What supports Bitcoin's value?

Contrary to popular belief, Bitcoin actually has something to support. Its support is the same as any other form of currency: the credibility of its monetary properties. Money is not a collective illusion, nor is it just a belief system. In the course of history, many media have become currencies, and each occurrence is no accident.

Commodities that become currencies have unique attributes that distinguish them from commodities in other markets. Despite the fuller discussion in the Bitcoin Standard book, currency commodities have unique attributes that make them a particularly useful medium of exchange; these characteristics include scarcity, durability, separability, interchangeability, and Portability, etc. For each emerging currency, the intrinsic attributes of one medium will improve and eliminate the intrinsic monetary attributes of the existing currency, and each time one commodity is monetized, the other will be demonetized at the same time. (Blue Fox Note: Due to the network effect of currency, there is a zero-sum game relationship here)

In essence, the comparative advantage of one currency medium must compete with another medium, and Bitcoin is no exception. It represents technological progress in the global currency competition. It is an excellent successor of gold and the fiat currency system that uses the currency properties of gold.

- The rise and fall of blockchain in China in the past ten years

- 2020 forecast (overseas version): USDT will become third in market capitalization, Ray Dalio announces holding BTC …

- Sichuan Ganzi shut down bitcoin mines? Officials say it ’s just collecting opinions, not everything

Bitcoin is surpassing its predecessor currency by virtue of its monetary attributes. Bitcoin is limited and scarce, and it is easier to split and transfer than current competitors. It is more decentralized and, as a derivative, more resistant to corruption. There will never be more than 21 million bitcoins (Blue Fox Notes: actually lower, according to research institutions, about 2-3 million bitcoins have been permanently lost), each bitcoin can be divided into 8 decimal places ( One billionth). The value can be transferred to anyone in any part of the world without permission, and the final settlement does not depend on any third party.

Overall, its currency properties are significantly better than any other form of currency currently in use. Moreover, these characteristics do not exist by accident, nor do they exist in a vacuum. The currency attributes that appear in Bitcoin are ensured and enhanced by a combination of cryptography, a decentralized node network that enforces common consensus rules, a robust mining network that ensures the integrity of the Bitcoin transaction ledger, and is non-tamperable.

The currency itself is the cornerstone that binds the system together and creates economic incentives that allow security to be achieved in a holistic manner. But even so, Bitcoin's monetary attributes are not absolute. On the contrary, compared to the intrinsic attributes of other monetary systems, Bitcoin's monetary characteristics are being evaluated by the market.

CoinbasePro: Bitcoin's USD exchange rate over the past 6 months (as of 2019.9.27)

CoinbasePro: Bitcoin's USD exchange rate over the past 6 months (as of 2019.9.27)

It can be seen that for every dollar of Bitcoin sold, the same amount of USD and Bitcoin exists in the world. All these changes reflect the relative preference of holding one currency over another. As the value of Bitcoin rises, this shows that market participants are increasingly inclined to hold Bitcoin over USD. Higher bitcoin prices (in U.S. dollars) mean that more dollars must be sold to get the same amount of bitcoin.

Overall, it is the market's assessment of the relative power of monetary attributes. Price is output. The currency attribute is input. When people evaluate the monetary attributes of Bitcoin, the natural question becomes: Who owns more reliable monetary attributes? Bitcoin or USD? So, what underpins the dollar (or euro, etc.)?

When trying to answer this question, the most common rebuttal is that the dollar is supported by the government, the military, and taxes. However, the dollar is not supported by these things. Not the government, the army, or the tax. The government levies taxes on valuable things; a commodity is valuable not because it is taxed (Blue Fox Note: but because it has value in itself). Similarly, the military protects the security of valuable things, not because the military protects it (Blue Fox Note: but because it is inherently valuable). Similarly, the government does not determine the value of its currency; it can only determine the supply of money.

Venezuela, Argentina, and others have government, military, and taxation rights, but their respective currencies have depreciated significantly over the past five years. Although this is not enough to prove counterfactuals, each of these examples runs counter to the idea that the value of money comes from the function of government. Every event of hyperinflation is sufficient to prove the inherent flaws of the fiat currency system. Unfortunately, this is not the case. Rather than understanding hyperinflation as the logical end game of all fiat currency systems, consider hyperinflation simply as a proof of poor currency management.

This simplified view ignores the first-principles and the drive to ensure currency depreciation in the fiat currency system. Although the US dollar is more flexible in structure as a global reserve currency, the function of supporting all fiat currencies is the same, and the US dollar is just the strongest among a bunch of weak chickens. Once the mechanism that supports the US dollar (and all other fiat currency systems) is better understood, it can provide a benchmark that can be used to better evaluate the mechanism that supports Bitcoin.

Why is the dollar valuable?

The value of the dollar does not appear on the free market. Instead, it appears as a small representation of gold (originally silver). In essence, the US dollar is a solution to the inherent limitations of gold interchangeability and transferability. It began by relying on the monetary attributes of basic finance, rather than the intrinsic attributes of the dollar itself. Initially it was also a trust-based system: accepting the US dollar and believing that it could be converted back to gold at a fixed exchange rate in the future. Solving the limitations of gold as a currency is the US dollar system, and without gold, the US dollar will never exist in the current structure. A quick review of the history of the US dollar anchored in gold:

* In 1900, the Gold Standards Act of 1900 established gold as the only metal convertible into dollars. The exchange rate between gold and the US dollar is: $ 20.67 per ounce.

