LianGuai Daily | Hong Kong officially regulates stablecoins and temporarily does not allow retail trading; El Salvador launches its first Bitcoin mining pool

Hong Kong regulates stablecoins and suspends retail trading; El Salvador launches first Bitcoin mining pool.Today’s news highlights:

Curve initiates proposal voting in the Arbitrum community, planning to apply for a maximum of 50 million ARB incentive budget

Hong Kong Financial Secretary: Retail trading of stablecoins not allowed until official regulation

THORSwap temporarily transitions to maintenance mode due to illegal funds using THORChain

- Understanding the Current Status and Future Development Direction of Blockchain Data Business with One Article

- NDV Practical Insights Profit and Cost Analysis of BTC Mining Industry

- Calls for the adoption of cryptocurrencies are rising in sub-Saharan Africa.

Southern Fund’s Bitcoin ETF has a yield of up to 54.63%, with multiple public fund giants entering the digital currency market

El Salvador launches its first Bitcoin mining pool, utilizing geothermal energy

Data: FTX attacker has converted approximately $124 million worth of ETH into BTC

Regulatory news

Bloomberg: US CFTC considering enforcement action against former Voyager CEO

The enforcement department of the US Commodity Futures Trading Commission (CFTC) is internally recommending bringing charges against Stephen Ehrlich, the former CEO of Voyager, alleging that he violated the agency’s regulations and misled customers about the security of their assets. Sources say that CFTC commissioners are currently voting on whether to approve enforcement action against him within days.

Hong Kong Financial Secretary: Retail trading of stablecoins not allowed until official regulation

According to Ming Pao News, Hong Kong’s Financial Secretary Christopher Hui said in a radio interview that stablecoins, which are backed by assets such as the US dollar or gold to maintain their value, have experienced price fluctuations and even collapses in the past. The management of reserves by stablecoin issuers can affect price stability and the rights of investors to redeem fiat currencies. Taking these factors into consideration, retail trading of stablecoins will not be allowed until official regulation is in place in Hong Kong.

Taiwan lawmakers aim to propose a special law on cryptocurrencies by the end of November to prevent regulatory arbitrage

According to The Block, lawmakers in Taiwan aim to propose a special law on cryptocurrencies for a first reading by the end of November this year to prevent regulatory arbitrage. Legislator Jason Hsu stated that it is necessary to have a specific law to regulate cryptocurrency companies as cryptocurrencies differ from traditional financial products in many aspects. In addition, Jason Hsu held a public hearing in Taiwan’s Legislative Yuan today to discuss the proposed law with virtual asset service providers, legal experts, and scholars.

European Securities and Markets Authority releases second consultation paper on MiCA

According to Cointelegraph, the European Securities and Markets Authority (ESMA) has released its second consultation paper on the Markets in Crypto-Assets Regulation (MiCA) in the European Union. ESMA is seeking feedback from stakeholders on five areas of MiCA, including sustainability indicators for distributed ledger technology, internal disclosure of information, technical requirements for whitepapers, transparency measures for transactions, and record keeping for crypto-asset service providers (CASPs).

Singapore to establish inter-agency committee to review the anti-money laundering system

According to official sources, Singapore will establish an inter-agency committee to review the anti-money laundering system in light of the recent discovery of Singapore’s largest money laundering case. Relevant personnel will be appointed by institutions such as the Monetary Authority of Singapore, with the Second Minister for Finance and the Ministry of National Development serving as the committee chair. Singapore will subsequently re-examine the anti-money laundering system from the perspective of foreign individuals purchasing and holding local real estate, as well as the registration and operation of corporate entities.

NFT

Project Updates

Curve initiates proposal voting in the Arbitrum community to apply for a maximum budget of 50 million ARB as an incentive

Curve has initiated a proposal voting in the Arbitrum community regarding the application for a Short-term Incentive Program (STIP), planning to apply for a maximum budget of 50 million ARB specifically for providing incentive grants to eligible protocols. Successful applicants will receive funds after coordination with the Arbitrum Foundation and STIP-ARB multi-signature, subject to the completion of KYC and the signing of the Arbitrum Foundation funding agreement by each applicant.

THORSwap: Temporarily switching to maintenance mode due to illicit funds using THORChain

Cross-chain DEX aggregator THORSwap tweeted that illicit funds may be flowing through THORChain, especially THORSwap, recently. THORSwap firmly opposes any criminal activity. Therefore, after careful assessment and consultation with advisors, legal advisors, and law enforcement agencies, it has been decided to temporarily switch the THORSwap frontend interface to maintenance mode to quickly contain any further potential illegal activities. THORSwap will remain in maintenance mode until a more lasting and better solution can be implemented. Currently, there are no specific or further details to share, but updates will be provided in a timely manner.

