How will the Pendle War unfold?

Pendle War: what's next?1. Pendle’s Current State

Pendle Finance is a yield strategy protocol deployed on Ethereum and Arbitrum. In late 2022, it launched its v2 version and changed its economic model, and later added support for LST assets and went live on Arbitrum. For more fundamental information, please refer to the LD Pendle Historical Report.

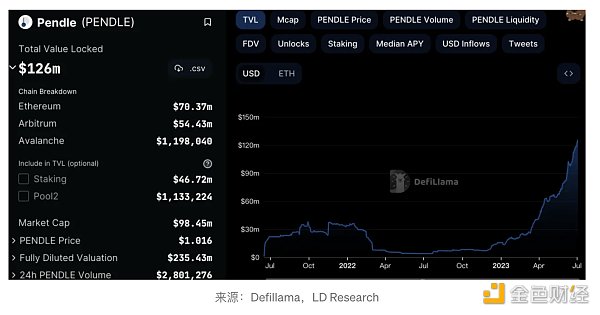

Image: Pendle TVL

- OPNX bond trading is being questioned as a “false transaction” gimmick. Can Su Zhu fulfill his wish to open an exchange to pay off debts?

- Founder’s Complaint: What Has Moonbirds Done This Year to Make People Disheartened?

- Global Coin Research: How to create a sustainable Web3 game economy model

Its TVL has been steadily increasing since late 2022 and has now surpassed $126 million.

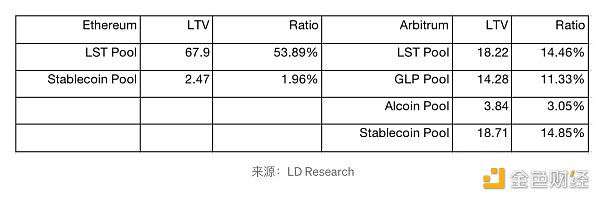

Image: Liquidity Distribution (Million)

The liquidity within the Pendle protocol mainly comes from LST assets, with GLP, stablecoins, and other tokens accounting for only about 30% of its TVL. The income source of GLP mainly comes from 70% of the traders’ profit and loss and protocol fees. The profit and loss of traders and protocol fees change every day, and the rate of return has a higher game space and tradability.

The initial income of LST assets comes from ETH PoS, and there are differences in the amount of pledged assets, LSD protocol operating mechanisms, and platform fees, so the rates of return on LST assets on various LSD platforms vary, but the differences are not significant. The rate of return is usually maintained at around 4%, and the low elasticity of the rate of return determines the poor tradability of LST assets. Pendle protocol uses veToken and Gauge voting mechanisms for liquidity mining, so the yield of Pendle LST pool can reach 10%-30%.

Image: Pendle Protocol Trading Volume

According to historical trading volume data, the daily trading volume of the Pendle protocol is generally below $1 million. LSD asset trading volume accounts for 54.82% of the total trading volume, and GLP’s historical trading volume accounts for 24.09% of the total trading volume. GLP’s trading usually occurs in more active market conditions, so in the past day, GLP accounted for 51.29% of the trading volume. Considering the LTV ratio of various assets in the protocol, the game space of GLP’s yield is larger.

2. Pendle Economic Model

Token allocation

Image: Token Allocation

The team, advisors, and investors have all completed their unlocking periods.

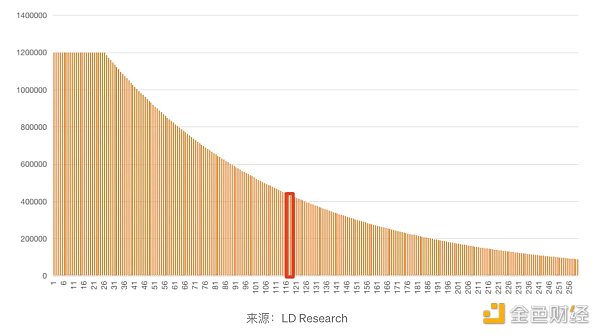

In the liquidity incentive section, 1.2 million tokens will be distributed each week for the first 26 weeks, after which the amount will decrease by 1.1% per week until week 260. After week 260, the annual inflation rate will be based on a 2% supply of circulating tokens, with the weekly liquidity release remaining at a relatively stable level. According to the team’s description, the weekly release amount in October 2022 is 667,705 (week 79 release amount), currently approximately between weeks 113-117, with a weekly release of about 450,000. PENDLE will continue to release over the long term.

Figure: PENDLE Weekly Release

In November 2022, Pendle introduced the veToken model, primarily aimed at increasing protocol liquidity. Pendle’s lock-up time varies from 1 week to 2 years. vePENDLE holders direct rewards to different pools through voting, incentivizing liquidity in the voting pool. A snapshot of all votes is taken at the beginning of each cycle on Thursdays at 00:00 UTC, and the incentive rate for each pool is adjusted accordingly.

Main features of vePENDLE:

1) The LST issuer has little incentive to bribe vePendle. As a leading DEX, asset issuers typically provide their own token mining rewards and bribe veCRV voting to increase CRV liquidity mining incentives to improve the liquidity of their own protocol assets in Curve. The demand for vePENDLE mainly comes from LPs participating in mining and lacks strong demand from asset issuers.

2) vePENDLE lockers can only participate in fee allocation for pool transactions that are voted on.

3) vePENDLE holders can share 3% of the fees generated by the Yield Token (YT).

4) vePENDLE holders can receive 80% of the transaction fees for the AMM pool they voted on.

Figure: PENDLE Pledge Status

As of July 3rd, PENDLE had a lock-up amount of 37 million tokens, with an average lock-up time of 392 days.

