Interpreting the Future Path and Star Projects of LayerZero’s Cross-chain Innovation

Previewing LayerZero's Cross-chain Innovation's Future Path and Star Projects.Author: Jill, LD Capital

1. What is Cross-Chain Interoperability?

The current development trend of blockchain is multi-chain parallelism. However, blockchain itself does not have the ability to communicate with external systems or APIs, and data and value cannot be freely transmitted across networks, resulting in the isolation of the ecosystem and the inability to exchange information with each other.

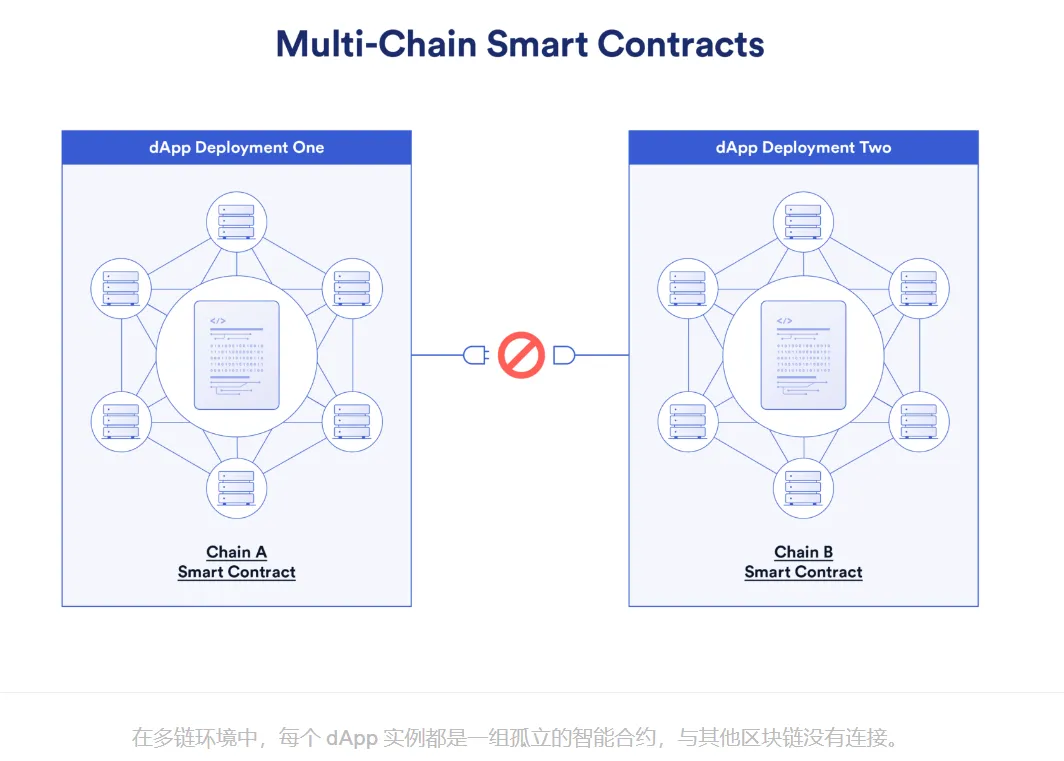

From the perspective of developers, each deployment constitutes an isolated and independent entity, resulting in no connection between backend contracts and no knowledge of each other’s existence. For example, a decentralized exchange (DEX) DApp may need to be deployed on Ethereum, BNB Chain, and Polygon networks respectively, so each version of the DApp is independent of each other.

- Analysis of 10 Tips for Web3 Entrepreneurship The period of bonanza for bottom-up project development has passed, and marketing is becoming more important.

- Overview of the first six investment projects of the Base Ecosystem Fund

- One out of a hundred, taking stock of the first batch of investment projects by the Base Ecology Fund.

Source: Chainlink

For users, this multi-deployment method also increases the difficulty of adoption:

1) Users cannot seamlessly transfer tokens from one blockchain to another.

2) The transfer process is time-consuming and the experience is poor because assets are usually destroyed on the source blockchain and then re-minted on the target blockchain using third-party bridges.

3) Holding assets on multiple blockchains also carries high security risks, making them vulnerable to hacker attacks and resulting in fund loss.

