SEC has been repeatedly ‘losing face’ in cryptocurrency cases. Is it because the US Department of Justice is intentionally balancing its power?

Is the SEC losing face in cryptocurrency cases due to intentional power balancing by the US Department of Justice?Author: Matthew Lee

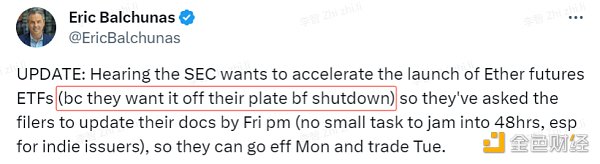

On September 27th, SEC Chairman Gary Gensler attended a hearing of the U.S. House Committee on Financial Services. The hearing reviewed regulatory developments, rulemaking, and activities of the SEC since October 5, 2021, including the SEC’s proposed amendments to the definition of “exchange” and the expansion of the SEC’s authority over digital asset trading platforms. Although Gary Gensler still holds a strict scrutiny attitude towards virtual assets, the SEC is no longer a united front, and internal personnel are already exhausted. Bloomberg’s senior ETF analyst also stated that employees hope to be liberated from this type of work before the government shuts down.

Although U.S. regulations have always suppressed the development of the industry, the positive aspect is that it is developing a legitimate procedural legal system. When things may go beyond control, it ensures the correct corrective measures (as seen in the comparison of losses suffered by U.S. investors and Asian investors due to FTX’s bankruptcy).

- What new opportunities has AI brought to the gaming industry in 2023?

- Co-founder of Three Arrows Capital, Su Zhu, has been arrested and may face 4 months of imprisonment, while co-founder Kyle Davies is still missing.

- LianGuai Morning News | Hong Kong Securities and Futures Commission Releases Multiple Lists of Virtual Asset Trading Platforms

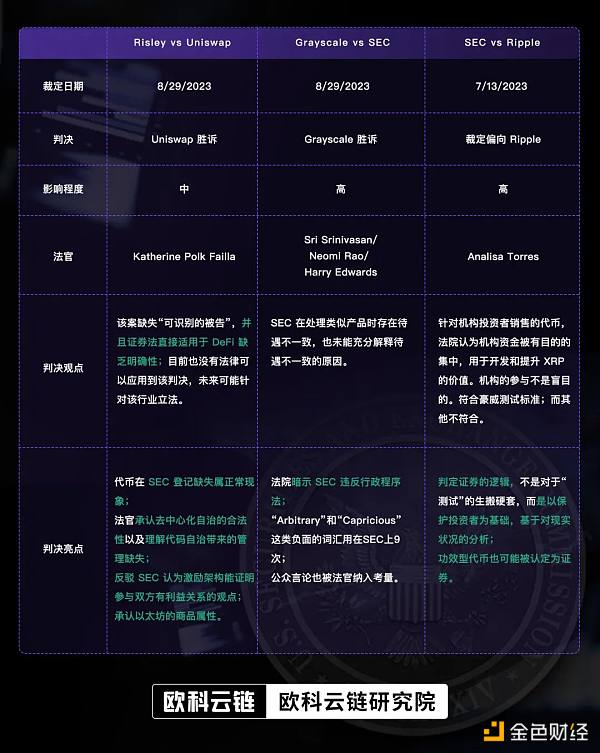

In the past three months, the court has ruled on three industry-related cases, namely Risley vs Uniswap, SEC vs Ripple, and SEC vs Grayscale, and the rulings have been relatively favorable for the industry. Combined with a series of rulings by the Department of Justice against the SEC, one cannot help but speculate whether the SEC’s “long arm” behavior towards virtual assets will be restricted.

The details highlighted in the judgments are very worthy of discussion and highlight the positive factors in the U.S. regulatory environment. Below, we will observe the attitude of the judicial system towards virtual assets and SEC regulation and explore the regulatory trends of virtual assets.

TL;DR

Key Points of the Risley vs Uniswap Ruling

The court ruling on Uniswap and Risley received the least public attention, but it also had the most detailed ruling details, with some very clear and directional viewpoints that can illustrate the court’s attitude towards the industry.