3. Penpie/Equilibria

Penpie and Equilibria are both auxiliary protocols that improve LP revenue on the basis of the Pendle veToken economic model, allowing LPs to receive Pendle mining boost revenue without staking Pendle. The business model of the two is similar.

Penpie

The protocol currently supports Ethereum mainnet and Arbitrum.

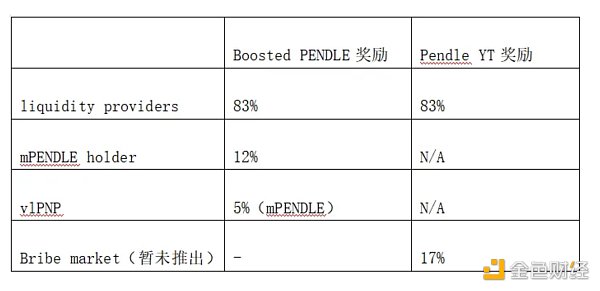

Users can convert PENDLE to mPENDLE through Penpie, and the protocol collects PENDLE staked as vePENDLE to achieve mining boost for LPs. 83% of the boost income is distributed to LPs, 12% to mPENDLE holders, and 5% to vlPNP. The team plans to allocate 17% of the YT rewards in the vePENDLE equity to the Bribe market, but it has not yet been launched.

Table: Income Distribution

PNP is the governance token of Penpie. Users can obtain vlPNP at a 1:1 ratio by locking PNP tokens. Holding vlPNP can earn protocol distribution income and participate in governance. Once the user locks their PNP tokens as vlPNP, they will enter the default lock state, and the lock-up period is not limited. Users must “start unlocking” to enter a 60-day cooling-off period. During the cooling-off period, vlPNP holders can continue to earn passive income but cannot participate in voting. After the 60-day deadline, users can completely unlock their vlPNP as PNP. The penalty cost for the first day of the cooling-off period is 80% of the total amount of PNP tokens locked by the user, and it will decrease non-linearly over time.

Equilibria

Equilibria’s business model is basically the same as Penpie, which also helps Pendle LP realize mining boost without the need to pledge PENDLE. After pledging PENDLE as ePendle, it cannot be reversed. Users need to lock EQB/xEQB as vlEQB to obtain protocol fees and voting rights. xEQB can be converted to vlEQB, and the team plans to integrate xEQB into other protocols, but there are currently not many use cases.

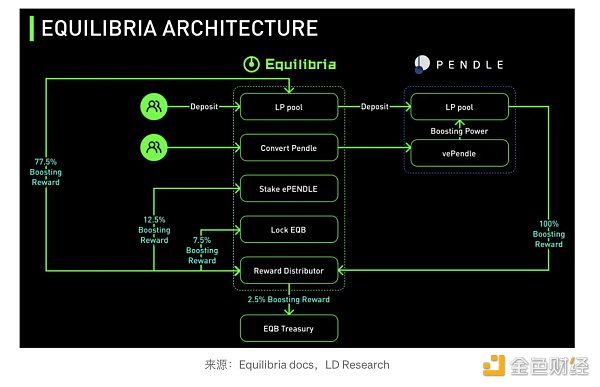

Figure: Equilibria architecture

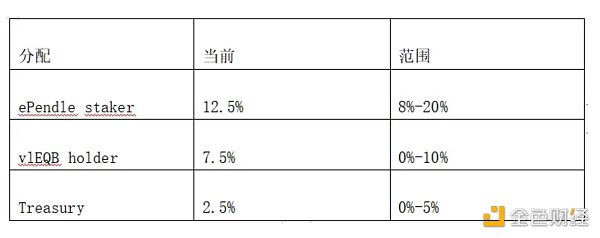

After realizing mining boost through Equilibria, 77.5% is allocated to LP, 12.5% is allocated to ePendle holder, 7.5% is allocated to vlEQB holder, and the Treasury obtains 2.5%. The income distribution ratio of each role is set within its range.

Table: Income Distribution

Protocol Data

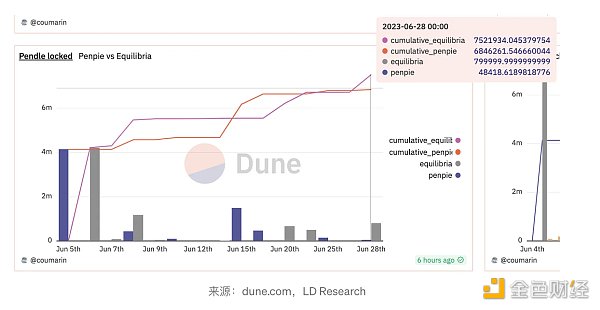

Figure: PENDLE lock-up data

*Dune data is for reference only (stagnated on June 28), and there are differences from the current data on the official website of the protocol.

According to the official website data, as of July 4, the Penpie PENDLE lock-up amount was 7.45M, and the Equilibria lock-up amount was 7.54M. Although ePENDLE and mPENDLE and PENDLE are exchanged at a 1:1 ratio, Equilibria announced on June 19 that it will suspend the liquidity pool of ePENDLE/PENDLE. The original plan was to delay for two weeks or longer. Currently, from the community dynamics, the team has not given a definite time, and mPendle has been launched on Wombat, but the exchange ratio is about 1:0.72, which is severely worn out.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Canadian woman creates a metaverse law firm and plans to profit from renting out metaverse properties.

- Gemini co-founder angrily accuses DCG founder: “Scammer, return the money quickly, or we will officially sue DCG and individual.”

- DWeb Camp Experience and Impressions

- Binance Launchpool will list Pendle

- How to initiate the NFT era with ERC-6551?

- IOSG Ventures: Network effects of Web3 game engines

- In-depth explanation of the ERC6551 token binding account protocol, which has recently gained popularity