Cryptocurrency Track Weekly Report [2023/09/11] ETH Staking Rate Rises, Layer2 TVL Declines

Crypto Track Weekly Report [2023/09/11] ETH Staking Rate Up, Layer2 TVL Down

【Summary】

Lending: Venus announces the Prime program, which aims to incentivize the staking of XVS tokens. The program is expected to launch in Q4.

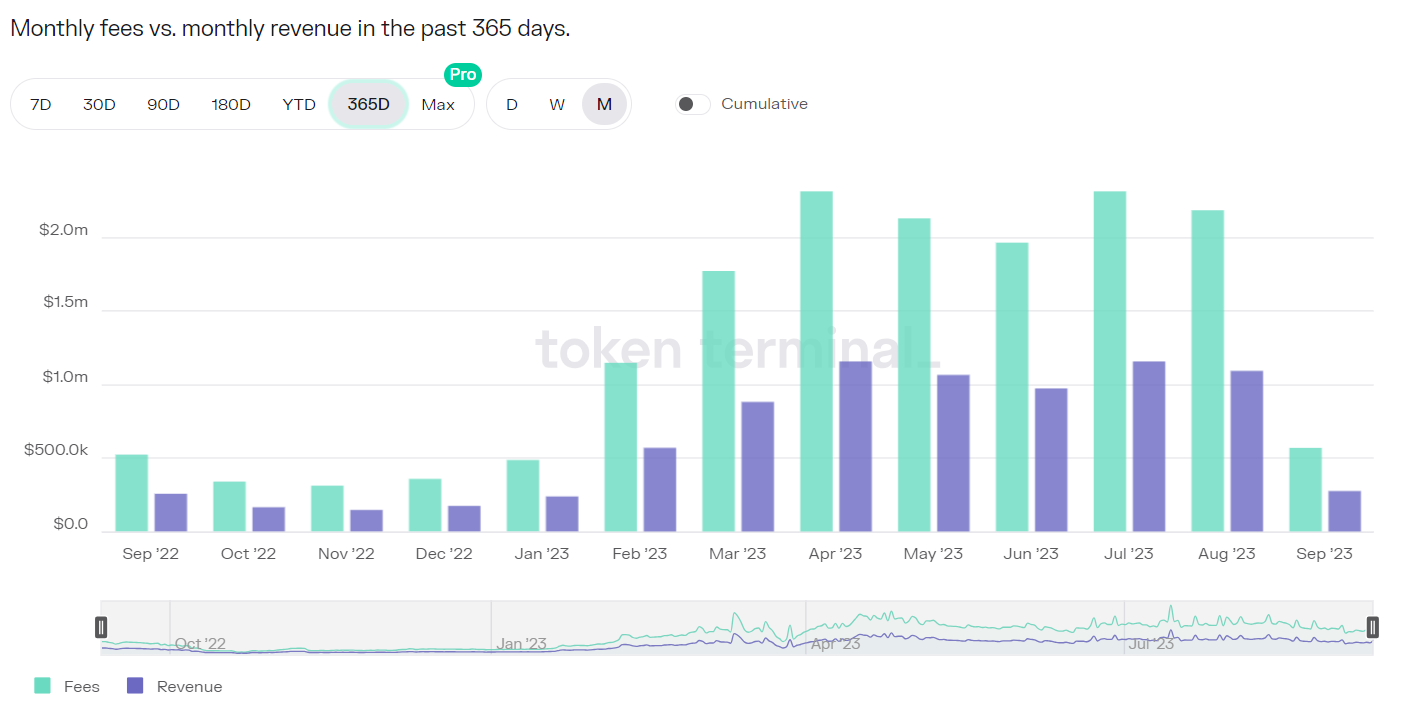

LSD: Last week, the staking rate of ETH increased to 22.16%, an increase of 0.44% compared to the previous week. Last week, there were 26.59 million ETH locked in the beacon chain, corresponding to a staking rate of 22.16%, an increase of 0.44% compared to the previous week. Among them, there were 787,600 active validator nodes, an increase of 1.94% compared to the previous week, and 39,200 nodes in the queue for validation, a decrease of 21.35% compared to the previous week. This week, the staking yield of ETH is about 3.80%.

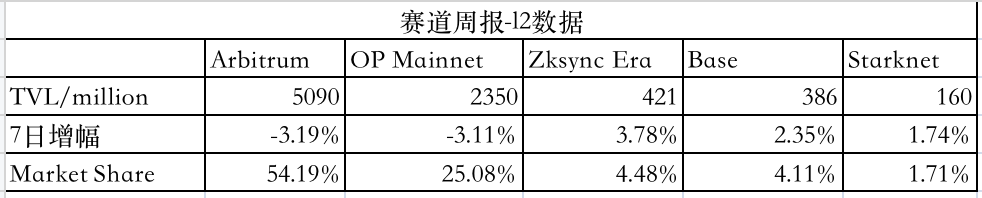

Ethereum L2: The total value locked (TVL) of Layer2 decreased by $230 million compared to the previous week, with a total locked amount of $9.4 billion. BaseTVL is approaching the Zksync Era, actively deploying the ecosystem. Last week, the first batch of six investments of the Base ecosystem fund was announced, and it joined the tokenization alliance (TAC) and Circle launched native USDC on Base and OP Mainnet.