1confirmation Founder: First fund has distributed cash returns of 5.13x to LPs, net DPI of second fund is now 1.78

Venture capital firm 1confirmation’s founder Nick Tomaino tweeted that the latest cash distribution has just been made to LPs. The first fund launched in 2017 has distributed cash returns of 5.13x to LPs, and the net DPI (Distributable Profit Index, the ratio of distributable cash returns to committed capital) of the second fund launched in 2019 is now 1.78.

Crypto KOL: FTX debt claims ranging from $100,000 to $1 million can be negotiated at around 32%-37% of the price and paid in a lump sum

Crypto KOL and former FTX community partner Benson Sun tweeted that debt claims from medium-sized creditors (ranging from $100,000 to $1 million) can now be negotiated at around 32%-37% of the price and paid in a lump sum, without installment payments.

Bitcoin ETF fund under Southern Fund has a yield rate of up to 54.63%, several public fund leaders enter the digital currency market

According to a report from Securities Times, Wind data shows that the highest return rate of fund products this year is 55.32%, and the second highest return rate of fund products is 47.5%. The fund with the highest loss has lost 40% of its net value this year. This data does not include alternative products operated by public fund overseas subsidiaries. Taking Southern Fund as an example, the return rate of a Bitcoin ETF fund operated by its Hong Kong subsidiary has reached 54.63% this year. This performance has surpassed 99% of domestic public fund products, whose main investment target is stock assets. The report also pointed out that the strong performance of Bitcoin and Ethereum may benefit star fund managers who enter alternative investments, including former public fund leader Xiao Feng and former top stream Wang Yawei.

Action RPG blockchain game Ascenders will stop game development, and the company will cease operations

AAA-level action RPG blockchain game Ascenders recently announced on Discord that it will stop developing games, and its company will also cease operations. The announcement stated that the Land NFT casting results prepared by the team in May 2023 did not meet expectations. According to niels, who claims to be an angel investor of Ascenders, the investment has been written off to zero, and it was learned in July this year that the company is facing bankruptcy due to lack of remaining funds.

El Salvador launches the first Bitcoin mining pool, utilizing geothermal energy for mining

According to The Block, El Salvador renewable energy and mining company Volcano Energy and Bitcoin mining software provider Luxor Technology jointly launched “Lava Pool”. This is the first Bitcoin mining pool in El Salvador, aiming to mine Bitcoin using the country’s abundant geothermal energy. According to a statement, Volcano Energy will exclusively mine through the mining pool and donate 23% of its net income to the Salvadoran government as part of a public-private partnership.

Funding news

Crypto startup Burnt receives strategic investment from Circle Ventures and launches XION public testnet

Crypto startup Burnt announced that it has received strategic investment from Circle Ventures, but did not disclose the specific amount, and launched the XION public testnet. XION uses USDC as the main trading currency, allowing any application built on XION to price assets in USDC. The fees generated from USDC will be collected and exchanged for native tokens, which will be distributed to validators.

Web3 social app Phaver completes $7 million seed round financing, with an estimated valuation of about $80 million

Web3 social app Phaver announced that it has completed a $7 million seed round financing, with participation from Polygon Ventures, Nomad Capital, Symbolic Capital, dao5, Foresight Ventures, Alphanonce, f.actor, Superhero Capital, SwissBorg, and other institutions. So far, it has raised a total of over $8 million in funding, with an estimated valuation of about $80 million. The funds raised this time will be used to expand the team, product development, and other partner relationships.

Important data

Data: The attacker of FTX has cumulatively exchanged approximately $124 million worth of ETH for BTC

According to the monitoring data from Lookonchain, as of the time of writing, the FTX attacker has exchanged a total of 75,636 ETH ($124 million) into BTC and cross-chain transferred to the Bitcoin network, currently still holding 109,485 ETH ($179 million).

Data: The number of independent user addresses on Coinbase L2 network Base has exceeded 310,000.

Data from Dune shows that the number of independent user addresses on Coinbase’s Layer 2 blockchain Base, built on the OP Stack, has surpassed 319,000, bridging a storage value of nearly 211,000 ETH.

The LianGuaiNews APP Points Mall is officially online

Hardcore prizes for free redemption: imKeyPro hardware wallet, First Class Research Monthly Card, Ballet REAL series wallet, AICoin membership, various peripherals, and hundreds of selected research report collections, first come first served, experience it now!

