Uniswap Foundation plans to raise 60 million to develop its ecosystem. What are the plans of the DEX Planner?

Uniswap Foundation raising 60 million for ecosystem development. DEX Planner's plans?One year later, Uniswap Foundation announces funding proposal

On September 27th, Uniswap Foundation announced its latest funding plan and future plans.

Last year, Uniswap governance approved $74 million in funding for the Uniswap Foundation. Today, the Uniswap Foundation has released a proposal to request a second batch of funding totaling $62.37 million, which includes the committed amount of $74 million plus a 10% buffer. The proposal is planned to be voted on chain on October 4th.

This batch of funding will be used to support the development of the Uniswap ecosystem, including developer support, research funding, etc. In addition, the foundation has announced several future plans, including further development of the Hooks ecosystem, launching the Fellowship in October 2023, continuing to support IRL representative activities, and building more digital connections.

The foundation also plans to achieve bigger goals in 2024 and beyond, such as expanding its ecosystem, innovating, and strengthening governance.

- ChatGPT has undergone three major upgrades in a week, and the Connect feature has been re-enabled.

- LianGuaiWeb3.0 Daily | HashKey Exchange has officially launched AVAX

- Friend.tech without ‘innovation’ gives a lesson on products in the cryptocurrency circle.

Related reading: “Complete initial funding of the Uniswap Foundation”

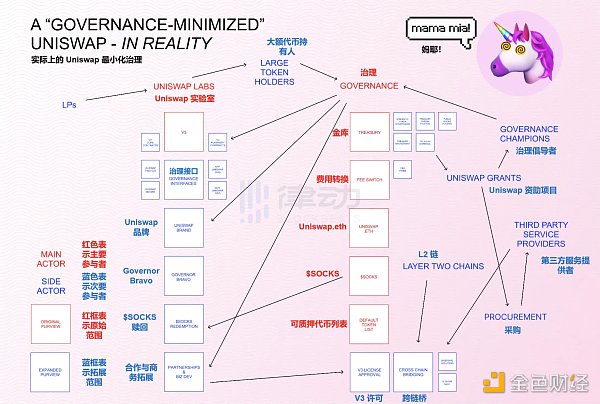

Uniswap Foundation has become a “DEX development planner”

On August 5th, 2022, the Uniswap community released a new proposal to establish the Uniswap Foundation (UF). According to the proposal, the mission of UF is to support the decentralized sustainability and growth of the Uniswap protocol, its supported ecosystem, and community. UF will provide grants to builders, researchers, organizers, scholars, analysts, and more to develop the protocol and plan for its future. Devin Walsh, former Chief of Staff at Uniswap Labs, will serve as Executive Director, and Ken Ng will serve as Chief Operating Officer, and a team of 12 people will be formed.

To achieve the above goals, the team is seeking a total of $74 million in funding, divided into two payments. The first payment of $20 million includes a $14 million operating budget to cover the team’s expenses for 3 years and a $60 million Uniswap Grants Program (UGP) funding budget to cover expenses for over 3 years.

Image source: https://seedao.mirror.xyz/m6Ua8urz-z4o6nfB-_pDBxb0WAI_d6xcipwLOasz4rg

It also requires the authorization of 2.5 million UNI tokens for governance. These UNI tokens can be revoked by the DAO at any time using the new smart contract The Franchiser and cannot be used for any purposes other than governance.

The proposal was passed on August 24th last year, and $74 million will be requested from the DAO Treasury, with $14 million of the funds allocated to support the foundation’s team and $60 million allocated to developer grants.

On September 20th this year, the Uniswap Foundation announced that since taking over the Uniswap Grants Program a year ago, they have awarded 72 grants, with 40 of them already completed. Nine grants have exceeded $100,000, with a total commitment of approximately $4.5 million.

Then, on September 21st, the Uniswap Foundation announced the launch of the education platform “Uniswap University”, a comprehensive education platform tailored for everyone, from beginners to experienced Uniswap v3 liquidity providers. It provides participants with a structured learning path to enable them to obtain and understand providing liquidity, including four modules: guides, tidbits, simulations, and training.

Related reading: “Can Uniswap University bring liquidity increment to DeFi by learning from CEX? “

“Compared to centralized trading platforms, Uniswap has a higher degree of difficulty and entry barrier for newcomers. Perhaps this is the greatest significance of Uniswap University. It is more urgent for Uniswap to attract more people to enter the DEX world than to introduce people from the Web2 world into the crypto world.”

It can be seen that the existence of the Uniswap Foundation has made decentralized trading platforms more stable and has also radiated more possibilities for the crypto ecosystem.

Is Uniswap also launching a Fellowship program?

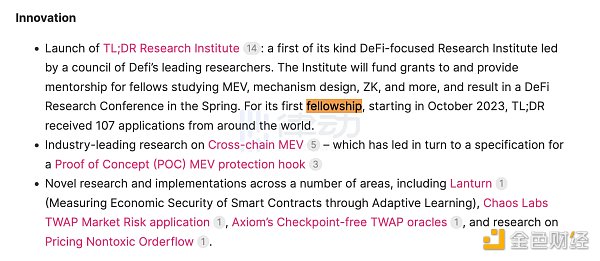

According to the Uniswap Foundation’s fundraising plan yesterday, one of the uses of this fund is to launch the Fellowship program in October 2023 and create a working group to directly apply MEV and other cutting-edge research in the field to Uniswap.

The first research institute focused on DeFi will be led by a committee of leading researchers in the DeFi field. The research institute will provide funding and guidance for researchers studying MEV, mechanism design, ZK, etc., and will hold a DeFi research conference in the spring. The first Fellowship program received 107 applications from around the world.

Image source: Uniswap governance interface

Previously, BlockBeats reported that Consensys and zkSync have successively launched Fellowship programs, believing that in addition to the Fellowship program, major L2 projects seem to be more enthusiastic about project orthodoxy, code originality, and RaaS. The competition in the L2 track seems to be turning into a fierce “melee”.

Related reading: “Consensys and zkSync successively launch Fellowship programs, and the competition in L2 enters the ‘melee stage’?”

Now, the leading DEX Uniswap is also launching a Fellowship program. It can be foreseen that major projects will build their own moats in terms of education, reserve their strength, and wait for the bull market to come.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- 269% growth in the past 30 days, a comprehensive on-chain analysis of $TRB

- In-depth Analysis of Account Abstraction AA User Growth Data

- Why is Binance in such a hurry to sell its Russian business to a newly launched exchange?

- Is the recent court ruling an intentional attempt by the judicial department to balance the scales of SEC regulation?

- Friend.tech without innovation has brought a product lesson to the cryptocurrency circle.

- Namada in Detail A Modular Privacy Solution for Multi-chain Ecosystems

- How do lawyers use AIGC to write articles? Taking Microsoft Copilot as an example.