* In 1913, the Federal Reserve was created in 1913 as part of the Federal Reserve Act.

* In 1933, President Roosevelt banned people from hoarding gold through Executive Order 6102, requiring his citizens to exchange their gold for U.S. dollars at an exchange rate of $ 20.67 per ounce, otherwise they would face a fine of up to $ 10,000 or up to 5 to 10 years Imprisonment.

* In 1934, President Roosevelt signed the "Gold Reserve Act", which devalued the US dollar by about 40% and exchanged $ 35 per ounce of gold.

* In 1944, the Bretton Woods Agreement officially allowed foreign governments and central banks to exchange gold for U.S. dollars (and vice versa) at an exchange rate of $ 35 per ounce, and established a fixed exchange rate between the U.S. dollar and other foreign currencies.

* In 1971, President Nixon officially ended the exchangeable relationship between the US dollar and gold, and effectively terminated the Bretton Woods system. The exchange rate between the US dollar and gold became $ 38 per ounce.

* In 1973, the US government repriced gold at $ 42 per ounce.

* In 1976, the US government completely decoupled the value of the US dollar from gold in 1976.

During the twentieth century, the US dollar changed from a reserve-backed currency to a debt-backed currency. Although most people never stop thinking about the value of the dollar in the post-golden age, the most common explanation remains, either this is a collective illusion (that is, the dollar is valuable simply because we all believe it is valuable), or This is due to the functions of government, military and taxation.

None of these explanations are based on first-principles, nor are they the fundamental reason why the dollar can maintain its value. Instead, today, the dollar maintains its value as a function of debt and the relative scarcity of the dollar versus dollar-denominated debt. In the dollar world, everything is a function of the credit system.

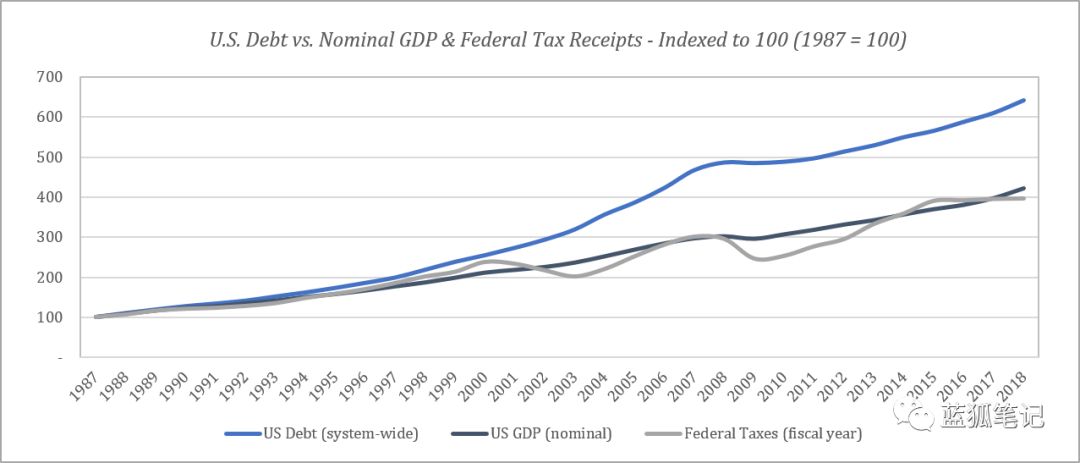

Nominal GDP is functionally dependent on the size and growth of the credit system, and taxation is a derivative of nominal DGP. The mechanism for funding the government (taxes and deficit spending) depends on the credit system, which is the kind of credit system that enables the dollar to play a role in the current structure.

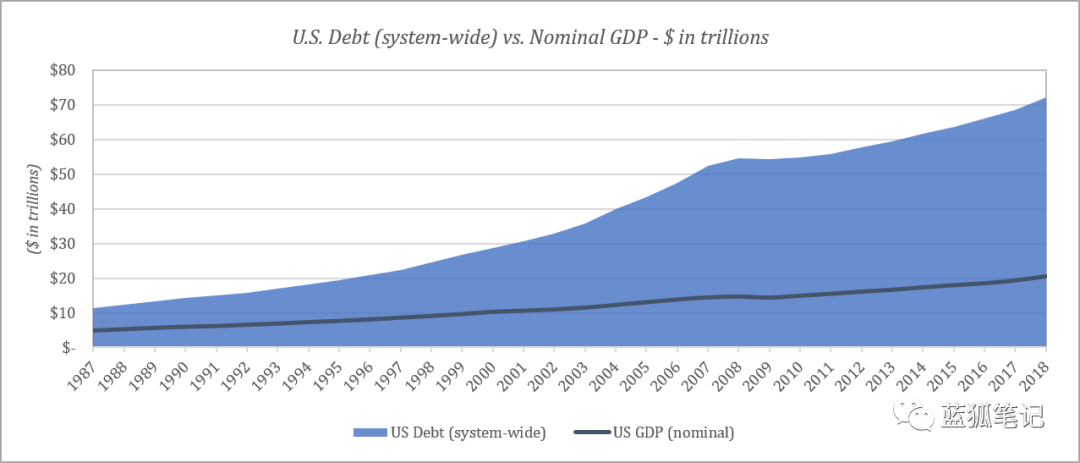

The size of the credit system is several times the nominal GDP. Since the credit system is also several orders of magnitude larger than the base money supply, economic activity is largely coordinated by credit distribution and expansion. However, the growth of the credit system over the past three decades has far outpaced GDP growth.