Allegations

Risley’s allegations against Uniswap Labs and its venture capital companies LianGuairadigm, Andreessen Horowitz, USV, etc. mainly include the following points:

i) Uniswap platform selling unregistered securities;

ii) Uniswap is an unregistered broker-dealer;

iii) Uniswap Labs profited through false advertising.

Court’s Response

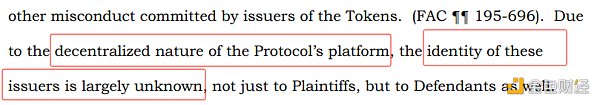

Uniswap’s decentralized architecture makes it unable to identify fraudulent token issuers, resulting in the absence of “identifiable defendants” in this case. And securities laws do not directly apply to DeFi due to lack of clarity, and there is no federal law that allows the court to hold Uniswap Labs and its venture capital companies accountable. Therefore, based solely on Uniswap Labs’ collection of transaction fees and other aspects of authority, it is not sufficient to determine that Uniswap Labs or venture capital companies should be held responsible.

Highlights of the Judgement

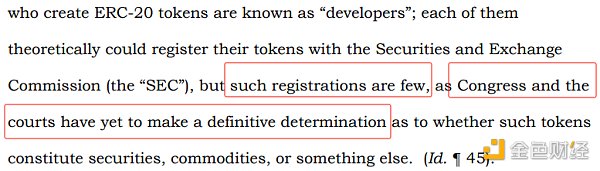

This paragraph contains a very important statement, where the judge believes that law should not be separated from reality, and in combination with the current situation, it is considered normal for tokens to be lacking in registration with the SEC. Therefore, many of the SEC’s accusations, such as “failure to register with the SEC or issue a prospectus or annual report in violation of securities laws,” are unfounded.

Due to the characteristics of decentralized autonomy, the judge understands the lack of management for “Scam Tokens.” However, as the law becomes more perfect, decentralized organizations should also adopt on-chain tools to remind users of the risks associated with certain tokens in order to avoid legal disputes. Institutions should also consider using on-chain tools to avoid risky interactions when conducting large-scale transactions on decentralized autonomous platforms.

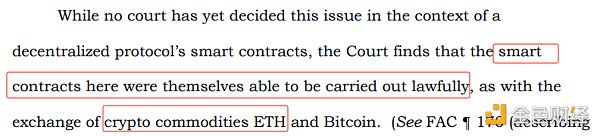

The judge reveals two pieces of information: i) acknowledging the legality of smart contracts in operation; ii) acknowledging the nature of Ethereum as a commodity (when the SEC sued Coinbase, it claimed that ETH was a security rather than a commodity).

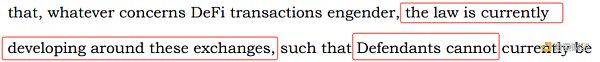

Due to the lack of laws, decentralized trading platforms have not been punished, but there will be stricter regulations on decentralized organizations, especially trading platforms. Taking Hong Kong and Singapore as examples, both have established strict legal requirements for trading platforms to conduct rigorous reviews of tokens traded on their platforms. Many platforms have also purchased data labeling services from on-chain data service providers to comply with anti-money laundering requirements. In the future, decentralized trading platforms will not have many privileges.

However, the judge’s current conclusion clearly distinguishes from the previous views of the SEC chairman, who stated that “most DeFi trading platforms are essentially no different from traditional exchanges.”

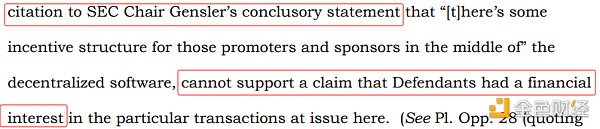

The court also dismisses the plaintiff’s reference to the SEC’s views, believing that the existence of incentive structures cannot prove any relationship between the defendant and the project party. This viewpoint can give relief to many projects with incentive measures.

Summary

The judgement contains two very important pieces of information: i) the judge has a deep understanding of the operational logic and characteristics of decentralized projects; ii) the judge is tolerant of the running of decentralized project codes and acknowledges the legality of smart contract operations.