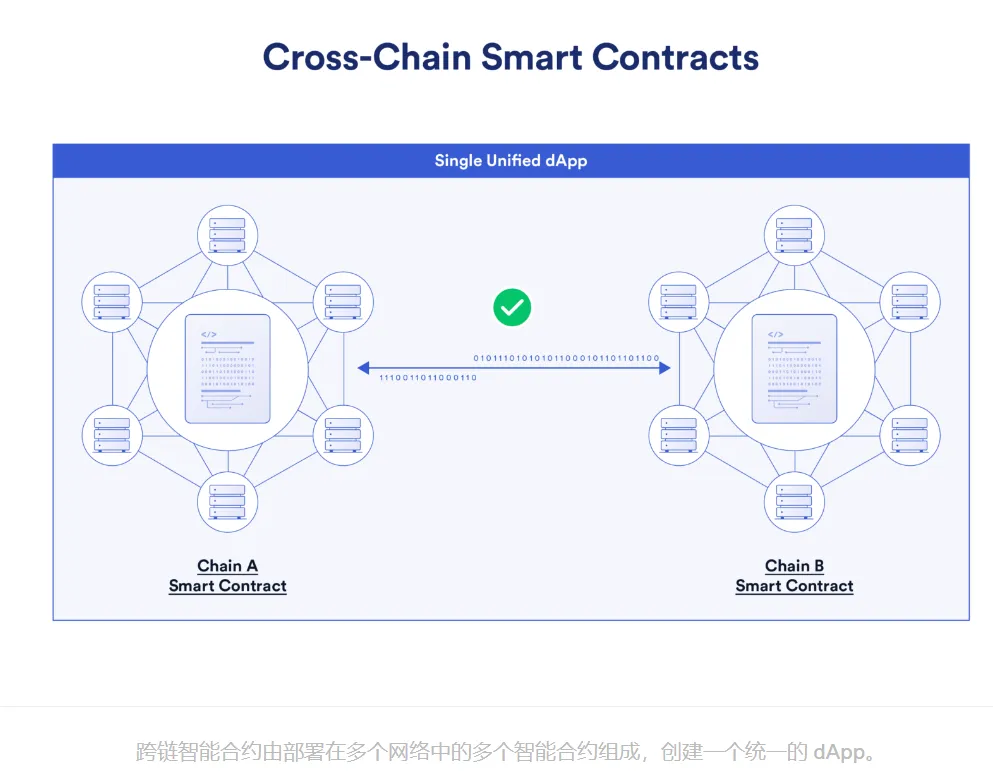

Due to the diversity of the blockchain ecosystem, it is crucial for different chains to interoperate and communicate with each other. The key part of exchanging data and assets between different blockchains is the Cross-Chain Interoperability Protocol. Cross-chain interoperability allows developers to build a unified cross-chain application, which means that the same dApp can be deployed on multiple different blockchains without the need to deploy multiple independent versions on different chains, thus releasing higher capital efficiency and better liquidity conditions.

2. Cross-Chain Solutions

Cross-chain solutions typically involve verifying the state of the source blockchain and relaying subsequent transactions to the target blockchain. A key part of the infrastructure is the Cross-Chain Bridge, which allows assets to be transferred from the source blockchain to the target blockchain. Cross-chain bridges typically involve locking or destroying assets on the source chain through smart contracts and unlocking or minting them through another smart contract on the target chain. In fact, the use case of cross-chain bridges is very narrow, and their role is to transfer assets between different blockchains. Therefore, cross-chain bridges are usually application-specific services between two blockchains.

Currently, developers have built various cross-chain solutions, such as:

– Chainlink is developing the Cross-Chain Interoperability Protocol (CCIP), which is an open-source standard that supports cross-chain communication, including sending messages and token transfers. The goal of CCIP is to achieve universal connectivity between hundreds of blockchain networks using standardized interfaces, with the hope of reducing the complexity of building cross-chain applications and services.

The Wormhole protocol is a universal interoperability protocol that enables the transfer of tokens and messages across different blockchain networks. Network guardians monitor and validate information on the source chain, facilitating its transfer to the target chain. Developers using Wormhole can build cross-chain decentralized applications called XDApps.

The Inter-Blockchain Communication (IBC) protocol is a standard protocol for blockchain interaction in the Cosmos network, aiming to achieve interoperability between different blockchains. IBC defines a set of minimal functions specified in the Inter-Chain Standards (ICS), which define how blockchains communicate and exchange data with each other.

LayerZero is a full-chain interoperability protocol for lightweight information transfer between blockchains, providing secure, reliable, and trustless message delivery.

This article mainly introduces the LayerZero full-chain interoperability protocol, which focuses solely on the transmission of information between chains. It can send messages to any smart contract on any supported chain, responsible for smart contract communication between blockchains. Asset cross-chain functionality is handled by Stargate, developed by LayerZero Labs.

III. LayerZero Technical Features and Advantages

1. Technical Features

The most prominent feature of LayerZero is its ultra-lightweight nodes. By utilizing ultra-light node technology, messages are transmitted between endpoints on different chains through relayers and oracles, reducing costs while ensuring security.

1) Ultra-Light Nodes

Firstly, in a blockchain network, each node is essentially a computer or server terminal that stores data. A light node is just one mode of operation for a node. Unlike full nodes, light nodes only store a small portion of blockchain data, such as block headers and other information, without storing the specific transaction details within blocks. Compared to light nodes, ultra-light nodes have the same validation method. However, due to the high cost of writing to the blockchain and the expensive continuous transmission of block headers, ultra-light nodes do not retain all block headers. Instead, they use oracles to stream these block headers on-demand, synchronizing with off-chain entities more efficiently, thus changing the previous continuous streaming method.

The benefit of this approach is that it does not rely on a continuous stream of block header data starting from the genesis block. However, the drawback is the lack of a historical sequential data stream. If both oracles and relayers act maliciously at the same time and pass verification, it can result in the execution of malicious information. Therefore, LayerZero strikes a balance between significantly reducing validation costs and compromising some degree of security. Whether this trade-off is worthwhile may depend on how it is weighed based on its own specific use cases.

2) Core Components

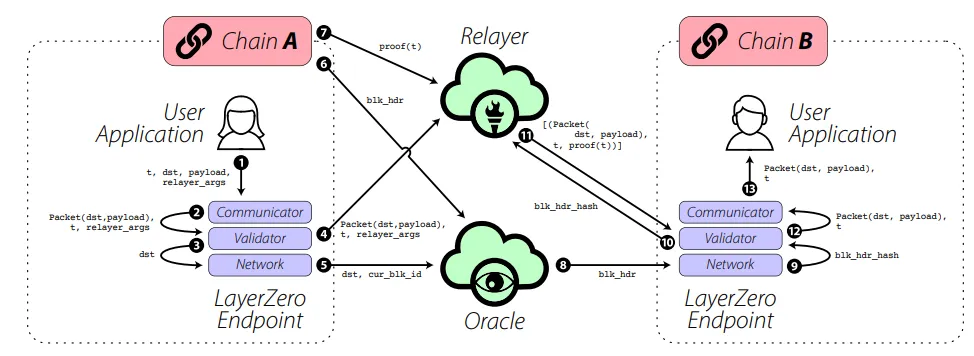

In the official LayerZero whitepaper, the core components responsible for information transfer between two chains are endpoints, oracles, and relayers.

Endpoints are facilities that directly interact with users or applications, responsible for handling message transmission, validation, and reception. Their purpose is to ensure effective message delivery when users use the protocol to send messages. In the LayerZero protocol, each chain needs to deploy endpoints, which can also be called by other apps on the same chain, responsible for sending information to external chains.

Oracle is a third-party service that provides an independent mechanism component separate from other LayerZero components. It can read a block header from one chain and send it to another chain, allowing the target chain to verify the validity of transactions from the source chain. Chainlink is currently used as the oracle for LayerZero.