The table below compares the rate of change of the credit system with the rate of change of nominal GDP and federal tax revenue (from 1987 to the present). In the Federal Reserve system, credit expansion drives nominal GDP, which ultimately determines the level of federal taxation.

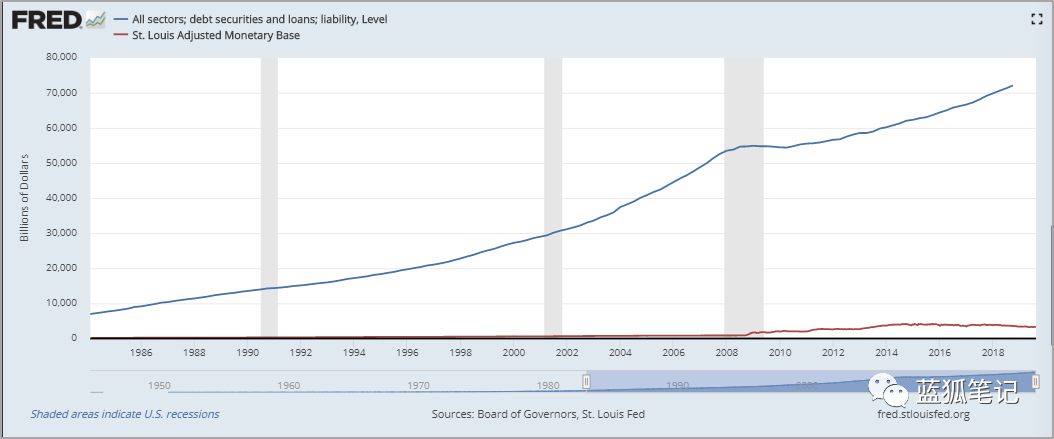

Today, according to the Federal Reserve (z.1 report), there is a total of $ 73 trillion in debt (fixed maturity / fixed debt) in the U.S. credit system, but actually only $ 1.6 trillion in the banking system. This is how the Fed manages the relative stability of the dollar. Debt creates future demand for the dollar. In the Fed system, the leverage on each dollar is approximately 40: 1. If you borrow dollars today, you need to get dollars to pay off debt in the future. Each dollar in the banking system is currently owed more than 40 times. The relationship between the size of the credit system and the total amount of dollars gives the relative scarcity and stability of the dollar. In general, everyone needs dollars to pay off US dollar-denominated debt. (Blue Fox Note: In other words, the Federal Reserve's credit system created demand for the dollar)

The dollar debt owed by the entire system far exceeds the existing dollar stock, thus creating an environment with high demand for the dollar. If consumers don't pay their debts, their homes will be unsecured and redeemed, or their cars will be taken back. If the company does not repay the debt, through the bankruptcy process, the company's assets will be confiscated and distributed to creditors, and the shares will be completely cleared. If the government does not repay the debt, its basic functions will be shut down due to lack of funds. In most cases, the consequence of failing to receive the dollars necessary to pay off the debt is to lose everything.

Debt creates the ultimate motivation for dollar demand. As long as the dollar is scarce relative to the amount of outstanding debt, the dollar will remain relatively stable. This is how the Fed's economy operates, it inspires credit, and you create the source of future demand for the underlying currency. In a sense, this is a bit like a drug dealer. Make the addict addicted to your drugs, and then Ta will keep coming back for more. In this case, the drug is like debt, and it forces everyone to stay on the hamster wheel. (Blue Fox Note: It is to let people enter the environment of credit consumption. In order to repay the loan, they must work hard and cannot escape, similar to the situation of a house slave)

