Nima Capital sells tokens and sells luxury homes, previously invested in these 16 projects.

Nima Capital sells tokens and luxury homes, previously invested in 16 projects.Author: Joy, LianGuaiNews

Nima Capital entered the domestic crypto community for the first time, but unexpectedly in the form of a suspected rug pull.

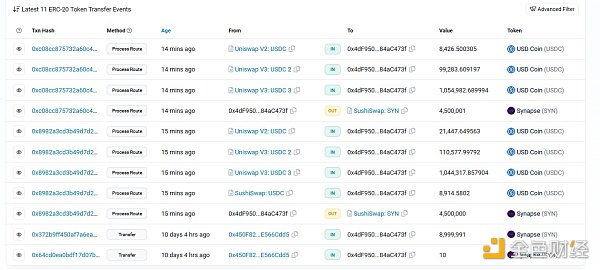

On September 5th, the cross-chain protocol Synapse experienced a sharp price drop. The official response stated that a Synapse liquidity provider sold its SYN tokens and withdrew liquidity. The community later discovered that the liquidity provider was Nima Capital. In just one minute, Nima Capital sold 9 million SYN tokens worth $3.1 million through Sushiswap and withdrew over $37.5 million in stablecoin liquidity from Synapse. The sell-off was swift and without regard for slippage, causing the price of SYN to drop 22% within three hours.

Earlier this year in March, Synapse passed a proposal by Nima Capital, which promised to provide $40 million in stablecoin liquidity within 12 months. However, SynapseDAO was required to provide a Grant and 33% of the bridging and transaction fees. In the proposal, Nima Capital claimed that its cryptocurrency liquidity team focuses on various DeFi projects such as on-chain market-making, real-time liquidity, node operations, and trades relying on the mempool. They also claimed to have been one of the largest users of core protocols such as AAVE, Compound, Yearn, Convex, and Canto.

- With 8 years of experience and managing over 540 million dollars, how does CoinFund, a cryptocurrency fund, choose its track and invest in projects?

- Investment institution Rug? Nima Capital sells tokens to sell luxury homes, previously invested in these 16 projects

- APR Winter? A comprehensive analysis of high-yield DeFi projects in the market

However, Nima Capital did not fulfill its promise, and Synapse stated that they were unable to contact Nima Capital. As of now, there has been no response from the official Nima Capital team or related personnel. The official website is inaccessible, and the official Twitter account has been locked. The founder, Suna Said, has not updated her Twitter account for over a year. These circumstances have led the community to speculate whether Nima Capital has run away after the sell-off.

Coincidentally, The Wall Street Journal reported in August that a set of apartments owned by Nima Capital was sold for approximately $80 million. The institution had previously spent $65.59 million in 2020 to purchase the apartment overlooking Central Park in New York. According to The Wall Street Journal’s report in February this year, Suna Said and her husband Scott Maslin purchased a Silicon Valley estate worth around $45 million from Joel Peterson, the former chairman of JetBlue Airways.

In reality, Nima Capital’s reputation in the crypto community was not high, and they did not actively participate in publicly visible activities in the crypto industry. According to LinkedIn, Nima Capital was established in 2013 and is a large single-family office based in New York City. Its founder, Suna Said, claims to have been investing vertically in the crypto field since 2016, including incubators, early-stage investments, token investments, and liquidity mining. She is also an advisor to Bitwise, co-founder of music NFT company OneOf, and a board member of the DeeLianGuaik Chopra Foundation.

Founder of Nima Capital, Suna Said

According to DeFiLIama data, Nima Capital’s investment portfolio leans towards DeFi and trading, with over half of the projects focused on this sector. In addition to Synapse, their public investments include Flow, Fordefi, Dexguru, Bitwave, AnChain.ai, Axelar, Notional, Risk Harbor, Liquity, 0x, TAP Network, 1Inch, Coinme, Flexa, Celo, and NuCypher.

Compared to other investment institutions, Nima Capital, as a family office, primarily manages its own funds. It is understood that Suna Said’s husband, Scott Maslin, is the founder of real estate investment company Woodglen Investments and also the founding partner of Alpha Blue Ventures, which focuses on acquiring, developing, and managing real estate projects in New York and Southeast Florida. Therefore, it is not surprising that Nima Capital is involved in expensive real estate projects.

Currently, no one knows what has happened inside the low-key and mysterious Nima Capital. As the community speculates, Nima Capital’s financial situation may be in trouble. There are four different possibilities: 1. Nima Capital has been hacked; 2. Nima is insolvent or facing legal troubles; 3. The U.S. SEC has found infringements by the Synapse protocol on NRV holders (projects previously founded by the team); 4. A combination of the above situations.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- 20 Worth-Watching Unreleased Coin Projects

- What does the SEC action mean by treating NFT projects as unregistered securities for the first time, and what does the related legislation say?

- Understanding the Cross-Chain Leveraged Trading Aggregator MUX in One Article

- Two-tier reversal, friend.tech still agreed for you to be friends with the imitation platform.

- TRB, the oracle mining coin project, has experienced a skyrocketing price against the trend. Is it due to improved fundamentals or speculative capital?

- EigenLayer Official Inventory of 12 Early-stage Projects in the Ecosystem

- Product Expansion and Mechanism Update of Lybra V2