Relayer is an off-chain service that is similar to an oracle in functionality, but instead of retrieving block headers, it retrieves proofs of specific transactions. To ensure effective delivery, the only requirement is that the oracle and relayer must be independent of each other for any given message sent using the LayerZero protocol. Any entity can act as an oracle or relayer, and LayerZero can even implement its own relaying service.

An important trust assumption in LayerZero is that oracles and relayers operate independently from each other. The block headers submitted by the oracle are cross-validated with the transaction proofs submitted by the relayer, and no consensus is formed between them, only message transmission. In simple terms, the oracle acts as a notary in LayerZero cross-chain transactions, allowing the target chain to know the result of the verification, while the relayer is responsible for providing the proof process required for transaction verification and the specific content of cross-chain information. To ensure the effective transmission of information, if there is any dispute in the information transmission between the relayer and the oracle, the smart contract will be paused and the information will not be submitted to the target chain.

Refer to “Detailed Explanation of LayerZero Interoperability Protocol Technology and Features”

If a transaction from chain A is crossed to chain B, the overall process is roughly as follows:

This transaction starts from the user launching the application, and then with the assistance of the oracle and relayer at the LayerZero endpoint, the transaction is broken down into multiple parts (proofs and block headers). Once the oracle and relayer send their respective information on the target chain (signing the transaction on-chain), and the LayerZero endpoint (contract) verifies the correctness of the information, the message will be transformed and executed on the target chain.

2. Advantages

1) Security

As a underlying protocol, the security of LayerZero is independent of external protocols, ensuring the stability of the entire protocol consensus. In addition, thanks to the unique design of oracles and relayers, they are independent of each other, and a transaction will only be completed when both are considered to be genuine, ensuring the security of information transmission.

2) Scalability

LayerZero, as a general messaging layer, means that any contract can be transferred from chain A to chain B to achieve cross-chain interoperability with LayerOne networks. With innovative endpoint design, LayerZero can easily scale to support any chain, bringing a wider range of applications to the blockchain ecosystem.

3) Efficiency

Firstly, LayerZero’s super-light node technology achieves higher transmission efficiency and reduces verification costs while ensuring security. Secondly, the relayers or oracles of LayerZero do not form any consensus, only simple message transmission, and all verification is done on their own target chains, so the speed and throughput limitations depend entirely on the properties of the two chains involved in the transaction.

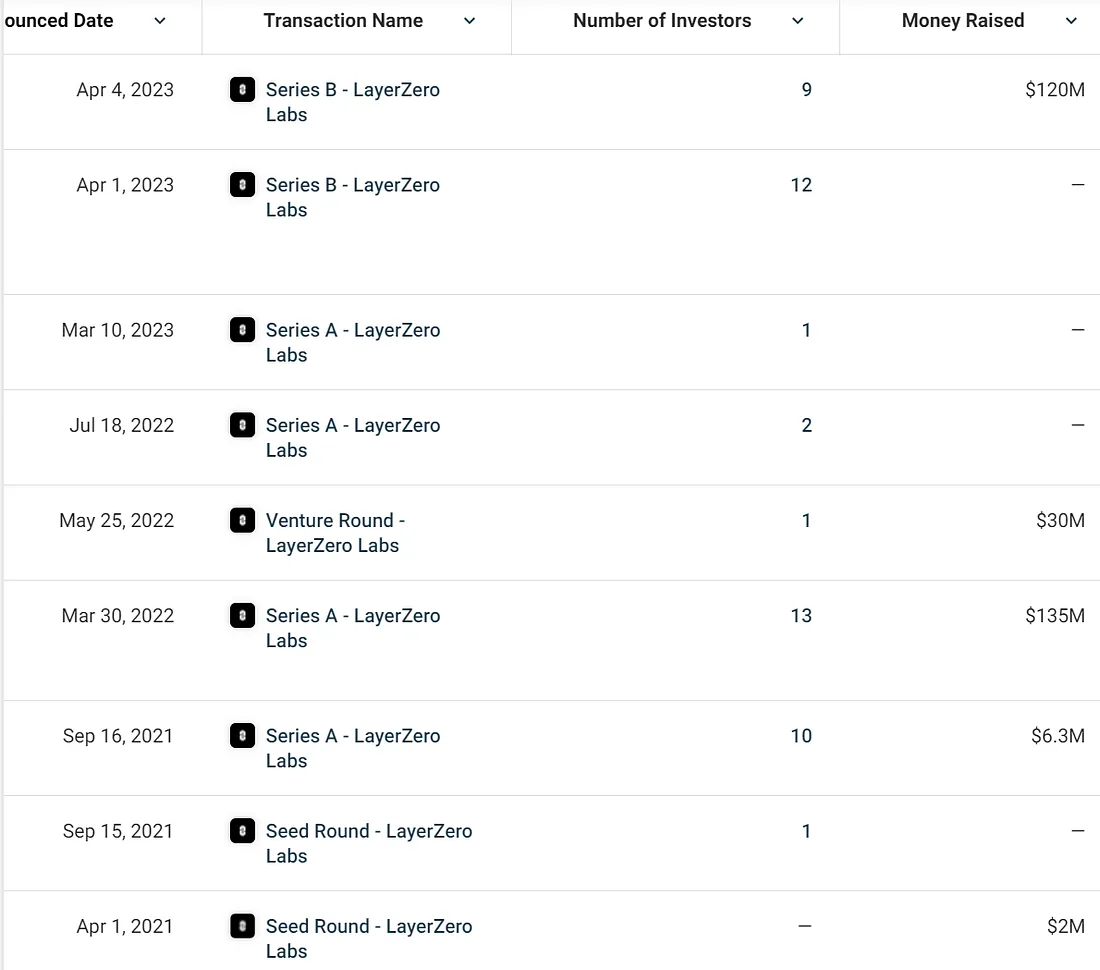

4. Financing

LayerZero has conducted three rounds of financing in total, with a total disclosed amount of $293 million. The participating investors include well-known crypto investment institutions such as Multicoin, Binance Labs, a16z, and Sequoia Capital. The latest round of financing took place on April 4, 2023, with a valuation of $3 billion and raised $120 million.