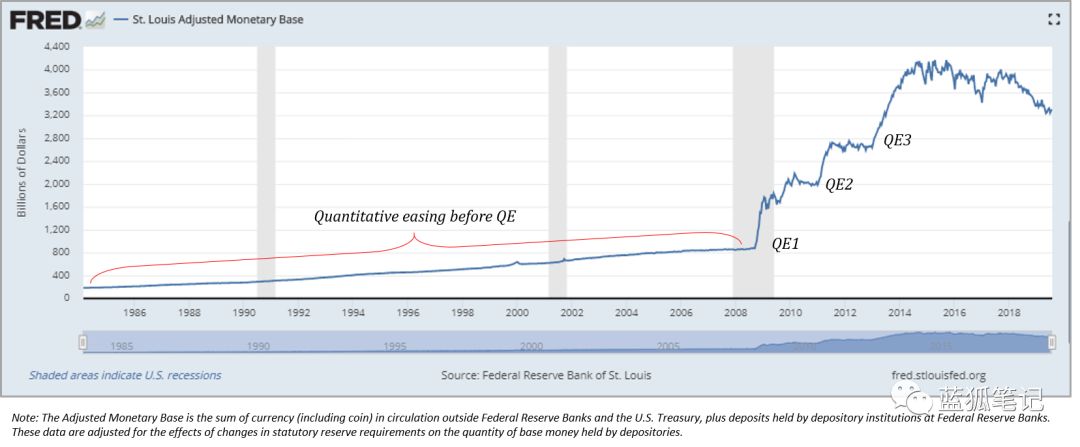

The problem with the Fed's economy (and the dollar) is that it relies on the functioning of a highly leveraged credit system. To stay afloat, the Fed must increase the amount of the base dollar. This is why quantitative easing and its existence exist. To maintain the amount of debt in the system, the Fed must systematically increase the actual dollar supply, or the credit system will collapse. Increasing the base dollar amount has a direct effect on deleveraging the credit system, but it has the long-term effect of drawing more credit. It also has the effect of depreciating the dollar over time. These are the results of design. Credit ultimately supports the U.S. dollar, because credit actually represents claims on real assets, and therefore people's livelihood. Getting future dollars, or risking losing your house, is a huge motivation for people to work for dollars.

The relationship between the U.S. dollar and U.S. dollar credit allows the Fed's games to work, and the central bank believes they can be played forever. Create more dollars; create more debt. Too much debt? Add more dollars and continue. Ultimately, under the Fed's system, money is the release valve.

With $ 73 trillion in debt and only $ 1.6 trillion in the US banking system, more dollars must be added to the system to support debt. The scarcity of the dollar relative to its demand has given it value. That's it. Nothing else supports the dollar. Although the dynamics of the credit system have caused the relative scarcity of the dollar, it also ensures that the dollar will become increasingly scarce on an absolute basis.

Too much debt → Create more currencies → More debt → Too much debt

As with any monetary asset, scarcity is the monetary attribute that underpins the dollar, but the dollar is only scarce relative to existing debt denominated in dollars. Now it's really competing with the Bitcoin form. The dollar system and its lack of inherent monetary attributes are in stark contrast to Bitcoin's inherent monetary attributes. The scarcity of the dollar is relative, while the scarcity of bitcoin is absolute.

The dollar system is based on trust, while Bitcoin is not. The supply of US dollars is controlled by the Federal Reserve, while the supply of Bitcoin is managed by consensus among market participants. The supply of US dollars always matches the size of its credit system, while the supply of Bitcoin has nothing to do with the credit system. And creating a dollar is almost zero cost, while the cost of creating bitcoin is tangible and increasing. In the end, Bitcoin's monetary attributes came into being and became more and more difficult to manipulate, while the dollar was essentially manipulable.

Currency and digital scarcity

When evaluating Bitcoin as a currency, the most difficult psychological obstacle to overcome is usually: it is digital. Bitcoin is not tangible, and on the surface, it is not intuitive either. How can something completely digital become money? Although the US dollar is mostly digital, in most people's minds, it is far more tangible than Bitcoin. Although the digital dollar emerged from its predecessor of the paper dollar, the physical dollar is still in circulation, and Bitcoin is purely digital native.

With dollars, there are physical representatives who anchor our mental models to the physical world. Bitcoin does not have a similar mental model anchoring. Although Bitcoin has more reliable monetary properties than the US dollar, the US dollar has always been the currency (for most of us), and as a result, its digital representation appears to be a more intuitive extension from the physical world to the digital world. Although the dollar as a currency has time to settle and its digital nature looks more tangible, Bitcoin represents a limited scarcity. On the other hand, the supply of dollars is unlimited.

Remember that the US dollar does not have any inherent monetary properties. In the process of enhancing its global reserve status, it has made full use of the monetary attributes of gold. For its part, the US dollar has no unique attributes that can make it a stable form of currency, but it has maintained a relative role in the construction of the dollar-linked currency system. Scarce. The first major question to consider when evaluating Bitcoin is whether digital things can share the typical attributes that make gold a value store (and form of currency). Does gold become money because it is physical, or because it has extraordinary attributes that surpass other physical objects?

Why is gold the currency of all things in this world? Gold becomes currency not because it is physical, but because its general characteristics are unique. Most importantly, gold is scarce, interchangeable and highly durable. Although gold has multiple attributes that are superior to its predecessors, its fatal drawback is that it is difficult to carry and easy to centralize. That's why the dollar eventually became its counterparty. (Blue Fox Note: Because the dollar can solve this fatal shortcoming of gold)

"As a thought experiment, suppose there is a base metal that is as scarce as gold, but has the following properties: boring gray, does not have good conductivity, is not particularly strong, is not easy to pull or shape, and does not have Practical or decorative use, and has a special magical attribute-can be transferred through communication channels. "-Satoshi Nakamoto (August 27, 2010)

Bitcoin has the monetary attributes that make gold the medium of money, but it also improves the shortcomings of gold. Although gold is relatively scarce, Bitcoin is limitedly scarce, and both are extremely durable. Although gold is tangible, it is difficult to test. Bitcoin is interchangeable and easy to verify. Gold is difficult to transfer and is highly centralized. Bitcoin is easy to transfer and highly decentralized.

