As the ZK Rollup track becomes increasingly crowded, what are the first-mover advantages of zkSync Era?

What are the benefits of zkSync Era as the ZK Rollup market gets more crowded?Listing: DODO Research

Editors: yaoyao & Lisa

Author: dt

Ethereum’s layer-two expansion mechanism is both a well-known concept and a battlefield for blockchain development.

- Lens Protocol: Introducing Lens Improvement Proposals (LIPs), Analyzing the First Three Proposals Launched Today

- SEC’s encryption regulation B-side: The Fantastic Story of Prometheus Exchange

- 20,000-word explanation of the RWA tokenization track: the next wave of the crypto narrative?

This article will introduce zkSync, the first layer-two network to go live on the mainnet using zk-rollup technology, from the perspective of the public chain itself to the development of ecosystem projects, providing a comprehensive analysis from fundamentals and data to the ecosystem.

I. Introduction to zkSync Era

zkSync is an Ethereum layer-two scaling solution based on the zk-rollup architecture, aiming to achieve high-performance, low-cost smart contracts and blockchain applications. It uses zk-rollup technology to achieve high throughput scaling, reducing transaction costs and increasing confirmation speeds. zkSync Era is built on the zkSync protocol and features faster transaction speeds, higher scalability, and more economic efficiency. It is applied in various fields such as DeFi, cross-chain bridges, and NFT. Due to its efficiency and low cost, zkSync has received widespread attention from the capital market and is developing rapidly.

The zkSync development company, Matter Labs, has completed a total of four rounds of financing, with a total financing amount of 458 million US dollars. Well-known venture capital firms including a16z, Dragonfly, 1KX, OKX Ventures, bybit, and Blockchain Capital have all participated in the investment. Looking back, this financing amount is a notable amount in both the WEB3 and WEB2 fields, and is one of the leading unicorn projects in the blockchain industry.

Strong financing background, cutting-edge technology, and being the first batch of players in the zk-rollup technology that Ethereum founder Vitalik previously praised, zkSync Era is one of the few zkEVM rollups already launched. In terms of narrative, capital, and practical aspects, zkSync Era is a leader, and the blockchain world’s desire for new things makes zkSync Era the most anticipated and hottest public chain in 2023.

History of zkSync Era

zkSync 1.0 – zkSync Lite was launched on the Ethereum mainnet on June 15, 2020, achieving a transaction throughput of about 300 TPS, but it is not compatible with EVM.

zkSync 2.0 – zkSync Era was launched on March 24, 2023, supporting arbitrary smart contract functions through Solidity (via zkEVM) and Zinc (the internal programming language of rollup). Secondly, through zkPorter, a protocol that combines zk-rollup and sharding, the throughput increases exponentially, reaching 20,000+ TPS.

One of the biggest selling points of zkSync Era compared to zkSync Lite is its compatibility with the EVM. This means that it can execute smart contracts written in Solidity or other high-level languages used in Ethereum development, which can attract more developers and users to seamlessly connect to the ecosystem. In addition, the transaction cost has been reduced by 50 times compared to before, and the speed of 20,000 TPS makes the user experience a long-term improvement compared to Ethereum itself or zk lite.

zkSync’s Competitors

The competitor of zkSync is undoubtedly the various public chains in the L2 track. In addition to the mature and leading Arbitrum One & Optimism, many latercomers using zk-rollup are the opponents that zkSync needs to pay more attention to:

They include Polygon zkEVM, which has been launched, Starkware, which is well-known and has been invested heavily by many capital giants, Linea developed by Consensys, Scroll, which is also committed to developing zkEVM, Aztec, which focuses on privacy, two L2 solutions respectively sponsored by exchanges, Taiko invested by OKX and Mantle developed by Bybit. Even the already launched Optimistic Rollup Metis announced that it is actively developing Hybrid Rollup by combining zk-rollup with the current Optimistic Rollup. Finally, there is Kakarot, which received attention because Vitalik personally invested in the Pre-Seed round.