FTX participated as the lead investor in the Series A financing on March 30, 2022. Due to its collapse, on November 11, 2022, LayerZero officially announced that it had repurchased 100% of the equity, token rights, and other agreements from FTX.

Source: Crunchbase

5. Ecosystem

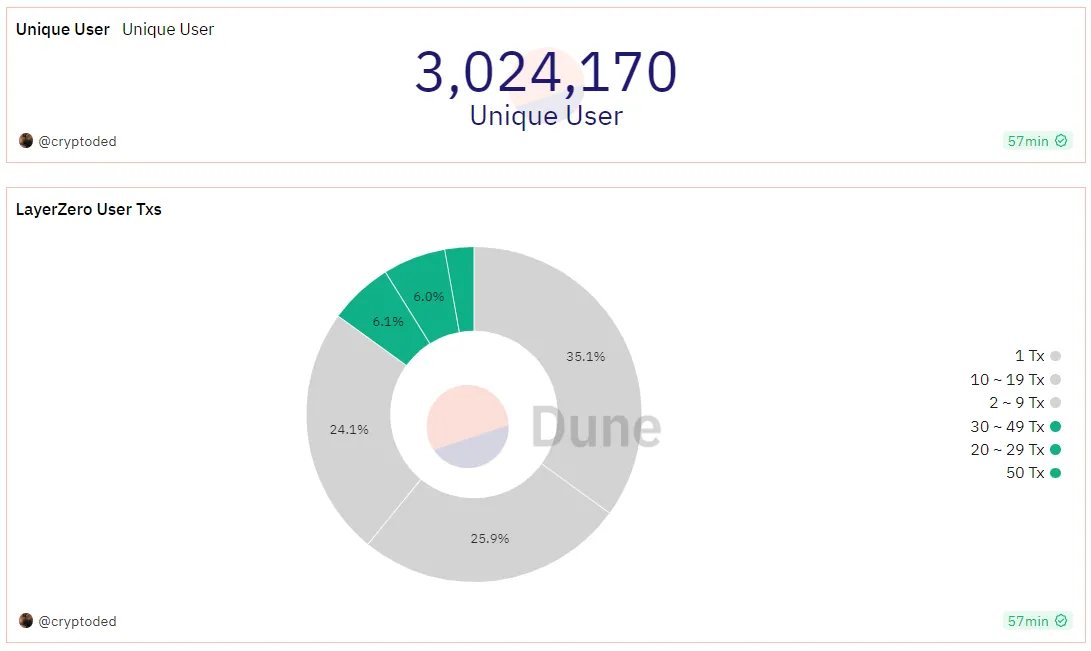

So far, LayerZero has supported a total of more than 20 chains including Ethereum, BNB Chain, Avalanche, Polygon, and Base. The number of independent users has reached 3 million, and the cumulative number of transactions has reached 56 million. However, 35% of users only have 1 transaction record, and there are only about 730,000 users with more than 2 interaction records.

Source: Dune Analytics

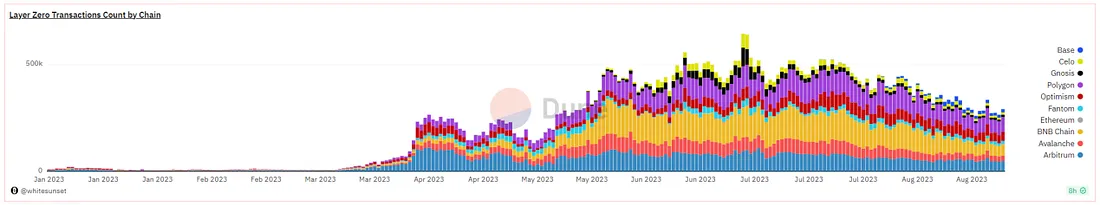

User interaction activities mainly occur on BNB Chain, Arbitrum, and Polygon. Especially since the release of Arbitrum, the community has been excited about airdrops, which has also driven a significant increase in user activity on LayerZero.

Source: Dune Analytics

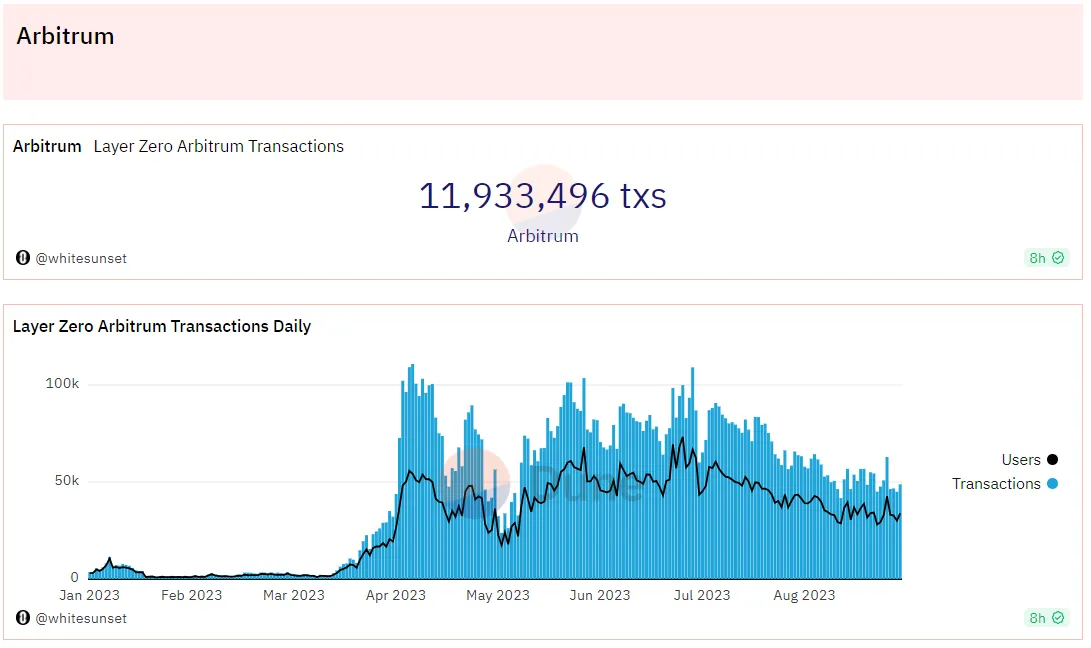

Taking Arbitrum interaction data as an example, the number of transactions reached about 12 million. April 2023 was the peak period of user activity, and with the sluggish overall market conditions, user activity also slightly declined.

