Perspectives | MOV Ecology and Blockchain Thinking

1 Pain points of the blockchain industry

We often wonder whether the positive attitude of the government, the positive reports of the media, the accumulation of funds and talents, the world of the blockchain seems bright, but when you look down at the reality, you will find that the journey is long and distant. Seems not to see a little light.

Not only to reflect, what problems in the blockchain world have not been resolved, and what factors are blocking the development of blockchain.

When we look back, we will find that in our decentralized ecology, the two most important links, the exchange and the stablecoin, are all centralized.

- Babbitt Site | Super Ledger Beyond Fabric, 15 Projects in Progress, Reward 9 Cases

- Can't beat Bitcoin in 2019, where is the strength of Ethereum in 2020?

- ECB President makes clear statement on stablecoin: EU should lead the world in stablecoin projects

Exchanges often lose coins and are stolen, as far away as Mentougou in Japan, and recently as the theft of Binance, the security issues of exchanges have been consistently criticized. All two-thousandths of the transaction fees for transactions are subject to USDT cuts when entering and exiting the exchange. USDT is not financially transparent, and it is not known whether the mortgage is sufficient or not, and whether there are multiple currencies.

Concerns about centralized exchanges and stablecoins have reduced the credibility of the blockchain. The huge profits of exchanges and stablecoins still come from monopoly and information asymmetry. Does this production relationship violate the original intention of the blockchain and What about nature? If the exchanges and stablecoins are not secure and credible, how to make outsiders believe that blockchain can create value, how to convince financial institutions to solve security and trust, and how to convince governments to serve entities?

2 Blockchain thinking

In order to solve the problem of the centralization of the stablecoin of the exchange, it is still necessary to return to the nature and thinking mode of the Internet and blockchain.

In essence, both exchanges and stablecoins belong to the traditional information Internet thinking. The Internet thinking focuses on aggregation and maps physical stores to the Internet. For example, Tmall aggregates multiple malls into one platform for transactions, and provides trust through transaction history, ratings, reviews, and third-party payments. Everyone can buy and sell things on the same platform based on this trust, opening up an information island. , Reducing the cost of rent, utilities, etc.

But when the Internet reaches a certain scale, it will be found that the platform's use of monopolies is becoming larger and larger, and even if businesses do not make money, they still have to pay a lot of fees for the platform every year. Most of the profits of operating entities have been continuously exploited by centralized platforms using monopoly advantages.

The difference between blockchain and the Internet is that blockchain thinking uses the underlying decentralized protocols, such as the ecology of Bitcoin, to decouple centralized institutions into competing individuals, and then use consensus mechanisms and shared ledgers to separate individuals. Establish trust between them, and provide incentives for the ecology to open up the island of value and align the interests of all parties involved, thereby forming a win-win economy capable of self-sustainable development.

Therefore, the essence of the blockchain is the supplement of the Internet. It must not only converge, but also break monopoly, open up islands of value, reduce transaction costs, and return benefits to profit creators.

3 MOV ecology

As mentioned above, the way that the blockchain's thinking solves the problem is not to establish a DAPP or a decentralized exchange, but to establish a decentralized transaction agreement and ecology, and use the incentive of the currency to fully mobilize the enthusiasm of each ecological role, so that each participating Subjects can get their own created benefits.

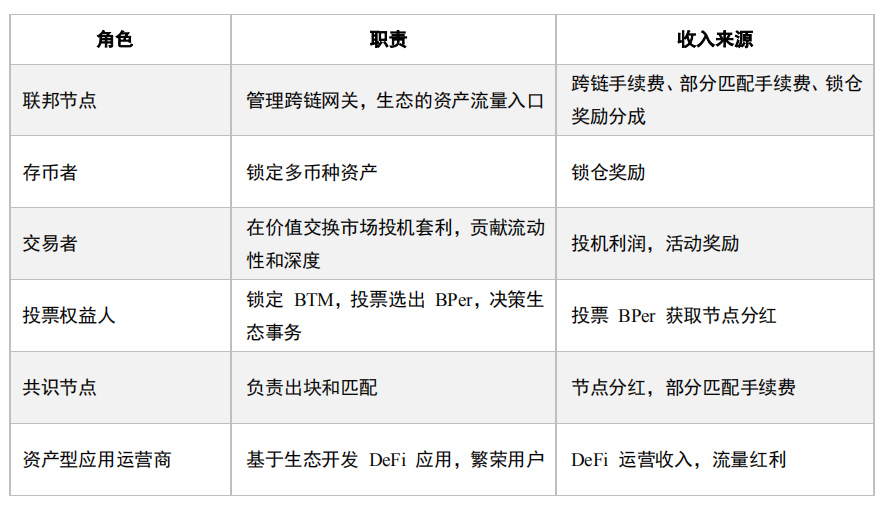

The MOV protocol is to make full use of the blockchain thinking to decouple a one-to-many relationship between a center of the exchange and multiple traders into six participating roles.

These six roles are federal nodes, depositors, traders, voting stakeholders, consensus nodes, and asset-based application operators. It also clarified their respective responsibilities and ecological position, and also provided multiple economic sources such as basic income and value-added distribution, to ensure that the operation of the trading system and the enthusiasm of the participants can be maintained in the early stages of the ecology and in the medium and long term.