- In-Depth Analysis of Coinbase’s Proposal for Flatcoin How to Design an Inflation-Adjusted Stablecoin?

- Why should MakerDAO choose Cosmos instead of Solana?

- An Instrument for Observation, Decision-making, and Trading – Friend Tech Tools.

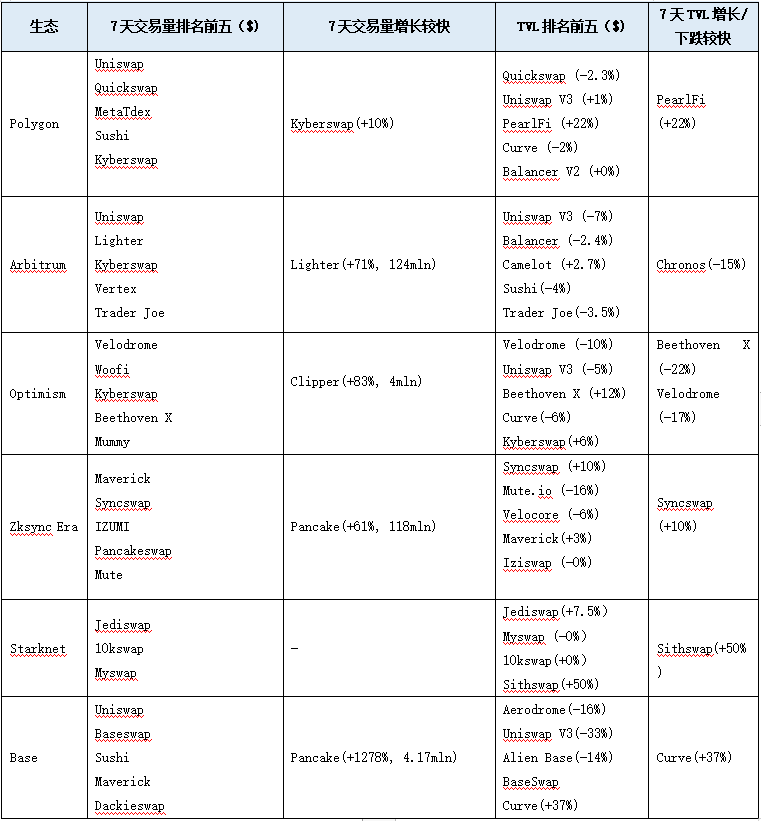

DEX: The combined TVL of DEX is $11.74 billion, which is the same as last week. The 24-hour trading volume of DEX is $1.38 billion, and the 7-day trading volume is $9.5 billion, a decrease of $2.5 billion compared to last week. The market trading volume is weak.

Derivative DEX: The trading volumes of the major derivative DEX in the past two weeks were $6.4 billion and $4.8 billion respectively. The trading volume has shrunk again and returned to the lower range of the year. After the big drop of BTC and ETH on August 18th, it entered a sideways oscillation and downward range. DYDX still ranks first in trading volume, with a weekly trading volume of $2.8 billion; Synthetix ranks second with $790 million; Vertex has a trading volume of about $490 million; GMX has only $150 million in weekly trading volume, and the shrinkage is the most severe.

【Lending】

Venus

Venus, a leading lending protocol on the BSC chain, announces the Venus Prime program, which allows eligible XVS stakers to receive Soul-Bound Prime Tokens. These tokens provide specific asset market boost rewards, and the program aims to incentivize XVS staking.

Eligibility:

– Non-retrospective OG Prime Token

1) Users need to lock XVS for 12 months

2) Users need to use the Venus lending market at least once a month within a year

– Retrospective Prime Token

1) Users need to stake at least 1,000 XVS for a period of 90 days within a cycle to receive the tokens upon maturity

2) If users decide to withdraw XVS and the staked quantity is less than 1,000, the Prime Tokens will be destroyed

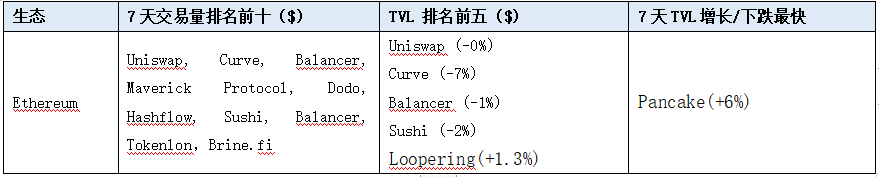

The Prime Token rewards come from protocol revenue, which is the borrowing fees minus the depositors’ earnings. Based on the token terminal data from the past year, when the Venus protocol has good monthly revenue, it can reach around $1 million, while in months with lower revenue, the monthly revenue is only around $200,000.