Source: Dune Analytics

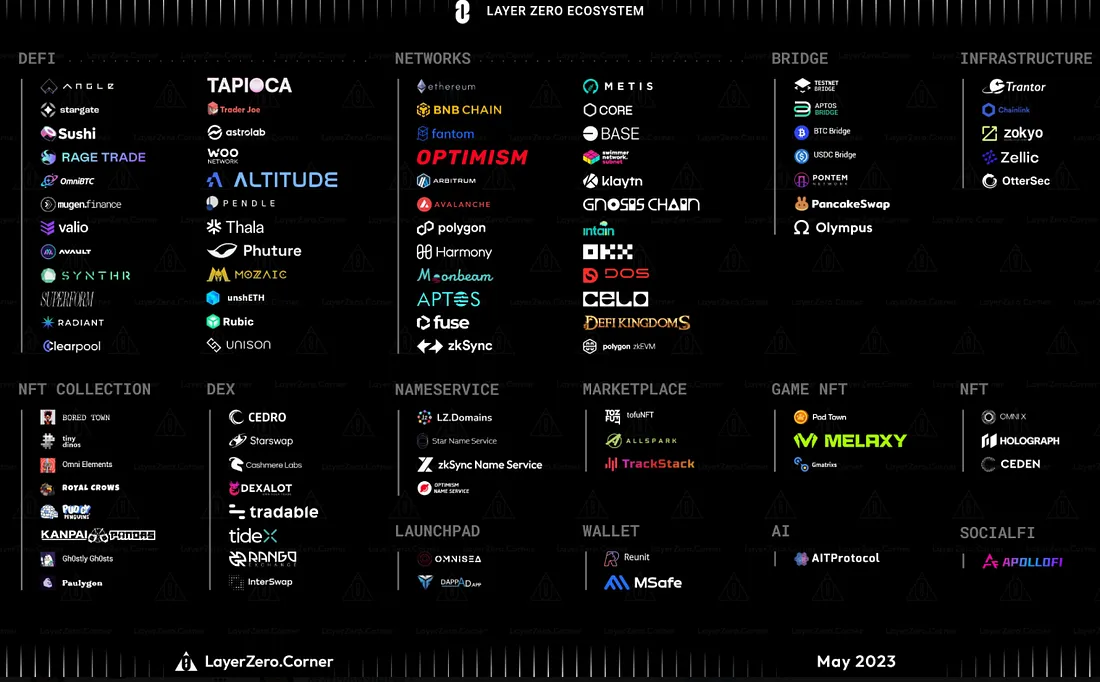

LayerZero’s minimalist architecture gives the protocol unlimited possibilities. Its low developer integration complexity has resulted in over 50+ dApps currently integrated or using its technology.

Source: Twitter

Star Projects

1. Stargate Finance

The first dApp based on the LayerZero protocol developed by LayerZero Labs. It has built the first fully composability native asset bridge with the vision of making cross-chain liquidity transfer a seamless and single process. The product highlights the use of a unique “Delta algorithm” to solve the “impossible triangle” problem in cross-chain bridges without making trade-offs.

The Stargate team believes that there is an “impossible triangle” in cross-chain asset bridges:

1) Instant verification and confirmation: Assets can be successfully transferred to the target chain upon transaction confirmation, ensuring timeliness;

2) Unified liquidity: Single liquidity pools are shared among multiple chains;

3) Asset nativeness: Users obtain native assets directly through cross-chain bridges, rather than synthetic or wrapped assets.

Of course, while ensuring instant verification and asset nativeness, if there is no involvement of more complex liquidity dynamic allocation algorithms, it is only possible to build a liquidity pool between each pair of chains, which will reduce capital efficiency.

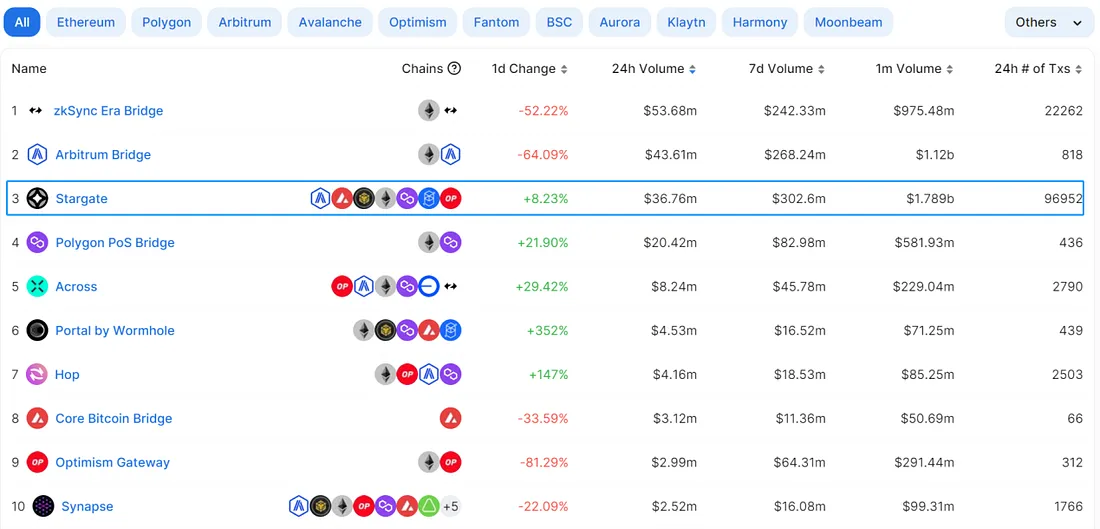

According to defillama data, in terms of trading volume in the past month, Stargate ranks first among various cross-chain bridge protocols, with a trading volume of up to 96,000 transactions in 24 hours.