At the same time, MOV ecological incentives have a self-consistent economic closed loop, set clear economic inputs and economic outputs for each participant and each link, and always maintain a dynamic balance of cost and benefit ratios at different development stages. The economic behavior of the six roles is closely coordinated to form a complete ecological cooperative body.

For traders: It is not necessary to transfer assets to a centralized exchange, which significantly improves security, and allows transactions to be carried out securely in a wallet in which the private key is held, which brings great convenience and reduces transaction costs.

For matching nodes: decoupling centralized exchanges and transforming centralized matching into multi-node competitive matching, some small exchanges no longer need to make great efforts to reach the resources of the users they are robbing, as long as they strive to improve their matching efficiency, Can obtain considerable benefits in the MOV ecology.

In the field of virtual assets, MOV's decentralized transaction protocol transforms the centralization firm into a multi-competitive ecosystem, which truly solves the problems of insecure centralized exchanges and the loss of coins caused by hackers. A convenient, safe and sustainable decentralized trading eco-economy.

4 MOV implementation

MOV consists of three core modules: a value exchange engine magnetic contract, a decentralized cross-chain gateway, and a high-speed side chain. It is dedicated to building a heterogeneous and integrated diversified asset value exchange collaboration.

The purpose of MOV is to achieve decentralized transactions, and high-speed side chains, gateways, and magnetic contracts are means.

How to realize decentralized transactions and make transactions transparent and traceable is the key to MOV's realization. It is also a sufficient condition for the transaction to be supervised.

One idea is in-chain acceleration. Doing in smart contracts is unsatisfactory and has limited potential. For example, the decentralized exchange NEWDEX on EOS is created by means of smart contracts. Decentralization is guaranteed by open source code and auditing. This method The disadvantages are 1) audit has security risks, and whether the audit is credible. 2) Multiple DAPPs are running on a main chain, resulting in the inefficiency of decentralized exchanges. 3) The assets on the chain are mainly based on the EOS ecosystem, and atomic transactions with other digital assets cannot be achieved, which limits the market cap for transactions.

The second idea is to match off-chain. This way is not auditable.

The third way of thinking is to separate the clearing and settlement and build a clearing chain and a settlement chain.

The above ideas have their disadvantages and cannot solve all the difficulties faced by decentralized exchanges.

It can be clearly seen in the MOV's white paper that the MOV decentralized transaction agreement adopts the matching and mining solution. The content includes (1) separation of the execution of the matching from the verification of the matching; (2) the execution of the matching is undertaken by the off-chain plug-in, and the verification of the matching is undertaken by the on-chain contract; (3) whoever successfully matches first, who shares the revenue of the matching service.

Different exchanges form parallel competition relationships with multiple exchanges under the same conditions. Breaking the monopoly of the central exchange, freeing users from the centralized exchange and operating in the wallet, improving security and trustworthiness, thereby reducing the cost of traders.

From the overall perspective of the blockchain, the monopoly benefits of centralized exchanges such as Binance, Huobi, and OK will be completely eliminated, and some will be returned to the holders and some will be allocated to the ecological participants. This is exactly what MOV means.

5 DEFI on MOV

MOV will provide SDKs for each module, provide an interface for asset data service providers to establish decentralized finance, and open up quantitative strategy support, market maker interfaces and matching interfaces to provide market liquidity. This solves the biggest concern of people, the issue of transaction depth.

After the decentralization of this key element of transactions, whether it is Bitcoin, Ethereum, EOS or other coins, will be able to flow freely. Decentralized transactions make data transactions checkable, transparent, credible and supervisable.

The credibility of the data has further spawned chain oracles, and decentralized stable coins and decentralized finance such as lending can be established based on such trusted transactions.

6 Value of MOV

It can be seen that when we understand MOV, we can't just understand it as just a single point technological breakthrough, but make full use of the blockchain thinking to fully mobilize the wallet parties, exchanges, project parties, traders, and currency holders in the ecosystem. A decentralized financial services ecosystem. By making each of the ecosystems play their own advantages, full competition, and consistent interests, they can solve the old difficulties of centralized exchanges, centralized stablecoins, and centralized P2P, so that the blockchain can truly serve the society, and all transactions are Use BTM as collateral and fuel.

The MOV agreement distributes the monopoly benefits of the original centralized institutions to the ecological participants who contributed in many economies. It may replace the traditional centralized exchange and the centralized stablecoin USDT, that is, the value of MOV may not be less than the value of the centralized exchange. And the decentralized finance established on this basis, such as the sum of the value of stablecoins, loans, and derivatives.

7 Literature

[1] 1 MOV next-generation decentralized cross-chain layer2 value exchange protocol

[2] Evening thinking and digital motivation of company block at dusk Gong Yue Li Lei Yu Hongjun

[3] Probe into Decentralized Transaction Mechanism

[4] A multi-bit asset exchange protocol over the original chain

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Review Ethereum 2019: speak with data

- Industry Blockchain Weekly 丨 31 Provinces Release Policy Information, Blockchain Concept Stocks Expand

- Rebirth! Digital Assets (DA) receives $ 35 million Series C funding led by Australian Securities Exchange (ASX)

- Can smart contracts exist without blockchain? The answer from S & P Global is YES

- Can I understand the blockchain consensus mechanism after watching "Lipstick One Brother" live?

- Omni receives funding from Tether to support new version development, will allow users to buy Bitcoin using any on-chain asset

- Filecoin mainnet test, "first move" miners may be eliminated