Source: token terminal

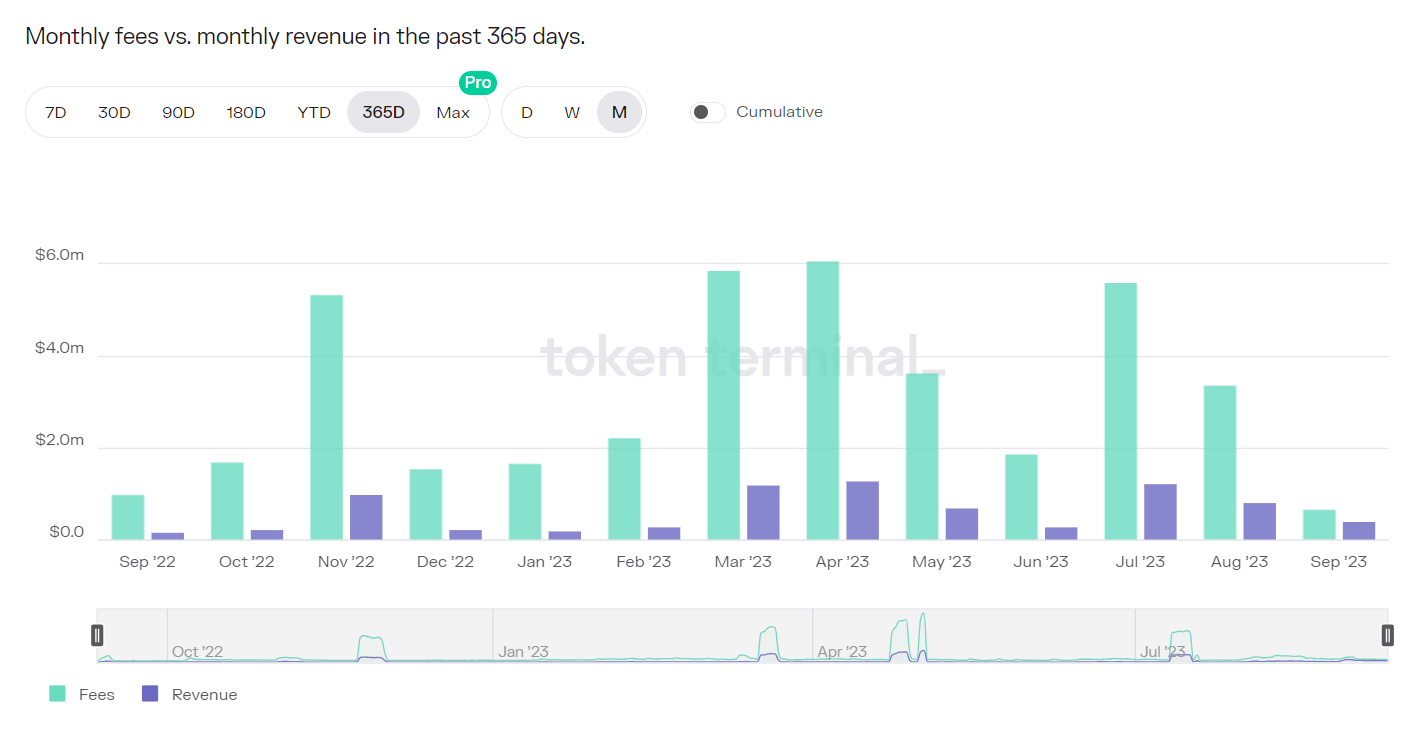

The second-ranked lending protocol on the BSC chain is Radiant. Radiant is deployed on both Arbitrum and BSC, and its monthly revenue is currently stable at around $1 million. In comparison, Venus protocol has average revenue, so the boost to the Prime plan may be limited.

Source: token terminal

【LSD】

Last week, the ETH staking rate rose to 22.16%, an increase of 0.44% compared to the previous week. Last week, there were 26.59 million ETH locked in the beacon chain, corresponding to a staking rate of 22.16%, an increase of 0.44% compared to the previous week. Among them, there were 787.6 thousand active validating nodes, an increase of 1.94% compared to the previous week, and 39.2 thousand validating nodes in the queue, a decrease of 21.35% compared to the previous week. The staking yield for ETH this week is about 3.80%.

