How can we participate in interactions now that the re-collateralization agreement EigenLayer has officially launched on the mainnet?

How can we participate in EigenLayer's interactions on the mainnet?On this morning, Ethereum re-staking protocol EigenLayer officially announced the launch of the first phase application on the mainnet, allowing users to restake through two methods: liquid restaking and native restaking.

Last quarter, EigenLayer just completed a $50 million Series A financing round, led by Blockchain Capital, with participation from Coinbase Ventures, Polychain Capital, Zonff Blocking Partners, Bixin Ventures, Hack VC, Electric Capital, and IOSG Ventures.

Earlier, EigenLayer completed a $14.5 million seed round, led by Polychain Capital and Ethereal Ventures.

Due to the innovative restaking mechanism that opens up the imagination space for expanding Ethereum’s trust layer, EigenLayer has attracted countless attention in the current LSD boom, and even many practitioners regard it as the most important project in the current Ethereum ecosystem (perhaps unnecessary to add “one” in the eyes of many people).

- How can Prisma, who calls themselves “LST Endgame,” create a growth flywheel?

- Interpreting the Maverick Protocol DeFi Protocol

- Two Sides of a Digital Being: Aging in the Metaverse, Rebirth in AIGC

Odaily Star Daily Note: For an introduction to EigenLayer’s mechanism, please refer to “EigenLayer: Expanding Ethereum’s Trust Layer Through ‘Restaking'”.

As mentioned earlier, users who want to experience and interact with EigenLayer can operate through two restaking methods: liquid restaking and native restaking, with the latter being suitable for staking users running their own verification nodes.

In the following sections, we will explain the details of these two restaking methods separately, especially the liquidity restaking method that is more suitable for ordinary users.

Liquidity Restaking

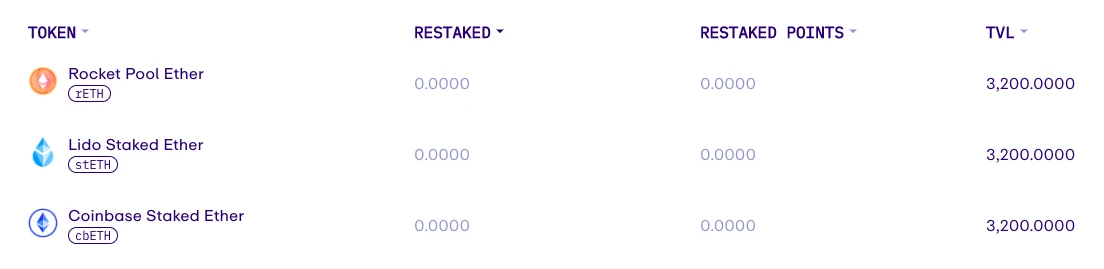

At the current stage, EigenLayer supports three liquidity staking derivative tokens: Lido stETH (stETH), Rocket Pool ETH (rETH), and Coinbase Wrapped Staked ETH (cbETH).

For stability reasons, EigenLayer has temporarily imposed restrictions on the protocol’s TVL and single deposit amount. For TVL, the limit for the three assets stETH, rETH, and cbETH is 3200 tokens (approximately 9600 ETH in total), and for single deposit amount, users are required to deposit only 32 tokens at a time.

Due to EigenLayer’s high popularity, although the threshold for these restrictions is already high, the three assets have quickly reached the TVL ceiling shortly after the mainnet launch and can no longer be deposited for the time being.

However, EigenLayer has also mentioned that it will gradually relax the TVL and single deposit amount limits in the next few weeks to months. For users who intend to interact with this leading protocol, it is still necessary to understand the operation methods in advance so as to seize the “seat” as soon as possible when the limit is lifted.

Before starting the operation, users need to prepare a certain amount of stETH, rETH, or cbETH.

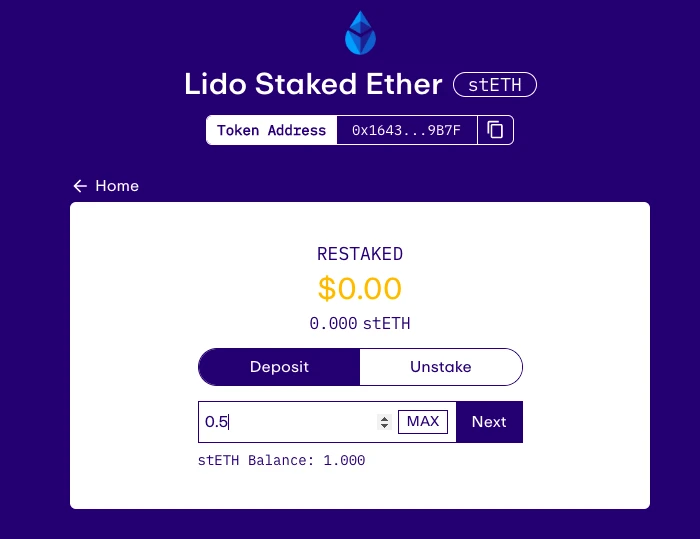

Taking the most commonly used stETH as an example, after clicking the stETH column on the Dapp official website, you can jump to the corresponding re-staking page. Next, the user needs to enter the amount of stETH they want to re-stake, click “Next”, complete the authorization (here will prompt “custom expenditure upper limit”, select the maximum), and confirm the two transactions. When you see “Deposit Successful”, the re-staking is successful.

