have a profound impact on the encryption industry, thereby making the US encryption market enter the era of “regulated by law”. In addition, in a sense, what we are experiencing now is undoubtedly an important milestone for encrypted assets and encrypted markets to truly enter the traditional financial market.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- How can the development path centered around application chains avoid the pitfalls of Polkadot and Cosmos?

- How can we participate in interactions now that the re-collateralization agreement EigenLayer has officially launched on the mainnet?

- How can Prisma, who calls themselves “LST Endgame,” create a growth flywheel?

- Interpreting the Maverick Protocol DeFi Protocol

- Two Sides of a Digital Being: Aging in the Metaverse, Rebirth in AIGC

- Top venture capitalists: The biggest risk of AI is not pursuing it with maximum effort

- Review of the CRV Bull-Bear Battle and Current Short-Selling Cost Evaluation