ETH staking growth slows down

Staking yield for ETH this week is 3.80%

Among the three major LSD protocols, in terms of price performance, LDO fell by 6.4% last week, RPL fell by 11.5%, and FXS fell by 9.4%. In terms of ETH staking volume, Lido increased by 1.04% last week, Rocket Pool increased by 1.19%, and Frax increased by 0.51%. The current deposit pool balance of Rocket Pool is 17,744 ETH, with a staking rate of 48.92% and an effective staking ratio of 92.01%. There are many nodes that need to replenish collateral. This week, we will pay attention to the third mainnet launch meeting of SSV. In the third phase of the SSV mainnet launch, partner staking of ETH will be introduced, and the TVL of the SSV network will start to increase, and the protocol will start capturing revenue. Frax V3 has entered the code auditing phase and the specific launch time has not been announced yet.

【Ethereum L2】

TVL

The total TVL of layer2 decreased by $230 million compared to last week, with a total locked value of $9.4 billion

Source: L2beat, LD CapitalProgress of Cancun Upgrade

On September 7, 2023, Ethereum core developers held the 117th All Core Developers’ Consensus (ACDC) conference call.

(1) Regarding Dencun Testing, developers are continuing to test the Cancun/Deneb (Dencun) upgrade on Devnet #8. Barnabas Busa, a DevOps engineer at the Ethereum Foundation, stated that Devnet #8 is still healthy and stable. In this meeting, the release of Devnet #9 was postponed by one week to next Tuesday (September 19).

(2) Etan Kissling, a developer of the Nimbus (CL) client, is working on upgrading Ethereum’s data structure to a new serialization format called SSZ (which essentially combines all the advantages of the previous format and can also be reused for other purposes, eliminating the current unused SSZ Union and SSZ Optional types). He named this new approach for the upgrade “StableContainer” and formatted it into a formal Ethereum Improvement Proposal (EIP).

(3) Holesky testnet will launch this Friday, September 15th.

Base

The growth rate of TVL has slowed down, with a weekly growth of 2.35%, but the total TVL is already close to Zksync Era.

(1) The Base ecosystem fund led by Coinbase Ventures was launched earlier this year, aimed at investing in next-generation on-chain projects based on Base. On September 8th, the Base ecosystem fund announced the first batch of six investments from over 800 applications: Avantis, BSX, Onboard, OpenCover, LianGuairagraph, and Truflation.

Avantis is a synthetic derivative protocol based on oracles, allowing users to trade cryptocurrencies and real-world assets with leverage of up to 100x and earn profits by providing USDC liquidity as a market maker.

BSX is building a decentralized limit order book for users to use leverage for long and short positions.

Onboard provides users with an on-chain, self-custodial path to transfer cryptocurrencies in a peer-to-peer manner using their own MPC wallet and smart contract.

OpenCover is the first L2 insurance aggregator working with underwriters such as Nexus Mutual to protect DeFi users from on-chain risks such as smart contract hacks and oracle failures.

LianGuairagraph is an on-chain creator platform that helps creators publish, share, and build businesses around their content, using permissionless protocols to enhance growth and profit potential.

Truflation is an on-chain financial oracle that provides automated, independent daily inflation reports by compiling data from 18 million points and over 40 data sources in real-time.

(2) Circle launches native USDC on Base and OP Mainnet.

(3) Base has joined the Tokenized Assets Consortium (TAC), which aims to promote the adoption of public blockchains and asset tokenization, solving the inefficiencies of traditional finance and paving the way for the native financial system of blockchain. The alliance members include Aave, Centrifuge, Circle, Coinbase, Credix, Goldfinch, and rwa.xyz.

Arbitrum

Offchain Labs has withdrawn 2.279 million ARB (equivalent to 2.07 million USD) from Binance over the past week, with an average price of 0.91 USD. Since August 23rd, a total of 5.367 million ARB (equivalent to 5.07 million USD) has been withdrawn from Binance, with an average price of 0.94 USD.

Starknet

(1) On September 5th, Starknet announced the deployment of version V0.12.2 on the mainnet. This version includes some key upgrades to improve the performance and reliability of the network:

Enabled P2P identity verification through a new endpoint, which can sign based on state differences;

Resolved some mismatch issues between pending blocks and pending state updates;

Increased the maximum step per transaction from 1M to 3M;

The maximum throughput and TPS have also been improved, enhancing the overall speed and scalability of the network.

(2) On September 6th, Starknet announced that its core stack has been fully open-sourced, including Full Node, Execution Engine, Sequencer, and Prover.

