Will going online mean the end? BALD plummets a thousand times, what is the future of Base public chain?

What is the future of Base public chain as BALD plummets a thousand times when going online?Recently, the L2 network Base launched by Coinbase based on OP Stack has caused heated discussions in the crypto community. The reason is that the Meme coin BALD issued on Base has skyrocketed, attracting tens of millions of dollars in hot money to the Base chain in just two days. Its market value has surpassed $100 million, and the liquidity pool has exceeded $25 million.

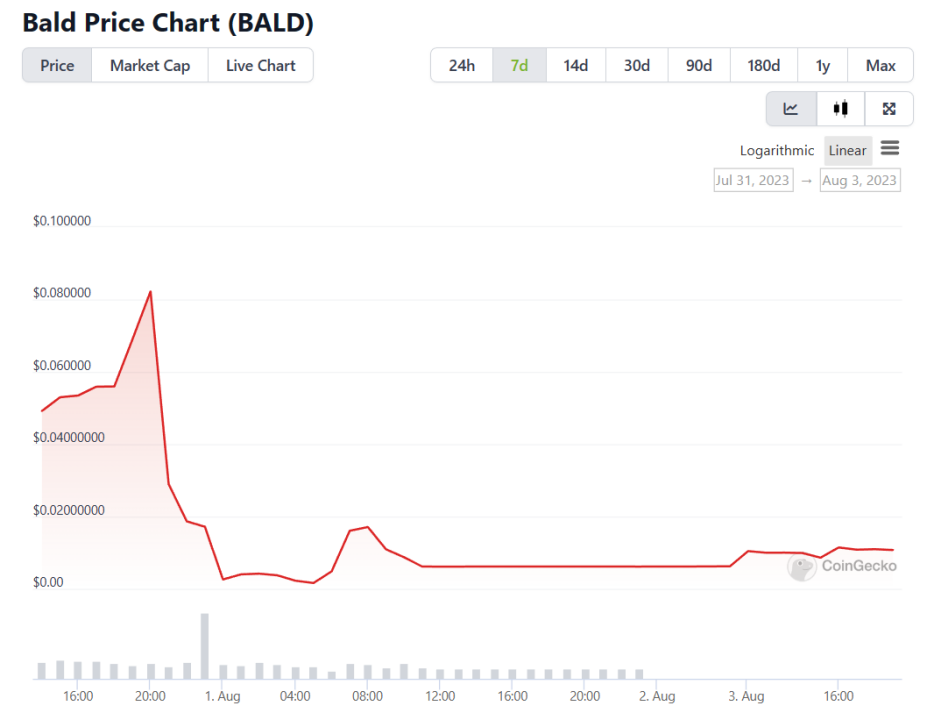

However, when the crypto community was immersed in the speculation of whether “BALD will create a new myth of wealth”, the price of BALD token began to plummet. This is because Bald withdrew a total of 8,660 ETH and 179 million BALD tokens from the liquidity, causing a significant drop in the price of BALD. The maximum decline reached 80%, and the TVL temporarily dropped below $9 million.

What are the reasons behind the sudden surge and rapid decline of BALD? What is the future direction of the Base chain? In this article, veDAO Research Institute will provide an interpretation of the Base chain and BALD.

- The hype of room-temperature superconductor triggers the meme token craze of LK-99 Innovation or cutting-edge?

- AlterVerse Research Report Web3 Sandbox Game Based on Binance Chain

- LianGuai Daily | Hackers have returned all stolen funds to Alchemix Curve pool; US SEC provides over $104 million in rewards to 7 whistleblowers

Controversy brought by BALD

BALD is a token project launched on the Base chain. It takes inspiration from the bald head of Brian Armstrong, the CEO of Coinbase, and creates an image called BALD Jesus and a philosophy called BALDism. The project claims to be the first Meme coin on Base and pays tribute to Coinbase CEO Brian Armstrong with the name “bald head”.

The BALD project has attracted a lot of attention and investment from users. However, the project experienced dramatic surges and declines within two days.

The fluctuation of BALD token price is closely related to large capital outflows. Since the Base mainnet has not been officially released to the public, BALD tokens based on the Base network can currently only flow in but not out.

However, there is an exception, which is the deployer of BALD, “BaldBaseBald”. They still have the permission to freely trade the tokens.

Therefore, a strange situation occurred: as the price of BALD token soared, more and more retail investors entered, boosting the token to its all-time high price. However, afterwards, BaldBaseBald withdrew over 10,500 ETH worth nearly $25 million from the BALD liquidity pool, almost depleting the pool. This caused the token price to plummet by 85% within minutes, with the token trading price dropping to $0.0000000018, with almost no trading volume or activity. This move has caused anger and disappointment among many crypto investors and supporters.