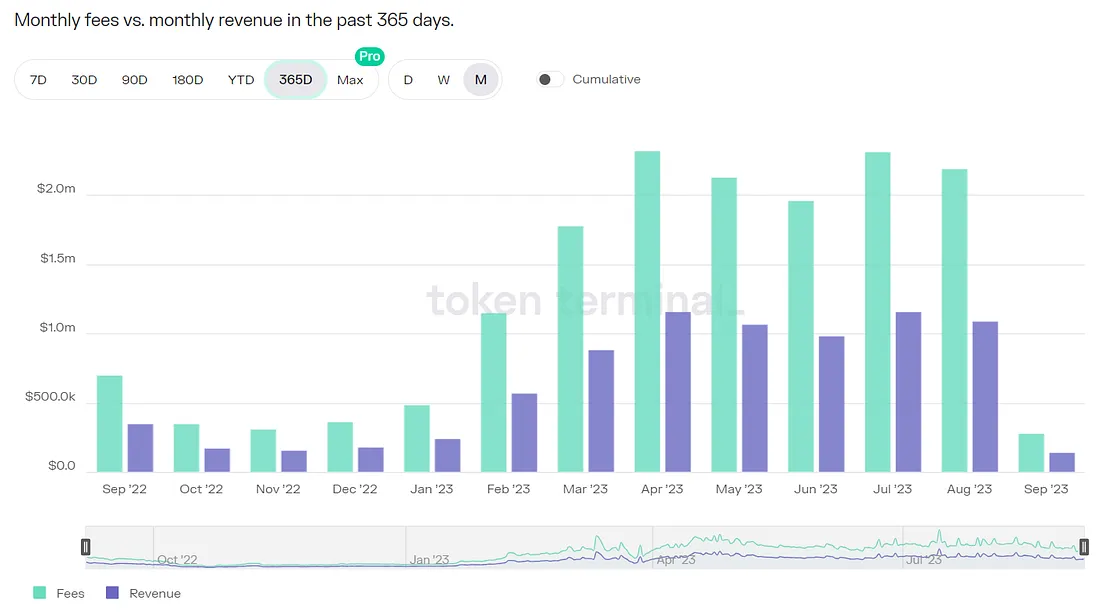

Protocol revenue

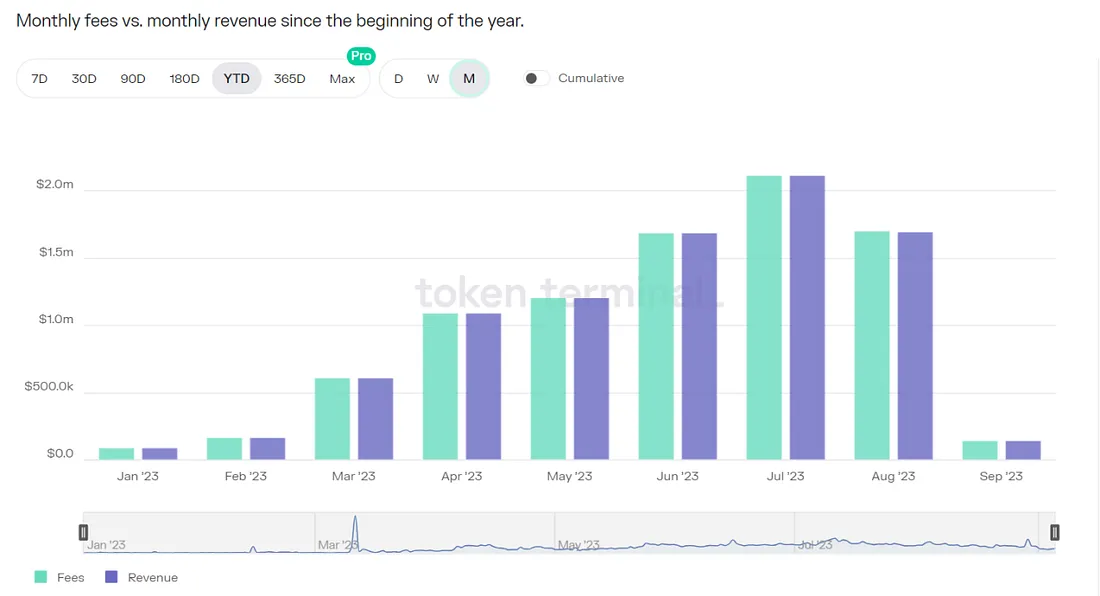

Stargate is the first dApp launched on LayerZero, and its protocol fees and revenue have been steadily increasing since March 2023, when the on-chain transaction activity increased significantly due to the anticipation of airdrops. Currently, the protocol’s monthly revenue exceeds $1 million.

Source: Token Terminal

Economic model

The total supply of STG tokens is 1 billion, with a circulating supply of 200 million. The functions of the token are as follows:

1) Asset cross-chain transfer fees: Non-STG token transfers will incur a 0.06% fee, of which 0.045% will be distributed to liquidity providers and 0.015% to the protocol’s treasury;

2) Governance: By staking and locking STG tokens for 3 to 156 weeks, governance tokens veSTG can be obtained, and the longer the STG tokens are locked, the greater the voting weight;

3) Protocol rewards: Stablecoin liquidity pool and liquidity mining rewards.

