Is USDT facing severe selling pressure due to market makers exiting?

Are market makers exiting USDT, causing significant selling pressure?According to data, in the past 24 hours, a total of 99 million USDT were sold in Curve’s 3pool, with a net outflow of 64.4 million US dollars. In the past three days, a total of 205 million USDT were sold in 3pool, with a net outflow of 130 million US dollars. At the same time, according to the latest data from Curve, as of the time of writing, USDT accounts for 74% of 3pool, with a total of 301,753,409. The proportion of DAI and USDC is 12.91% and 12.74%, respectively.

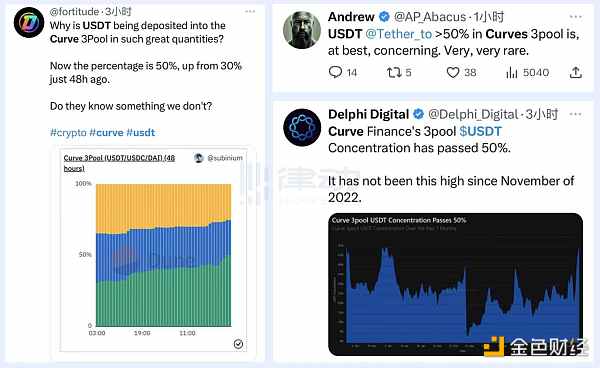

In the past 48 hours, the concentration of USDT in the Curve 3pool has risen to 50%, and in just one hour, it has sharply risen from 50% to 74%. This has raised concerns in the community, and everyone seems a little confused about the sudden selling pressure on USDT. Could someone have known some key information in advance? After all, the last time the concentration of USDT in Curve 3pool exceeded 50% was during the FTX crash in November 2022, and since then, the concentration of USDT has not reached such a high level again.

- How can the development path centered around application chains avoid the pitfalls of Polkadot and Cosmos?

- How can we participate in interactions now that the re-collateralization agreement EigenLayer has officially launched on the mainnet?

- How can Prisma, who calls themselves “LST Endgame,” create a growth flywheel?

Are market makers withdrawing?

Today’s selling pressure on USDT makes us think of the rapid depletion of market liquidity in the past month. Recently, the market has performed poorly and seems to have entered a phase of liquidity shortage. Especially the “15-minute crash” event on June 10, when the price of many altcoins fell by more than 20%, and mainstream currencies also fell by a corresponding percentage. It is worth noting that at that time, the market had not yet been affected by SEC regulation. As for the reason for the “15-minute crash,” there are rumors in the market that Jump Trading is withdrawing liquidity and DWF is withdrawing liquidity and delisting.

In fact, this speculation is not groundless. Today, DWF Labs managing partner Andrei Grachev tweeted that the 24-hour spot trading volume in the market has dropped to the lowest level since the winter of 2019, at 23 billion US dollars. He revealed that the trading platform has begun to require projects to have a certain level of trading volume and liquidity, otherwise they will be delisted. Retail activity is also relatively low, but for those who want to speculate, make money, or lose money, they still need something to meet their needs. Even for coins with a large market capitalization, price fluctuations of 20-30% may occur within 24 hours.

Grachev explained that IDOs, IEOs, and direct listings are no longer popular, and many are waiting for new things to emerge, including Binance LaunchBlockingd projects, as they always help promote retail activity. If a project is successful, many will try to emulate it. “Projects, trading platforms, market makers, and other market participants are working behind the scenes to repair the market, although there is no 100% solution, these efforts will certainly benefit the market. We are currently in a low point in market activity, but the future of prices is still uncertain. In a few months, our market activity is expected to increase and stimulate price increases, which also depends on our luck.”

Andrei Grachev’s statement is clearly reflected in the once-shining star in the industry, Sui. The Sui, which strongly launched IEO on exchanges such as OKX and Kucoin, has been sluggish since its token price soared in a short time. Although OKX has supported new projects in the Sui ecosystem many times, the price performance of its token SUI is still very low, falling all the way. According to institutional insiders who revealed to BlockBeats, due to the exhaustion of liquidity and the huge selling pressure of IEO, many institutions and market makers are unwilling to provide liquidity for SUI. A once-popular public chain seems to be slipping towards the edge of “heavenly projects.”

As the virtual asset most commonly used by market makers, most institutions will hold USDT. Under various hints, we cannot help but associate whether the serious skew of Curve 3Pool pool today is also related to institutional exit.

Will USDT decouple?

With the resurgence of USDT’s FUD, some people in the market are eager to short USDT. Will USDT once again experience a serious decoupling?

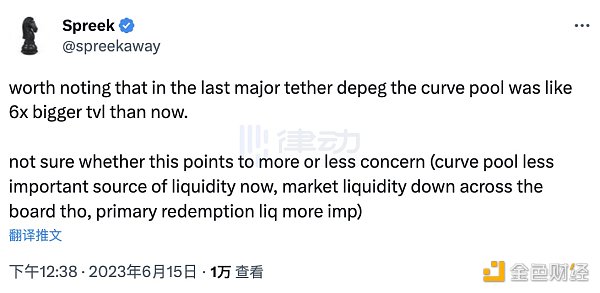

Some voices from the community have questioned this. A Twitter user named Spreek (@spreekaway) stated that the liquidity of Curve’s fund pool is now very small and is no longer an important source of liquidity, and the overall market liquidity has decreased. Curve seems to have lost pricing power.

Spreek pointed out that it is worth noting that the size of Curve’s fund pool was about 6 times larger in the last Tether decoupling event than it is now. Some people believe that before redemption, secondary liquidity is usually consumed first, because the redemption fee is 10 basis points. This time, the amount of funds required to exhaust secondary liquidity is less than last time. By observing the trading volume when the price reaches the redemption price, you can understand people’s attention to this. If there are many transactions with a price lower than the redemption price, it means that people are more concerned.

When the liquidity of a stablecoin is too concentrated, any threat or fluctuation to the supply or liquidity of that stablecoin can have a significant impact on the entire Curve platform and its users. This can lead to market instability and uncertainty. High concentration can lead to liquidity imbalances, where some stablecoins have excess liquidity while others have insufficient liquidity, which can affect the efficiency and cost of trading and have an impact on price formation.

“Will USDT experience severe decoupling again?” In response to this question, Tether CTO Paolo Ardoino tweeted that the market is currently volatile and therefore attackers can easily take advantage of this widespread sentiment, “but Tether is always prepared, bring it on, we are ready to redeem any amount of funds.”

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Interpreting the Maverick Protocol DeFi Protocol

- Two Sides of a Digital Being: Aging in the Metaverse, Rebirth in AIGC

- Top venture capitalists: The biggest risk of AI is not pursuing it with maximum effort

- Review of the CRV Bull-Bear Battle and Current Short-Selling Cost Evaluation

- Potential Airdrop Opportunity: Taro Testnet

- MakerDAO community initiates a vote to reduce the GUSD reserves of DAI from 500 million US dollars to 110 million US dollars.

- EigenLayer has been deployed on the Ethereum mainnet