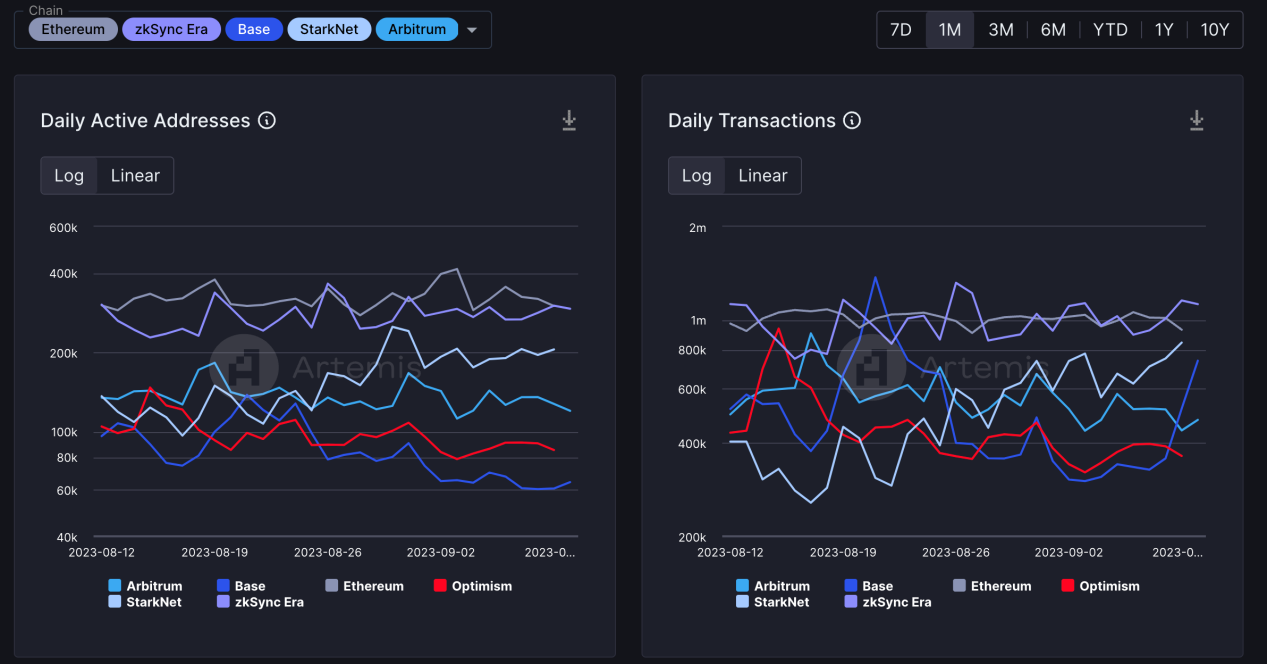

Blockchain Activity

Source: Artemis

【DEX】

Dex combined TVL remains at 11.74 billion, unchanged from last week. Dex 24-hour trading volume is 1.38 billion, with a 7-day trading volume of 9.5 billion, a decrease of 2.5 billion from last week, indicating a sluggish market trading volume.