Odaily Star Daily Note: This is a screenshot of the test network because the main network can no longer deposit.

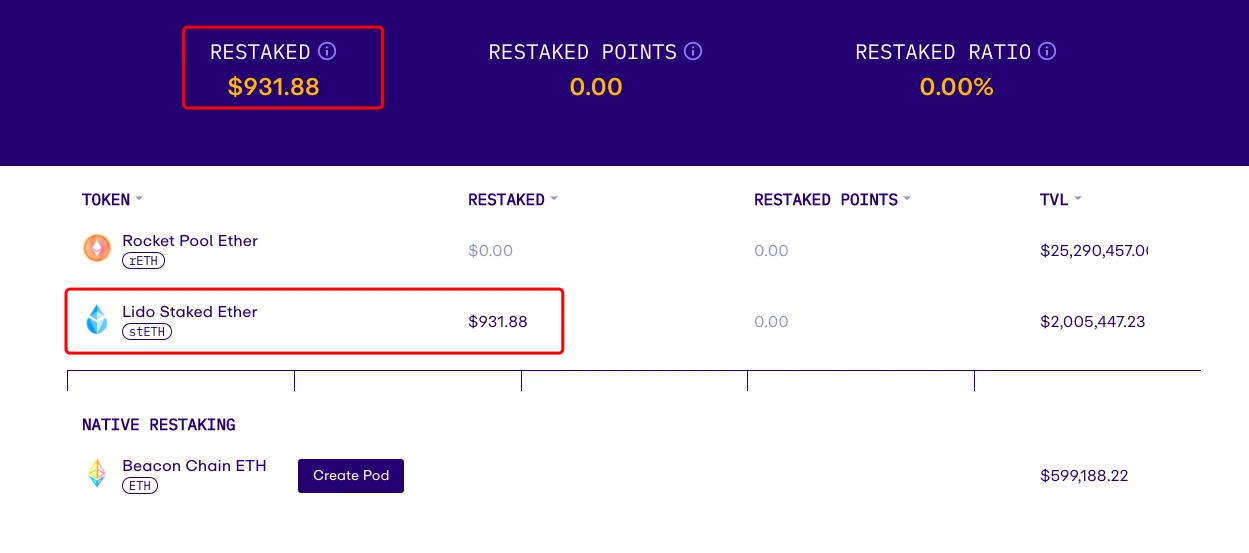

After returning to the homepage, we can directly track the changes in our stETH reward after re-staking.

Odaily Star Daily Note: This is a screenshot of the test network because the main network can no longer deposit.

After completing the re-staking, we can also withdraw our assets by unstaking them, which can be done by selecting “UnStake” on the re-staking page for a specific token. One thing to note about unstaking is that it requires a 7-day safety period to extract funds from EigenLayer, so assets can only be withdrawn after waiting for at least 7 days.

Native Re-staking

Unlike liquidity re-staking, native re-staking requires users to independently run verification nodes, so the technical and financial thresholds for users are relatively high (also 32 ETH, but the liquidity re-staking will relax the limit in the future, while this is a hard requirement for Ethereum mainnet staking and is unlikely to change in the future).

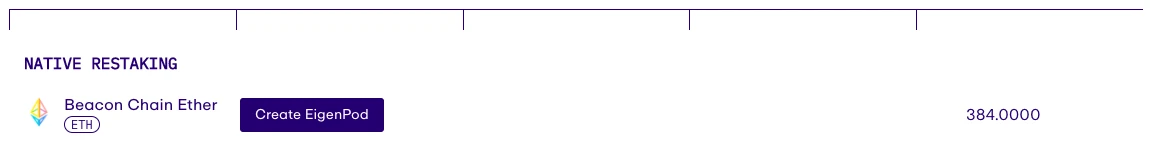

For this method, EigenLayer has also set a TVL limit of 9600 ETH, but currently only 384 ETH has been deposited (which translates to only 12 addresses have made deposits), so there is still a lot of room for growth.

Users who are running independent validation nodes and wish to re-stake using this method, can refer to the tutorial provided in the official documentation to allocate the validator’s withdrawal credentials to the EigenPods address. There are four specific deposit steps involved.

- First, go to the Dapp website and connect your wallet.

