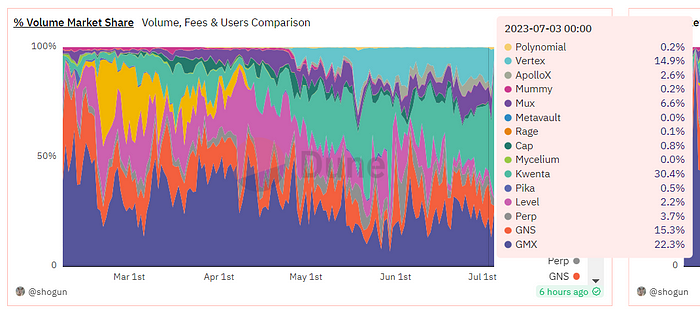

Vertex: Derivative DEX rookie, with a market share of about 10% in daily trading volume in Japan.

Vertex: Newcomer in the Derivative DEX market, holding about 10% of the daily trading volume in Japan.There is intense competition in the derivative DEX field, with GMX, DYDX, and SNX being the leaders, and Gains, MUX, Level, and ApolloX being the second-tier protocols. Additionally, there are constantly new emerging protocols being launched.

Vertex is a recently performing well derivative DEX protocol. Since its launch at the end of April 2023, its daily trading volume has accounted for about 10% to 15% of the funds pool model derivative DEX market, and it received strategic investment from Wintermute in June 2023.

Source: dune

Source: dune

Note: DYDX’s data is not included in this chart, which compares funds pool model derivative DEX.

- The Battle for Hong Kong Dollar Stablecoin: Government Issued VS Private Issued

- Multichain crisis resurfaces, with over $130 million in token liquidity withdrawn.

- Construction and Case Studies of zk-SNARK

1. Business Data

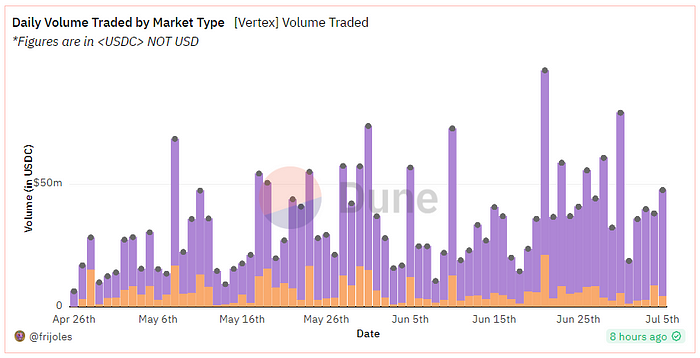

l Trading Volume: It created higher trading volume mainly through trading incentive measures, and the average daily trading volume in the past 7 days is about USD 40 million. The purple part is derivatives, and the yellow part is spot trading, with derivatives trading as the main focus.

The daily trading volume is lower than that of the top derivative DEX (DYDX/GMX/SNX), and is comparable to that of the second-tier derivative DEX. From the trading volume of the past 7 days, Vertex has entered the top 10.

Source: dune

Source: dune

TVL: USD 6.22 million, the scale is still relatively small, including four types of tokens, the specific composition is as follows:

Source: dune

Source: dune

DAU: The total number of users is 1842, and the number of daily active users in the past 7 days is about 200. In comparison, GMX has more than 1,000 daily active users, DYDX has around 700, and SNX has about 500.

Source: dune

Source: dune

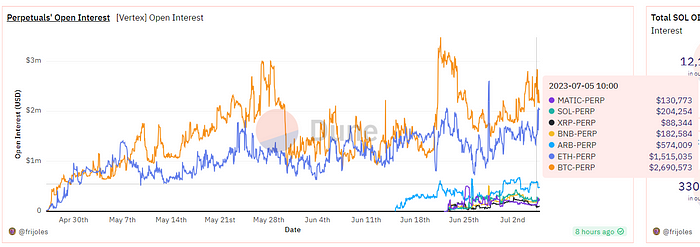

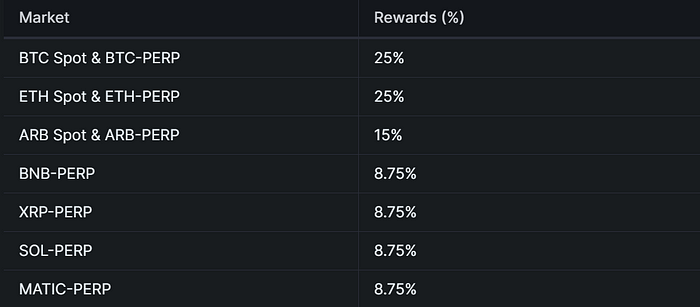

Open Interest: There are a total of 7 trading pairs, with BTC and ETH occupying the main share, and the current position is about USD 5.37 million. The position amount is also relatively low.

DYDX’s position amount is about USD 300 million, GMX’s position amount is between USD 150 million and USD 200 million, Gain Network is between USD 30 million and USD 50 million, and Mux is between USD 20 million and USD 50 million.