However, the most important factor is that the decentralized operating model and the lack of a legal framework prevent the court from making an objective judgement. There are already several senators proposing new legal frameworks for virtual assets, KYC, and even decentralized protocols, with the aim of clarifying regulatory frameworks and responsibilities.

Key Points of Grayscale vs SEC Judgment

Accusations

Grayscale accuses the SEC of arbitrarily and repeatedly rejecting the listing of Grayscale’s Bitcoin ETP, but approving the listing of essentially similar Bitcoin futures ETPs.

Court’s Response

The court did not object to Grayscale’s evidence that the Bitcoin spot market and futures market have a 99.9% correlation, nor did it imply that market inefficiency or other factors would undermine this correlation. The judge believed that the SEC had inconsistent treatment when dealing with similar products.

Therefore, the judge approved Grayscale’s request and overturned the SEC’s order.

Highlights of the Judgment

It is rare for a court to state in a judgment that an institution has violated the law (Administrative Procedure Act), and the court uses very strong words to suggest that the defendant’s decision was hasty and capricious, even “an abuse of discretion.”

In the judgment, terms like “Arbitrary” and “Capricious” appeared 9 times, which are extremely negative.

Public opinion was also taken into account by the judge, and it can be said that almost everyone is displeased with the SEC’s decision in this judgment.

Summary

In this overwhelming 3-0 judgment, the judge questioned how Grayscale’s ETPs differ fundamentally from other approved ETPs, which allowed for the questioning of the SEC’s “differential treatment.” The SEC failed to answer this question.

In response to the judgment against Grayscale, LianGuairadigm’s policy director also provided some additional information: two judges appointed by Presidents Obama and Carter were very critical of the SEC’s arguments, so as Democrats (who are generally opposed to crypto assets), they joined the opinion of the conservative Judge Rao. Therefore, the probability of the SEC requesting a joint trial is very low, as it is likely to anger the court. If they were to reapply for rejection, the reasons should be related to the company’s internal operations, not the inherent risks of the ETP itself.

Key Points of SEC vs Ripple Judgment

Accusations

i) Ripple’s sale of tokens to institutions is alleged to constitute the sale of securities;

ii) Ripple’s sale of tokens to the public on digital trading platforms is alleged to constitute the sale of securities;

iii) The gifting of tokens to outsourcing companies is alleged to constitute the sale of securities;

iv) Failure to file similar prospectuses or updated annual reports with the SEC.

Since this article extensively uses the Howey Test to verify whether securities are involved, let’s first provide a brief overview – the Howey Test: 1. Whether there is an investment of money; 2. Whether the investment is in a common enterprise; 3. Whether there is an expectation of profits; 4. Whether the profits are derived from the efforts of others.

*SEC believes that most tokens meet the second and third criteria.

Court’s Response

i) Ripple’s sale of tokens to institutions through contracts constitutes the sale of securities. The court believes that institutional funds are purposefully concentrated and used to develop and enhance the value of XRP. The participation of institutions is not blind. It meets the Howey test criteria;

ii) Ripple’s sale of XRP to the public through “programmatic interfaces” (exchanges) does not constitute the sale of securities. The public does not know the source of the tokens and does not have an expectation of profit from the issuer’s efforts (but rather from other factors such as market trends). It does not meet the third and fourth criteria;

iii) Other channels of distribution do not involve the sale of securities. Because Ripple does not receive payment of “tangible or definable things” in exchange for XRP, the payment of XRP cannot be considered a sale of securities. It does not meet the first criteria.

Highlights of the Judgment

Ripple proposed the “essential elements” test – a narrow version of the Howey test, which was undoubtedly rejected by the court. The judge also demonstrated the logic of determining securities, which is definitely not a mechanical application of the “test,” but rather based on protecting investors and analyzing the current situation. Ripple’s proposed test focuses more on form.

The court believes that institutional users clearly understand the terms of the investment contract, and they do not view their purchase of XRP as currency or a commodity, but rather as an investment product. Therefore, the sale of XRP to institutions constitutes the sale of securities.