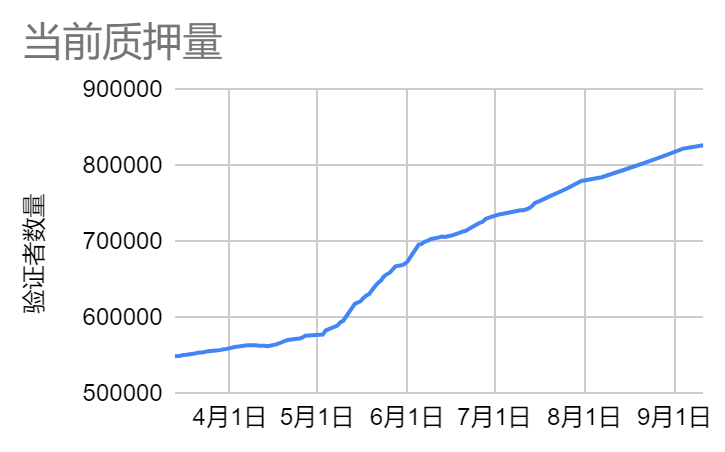

Ethereum

ETH L2/sidechain

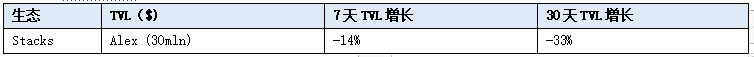

BTC L2/Sidechain

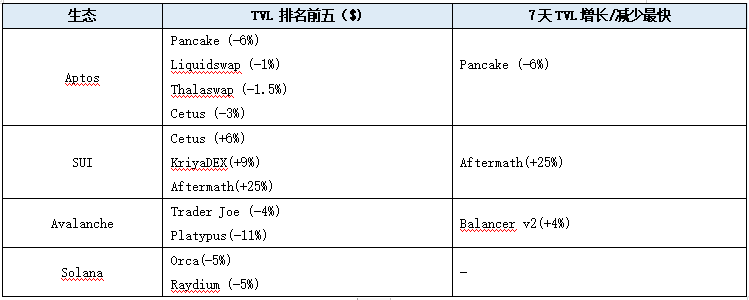

Alt L1

【Derivative DEX】

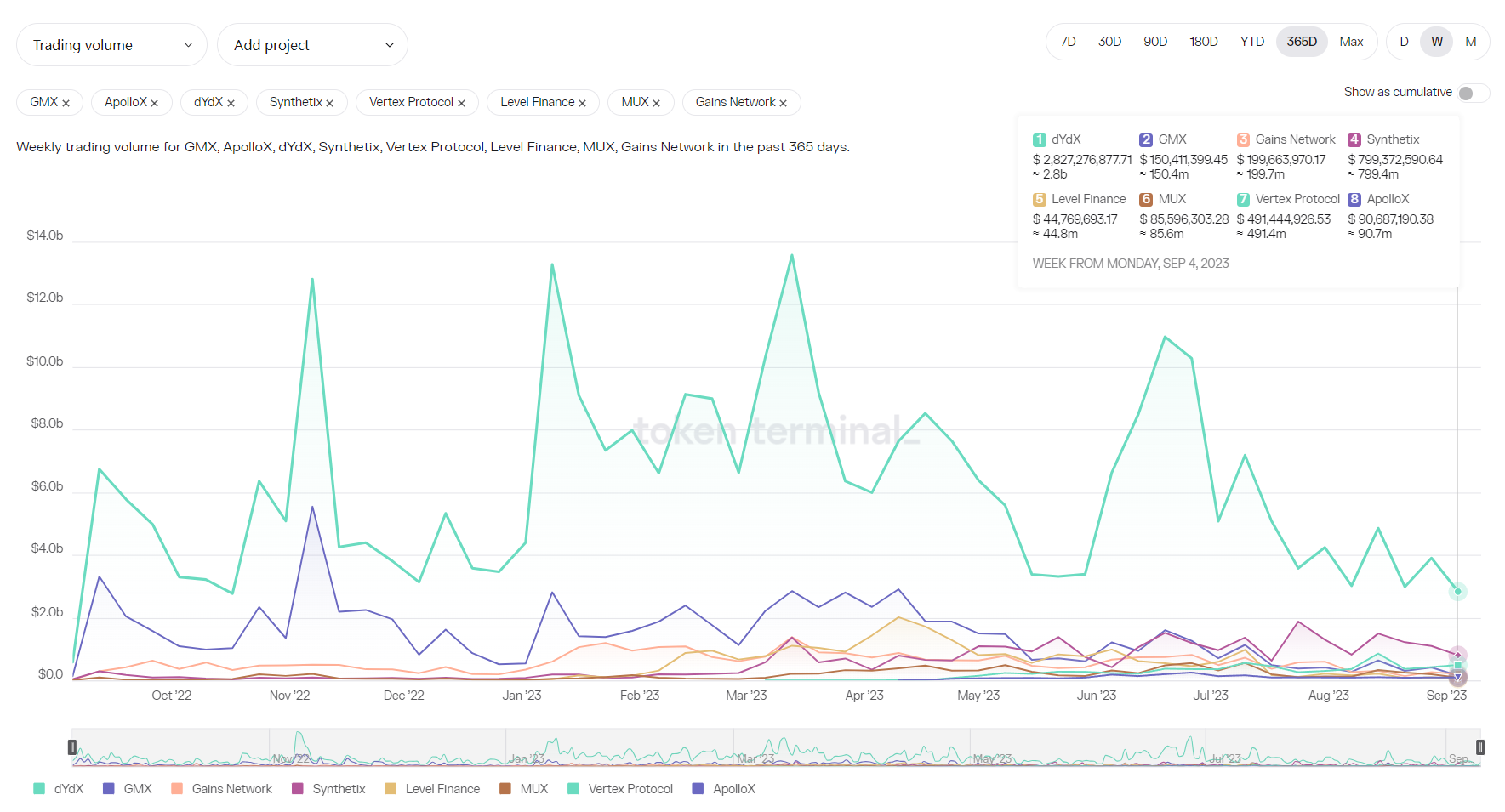

The trading volume of major derivative DEX in the past two weeks was 6.4 billion USD and 4.8 billion USD respectively, indicating a further contraction of trading volume, reaching the lowest level this year. After the sharp decline in BTC and ETH on August 18th, they entered a sideways downward trend. DYDX remains the top in terms of trading volume, with a weekly trading volume of 2.8 billion USD; Synthetix comes next with 790 million USD; Vertex has a trading volume of about 490 million USD; GMX has the lowest weekly trading volume of only 150 million USD, indicating the most significant contraction.

