Articles about Search Results BlackRock - Section 22

- You may be interested

- LingTing · Blockchain General Know...

- Research | Domestic encryption algorith...

- Burger King announced that it will acce...

- Babbitt Column | Trustworthy Lightning ...

- A Venezuelan self-report: In Caracas, I...

- US Congressman: Encrypted currency is r...

- Bitcoin market is like a roller coaster...

- False exit, true entry: SEGA is raising...

- a16z Research on the Impossibility of S...

- Is RWA the next growth engine for DeFi?

- "False" gold disrupts the mar...

- April 2 market comment: stock price lin...

- Unveiling the Rise of Lido: How it Cons...

- Analysis of the development status of t...

- 7 things we need to know before the Fac...

The “economic” logic behind the rise of Bitcoin

Looking back on the more than 14 years of development of Bitcoin, we find that it has gone through a rough development path from…

First leveraged Bitcoin ETF in the US quietly opens, with a first-day trading volume of nearly $5.5 million.

On June 27th, New York time, the first leveraged Bitcoin ETF in the United States (stock code: BITX) began trading on the CBOE BZX…

What are the considerations behind the “coveted” grayscale Bitcoin spot ETF?

BlackRock does not directly hold Bitcoin, it only manages client assets and provides clients with more cost-effective Bitcoin purchase services.

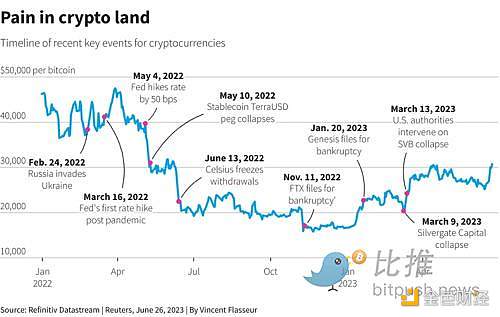

Regulatory intervention creates a “bottom” for the market. How will Wall Street’s entry during the chaos affect the industry?

Why have these financial institutions suddenly changed their stance on cryptocurrency? What impact does this have on the industry? Could this trigger a new…

How will Wall Street’s entry into the market during the regulatory “bear” bottom affect the industry?

As the US Securities and Exchange Commission (SEC) takes regulatory action against top cryptocurrency exchanges such as Binance and Coinbase, and the cryptocurrency market…

What are the considerations behind the Bitcoin spot ETF of “coveted” Belmont?

BlackRock does not directly hold bitcoin. It only manages client assets and provides clients with cost-effective bitcoin purchasing services. Written by huf, co-founder of…

Will the rebound of Bitcoin prompt large institutions to take action, and will the regulatory framework for cryptocurrency assets become a political achievement of the election?

With 1 year until the next election, will the U.S. encryption regulation bill become a political achievement? The fact that major institutions are betting…

Weekly Selection | Multiple institutions apply for Bitcoin spot ETF; Wall Street-backed exchange EDX Markets to launch; Bitcoin rebounds to $30,000, did the old money enter the market?

Multiple traditional financial giants apply for Bitcoin futures ETF; is old money coming in? EDX Markets, a Wall Street background exchange, will go live.…

Circle restarts buying US treasury bonds as USDC reserve assets

According to CoinDesk, the Circle Reserve Fund, managed by BlackRock, has begun purchasing US Treasury bonds as part of its $28 billion USDC reserve…

Bitcoin rebounds as hidden currents surge in the market

If the stock market is an economic barometer of a country, then Bitcoin is the compass of the global cryptocurrency market. Its every move…

Find the right Blockchain Investment for you

Web 3.0 is coming, whether buy Coins, NFTs or just Coding, everyone can participate.