OPNX bond trading is being questioned as a “false transaction” gimmick. Can Su Zhu fulfill his wish to open an exchange to pay off debts?

Is OPNX bond trading a gimmick? Su Zhu seeks to open an exchange to pay off debts.Author: Pomelo, ChainCatcher

Recently, the crypto debt trading platform OPNX (Open Exchange) founded by Su Zhu, founder of Three Arrows Capital, and others has gained attention from the crypto community due to the increase in trading volume and the surge in the price of its platform token OX. On June 26, OPNX tweeted that its daily trading volume had exceeded $50 million, with an average daily trading volume of $41 million. Since its launch on June 1, its platform token OX has risen from $0.011 to a high of $0.044, a maximum increase of 300%. Its price has now fallen to $0.036, with a total market value of approximately $119 million, ranking 233rd among crypto assets.

According to trading data from the OPNX platform, the trading volume of this new crypto trading platform, which has only been online for three months, is comparable to that of established crypto trading platforms such as Crypto.com (with a 24-hour trading volume of $79.63 million) and Bitfinex (with a 24-hour trading volume of $68 million).

It seems that these all indicate that OPNX is developing in the direction set by its founder, but due to the unique nature of the founding team, users have always been skeptical of the platform.

- Founder’s Complaint: What Has Moonbirds Done This Year to Make People Disheartened?

- Global Coin Research: How to create a sustainable Web3 game economy model

- Canadian woman creates a metaverse law firm and plans to profit from renting out metaverse properties.

On June 22, a community user raised questions about the inconsistency of the BTC asset trading pair volume and price fluctuations on OPNX, which led to extensive discussions in the crypto community. In addition, OPNX, which was originally positioned as a crypto debt trading platform, has turned its debt token into a gimmick product, and its real business is contract trading.

The combination of “untrustworthy founder + failed platform” has always been associated with OPNX, making it difficult to shake off.

OPNX’s trading volume of millions is questioned to have “fake trading”, and the price was less than two dollars on the first day of launch

Since June, OPNX has released a continuous stream of positive news. On June 26, OPNX tweeted that its daily trading volume had exceeded $50 million, with an average daily trading volume of $41 million. On June 25, it announced the launch of the first LaunchBlockingd project, the unsecured loan market Raiser (RZR), where all OX pledgers will share 10% of the RZR supply allocation. On June 24, OPNX announced the launch of the credit currency oUSD, which can be exchanged 1:1 with USDT. On June 1, it announced the launch of a new governance token OX and the governance platform The Herd, which allows users to trade for free by pledging OX, and supports the conversion of OX into FLEX.

OPNX (Open Exchange) is a crypto debt trading platform founded by Su Zhu, founder of Three Arrows Capital, Kyle Davies, and the bankrupt trading platform CoinFLEX. It tokenizes the debt tokens of crypto projects that have gone bankrupt and offers them for trading or as collateral to release trapped crypto asset liquidity. The platform made its debut in February of this year and announced in early March that it had acquired all the assets of the trading platform CoinFLEX, including personnel, technology, and tokens, and continued to use FLEX as the platform token. It was then reorganized and renamed Open Exchange.

Since the launch of the OPNX platform, its trading volume has received considerable attention from users. According to FLEX Statistics data, since June 23, the 24-hour trading volume of the OPNX platform has exceeded $50 million, reaching a high of $57 million, and the current 24-hour trading volume is $47.72 million.

However, the authenticity of OPNX’s trading data has been questioned. On June 22, crypto trading user @Loris posted on Twitter that by analyzing the daily trading volume data of OPNX’s BTC perpetual contracts and comparing them with the top trading platforms, it was found that OPNX may have “false trading.”

Loris pointed out that the normal volume and price data displayed on top trading platforms have consistent volume and price fluctuations (such as higher trading volume should be accompanied by large price fluctuations), and there are stable baseline features. However, the volume and price data of OPNX show that the price fluctuations corresponding to the amplification range of the trading volume are extremely small, while the price fluctuations are very large when the trading volume is reduced.

In addition, the daily trading volume of OPNX has an independent and obvious regularity relative to price fluctuations, from which it is judged that OPNX may have “false trading.”

Subsequently, another crypto user commented that the false trading volume of OPNX is so obvious.