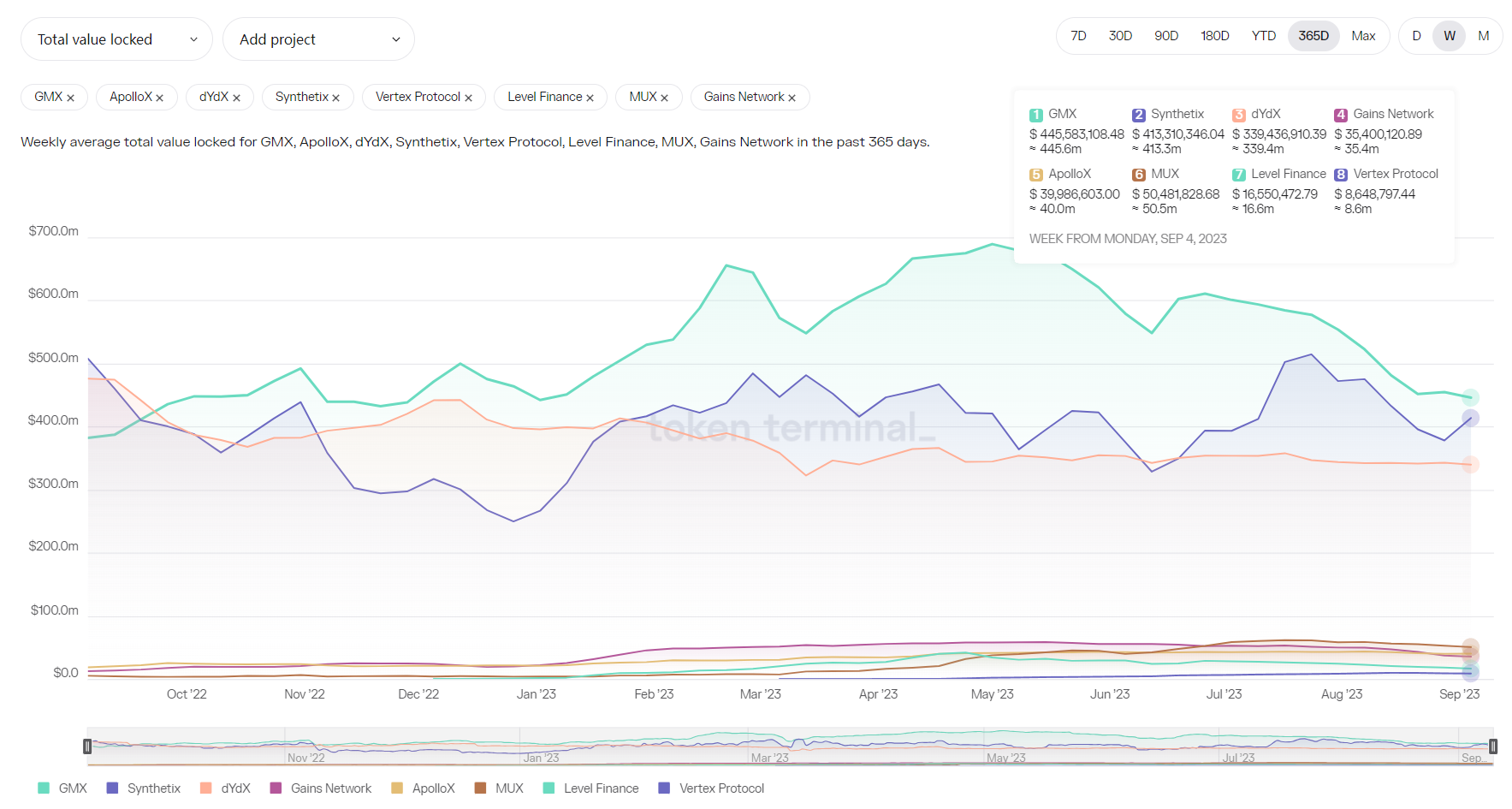

In terms of TVL, the overall TVL of derivative DEX is still declining, with funds slowly flowing out.