Currently, zkSync can be said to occupy 100% of the leadership advantage, and how to continue to lead and bring users a good experience in the future is the most important thing besides the technical aspect.

II. zkSync Era Data Overview

Before introducing the ecological project in detail, let’s first look at the data such as TVL, official bridge in and out, and daily on-chain transaction volume, to get a better understanding of the current status of the zkSync Era ecosystem.

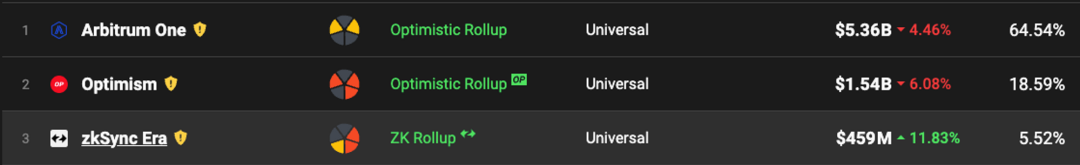

From the on-chain TVL data, after only 2 months of launch, the total TVL of the zkSync Era ecosystem has reached US$459 million. It has maintained stable growth in TVL since its launch, currently ranking third in Layer2 Rank, second only to Arbitrum One & Optimism, which uses Optimistic Rollup.

source: l2beat.com/scaling/tvl

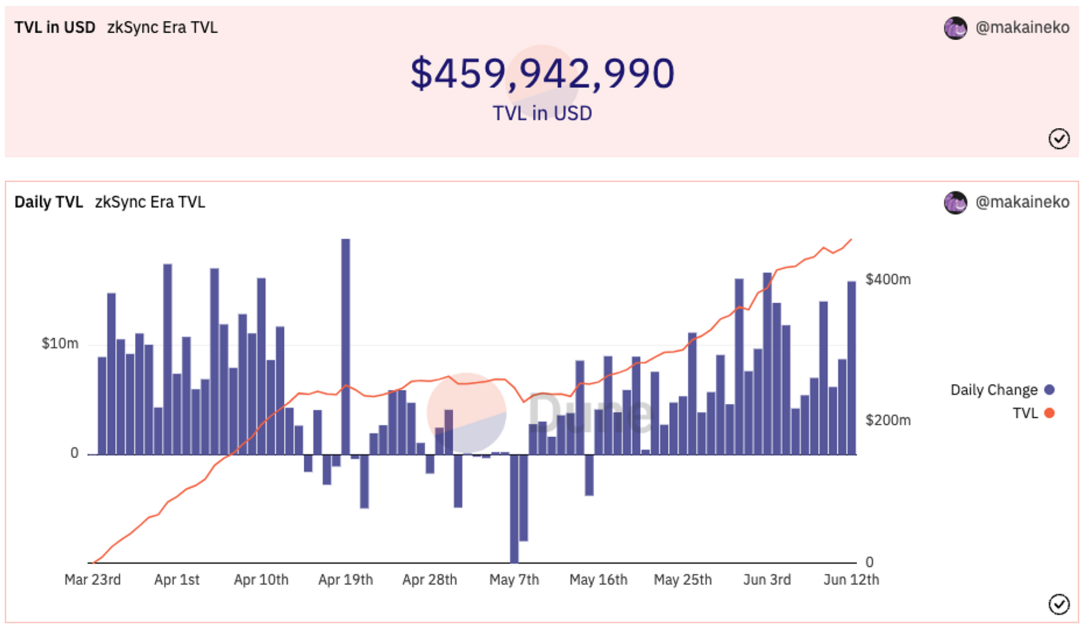

source: dune.com/makaineko/zksync-era-airdrop-criterion

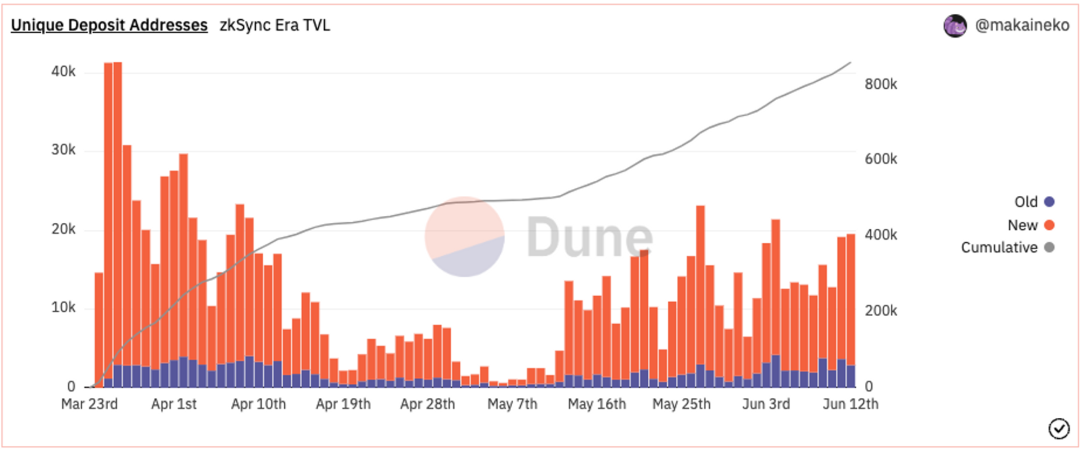