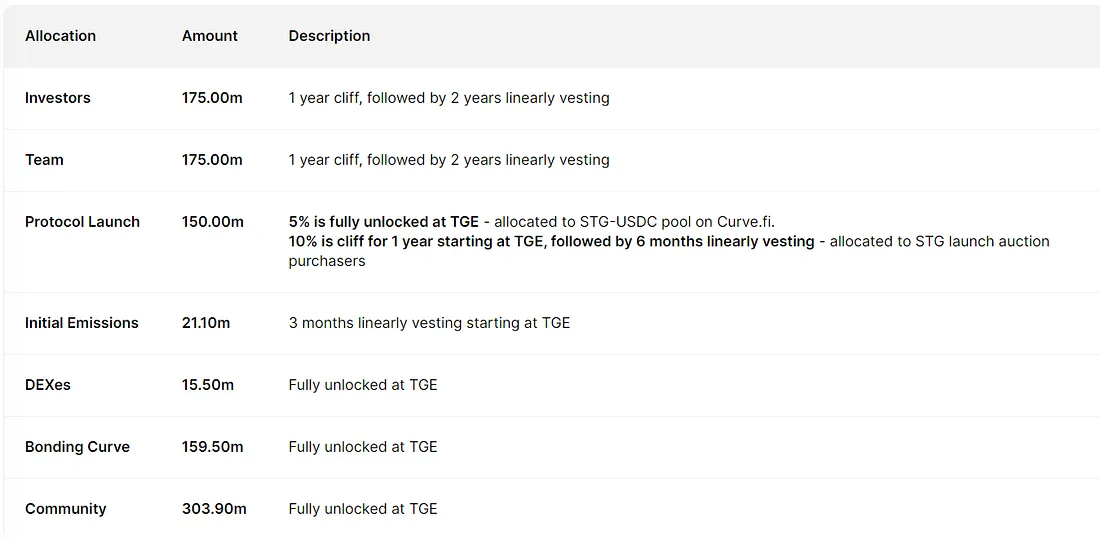

The token was issued on March 17, 2022, and the initial allocation details are as follows:

Source: tokenunlocks

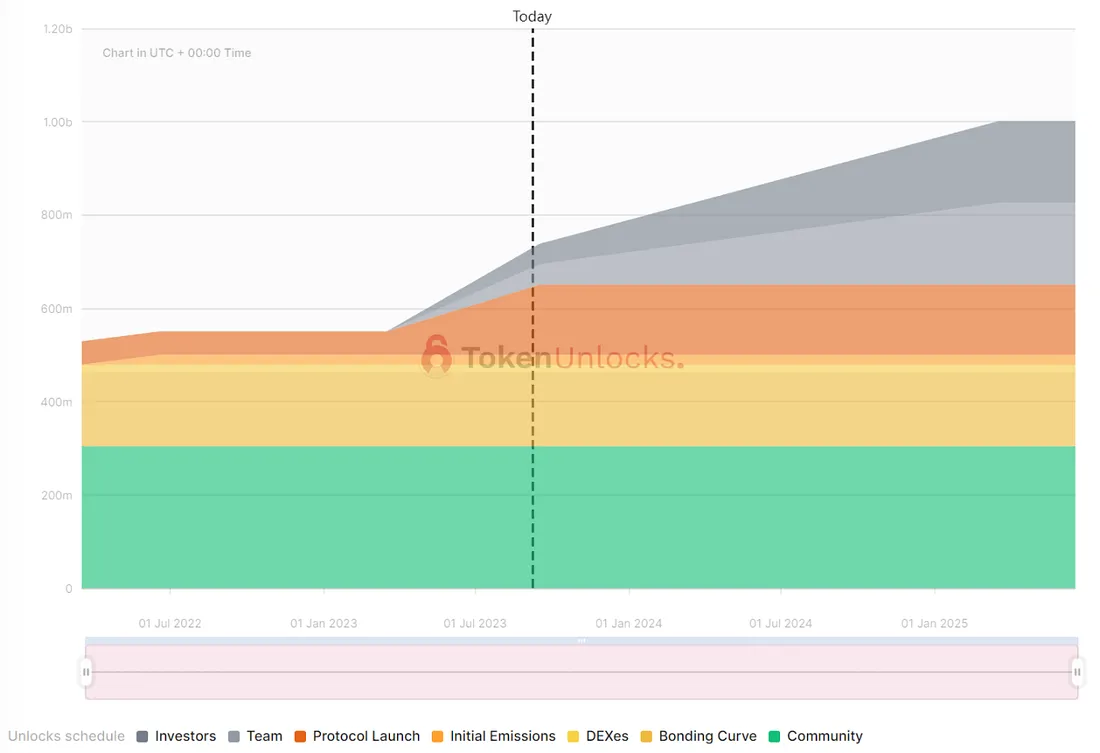

A total of 478 million tokens were directly unlocked at the initial token issuance, allocated to early DEX liquidity, Bonding Curve, initial release plan, and the community.

Part of the allocation for protocol launch includes a direct release of 5% (50 million tokens), with the remaining 10% locked for 1 year and then linearly released within 6 months. Currently, 145 million tokens have been released.

Part of the allocation for investors and the team is locked for 1 year and then linearly released over 2 years.

According to the aforementioned token allocation, the nominal emission of STG has reached 729 million. Based on the distribution of STG holding addresses, it can be clearly seen that there are still 297 million tokens from the community allocation that have not been circulated, and 320 million tokens from the allocation for investors and the team that have not been circulated. These two parts together account for approximately 6.7% of the circulating supply.

Looking at the distribution of holding addresses, the top 20 addresses account for 94% of the total holdings, with the top two addresses both owned by the official team and have not been circulated, accounting for 62%. Excluding these two parts, the remaining addresses hold 32% of the tokens, with Alameda holding 9.42% and individual whale addresses holding only 0.6% of the tokens, indicating that whales hold relatively few chips.

Alameda’s co-CEO, Sam Trabucco, posted on social media that Alameda Research participated in the public offering of the cross-chain bridge project Stargate on March 18th and purchased all the shares of STG (100 million, which is 10% of the protocol mentioned earlier). However, Sam Trabucco stated that Alameda would not sell STG within 3 years and would make long-term investments in the project and team. Alameda will also not interfere with the project’s governance and will relinquish its voting rights for aSTG to ensure more equal distribution of voting rights among early community members. Currently, 9.42% has been released.