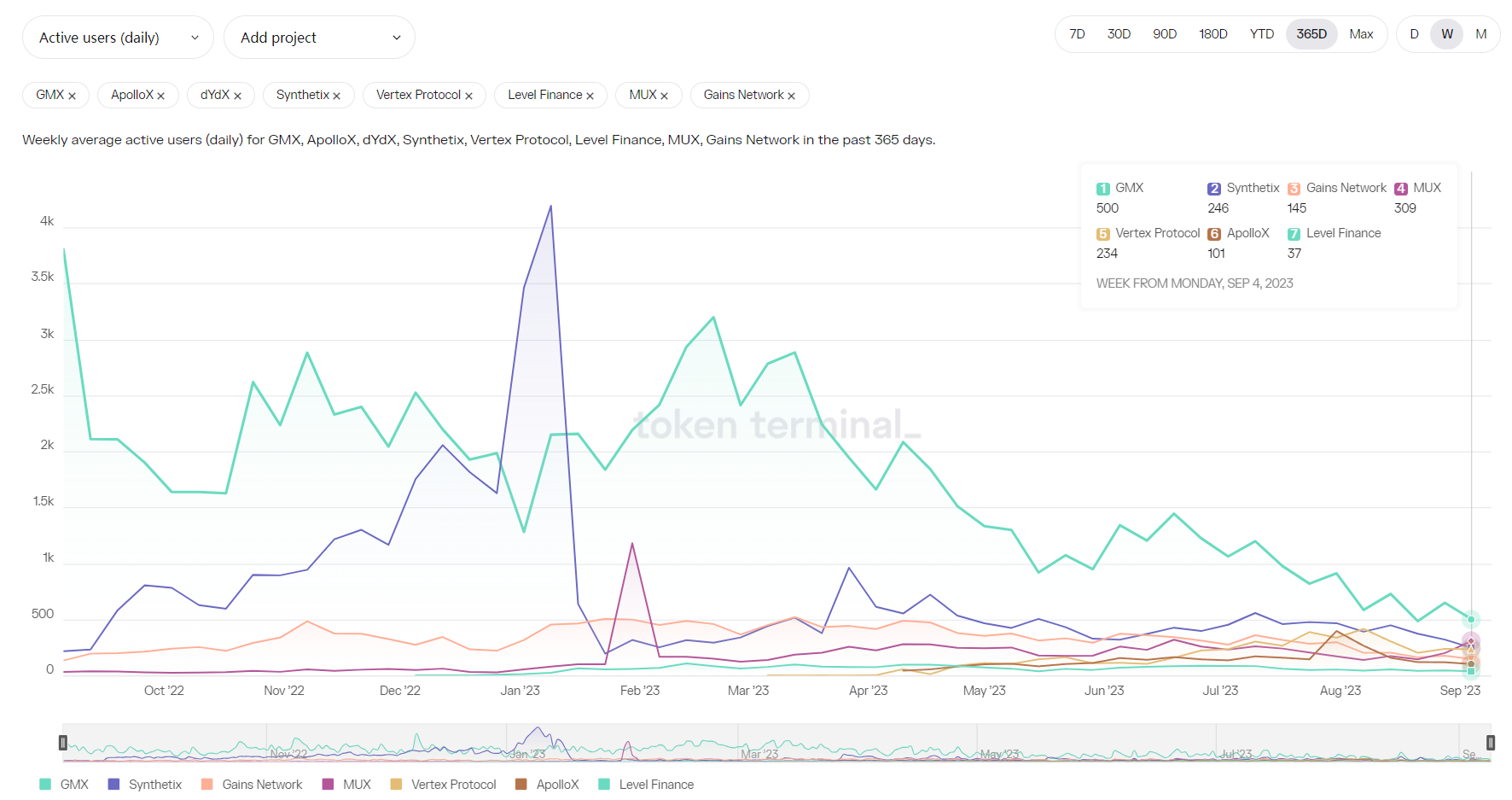

In terms of users, the number of daily active users of derivative DEX continues to decline. GMX has 500 daily active users, making it one of the most active protocols. Although Synthetix and Vertex have higher trading volumes than GMX, their daily active users are only about half of GMX’s. DYDX has not disclosed its daily active users, but according to its report for the 26th epoch (28 days), the number of people who deposited margin during this period was 1,932, a 12% decrease from the previous period.

Source: tokenterminal

Project Progress:

l dYdX releases semi-annual report

dYdX Foundation has released its semi-annual report, stating that the current focus is still on enabling dYdX DAO and preparing for the release of the open-source software for dYdX v4 (dYdX chain).

Regarding the progress of dYdX v4, on August 23, 2022, dYdX Trading Inc. announced the milestone 4 of the dYdX protocol entering dYdX v4. According to the previous plan, V4 has a total of 5 milestones, with milestone 4 being the public testnet phase where anyone can become a staking node for the dYdX chain and participate in validation. Milestone 5 will officially release the dYdX chain. There are approximately 57 validators participating in the v4 public testnet #2 of dYdX Trading. The current block time of the public testnet is 1.8 seconds, with over 2.9 million transactions and over 2.9 million bonded tokens.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Interpreting Arweave Atomic Assets and Its Ecosystem A New NFT Paradigm Paving the Way for Creators’ Migration

- Dark version of Friend.tech? A quick look at nofriend.tech, a social platform that converts friendship into rewards.

- What are the legal risks of NFT digital collectibles playing lottery?

- The Wonderful Use of Tokens in the Web3 Gaming Sector Incentivizing Community Engagement and Enhancing Network Effects

- TaxDAO Writes to the U.S. Senate Finance Committee Addressing the 9 Key Issues of Digital Asset Taxation

- Connext has made another mistake? Learn about the Connext airdrop claim incident in one article.

- The roller coaster trend behind Cyber explosive long liquidation, short selling, and a carefully planned hunting game by market makers.