According to official bridge data from zkSync Era, the number of cumulative deposit addresses has reached 800,000, and the average number of new deposit addresses per day from June to present is about 10,000.

source: dune.com/makaineko/zksync-era-airdrop-criterion

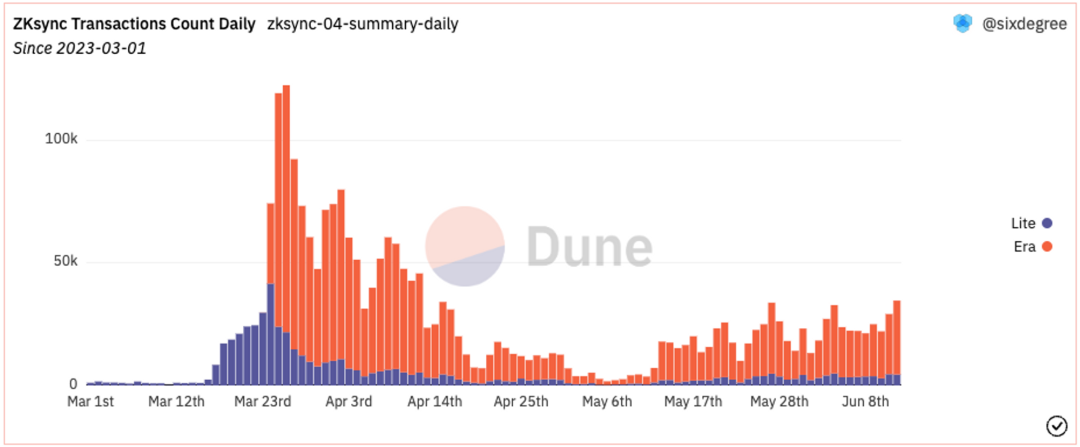

On the other hand, looking at the daily transaction volume of zkSync Era, it has fallen from a high of nearly 100,000 transactions at the beginning of its launch to a low of only 1,300 transactions per day in early May. It is currently stable at about 20,000 transactions per day. The reason may be that there is currently no killer DAPP on zkSync Era, and the surge in transaction volume was only due to novelty in the early stages of its launch.

source: dune.com/sixdegree/zksync-airdrop-simulation-ranking

In summary, its ecology is still in a very early stage, having achieved such results in less than three months is commendable. It has passed the early FOMO stage and is now steadily rising. It is expected to break through with the deployment of more projects on the chain in the future.