In essence, bitcoin has all the ideal characteristics of combining physical gold and digital dollars, and at the same time, there are no major flaws (Blue Fox Note: Objectively speaking, this is not the case. There are certain differences in the Bitcoin economic model Certainty, and its sustainability needs to be tested in reality). But when evaluating the monetary medium, the overarching principles are the most basic. Ignore the conclusion or the final point and ask yourself: If Bitcoin is actually scarce and limited, and ignore it is digital first, can it effectively measure value and ultimately achieve value storage? Is scarcity a strong enough property to make Bitcoin a currency, regardless of whether its scarce form is digital? (Blue Fox Note: For post-90s and post-00s, there should be no psychological barriers to digitalization, such as digital payment methods, digitization of game assets, etc. The author has been struggling with digitalization and feels that this will not be the future. Big question)

Although money may be an intangible concept, as long as trade and specialization can bring benefits, there will be actual demand and utility for money. Money is a tool we use to measure the relative value of rich consumer goods and capital goods. It is a commodity that coordinates all other economic activities. The absolute quantity of money is not as important as its scarcity and measurability.

Scarcity is the most important attribute of money. If the supply of units of measurement changes continuously and unpredictably, it will be difficult to measure the relative value of the commodity, which is why scarcity, by itself, is a very valuable attribute. Although the value of the underlying unit of measure may fluctuate relative to goods and services, the stability of the money supply results in the least amount of noise in price signals relative to other goods.

Although digital, Bitcoin is designed to be absolutely scarce, which is why it has the potential to be an effective form of money (and value measurement). There are only 21 million bitcoins, and 21 million bitcoins are very small in relative and absolute numbers. (Blue Fox Note: Remove the 2 to 3 million bitcoins that may have been lost, the actual bitcoin in the future will be about 18 to 19 million) and the Federal Reserve can create $ 100 billion in just one week, just click the button . (Blue Fox Note: The dollar that the Federal Reserve may add in a week is equivalent to the current market value of bitcoin. It can be seen that bitcoin is still in its early stages. Compared to the huge asset market, bitcoin is still a drop in the ocean. Of course, if the future Can develop, this is its space)

In order to provide a broader background, since the financial crisis, the Federal Reserve, the Bank of Japan, and the European Central Bank have created a total of $ 10 trillion in new currencies, which is equivalent to the total value of a denominated bitcoin of $ 500,000. Although the dollar, euro, and yen, and bitcoin are all digitized, bitcoin is the only obviously scarce medium and the only medium with inherent monetary attributes.

However, it is not enough to say that Bitcoin is limited and scarce, and one should not simply accept it. It is important to understand this situation and why. Why can't we create more than 21 million bitcoins? Why can't it be copied? Why is Bitcoin safe? Why can't it be manipulated? Although various factors have caused Bitcoin to operate with a reliable and fixed supply, the security within the Bitcoin network is mainly composed of three parts, and its security is strengthened through economic incentives:

- Network Consensus & Full Node: Enforce a Common Set of Governance Rules

- Mining & PoW: Verify transaction history, anchor Bitcoin security in the physical world

- Private key: Ensuring value units, ensuring ownership is independent of verification

What ensures Bitcoin security-network consensus & full nodes

21 million pieces are not just the number of software guarantees. In contrast, the fixed supply of 21 million Bitcoins is controlled by a consensus mechanism, and all market participants have economic incentives to enforce the rules of the Bitcoin network. Although the consensus of the Bitcoin network can theoretically decide to increase its supply to more than 21 million, the vast majority of Bitcoin users must collectively agree to devalue their currencies in order to implement this scheme. In fact, the global decentralized network of rational economic actors is a voluntary, opt-in currency system that does not collectively and overwhelmingly form a consensus to devalue their currencies. These are their independent decisions to use it as wealth storage currency. This reality then supports and strengthens Bitcoin's economic incentives, technology architecture, and network effects.

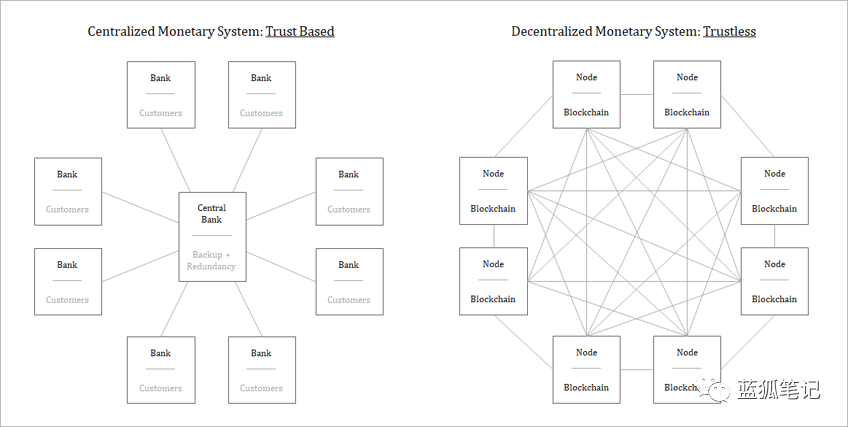

In Bitcoin, a full node is a computer or server that maintains a complete version of the Bitcoin blockchain. Full nodes independently aggregate blockchain versions based on a common set of network consensus rules. Although not everyone who owns Bitcoin runs a full node, everyone can do so, and each node can verify all transactions and all blocks.

