LianGuai Daily | Hackers have returned all stolen funds to Alchemix Curve pool; US SEC provides over $104 million in rewards to 7 whistleblowers

LianGuai Daily | Hackers return stolen funds to Alchemix Curve pool; SEC rewards 7 whistleblowers with $104 millionToday’s News Highlights:

1. Vyper Compiler for Ethereum releases vulnerability incident analysis report, and the vulnerability has been fixed and tested in v0.3.1.

2. The US SEC provides over $104 million in rewards to 7 whistleblowers.

3. Waves founder: Wave L2 whitepaper to be released next week.

- Decoding Decentralized Order Book The Best Combination of Pricing Quality and Fund Security

- LianGuai Daily | Coinbase, Block, and Apple release quarterly reports; X Company is seeking data partners to establish a trading platform.

- Ether Futures ETF Applications Pile Up, Is the Gear of Crypto ETF’s Fate Starting to Turn?

4. Curve Finance hacker returns all funds to Alchemix in the Curve pool.

5. Data: Multichain attacker sold stolen assets worth $36.7 million in the past week.

6. Data: Curve Finance founder sells 28.625 million CRV tokens again.

7. Data: ARK Invest has reduced its Coinbase stock holdings by over $18 million this month.

Regulatory News

The US SEC provides over $104 million in rewards to 7 whistleblowers

The US Securities and Exchange Commission (SEC) announced on its official website that it has provided over $104 million in rewards to 7 whistleblowers whose information and assistance have contributed to the success of SEC enforcement actions and related actions by another agency. This amount ranks fourth in the history of the SEC Whistleblower Program. It is reported that the 7 whistleblowers consist of two groups of joint whistleblowers and three individual whistleblowers, and the information provided by each group of whistleblowers has either prompted the SEC to initiate an investigation or played a significant role in the SEC’s investigation. The assistance provided by these 7 individuals to the staff includes providing documents that help law enforcement agencies substantiate allegations of misconduct, participating in interviews, and identifying potential witnesses.

NFT

Doodles collaborates with Crocs to launch a collectible series

NFT project Doodles announced on Twitter that it has collaborated with casual shoe brand Crocs and plans to officially launch a collectible series in August, including shoes, wearable devices, and Jibbitz decorations.

ApeCoin DAO initiates new proposal AIP-250 to maximize APE token staking rewards

The ApeCoin community has initiated a new proposal, AIP-250, which proposes a new APE token staking solution that allows users to receive prepayments while selling BAYC, MAYC, and BAKC, and stake APE with compound rewards. NFT holders will be able to leverage the value of their NFTs by generating additional passive income. This innovative approach provides ApeCoin community users with a more flexible and profitable staking experience. The current approval rate is 97.03%.

Project Updates

Waves founder: Wave L2 whitepaper to be released next week

Sasha Ivanov, founder of Waves, tweeted that 21.5 million XTN tokens have been burned, and currently only a small number of XTN holders have converted them into L2MP tokens to enjoy higher staking rewards. When whales start selling XTN, its price will drop significantly. The Waves L2 whitepaper will be released next week.

Curve Finance hackers have returned all the funds to Alchemix in the Curve pool.

DeFi lending protocol Alchemix tweeted that Curve Finance hackers have returned all the funds to Alchemix in the Curve pool and a full report will be released later.

Earlier, the Curve Finance hackers stated in the transaction memo for returning funds to Alchemix Finance: “I’ve seen some ridiculous views, so I want to clarify that I’m returning the funds not because you can find me, but because I don’t want to ruin your project. Maybe this is a lot of money for many people, but not for me, I’m smarter than all of you.”

Ethereum compiler Vyper releases vulnerability incident analysis report, the vulnerability has been fixed and tested in v0.3.1.

Ethereum compiler Vyper has released an analysis report on the vulnerability incident last week: on July 30th, multiple Curve liquidity pools were exploited due to a potential vulnerability in the Vyper compiler. Although the error has been identified and patched, the impact on protocols using the vulnerable compiler was not recognized at the time and they were not explicitly notified. The vulnerability itself was an improperly implemented reentrancy protection, and the affected Vyper versions are v0.2.15, v0.2.16, and v0.3.0.

The vulnerability has been fixed and tested in v0.3.1, and v0.3.1 and higher versions are secure. Measures will be taken in the future to improve the correctness of smart contracts compiled with Vyper. Firstly, improve the testing of the compiler, including continuing to improve coverage, comparing the compiler output with the language specification, and using formal verification (FV) tools to verify the compiler bytecode. Secondly, provide developers with tools to test their code more easily using multiple approaches, including source code and bytecode level testing. Thirdly, strengthen stricter two-way feedback for using the Vyper protocol.

Important data:

Data: ARK Invest has cumulatively reduced its Coinbase stock holdings by over $18 million this month.

According to data, since August 1st, ARK Invest has cumulatively reduced its holdings of 208,859 shares of Coinbase stock, which is valued at approximately $18.24 million at the current price.

Data: The Multichain attacker has sold stolen assets worth $36.7 million in the past week.

According to Spot On Chain, the Multichain attacker has sold stolen WBTC, LINK, CRV, YFI, and WOOO worth $36.7 million in the past week. 17 hours ago, they exchanged YFI, CRV, LINK, and WOOO for 1,443.5 ETH, and on August 1st, they exchanged WBTC for 29 million USDT and 433.2 ETH.