III. Introduction of zkSync Era’s ecological projects

Established Projects

Before it went live, zkSync Era received promises from many projects to deploy, including Balancer, Uniswap, Frax, OHM, and LayerZero, but not many have completed deployment. Currently, the established protocols that have been officially launched are 1inch and iZUMi Finance.

1inch Network

The 1inch aggregator is one of the cornerstones of Defi projects. It officially landed on zkSync Era on 4/20, becoming the 11th deployed public chain. With 1inch, the split liquidity on the chain has a good entry point, and users no longer need to think about which DEX to go to when exchanging tokens, which effectively promotes ecosystem development.

iZUMi Finance

iZUMi is also a Defi project with multi-chain deployment. It was deployed at the beginning of zkSync Era’s launch and was one of the first established protocols to actively deploy on zkSync Era. iZUMi has an impressive TVL on zkSync Era and is currently the second-ranked project on the chain, becoming a strong competitor in the zkSync Era DEX track.

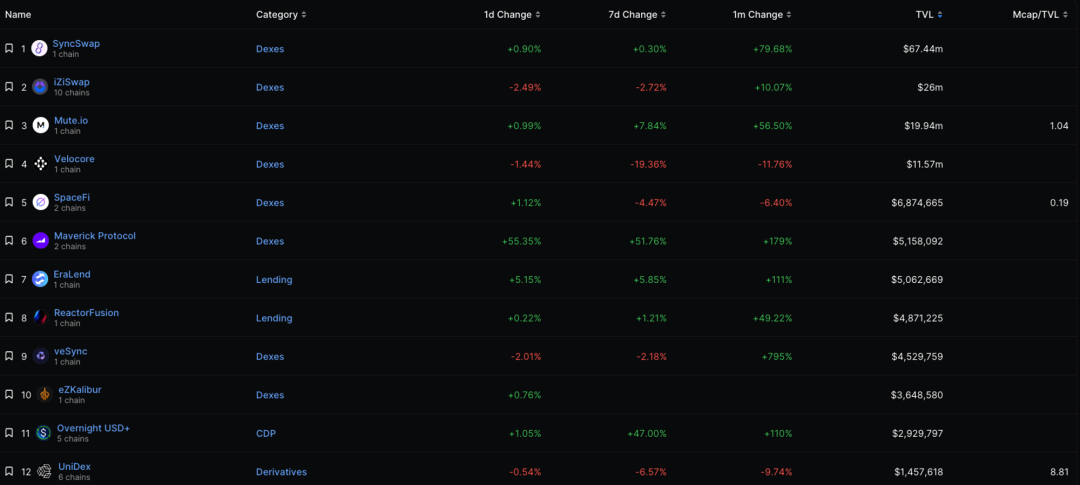

Viewing zkSync Era Top Projects from TVL

source: https://defillama.com/chain/zkSync Era?tvl=true

From Defillama statistics, it can be seen that the development on-chain is very early. The top five lock-up amounts are all DEX decentralized exchanges, and the top ten have eight DEX projects, with the remaining two being lending projects. There are no strong competitors in more complex fields, such as derivatives, GameFi, etc. The projects are introduced below by category.

DEX Decentralized Exchanges

SyncSwap

SyncSwap is a decentralized exchange built on zkSync Era. It itself has the characteristics of low transaction cost and inherits the complete security of zkSync.

SyncSwap’s features include supporting pool gauges, custom fee structures, advanced routers, voting trustee token models, governance, etc.