After experiencing the surge and decline, the BALD developers denied any wrongdoing and only responded on Twitter, stating that they simply added and removed two-sided liquidity and purchased tokens.

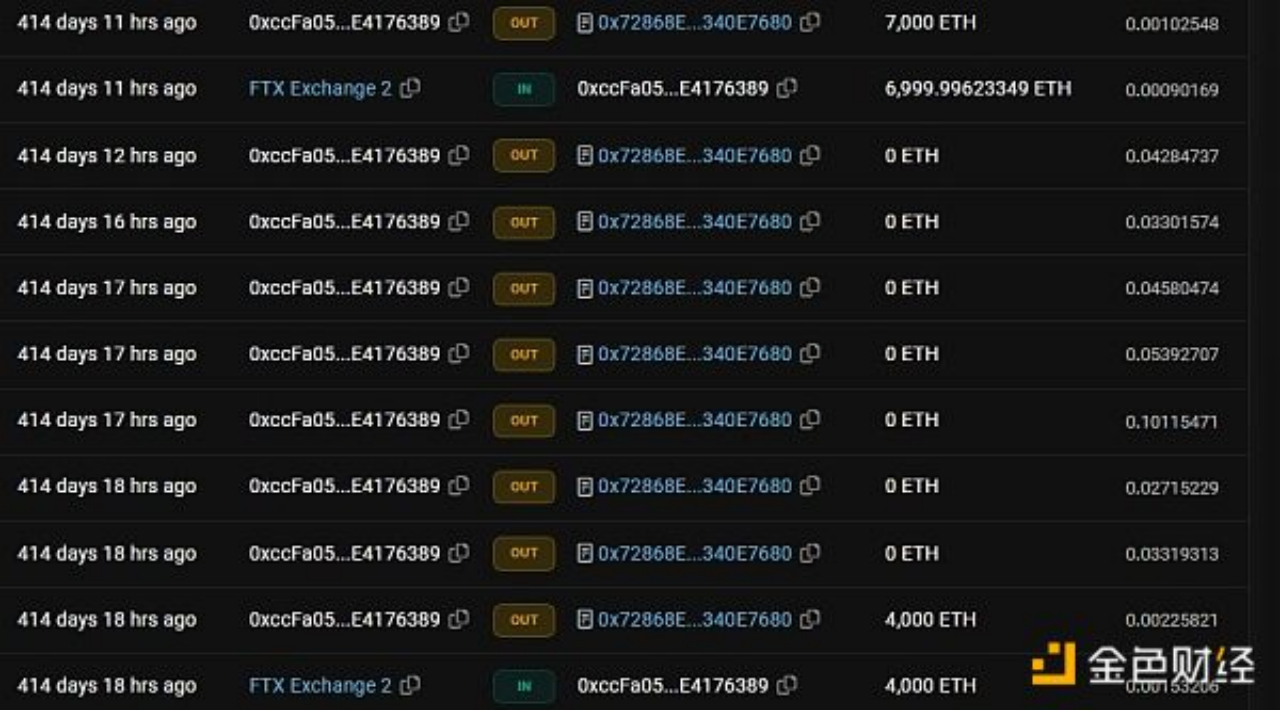

However, Bald’s strange actions have sparked a lot of speculation among the crypto community about its behind-the-scenes manipulator. According to research on on-chain data, the deploying address has received thousands of ETH from wallets related to FTX and Alameda Research.

There are also similarities in sentence structure between Bald’s official tweets and SBF’s tweets, such as the use of words like “Correct” and “quite well” appearing in Bald’s few tweets, which are commonly used by SBF.

However, it is just one of many speculations since SBF is currently under strict internet monitoring. There is currently no definitive answer as to who is behind Bald. Whether Bald is a scam or not cannot be determined at the moment. It may only be possible to draw a conclusion after the official launch of the Base mainnet and whether regular users can withdraw tokens normally. However, it is undeniable that Bald’s short-lived myth of getting rich quick has brought a breath of fresh air to the crypto community. Despite the overnight crash, it has become a traffic generator for the Base ecosystem. As a Coinbase-backed L2 public chain deeply integrated with OP, it naturally has its own traffic and funding, making it worth paying attention to.

What is Base Chain

Base, incubated by Coinbase, is the second L2 network deployed on the OP Stack, in addition to the Optimism mainnet, and intends to be part of the Optimism super chain.