Data: Curve Finance founder sells an additional 28.625 million CRV.

According to on-chain analyst Yu Jin, Curve Finance founder Michael Egorov has sold an additional 28.625 million CRV to six investors/institutions from last night to this morning. The specific details are as follows:

- 8.875 million CRV → 0x431

- 8.75 million CRV → 0xD11

- 7.375 million CRV → 0x70C

- 1.75 million CRV → 0xC47

- 1.25 million CRV → stake-capital.eth

- 0.625 million CRV → 0xeaf

Since August 1st, the founder of Curve has sold a total of 142.65 million CRV tokens to 30 investors/institutions, raising a total of $57.06 million in funding.

The LianGuaiNews APP points system – PT (Grape) officially launched, join Read to Earn together!

PT (short for Grape in Chinese) is a reward point that LianGuaiNews users can earn by participating in interactive activities such as reading news, sharing content, and liking and bookmarking on the LianGuaiNews website and app. PT Grape cannot be traded or transferred, and can only be used for redeeming various prizes in the “Points Mall” of LianGuaiNews and participating in various daily activities. Experience it now!

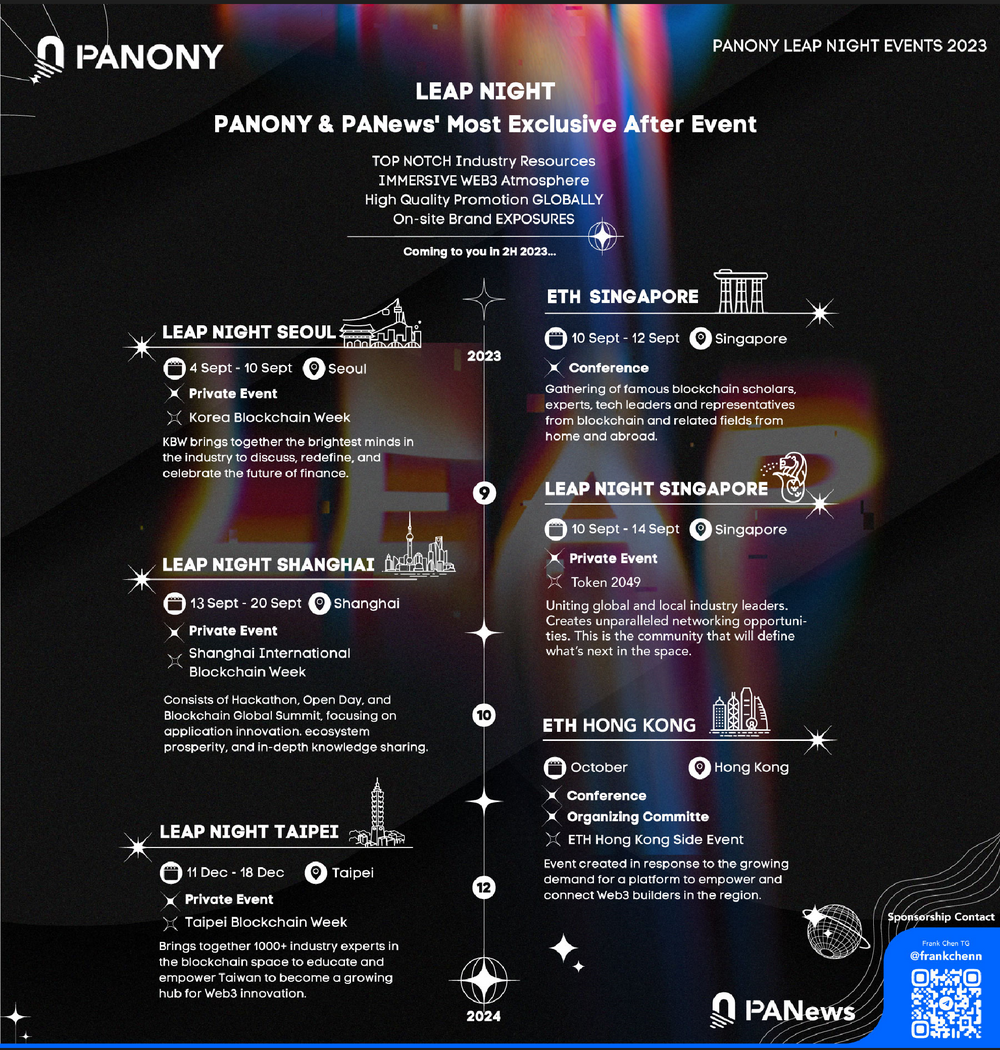

LianGuaiNews launches the global LEAP journey!

Korea, Singapore, Shanghai, Taipei, multiple locations gather from September to December to witness a new chapter of globalization!

📥Activities are being jointly built in multiple locations, welcome to communicate!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Developer’s Guide How to Build Products on the Base Mainnet?

- World Engine A sharding Rollup framework designed for full-chain games

- The inevitable outcome of Non-EVM public chains? Analyzing the reasons for the decline of ICP from multiple perspectives

- Latest developments in the Curve incident Has the crisis been resolved? Does the founder have to sell coins and pay off debts?

- OP Research Sociology Experiment of Currency and Global Citizens

- Exclusive Interview with 1inch Co-founder How does 1inch gradually innovate to grab food from the horse’s mouth in the liquidity battle?

- Extensive Article The Iron Curtain of Regulatory Control in the United States Has Fallen, What Tomorrow Will Crypto Face?