Recently, SyncSwap launched the cross-chain bridge Move based on the zkSync Era official bridge, which allows transfer between Ethereum and zkSync Era and supports multiple assets such as USDC, ETH, USDT, WBTC, LUSD, LSD, MUTE, etc. In fact, Move can be understood as a third-party front-end of the zkSync Era official bridge, with the same gas cost as the zkSync official bridge. The bridged tokens are 100% zkSync native assets without third-party risks. When a user approves or transfers with Move, they interact directly with the official zkSync smart contract.

iZUMi Finance

iZiSwap is a chain-based order book DEX launched on zkSync Era by iZUMi Finance, a one-stop liquidity-as-a-service DeFi protocol, using iZUMi’s discrete liquidity AMM (DL-AMM), similar to Uniswap V3’s centralized liquidity. DL-AMM can allocate liquidity to any fixed price, improving capital efficiency.

iZiSwap is a continuation of automatic market maker (AMM) DEXs represented by Uniswap. Its innovative design not only improves the efficiency of liquidity supply, but also greatly enriches users’ trading experience, making iZiSwap stand out in decentralized trading platform competition.

It is worth mentioning that iZiSwap has launched a fully decentralized limit order book model. During the transaction, all limit orders on a single point are processed as a whole. This method can greatly improve the efficiency of the transaction and ensure that the transaction is completed in O(1) time. Secondly, each time the price crosses a price point, the traded order volume will be transferred to an independent storage space called legacy. This design enables the system to clearly distinguish the order of the orders, ensuring the correctness of the transaction.

Finally, users need to claim the assets they traded by themselves. This is a necessary restriction that ensures users have full control over their assets and avoids security issues that may arise from automatic asset transfer.

This design brings a series of good features. First, since the limit orders on a single point are treated as a whole, the transaction can be completed in O(1) time, which greatly improves the efficiency of the transaction. Secondly, when the price passes through the target price (time point A) and then falls back (or passes through) the target price again (time point B), the limit orders after time point B will not be recorded as transaction status, which ensures the correctness of the transaction. Finally, when the price is on the target price, the part of the transaction is obtained by the user who initiates the claim operation first, ensuring the fairness of first come first served.

Overall, iZiSwap’s innovative limit order management method brings significant improvements in security, efficiency, and fairness, providing users with a better trading environment.

Maverick Protocol

Maverick Protocol is a DeFi liquidity infrastructure that aims to provide a liquidity market for traders, liquidity providers, DAO funds, and developers, supported by Maverick AMM.

Users can trade and provide liquidity on Maverick AMM. There are 4 different types of liquidity modes: Mode Right, Mode Left, Mode Both, and Mode Static. After selecting a mode, AMM will automatically move its liquidity to follow the price based on a specific set of rules. Maverick Protocol allows LPs to open Boosted positions, using incentive rewards to precisely attract liquidity, and other users can add liquidity to the Boosted position to purchase shares. LPs can earn income from transaction fees and LP incentives.

Mute

Mute.io is a zkRollup-based DEX on the zkSync Era, including modules such as limit orders, staking platform, and bond platform, supporting wallet, trading, LP pool, Amplifier, bond, and DAO governance functions, allowing trading and liquidity supply of assets such as ETH, USDC, MUTE, WISP, ZKINA, MVX, IDO, WETH, USD+, ZKDOGE, DOF, BOLT, ZKFLOKI, etc. After providing liquidity in the LP pool, users can obtain LP tokens and stake them in the Amplifier to earn income.

Bonds are Mute’s innovation, and users can use their LP tokens to purchase MUTE at a lower price (bond) from Mute DAO. After buying a bond, MUTE will be released after 7 days, and if the ROI is positive, users can earn more MUTE than LP tokens. Through bonds, Mute DAO can increase the liquidity owned by the protocol, increase the treasury income, and increase the long-term liquidity of the protocol. dMUTE is the DAO token of the Mute.io ecosystem, and users need to lock MUTE for 7 to 364 days to obtain dMUTE as a reward. After the lock-up period, users can redeem MUTE.