The launch of Base Chain is within Coinbase’s long-term plan. Its goal is to expand Ethereum through a powerful and interoperable Web3 ecosystem, so that anyone, anywhere, can build decentralized applications or on-chain Dapps based on Base in a secure, low-cost, and developer-friendly manner. At the same time, Base is also the home for Coinbase’s existing products, users, and assets on the chain. Dapps on Base can seamlessly integrate with Coinbase, fiat gateways, and the Coinbase ecosystem.

OP Stack and Optimism Super Chain

OP Stack is a standardized, shared, and open-source development stack that supports Optimism, currently maintained by Optimism Collective. OP Stack is a set of software that supports Optimism’s standardized, shared, and open-source development stack, maintained by Optimism Collective. It currently appears as software behind the Optimism mainnet and will eventually appear as the Optimism super chain and its governance. OP Stack focuses on creating a shared, high-quality, fully open-source system for creating new L2 networks. By coordinating shared standards, Optimism Collective can avoid duplicative construction in isolated islands.

Optimism Super Chain seeks to integrate isolated L2 networks into an interoperable and composable system. For example, Coinbase Base will collaborate with Optimism Collective to design and build a protocol that can prioritize multiple L2s and provide interoperability and composability between them through OP Stack. The short-term goal of the Optimism Super Chain is to upgrade the Optimism mainnet, Base, and other L2s to an initial super chain structure with shared bridges and sequencing. The long-term goal is to develop into a large network that maximizes interoperability, shares decentralized protocols, and standardizes its core primitives.