Source: dune

Source: dune

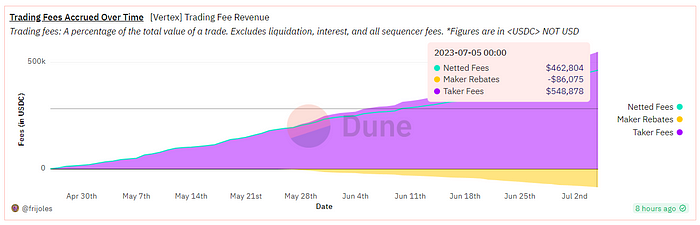

Fee: The cumulative gross income is about $540,000, deducted by $86,000 in commission to the maker, resulting in a net income of $460,000.

Source: dune

Source: dune

II. Team and Investors

Co-founder Darius is mainly responsible for external marketing activities.

Co-founder Alwin Peng previously worked at Jump Trading as a blockchain engineer.

Vertex received strategic investment from Wintermute Ventures in June 2023. Wintermute Ventures is the venture capital department of crypto market maker Wintermute. Wintermute provides market-making services for many well-known projects such as Arb, OP, and Blur.

When Wintermute announced its investment in Vertex, it said, “Vertex is led by a strong team of traders and engineers with a good track record in the TradFi and DeFi markets, and is at the forefront of smart contract and market innovation.”

Prior to this, in April 2022, Vertex received $8.5 million in seed funding, led by Hack VC and Dexterity Capital, with follow-on investments from Collab+Currency, GSR, Jane St., Hudson River Trading, Huobi, JST Capital, Big Brain, and Lunatic Capital. Early investors received 8.5% of the tokens, which means that Vertex’s seed round valuation was $100 million.

Vertex was originally built on Terra, but after Terra collapsed, the protocol was migrated to Arbitrum.

III. Product

Provides one-stop DeFi services, including spot, futures, and lending markets, mainly focusing on futures markets. Most of the trades are perpetual futures contracts, and spot and lending are more geared towards serving futures contracts, so they are classified as derivative DEXs.

Liquidity supply model: Hybrid order book-AMM model

The liquidity supply model is the main difference between Vertex and other derivative DEXs. Vertex believes that the off-chain order book can reduce MEV attacks through FIFO processing and improve transaction execution speed. On-chain AMMs provide permissionless liquidity support, allowing traders to force trades and ensuring effective trading when liquidity is low in the order book.

Vertex achieves a hybrid order book-AMM model through several components:

On-chain trading venue (AMM);

On-chain risk engine for fast settlement;

Off-chain sorter for order matching.

Figure: Vertex core component architecture

Source: Vertex

Source: Vertex

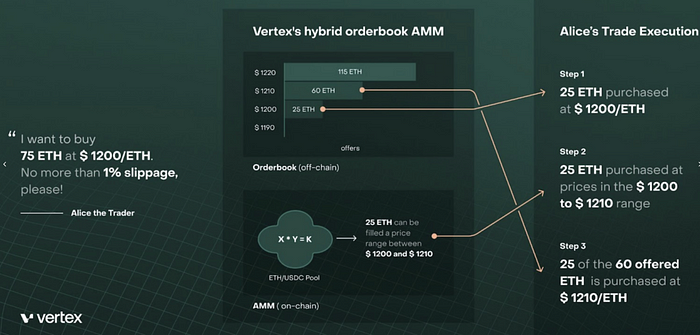

What this means is that there are two types of liquidity coexisting in the Vertex trading platform: liquidity from the order book provided by market makers through API, and liquidity from LP funds provided by smart contracts. These two types of liquidity are combined through the sorter, and what the user sees in the frontend is a unified liquidity to trade at the best available price. The following picture shows how the sorter works with order book liquidity and LP liquidity to complete a trade.

Source: Vertex

Source: Vertex

Process analysis:

ETH-USDC currency pair trading price is $1,200.

Alice wants to buy 75 ETH in the market and sets the maximum slippage to 1%.

There is an order worth 25 ETH on the order book at a price of $1,200, so one third of the trade is executed at $1,200.

The next set of sell orders on the order book (totaling 60 ETH) are priced at $1,210.

However, there is an LP position of 25 ETH in the price range of $1,200 to $1,210. Therefore, the next one-third of the trade is purchased from the LP position at a price between $1,200 and $1,210.

The final one-third of the trade is executed at $1,210.

Funds efficiency: Universal Cross Margin expands margin range

Vertex aims to increase the efficiency of funds usage and proposes the concept of “Universal Cross Margin”, which mainly expands the margin range.

Currently, there are two common margin models in derivative trading. One is the isolated margin mode, where a trading pair is an independent isolated margin account. Only the currencies of that trading pair can be deposited, held, and borrowed in a specific isolated margin account. Each isolated margin account has an independent risk rate, which is calculated independently based on the assets and liabilities held under the trading pair. The risk is isolated for each isolated margin account, and there is no impact on other isolated margin accounts in case of liquidation risk.