SBlockingceFi

SBlockingceFi is a Web3 platform that connects the Cosmos ecosystem and Ethereum Layer 2. Its products include DEX, NFT, Starter, SBlockingcebase, and upcoming products like Game and Social Network. SBlockingceFi supports the trading and liquidity provision of ETH, USDC, SBlockingCE, and WETH tokens. Users can participate in mining by staking single currency tokens like xSBlockingCE or LP tokens like SBlockingCE-USDC in SBlockingce Farms, and receive xSBlockingCE rewards. Starter is SBlockingce’s incubation and fundraising platform. Users can use USDT, ETH, or LP tokens such as SBlockingCE-USDC to pledge and obtain shares of project tokens at the initial issuance price. SBlockingcebase is SBlockingce’s on-chain community. By creating or joining SBlockingcebase, users can receive more mining rewards. Planet NFT is minted with SBlockingCE tokens. NFT holders can submit on-chain proposals. Both Planet NFT holders and xSBlockingCE holders can participate in governance voting.

Velocore

Velocore is the first ve(3,3) DEX on zkSync Era based on Velodrome Finance and Solidly code libraries.

Velocore’s core function is to allow users to trade digital assets with low cost and low slippage. Users can add liquidity to LP pools (divided into Stable Pool and Volatile Pool) and use LP tokens to obtain VC token incentives. VC is the native token of Velocore. VC holders can vote to delegate tokens and exchange governance tokens veVC (veNFT). VeVC can be transferred, merged and split. The lock-up period of VC can be up to 4 years. The longer the release time, the higher the voting weight and reward obtained by veVC holders. VeVC holders can also receive protocol fees, bribes, and kickbacks. Bribes can be used to encourage other users to vote for LP pool rewards. Velocore also has LaunchBlock and launched memecoin WAIFU.

veSync

veSync is also a ve(3,3) DEX on zkSync Era and a fork of Velodrome Finance. The TVL of veSync on zkSync Era is about 4.85 million US dollars, ranking seventh, with an increase of nearly 20% in the past 7 days.

VS is the native token of veSync and veVS (veNFT) is the governance token. VeVS can be transferred, merged, and split. veSync uses the ve(3,3) incentive model. Token holders can vote to delegate their tokens to receive veNFT. Longer vesting periods will bring greater voting rights and rewards. veSync liquidity pools are now divided into Stable Pools and Volatile Pools, with transaction fees ranging from 0.02% to 0.05%. In the future, veSync will launch Concentrated Pools, allowing users to customize the liquidity range they provide. Users choose a specific pool to participate in voting and receive bribes.

eZKalibur

eZKalibur is a new DEX that launched this week and raised a total of 653 ETH during the token fundraising phase. Based on the Camelot fork project of the Arbitrum head DEX, it adopts a special token lock-up dividend mechanism similar to Camelot xGrail. It also has a launchBlockingd function, but given that the project has not been online for long, there may be security risks to be aware of.

Lending Market

Lending has always been one of the most important infrastructures in each public chain besides DEX, but because Chainlink has not yet been integrated into zkSync Era, current users of Redstone Finance’s oracles, even Whale users, are not willing to use them. In addition, there are only two major assets in zkSync Era, which are ETH and USDC, and there are not many real use cases. Therefore, the lending field is a lukewarm presence in zkSync Era, and most users may be short hunters or DEFI farmers.

Eralend

Eralend, formerly known as nexon finance, is a compound fork protocol, similar to ReactorFusion, with no major innovations in terms of mechanism. The project was mentioned in the official tweet introducing the ecological projects of the zkSync Era, and the governance token has not yet been issued, which may have attracted a large number of short hunters to participate. Currently, its TVL is similar to ReactorFusion, both at around 5 million US dollars, making it a top lending market in zkSync Era.

ReactorFusion

ReactorFusion is the first project launched by velocore launchBlockingd, and the protocol itself is a compound fork with a unique bribe reward token mechanism. Its token ecosystem is highly tied to velocore, and its TVL is currently around 5 million US dollars.