By running a full node, anyone can access the Bitcoin network and broadcast transactions (or blocks) in a permissionless manner. At the same time, nodes need not trust other nodes. Instead, each node independently verifies the complete history of the Bitcoin transaction according to a common set of rules, allowing the network to converge with a consistent and accurate version of the history without requiring permission.

This is the mechanism by which the Bitcoin network removes the need for trust from any centralized third party and strengthens the credibility of its fixed supply. All nodes maintain a history of all transactions, allowing each node to determine if any future transactions are valid. Overall, Bitcoin represents the most secure computing network in the world, because anyone can access it without trusting one another.

The network is decentralized and there is no single point of failure. Each node represents checks and balances on the rest of the network, and in the absence of a central source of truth, the network is resistant to attack and corruption.

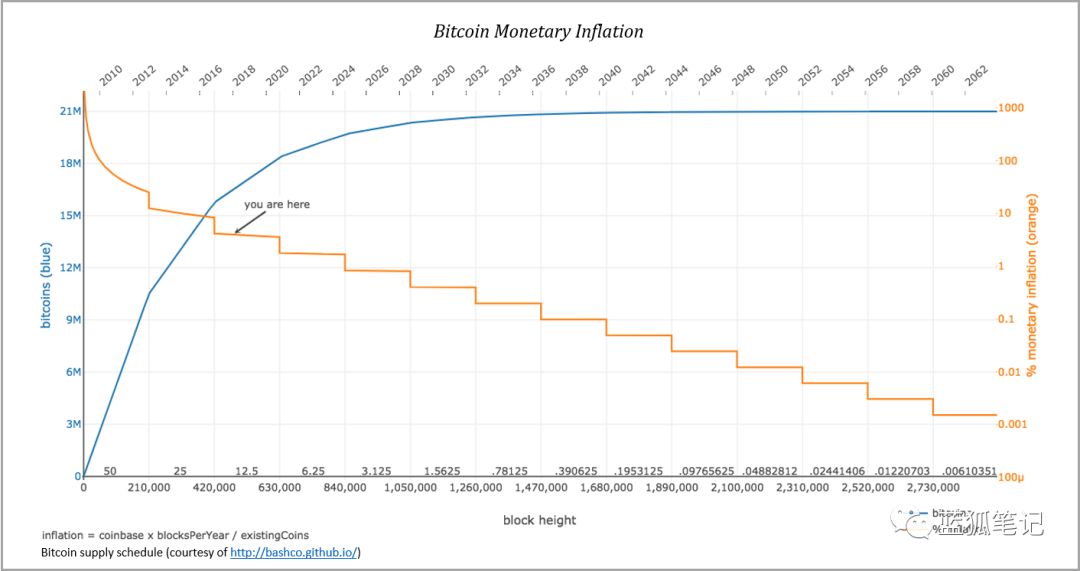

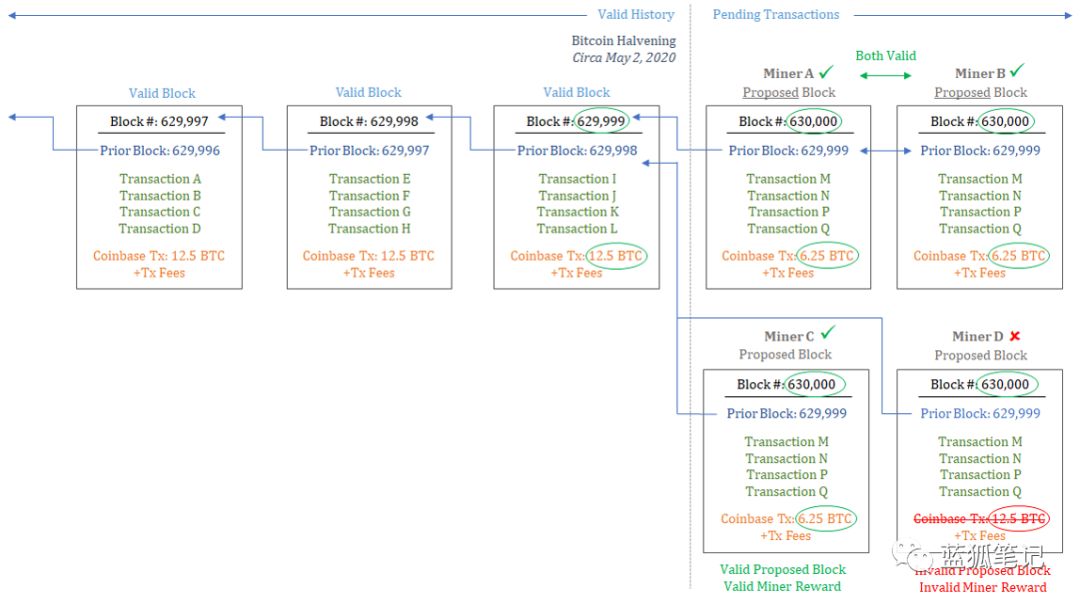

Any node can fail or corrupt, but the rest of the network will not be affected. The more nodes there are, the more decentralized Bitcoin will be. It adds redundancy and makes it more and more difficult for the network to be broken or censored. A key element in the implementation of the consensus rules of the whole node is the fixed supply of money. Each Bitcoin block includes a predefined number of Bitcoins issued, and each Bitcoin transaction must originate from a previously valid block in order to be valid. (Blue Fox Note: UTXO mode for Bitcoin transactions) For every 210,000 blocks, the token reward in the Bitcoin block will be halved until it is finally issued in 2140 and is eventually zero, thus creating a progressive, capped supply plan.