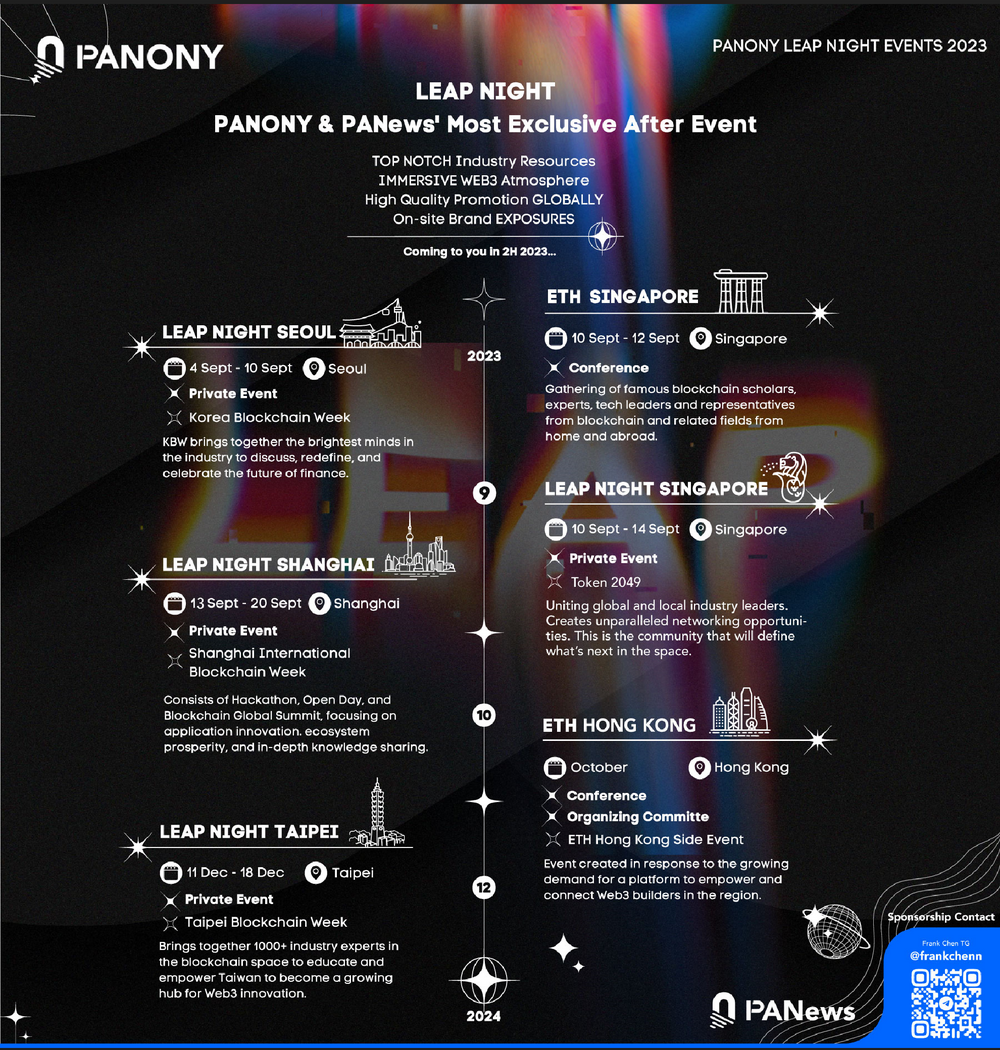

LianGuaiNews launches the global LEAP tour!

Korea, Singapore, Shanghai, Taipei, multiple locations will gather from September to December to witness a new chapter in globalization!

📥Multiple activities are under construction, welcome to communicate!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Galaxy Digital Bitcoin Ordinals Protocol Research Report Important Data, Impact on Bitcoin, and Latest Developments

- Andrew Kang Cryptocurrency and stock market correlation has dropped to a low level and will continue to stay that way.

- LianGuai Observation | Explaining why Hong Kong can become the engine of the East Asian Web3 market

- LianGuai Morning News | The supply of Bitcoin on exchanges has decreased from 5.99% since September 1st to 5.73%.

- LianGuai Daily | Bitcoin temporarily stabilizes above $28,000; FTX founder SBF’s trial will begin tomorrow, with jury selection on the first day.

- Analysis Why will the bull market start as early as next year from the perspective of the halving period?

- Wu’s Selection Zhu Su of Three Arrows suddenly arrested, Binance exits Russia, Mixin hacked for 200 million, MicroStrategy continues to buy BTC, and Top 10 news.