The total amount of transactions on the stable currency chain has exceeded the well-known micropayment service processing software Venmo

Foreword: In 2019, stable currencies, especially USDT, gained rapid growth, and their total transaction volume exceeded Venmo. It looks very good. However, we should see one thing: whether it is Venmo or other traditional payers, they deal with daily and work payments, from the needs of hundreds of millions of people shopping. Stabilizing the currency, no matter how large the transaction volume, its main scene is the trading scene of digital currency. It has not really applied to the offline shopping scene. The previous article published by Blue Fox notes, "The main user scene of stable currency: Is it a payment or a transaction? "It has been mentioned that this is a good start, but it will take time. We need more patience. Only when it is truly integrated into people's daily payments, it is invincible and is rooted in this world. The author of this article is Tradeblock, translated by the "Blue Fox Notes" community "kelinC".

In the past few years, the stable currency has gained a lot of attention. In the middle of 2018, several stable currency projects were launched in a big way. Recently, as large companies have begun to launch their own stable currencies, interest in stable currencies is rising. Earlier this year, JP Morgan released its own stable coin JPM token on the private blockchain. Facebook also released the highly anticipated Libra Stabilization White Paper, which has led to a variety of strong concerns and even opposition.

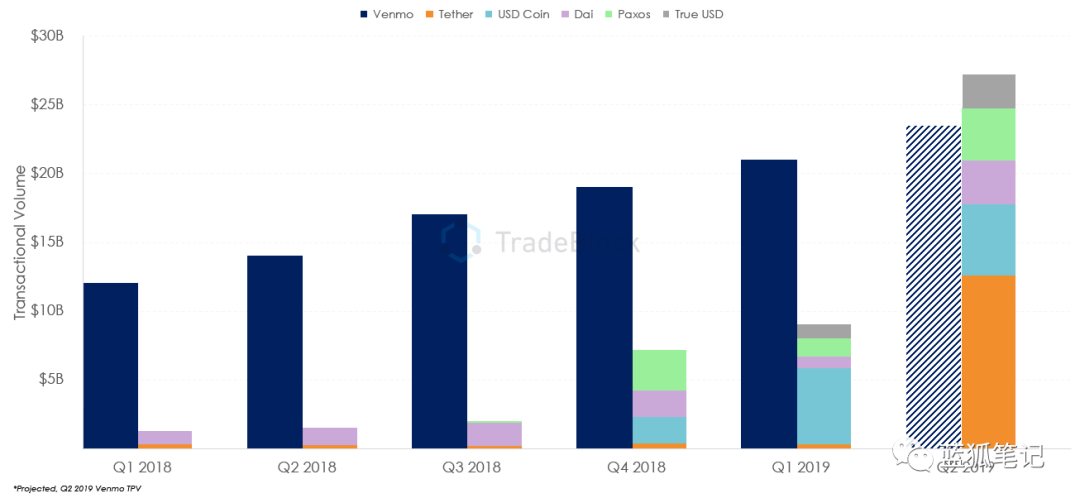

A common key indicator for measuring the adoption rate of a stable currency is the amount of transactions on the chain relative to traditional payers. The following is mainly to observe the adoption of stable currency by analyzing the trading volume indicator in the chain.

The chart below compares the TPV (total payment) between the top five stable currencies and Venmo. For a particular stable currency, an on-chain transaction is a transfer of value between wallet addresses. Trading on the chain does not include transactions that take place on a centralized exchange.

- "Wealth" magazine selected four major financial technology trends in 2020, Libra ranked first

- Babbitt column | Facebook is serious about sending money, how about the bank blockchain?

- Research Report | Central Bank Digital Currency Research Report (1)

(Data: TradeBlock and Etherscan)

(Data: TradeBlock and Etherscan)

In addition, the transaction cost of sending stable currency through the Ethereum network is very clear compared to the transaction cost associated with the Venmo service. In the largest five ERC-20 tokens, all users transferred more than $37 billion and paid $827,000 in network fees to Ethereum. During the same period, the related service fees paid to Venmo are expected to reach $150 million. (Blue Fox Note: The difference in the processing fee here is more than a striking 180 times.)