CDP Overcollateralized Stablecoin

Overnight USD+

Overnight is a multi-chain project that originated on Polygon and currently supports five public chains, including Polygon, BSC, OP, ARB, and zkSync Era. It is also one of the few protocols that quickly deployed cross-chain upon launching on zkSync Era. Its main products are the revenue stablecoin USD+ pegged to USDC and the delta-neutral revenue generation strategy treasury ETS. The project has been online for about a year and the team is relatively reliable, making it suitable for DEFI farmers who seek high stablecoin yields.

Derivatives

Unidex

Unidex is also a multi-chain project. Its main product is a decentralized perpetual contract trading platform. Its feature is that it can integrate the depth of other perpetual contract trading platforms and provide functions such as limit order take-profit and stop-loss. In addition to trading crypto assets, it also includes commodities such as US stocks and foreign exchange. It is a perpetual contract aggregator on the chain, and its other products include spot trading aggregator, limit orders, and other functions.

Other Projects

Kreatorland

Kreatorland is an Opensea Fork on the zkSync Era chain that provides a one-stop NFT project. It is one of the projects mentioned in the zkSync Era official Twitter post and provides users with services to create and issue NFTs, as well as a launch blocking and trading market. However, currently, only one NFT, Poop Genesis, is listed.

Goal3

Goal3 is a gaming platform project on the zkSync Era chain, which was also shared by zkSync Era’s official Twitter account. Its token $ZKG Lockdrop activity attracted a total of 2.8M USDC participants, and nearly 50% of the addresses that locked for a year. The funds locked in the Lockdrop activity are used for the depth of the gaming market. The beta version of the project has been launched, and users can place bets on various sports events on this platform.

Summary

zkSync has a rich development history, and its future prospects are promising. With the continuous advancement of Ethereum technology, competition in the zk-rollup or zk-EVM field is also increasing. zkSync Era took the lead in establishing an ecosystem by virtue of its pioneering position. Currently, from the perspective of data and ecosystem, zkSync Era’s overall public chain is in a stable and rising stage.

From the number of protocols, it can be seen that the DEX track is the most maturely developed in the zkSync ecosystem. Whether it is a traditional Uni v2 fork, ve(3,3) solidly fork, or centralized liquidity DEX, they all have outstanding achievements. However, there are no innovative applications that can attract users for lending, derivatives, NFTs, or GameFi tracks. It is expected that with the deployment of more basic infrastructure projects, including cross-chain protocols, oracles, and stablecoins, more interesting Defi Lego projects will emerge.

At the same time, it is necessary to pay attention to various Rug Pull incidents that emerge in the flourishing development of the ecosystem. There have been cases where user funds were locked due to code compatibility issues. When participating in the ecosystem, it is necessary to pay attention to various considerations such as the background of the project party. However, new things represent new opportunities, and there are many opportunities to discover early high-quality projects by participating more in the ecosystem.

References

https://foresightnews.pro/article/detail/33720

https://www.odaily.news/post/5187161

https://www.crunchbase.com/organization/matter-labs

https://www.alchemy.com/overviews/zkevm

https://l2beat.com/scaling/tvl

https://dune.com/makaineko/zksync-era-airdrop-criterion

https://dune.com/sixdegree/zksync-airdrop-simulation-ranking

https://defillama.com/chain/zkSync Era?tvl=true

https://ecosystem.zksync.io/

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Looking back on the innovation path of DeFi, how did Uniswap evolve from a founder to a culmination?

- Ordinals protocol has been updated to version 0.6.2, which supports recursive inscriptions and brings randomness to inscriptions.

- Analysis of “Azuki” in Bear Market: Development Plan and Status

- Who are the internal “leakers” behind Binance’s multiple regulatory accusations?

- Gary Gensler’s Crypto Game: Stealing the Spotlight from Congress to Illuminate the SEC’s Path

- Understanding the Distributed AI Computing Network Gensyn

- Office of the New York Attorney General Provides Tether-Related Documents in Response to CoinDesk