Analysis: Why did the cryptocurrency market fall today?

Reasons for today's cryptocurrency market fall may include: 1. Increased regulatory scrutiny worldwide 2. Negative news or rumors about a cryptocurrency or exchange 3. Market manipulation through pump-and-dump schemes 4. Technical issues with exchanges or wallets It's important to remember that the cryptocurrency market is highly speculative and volatile, and prices can fluctuate rapidly based on many factors.Author: Valdrin Tahiri, translated by Blocking from Beincrypto

Summary

-

The total market cap of the cryptocurrency market (TOTALCAP) has dropped below a key level and is validating it as resistance. This could lead to further downside.

-

The price of Bitcoin (BTC) failed to maintain its bullish momentum despite breaking out of a symmetrical triangle. It subsequently dropped below the breakout point.

-

Fantom (FTM) was rejected by a level of resistance at $0.32 and has since set a higher low on July 3rd. The price has since dropped.

Yesterday both the price of Bitcoin (BTC) and the total market cap of cryptocurrencies (TOTALCAP) dropped below key levels, indicating that they may have reached a local top. Meanwhile, the price of Fantom (FTM) is on a downward trend after being rejected by a level of resistance.

The non-fungible token (NFT) market continued to shrink in the second quarter with trading volumes down 38% and sales down 9.2%. Additionally, the number of NFT traders has also decreased significantly.

The total market cap of cryptocurrencies (TOTALCAP) drops below key support

Since bouncing at the support level of $980 billion on June 15th, the total market cap of cryptocurrencies (TOTALCAP) has grown. It broke out of an ascending parallel channel on June 20th and reached a high of $1.19 trillion on July 3rd. This growth resulted in a breakout above the resistance area at $1.15 trillion.

However, TOTALCAP failed to maintain its growth and dropped below the area of $1.15 trillion on July 6th. This is considered a bearish signal because the breakout did not continue (marked in red circle).

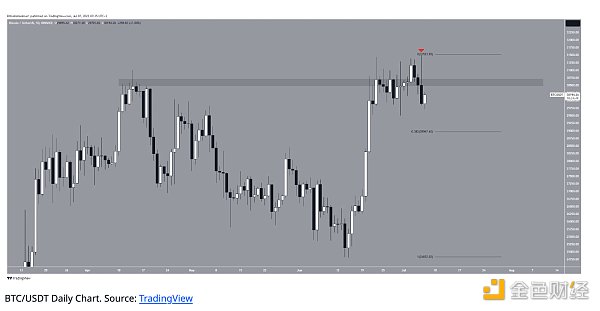

The price of Bitcoin (BTC) forms a bearish candlestick pattern

Similar to TOTALCAP, the price of BTC seemed to have broken above the resistance area of $30,500 on July 3rd. Three days later, it reached a new yearly high of $31,500. However, the price failed to maintain its growth and formed a bearish shooting star candlestick pattern (marked in red icon).

This type of candlestick pattern is characterized by a very long upper shadow and a low closing price. It usually indicates that the price has reached a local top. The price subsequently dropped and closed below $30,500, which is now expected to provide resistance.

If the BTC price falls, the closest Fibonacci support level will be $28,900. However, if the price reclaims the $30,500 area, it could rise to the next resistance level of $33,000.

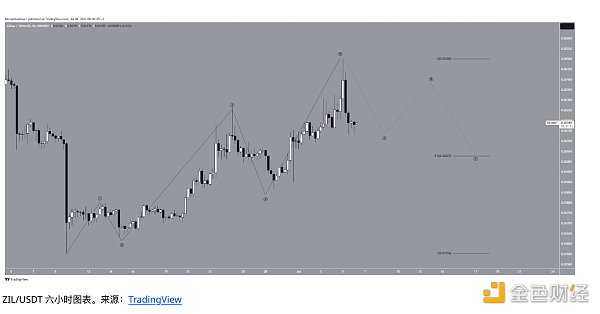

Fantom (FTM) Price Fails to Break Resistance

Fantom (FTM) saw a significant rise in price since June 10th. The price reached a high of $0.33 on June 25th.

However, FTM failed to break the resistance area at $0.32, resulting in a lower high on July 3rd. Since then, the price has been declining.

This trend suggests selling pressure around $0.32, preventing the price from continuing to rise. The lower high may indicate a change in market sentiment, weakening buying pressure or increasing selling pressure. In this case, a price drop may indicate that the market has entered a short-term correction or a downward phase.

If the downward trend continues, the next closest support level will be at $0.20. However, if the FTM price finds support again, it can again attempt to break the resistance level at $0.32.

Since the $0.20 area is below the low of June 10th, if the price falls below that level, it will mean that the trend is still bearish.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- “Fortune” interview with Sister Wood: Will ARK win the first Bitcoin spot ETF?

- Lightning Labs launches AI Bitcoin tool that enables sending Bitcoin on the Lightning Network

- What is Bitcoin Recursive Mnemonic?

- How is the market searching for logic in the old-school DeFi as COMP and MKR continue to rise in recent days?

- In the first half of the year, it lagged behind BTC. What kind of “danger” and “opportunity” will ETH face in the second half of the year?

- Foresight Ventures: The Best Attempt at a Decentralized AI Marketplace

- 2023 Financing Semi-Annual Report: Primary Market Sluggish, Infrastructure and Tools Leading the Way