2. Radiant Capital

Radiant is a cross-chain DeFi lending protocol that implements full-chain leverage lending and composability by using LayerZero as the cross-chain infrastructure. This allows users to obtain leverage in the DeFi protocols it supports and simplifies cross-chain lending operations for assets between different chains.

Radiant operates similarly to current lending protocols such as Aave and Compound, with the difference being that it aims to be a full-chain lending protocol. This means that users can deposit collateral on Chain A and then borrow on Chain B. However, when users need to use cross-chain lending services, they first need to deposit a certain amount of assets on the supported chain and become a dynamic liquidity provider (dLP) before being able to borrow the desired assets on the target chain.

Radiant is currently deployed on Arbitrum and BSC chains with a TVL (Total Value Locked) of $220 million, ranking relatively high among various lending protocols and already capturing a certain market share. It is the leading lending protocol on Arbitrum.

Protocol Revenue

In Radiant, protocol revenue = fees paid for borrowing – interest paid on deposits (supply-side fees). Since February this year, the fees earned by the protocol have stabilized at around $2 million, with monthly revenue reaching around $1 million.

Source: Token Terminal

Economic Model

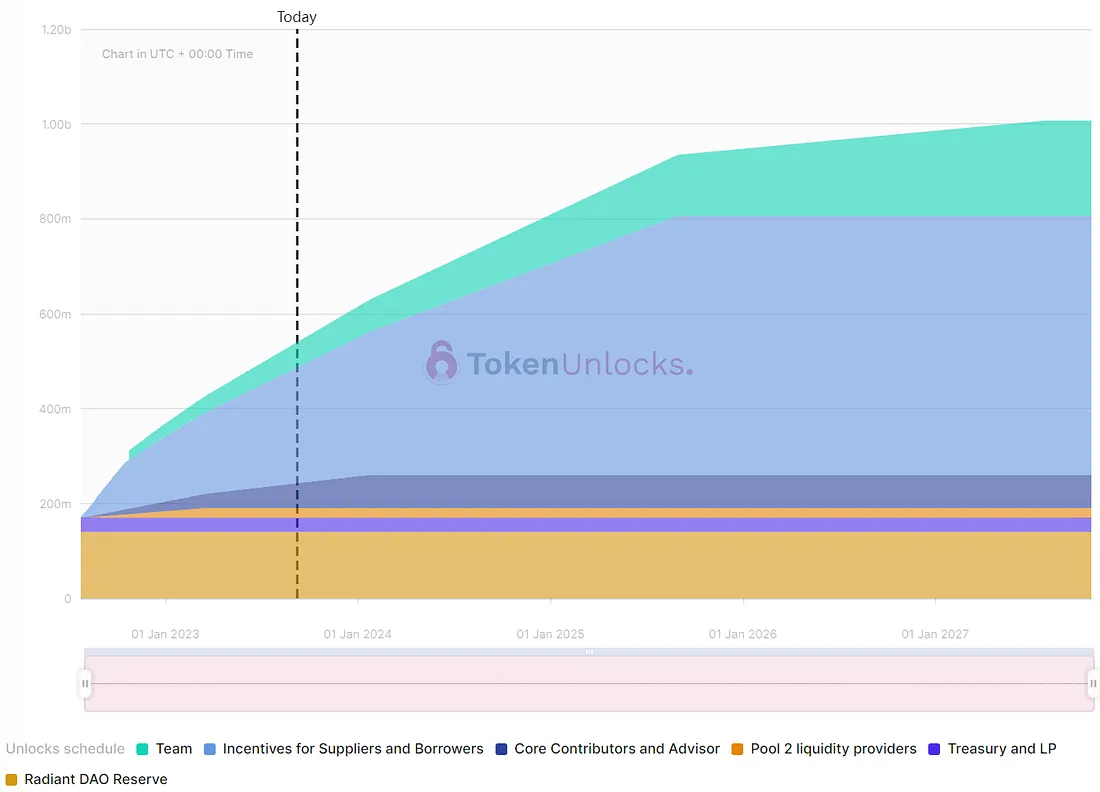

The total supply of RDNT tokens is 1 billion, with a circulating supply of 300 million. The main functions of the token are governance and liquidity incentives.

According to Token Unlock data, the portions allocated to 2Pool liquidity providers, Treasury, and the Radiant DAO reserve have all been unlocked. The portions allocated to the team, core contributors, and borrowers’ incentives are still unlocking. The portion allocated to borrowers is released at a rate of 4.85 RDNT per second. If calculated at this rate, nearly 210,000 tokens will be released per month.

From the token holding distribution, the top 20 token addresses account for 92.3% of the total, with the official contract address ranking first and still 23.4% undistributed. Tokens distributed in DEX account for 27.6%, while the top 20 addresses of large holders only account for 3.8% of the total.

Roadmap

The Radiant official team has revealed a simplified roadmap in its documentation. The current version is in the 2.0 stage, with the primary task being the deployment of Radiant cross-chain and the increase in the scale of collateral within the application. In the V3 version, the plan is to eliminate reliance on the third-party cross-chain bridge Stargate and fully integrate LayerZero, while the V4 version plans to fully achieve chain-wide liquidity lending.

Summary

Multi-chain is the development trend of blockchain, and cross-chain interoperability protocols are key components of communication between blockchains, with broad development prospects. LayerZero is still in the early stages of development, with few native projects to participate in. Backed by numerous well-known investment institutions, it has abundant industry resources, and its token issuance expectations are attracting the attention of the entire crypto market.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Nima Capital sells tokens and sells luxury homes, previously invested in these 16 projects.

- With 8 years of experience and managing over 540 million dollars, how does CoinFund, a cryptocurrency fund, choose its track and invest in projects?

- Investment institution Rug? Nima Capital sells tokens to sell luxury homes, previously invested in these 16 projects

- APR Winter? A comprehensive analysis of high-yield DeFi projects in the market

- 20 Worth-Watching Unreleased Coin Projects

- What does the SEC action mean by treating NFT projects as unregistered securities for the first time, and what does the related legislation say?

- Understanding the Cross-Chain Leveraged Trading Aggregator MUX in One Article