From the BTC contract price trend chart data on the OPNX official website, it is consistent with Loris’s statement. Since June, the trading volume has regularly (generally at 8:00, 12:00, 4:00, etc. every day) soared, and the peak values in the trading volume column are mostly in a similar range. During the period of low price fluctuations, the trading volume is huge, and during the period of large price fluctuations, the trading volume is extremely low. The BTC price chart data and trend of OKX platform during the same period are more in line with the volume-price law.

BTC/USDT contract chart on the OPNX platform

BTC/USDT contract chart on the OKX platform

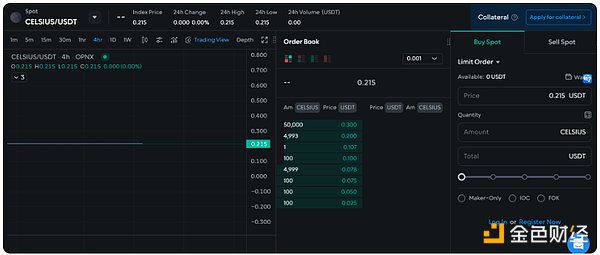

Furthermore, Celsius debt token CELSIUS, which went online on June 1, supports Celsius debt holders to tokenize their own debt, releasing liquidity for trapped funds. However, as of July 4, since the CELSIUS/USDT trading pair went online, there has been no trading, and the trading volume has always shown zero, and the token price has always been a straight line, with only eight sell orders on the order book.

Chart of the debt token CELSIUS

From this, it can be seen that OPNX did not develop into the intended debt trading platform, and now its business has shifted towards traditional cryptocurrency trading platforms, with contracts becoming the main force of the platform.

In fact, there were early indications of this. On April 4th, the platform OPNX, known for its debt claim transactions, officially launched and introduced the first feature that supported cryptocurrency spot and derivative trading services, not debt token trading. This has been described by community users as “a cover-up for supporting encrypted claim trading, when the real business is actually a contract casino.” This also shows that OPNX’s business focus is on cryptocurrency asset trading, not debt trading, as the types of assets for claim transactions and the user base are limited.

In addition, on April 18th, the Dubai Virtual Asset Regulatory Authority issued a written condemnation to the founders and CEO of OPNX, saying that they were operating and promoting their digital asset trading platform OPNX without the necessary local license. This exposed compliance issues with OPNX.

Can the plan to open a trading platform to repay the debt succeed despite the shadow of failure?

OPNX attracted attention from users through short-term increases in trading volume and a short-term surge in the platform token OX, but the shadow of failure caused by the founder’s dishonesty and CoinFLEX’s suspension of user withdrawals could not be completely removed.

On June 27th, the liquidator of Three Arrows Capital was still trying to recover $1.3 billion from its founders Su Zhu and Kyle Davies, and according to a previous report by business management company Teneo, Three Arrows Capital is now indebted to 27 companies for about $3.5 billion. Meanwhile, trading platform CoinFLEX has suspended all user withdrawals due to a funding shortfall, and its creditors, investors, and others have been forced to become shareholders of the company.

The combination of “a dishonest founder + a failed platform” makes it difficult for users to fully trust OPNX, and it was met with a lot of opposition in the early stages of its establishment. When Su Zhu first announced the launch of a cryptocurrency debt trading platform on Twitter, one cryptocurrency community user commented below, “You should focus on talking to your lawyer instead of launching a new scam.” In addition, Evgeny Gaevoy, CEO of market maker Wintermute, said he would not invest in the new trading platform founded by the founder of Three Arrows Capital; and crypto venture capital firm Castle Island Ventures partner Nic Carter later said that a disgraced fraudster was partnering with other disgraced fraudsters to trade claims on a fraudulent trading platform that had already gone bankrupt. This actually sounds quite reasonable.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Gemini co-founder angrily accuses DCG founder: “Scammer, return the money quickly, or we will officially sue DCG and individual.”

- DWeb Camp Experience and Impressions

- Binance Launchpool will list Pendle

- How to initiate the NFT era with ERC-6551?

- IOSG Ventures: Network effects of Web3 game engines

- In-depth explanation of the ERC6551 token binding account protocol, which has recently gained popularity

- Gemini co-founder publishes open letter condemning DCG founder: “Scammer, return the money, or face legal action from both DCG and me.”