Since each node independently verifies each transaction and block, the network collectively enforces a fixed supply rule of 21 million. If any node broadcasts an invalid transaction or block, the rest of the network will reject it, and the node will not be able to reach a consensus. In essence, any node can try to create more bitcoin, but other nodes are interested in ensuring that the predefined limited supply of bitcoin is consistent, otherwise, the currency will be arbitrarily devalued at the expense of other parts of the network.

In addition, anyone inside or outside the network can copy the Bitcoin software to create a new version of Bitcoin, but any unit of the copied version will not be considered valid by the operating nodes within the Bitcoin network. Any subsequent copies or units will not be considered valid and will not be accepted as Bitcoin by anyone. Each bitcoin node independently verifies whether a bitcoin is bitcoin, and any copy of bitcoin is invalid because it does not originate from a previously valid bitcoin block. You can hope it is currency, but no one will accept it as Bitcoin, nor will it share the emerging attributes of the Bitcoin network.

By running Bitcoin's full node, anyone can instantly analyze whether Bitcoin is valid, and any copy of Bitcoin will be immediately identified as counterfeit. Node consensus determines the effective state of the network in a closed-loop system. Anything that happens outside the wall is considered to have never happened (Blue Fox Note: That is, things outside its closed loop system are not recognized by the system).

What ensures Bitcoin security-mining and PoW

As part of the consensus mechanism, certain nodes (called miners) perform Bitcoin's PoW function and add new blocks to the Bitcoin blockchain. This feature verifies the complete history of transactions and clears pending transactions. The process of mining is ultimately to secure Bitcoin in the physical world. In order to obtain the right to add blocks, miners must perform tens of thousands of cryptographic calculations, which requires a lot of energy.

Once the problem of the block proposal is resolved, the miner submits it to the network for verification by the remaining nodes. All nodes (including other miners) will verify that the block is valid based on a common set of network consensus rules. If any transaction in the block is invalid, the entire block is invalid. In addition, if the proposed block is not built on the latest valid block, the block is also invalid (that is, to comply with the longest chain rule).

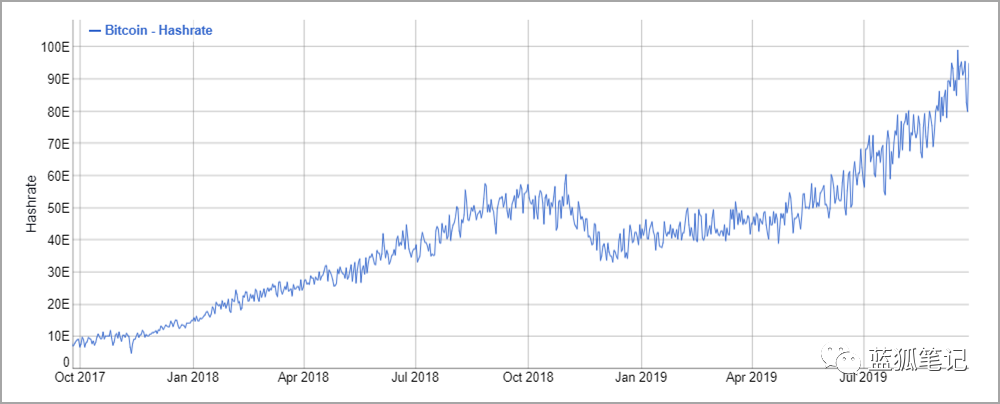

In terms of background, the Bitcoin network currently consumes about 9 gigawatts of energy per second, costs about $ 11 million per day, or about $ 4 billion a year, with a marginal cost of 5 cents per kilowatt (rough calculation) . New blocks are generated on average in about 10 minutes, which means that about 144 blocks can be added each day.

In the entire network, each block output costs about $ 75,000, and each block rewards about $ 100,000 (calculated based on the 12.5btc reward and the price of $ 8,000, excluding costs). The higher the cost of producing blocks, the higher the cost of attacking the network. The cost of producing a block represents the consumption of tangible resources that write history to the Bitcoin transaction ledger.

With the development of the network, the network becomes more decentralized, and the economic value of compensation to miners is generally increasing. From a game theory perspective, more competition and greater opportunity costs make collusion more difficult, and all network nodes are verifying the work performed by the miners, which is also an ongoing check and balance.