Another type is Cross Margin, in which a user generally has only one margin account that can trade all supported currencies. The assets and liabilities in the account are cross-collateralized and shared, and the risk rate is calculated based on all assets and liabilities in the margin account. In the event of a margin call, all assets in the account will be liquidated.

It can be seen that the capital utilization efficiency of Cross Margin is higher than that of Isolated Margin. Based on this, Vertex proposes Universal Cross Margin.

All of a user’s funds (deposits, positions, and investment P&L) on the platform can be used as margin, including open positions in spot, perpetual contracts, and currency markets. For example, if a user provides liquidity to the spot pool, the LP funds can be used as margin for contract trading while earning fees at the same time, improving the efficiency of capital utilization.

Universal Cross Margin also allows portfolio margining, in which unrealized profits can be used to offset unrealized losses or as margin for existing positions or new positions.

To help users manage their account risks more effectively, Vertex also provides risk level tips for accounts, which can be viewed directly on the page.

Accounts can be divided into two states: Initial and Maintenance. Under the Initial state, accounts can also be classified into low, medium, and high risk levels based on the ratio of margin to debt. The Maintenance state means that the initial margin usage has exceeded 100%, and no further positions can be opened. Users should replenish the margin as soon as possible, or they may face liquidation.

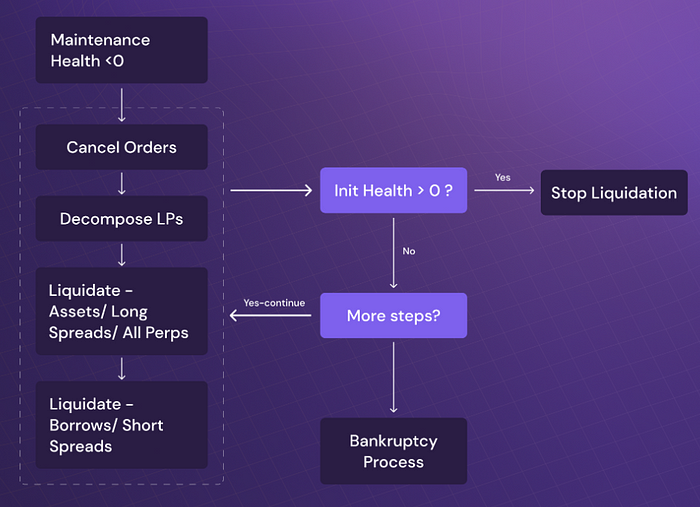

Due to Universal Cross Margin, liquidation is also performed under the Cross Margin mode, and positions will be liquidated in the following order:

Orders are cancelled, releasing the order funds;

LP assets are liquidated and sold;

Assets are liquidated (i.e., spot balances/contract positions);

Liabilities are liquidated (borrowing).

If the initial health score of the account is restored to above 0 during the liquidation process, the liquidation will stop.

Source: Vertex

Source: Vertex

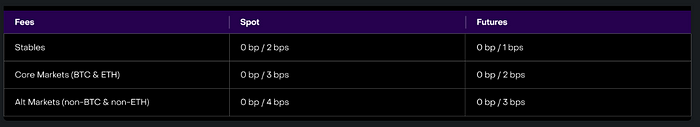

Lower trading fees

Vertex’s trading fees are relatively low. The maker fees for both spot and contract trading are currently 0, while taker fees range from 0.01% to 0.04%.

Source: Vertex

Source: Vertex

Source: Vertex

Source: Vertex

As the Vertex protocol token has not yet been issued, it is impossible to avoid the behavior of volume brushing. Currently, the launch of derivative DEX protocols relies on transaction incentives, such as Vela, which stimulated the growth of transaction volume during its beta version. Most protocols still maintain transaction incentives after their launch, such as DYDX, Kwenta, etc. The fact that Vertex is able to receive more adoption at this stage indicates that funds have a positive view of the protocol’s tokens.

V. Conclusion

The competition in the derivative DEX market is already a red ocean. Many projects have forked the GMX model and deployed it on new public chains or layer 2 solutions, offering high APRs in an attempt to attract funds and earn profits. In comparison, Vertex provides some innovative mechanisms to create better liquidity and higher fund utilization efficiency, which is worth paying attention to.

The risk to note is that while its Universal Cross Margin improves fund utilization efficiency, it also increases the risk exposure of user assets, and traders need to do corresponding risk control.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Six Catalysts for the Growth of Algorithmic Stablecoin Frax Finance

- Even Zuckerberg’s Threads is using ActivityPub. What makes this decentralized protocol capable of challenging Web 2.0 giants?

- Evening Must-Read | Meta Launches Twitter Rival Threads: How to Use and What’s Its Biggest Feature

- Six Catalysts Driving Growth for Algorithmic Stablecoin Frax FinanceFrax Finance

- What is GameFi?

- From NFTs to L2 network Loot Chain, what new story will Loot tell?

- What changes have been made to the point incentive system with the official launch of Blur V2?