Tether stable currency rise

Tether is the largest stable currency today, regardless of market capitalization or other indicators. Tether was originally built on the Omni layer of the Bitcoin blockchain, but Tether also migrated to other blockchains, such as Ethereum and Tron. Tether's ERC-20 standard token is based on the Ethereum blockchain, and its trading activity is growing rapidly, driving its market capitalization.

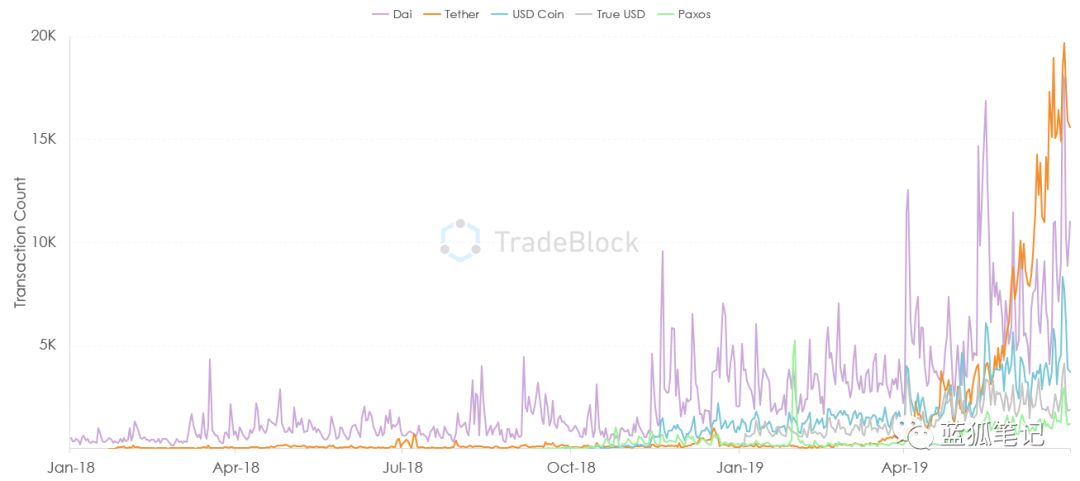

We analyzed the largest stable currency and found that Tether recently reached its highest point in chain trading activities on Ethereum. In addition, we have found that almost all of this type of stable currency has an increase in the volume of transactions and transactions. Below is the chain trade of the largest ERC-20 stable currency over time.

(Source: TradeBlock and Etherscan)

As shown in the above figure, since March 2019, Tether's number of transactions in the chain has shown a considerable upward trend. While other large stable currencies have similar growth, Tether's growth has been particularly rapid, far surpassing others. The recent increase in trading volume is similar to the bitcoin price and trading activity rebound period.

In contrast, between traditional payment processors and stable currencies, the number of transactions on the chain still lags behind Venmo and Zelle. Although the number of stable currency transactions per day reached thousands (as shown above), Zelle traded more than 1.5 million daily transactions in the first quarter of 2019.

Risk Warning : All articles in Blue Fox Notes can not be used as investment suggestions or recommendations . Investment is risky . Investment should consider individual risk tolerance . It is recommended to conduct in-depth inspections of the project and carefully make your own investment decisions.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- From the SAR to the digital currency: Shenzhen 38 years of currency transactions

- Research Report | Central Bank Digital Currency Research Report (2)

- The second exploration of the derivative products: Who is the king of the contract?

- Blockchain games are breaking out, where is the future of investment? | Hangzhou Blockchain Game Forum

- Questioning the resurgence, XRP is wilting because Ripple accelerates sales?

- The world of encryption originated in Bitcoin, and the prosperity stems from some "small problems" in Bitcoin.

- Market analysis: BTC fluctuates slightly, weekends are still resting