On the other hand, ordinary users do not understand the various documents from the SEC and Ripple’s market promotion, nor do they associate them with investment returns, so they do not meet the “expectation of profit” requirement of the Howey test.

Ripple argued that XRP is not a security and is more like ordinary assets such as gold and silver, so it does not have a “commercial nature” of securities. The court does not recognize the logic of XRP’s relationship because the court believes that even commodities can be sold in the form of investment contracts.

Many projects also claim that their tokens are not securities but utility tokens, but from the court’s perspective, although they have utility, it does not prevent them from being classified as securities.

Summary

Unlike the one-sided “support” for Grayscale and Uniswap, although the judge holds a more positive attitude towards the virtual market, the court still made some judgments favorable to the SEC, such as the Howey test should not be confined to form, and this determination to some extent conforms to the SEC’s definition of securities. Projects that claim their tokens are “utility tokens” have a hard time in court.

What puzzles me about this judgment is that the determination of tokens sold to institutional investors as securities is because institutional investors are aware of the investment regulations and the source of sales, while retail investors are “unaware.” However, the “intent” of determining securities is to protect investors, and retail investors have not received that protection. And following this logic: if tokens are sold through exchanges, then securities laws do not apply, and retail investors who purchase tokens on trading platforms will not be protected either?

The Regulatory Signals Revealed by the Judgments

Several judgments have shown some “unreasonable” aspects, demonstrating the bias of the judiciary towards the industry, and also highlighting the characteristics of mutual checks and balances within the United States. In the past few years, the SEC has taken aggressive measures to expand its “jurisdiction” on whether virtual currencies are securities. However, before the legislative department takes formal action, the judiciary has already begun to vigorously suppress the arrogance of the administrative department.

Ripple, as an example intentionally used by the SEC to send a warning to the industry, did not establish authority successfully, but instead gave the industry a big gift. As a country represented by case law, the judgment of “Ripple vs SEC” will provide a clearer direction for the industry lacking definition and legislation, especially pointing out that tokens sold “programmatically” do not belong to the SEC’s definition of “securities”.

Although the judgment of Uniswap is unrelated to the SEC, it reveals the attitude of the court: decentralized projects are different from ordinary companies, and tokens cannot be confused with the securities of a company. Katherine Failla, the judge in this case, also served as the judge in the SEC and Coinbase cases. The market is also very optimistic that Coinbase will reject the SEC’s lawsuit.

If the cases of Ripple and Uniswap are goodwill gestures from the judiciary to the industry, then the judgment on Grayscale dealt a heavy blow to the SEC. The overwhelming 3:0 judgment reveals disappointment with the SEC, regardless of whether it comes from the radical party or the conservative party.

The hearing held yesterday also indirectly sent signals to the industry. The strong regulatory actions of the SEC will be constrained, and the legislative department will also closely follow and clarify the regulatory framework. Although regulation will not be completely relaxed, future enforcement will be more “rule-based”. It is believed that members of Congress will not give up this opportunity to promote their own positions in the virtual currency industry and gain political capital. There will be a large number of ETF applications in October, and these applications have already put strong political pressure on the SEC. Combined with the recent “Ups and Downs” causing an awkward atmosphere at the Permissionless Conference, they are all striking at the SEC. If they continue to adopt unreasonable measures, they will be abandoned by public opinion and political resources.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- LianGuaintera Cryptocurrency Compensation Report 88% of practitioners work remotely, with executive salaries exceeding $5 million.

- Where is the total circulation of over 120 million Ethereum?

- GPT-4 is too costly, Microsoft can’t sustain it anymore, and it is reported to have quietly initiated Plan B.

- Cooperating with TON, Tencent wants to help Telegram create an ‘international WeChat’?

- Uniswap Foundation plans to raise 60 million to develop its ecosystem. What are the plans of the DEX Planner?

- ChatGPT has undergone three major upgrades in a week, and the Connect feature has been re-enabled.

- LianGuaiWeb3.0 Daily | HashKey Exchange has officially launched AVAX