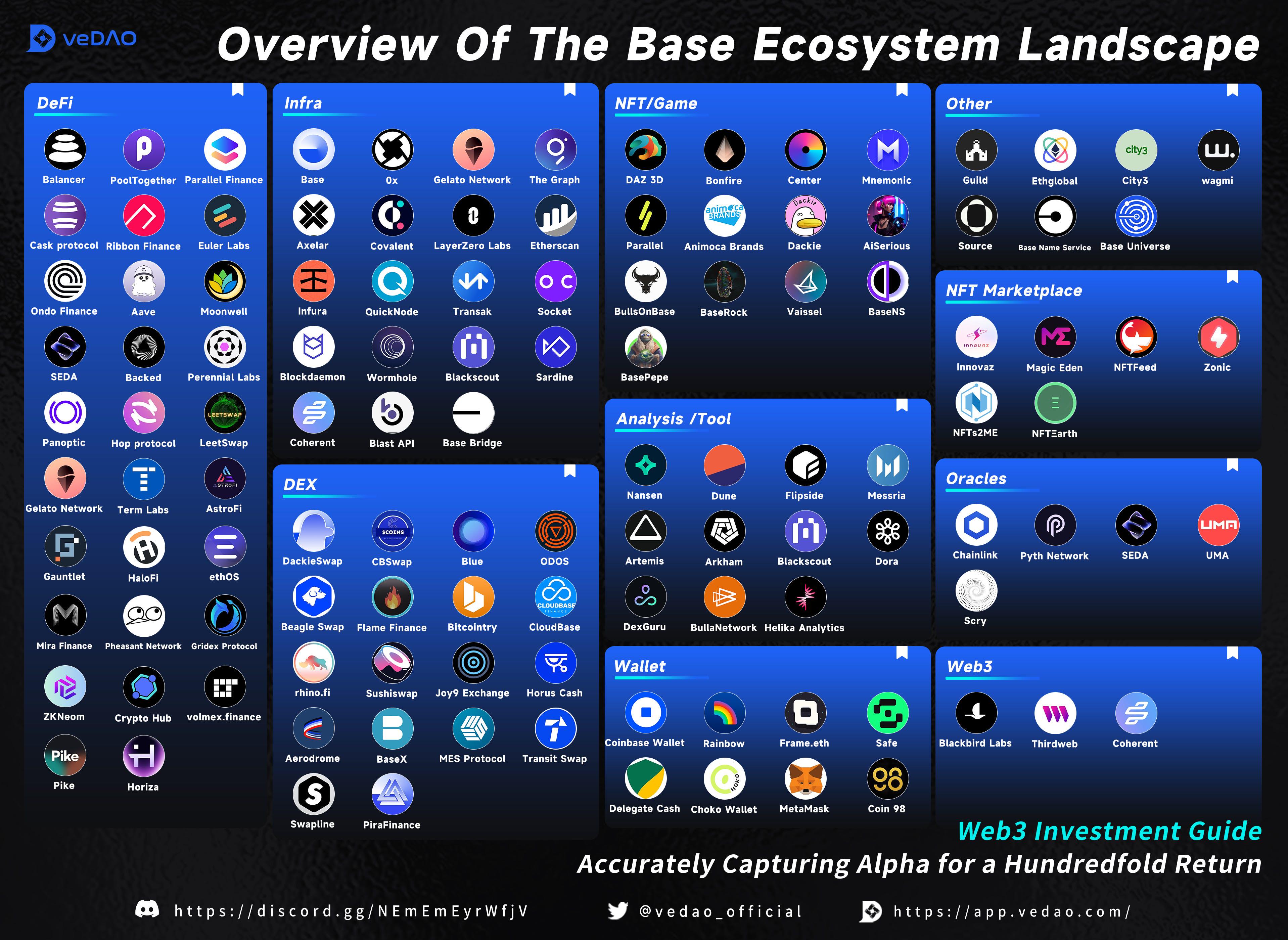

The reason why Base Chain’s ecosystem can explode in popularity is not only due to BALD’s influence, but also the reputation supported by Coinbase + Optimism. Although Base Chain currently only has a one-way cross-chain bridge without a front end (Ethereum → Base), it is still in the very early stages. However, as a crypto giant with a market value of $20 billion, Coinbase has unparalleled global influence in this field. Let’s take a look at the potential ecosystem projects on Base, aside from BALD.

Pike Protocol

Link: https://app.vedao.com/projects/c3a62c994ff82eb8c041c5736008d051ed4590d48c13b7473f75b25fbc8f8de7

Pike is a general liquidity protocol designed to unlock the utility of native assets by aggregating liquidity from blockchain networks.

MES Protocol

Link: https://app.vedao.com/projects/20c9f5d567fdb56ef6863e99e5966b0ed482ffe35cbfd62cba7a3181b8836835

MES Protocol is a highly scalable and high-performance order book DEX that supports multiple aggregated transactions within a single order book. The protocol is supported by zk Rollup and is currently running on zkSync and StarkNet-based order book exchanges. The protocol aims to create an exchange solution for interoperability across Rollups, enabling liquidity between Rollups, integrated order books for token exchange, and seamless asset transfers across networks.

Volmex Finance

Link: https://app.vedao.com/projects/a49fe93ed4788b21ccfa5085c05a8c1653807ea00743f4bbe6894b23ebc973bc

Volmex is a perpetual DEX that is based on a decentralized matching engine and order book. This engine and order book are maintained by a set of independent off-chain relayers or relayer nodes, which propagate and match orders between relayers using peer-to-peer communication.

Backed Finance

Link: https://app.vedao.com/projects/2e245c75a10481958e4d6b99feed17a5cfb13fe5d7767f3b408c2f0dae64b4c2

Backed is an RWA (real-world assets) platform that aims to expand the channels for acquiring financial assets by incorporating stocks into decentralized finance. The platform currently manages $12 million in assets, allowing users to purchase real-world assets on-chain and leverage their stablecoins. Backed’s first product is called bCSPX, which is an ERC-20 tokenized tracker for the iShares Core S&P UCITS ETF.

Perennial

Link: https://app.vedao.com/projects/c190def49bbb1f2eda9896fd42ae5dd872cb0b924e3abe772d82ad32c42ee70f

Perennial is a DeFi derivative protocol for trading price exposure. It is essentially a point-to-pool AMM that provides leverage exposure for traders and earns fees for LPs. The protocol’s mechanism design combines the advantages of DeFi and CeFi, making trading on Perennial both simple and scalable. It utilizes DeFi-native trading patterns, such as no order books, zero price slippage, permissionless leverage, and composable positions.

Summary

Of course, Base is still in its early stages, and whether these projects can succeed remains to be seen. However, the fact that there are regular projects on Base suggests that it is not just a blockchain for meme coins. There are still many promising projects on Base that could make it a viable alternative to Ethereum. The success of Base will depend on whether it can attract users who are looking for a more affordable and efficient way to use Ethereum. If Base can provide a compelling value proposition, it could become a major player in the Ethereum ecosystem.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Decoding Decentralized Order Book The Best Combination of Pricing Quality and Fund Security

- LianGuai Daily | Coinbase, Block, and Apple release quarterly reports; X Company is seeking data partners to establish a trading platform.

- Ether Futures ETF Applications Pile Up, Is the Gear of Crypto ETF’s Fate Starting to Turn?

- Developer’s Guide How to Build Products on the Base Mainnet?

- World Engine A sharding Rollup framework designed for full-chain games

- The inevitable outcome of Non-EVM public chains? Analyzing the reasons for the decline of ICP from multiple perspectives

- Latest developments in the Curve incident Has the crisis been resolved? Does the founder have to sell coins and pay off debts?