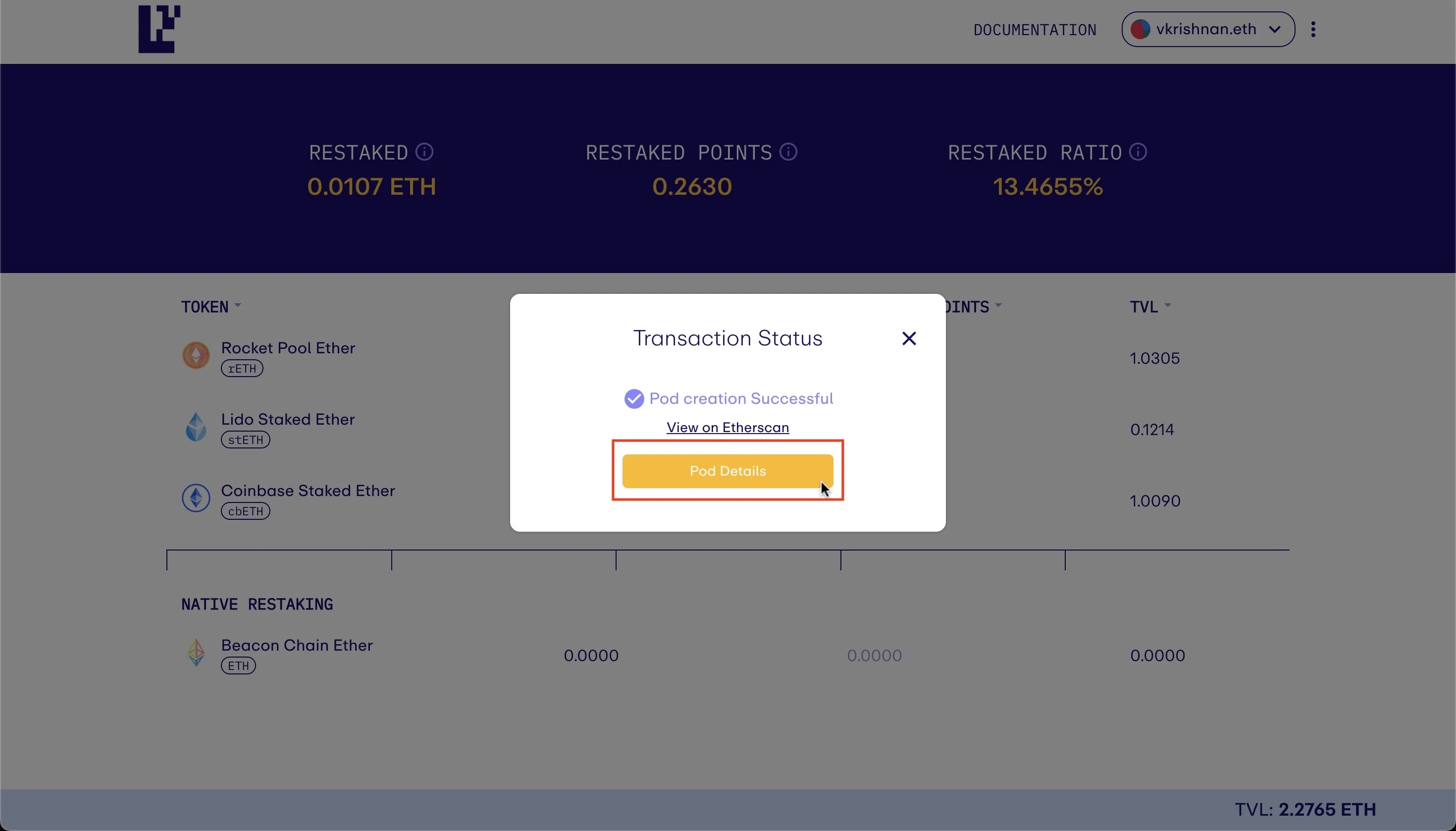

- Then, click on “Create EigenPod” to create an EigenPods, and click on “Pod Details” to get the specific address of the EigenPods.

- Next, users need to configure the withdrawal credentials on the Beacon chain to the EigenPods address (to complete this step, you need to run an Ethereum validation node first).

- Finally, you can go back to the homepage to check the real-time changes in your re-staking rewards.

The first phase is just the beginning

It is worth mentioning that, in addition to direct interaction, EigenLayer also launched a commemorative free NFT on Zora (Zora charges a minting fee of 0.000777 ETH), which is still open for minting for the next 3 and a half days, so interested users may want to give it a try.

According to EigenLayer’s official description, the launch of the protocol will be divided into three phases, in order to attract different participants to join the ecosystem.

In the first phase of the launch, “Stakers”, validators can try to re-stake through EigenLayer; in the second phase, “Operators”, node operators can accept delegations from validators on EigenLayer; and in the third phase, “Services”, active validation services will be launched.

As EigenLayer continues to release the other two phases in the future, Odaily Planet Daily will continue to follow up and report on the growth of the re-staking narrative with you.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Top venture capitalists: The biggest risk of AI is not pursuing it with maximum effort

- Review of the CRV Bull-Bear Battle and Current Short-Selling Cost Evaluation

- Potential Airdrop Opportunity: Taro Testnet

- MakerDAO community initiates a vote to reduce the GUSD reserves of DAI from 500 million US dollars to 110 million US dollars.

- EigenLayer has been deployed on the Ethereum mainnet

- Building to collapse? Another South Korean cryptocurrency company suspends withdrawals

- June 2023 FOMC Meeting Notes: Rates Can Go Higher