It can be recalled that a predefined number of Bitcoins will be issued in each valid block, that is, until the limit of 21 million is reached. The newly issued Bitcoin and network transaction fees for each block together represent economic compensation to miners who perform PoW. Miners are paid in bitcoin to ensure network security. As part of the block generation and proposal process, miners include the issuance of a predefined number of bitcoins to compensate for the consumption of tangible real-world resources and thereby protect the security of the network.

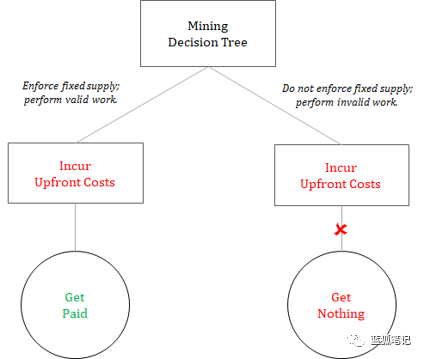

If the miner compensates with bitcoins that are inconsistent with the predefined supply plan, the rest of the network will reject it as a valid block. As part of the security function, miners must verify and implement a fixed money supply to be compensated. Miners pay substantial upfront costs (including energy expenditures), and ineffective work is not rewarded.

As a technical example, valid rewards paid to miners are halved every 210,000 blocks, and the next halving is expected to occur at block 630,000 (approximately May 2020). When halving this time, the reward per block will be reduced from 12.5btc to 6.25btc. Thereafter, if the miner contains an invalid block reward (an amount other than 6.25btc), the rest of the network will reject it as invalid. The halving is important, not only because of the reduction in the supply of newly issued bitcoins, but also because it also shows that the economic incentives of the network will continue to effectively coordinate and execute a fixed supply of money on a decentralized basis.

If any miner attempts to deceive, it will be punished to the maximum extent by the rest of the network. There is no other way to coordinate this behavior beyond the economic incentives of the network. It occurs on the basis of decentralization without the coordination of any central organization, thereby enhancing the security of the network.

Since mining is distributed, all miners continue to compete and it is not realistic for miners to conspire. In addition, all nodes verify the work of the miners, which can be performed immediately without substantial costs, which also creates a strong check and balance. Puzzles are difficult to solve but easy to verify. Overall, this is the fundamental difference between Bitcoin and the monetary system it competes with (whether it is gold or the US dollar). Moreover, the compensation paid to miners to protect the security of the network and strengthen the fixed supply is realized in the form of Bitcoin.

Monetary economic incentives are strong and penalties are heavy, which maximizes incentives for miners to collaborate and perform effective work. By introducing material costs in the mining process, including a fixed supply plan in the verification process (all nodes are verified), and by separating mining functions from network ownership, the entire network can be reliably and permanently based on no trust Implementation of a fixed supply plan (21 million pieces).

What secures Bitcoin-private keys and equal rights

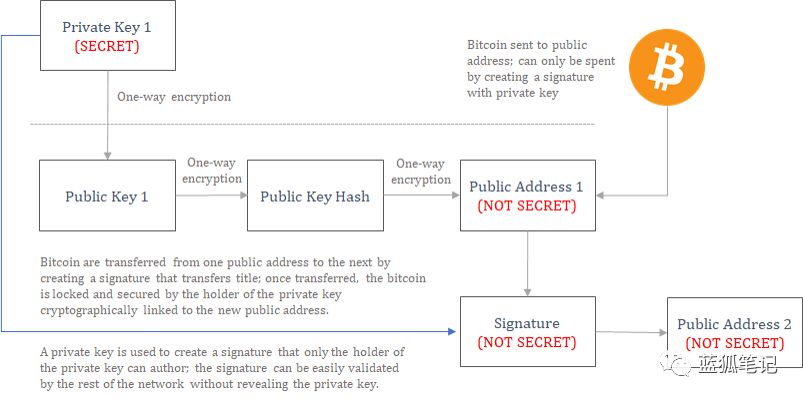

Although miners produce and propose blocks, nodes check and verify blocks, and private keys control access to value units. The private key controls the rights of 21 million bitcoins (so far, technically, about 18 million bitcoins have been mined). In Bitcoin, there is no identity. The Bitcoin network verifies the signature and private key. Only the person who controls the private key can create a valid Bitcoin transaction with a valid signature. A valid transaction is contained in the block, generated by the miner and verified by each node, but only the person with the private key can generate a valid transaction.

When valid transactions are broadcast, Bitcoin is transferred to a specific public address. The public address is derived from the public key, and the public key is derived from the private key. The public key and public address can be calculated using the private key, but the private key cannot be calculated from the public key and the public address. It is a one-way feature protected by strong encryption technology. The public key and public address can be shared without revealing any private key information. When Bitcoin is transferred to a public address, it is actually locked in the safe. In order to unlock the safe to spend Bitcoin, a valid signature must be generated with the corresponding private key (each public key and address has a corresponding unique private key).

The private key owner generates a unique signature without actually revealing its secret. The network verifies that the private key holder has generated a valid signature without having to know the private key itself. Public and private key pairs are the basis of Bitcoin. Ultimately, the private key controls access to the economic value of the network.

Whether a person owns 0.1 or 10,000 bitcoins, they are protected and verified through the same mechanism and rules. Everyone's rights are equal. Regardless of its economic value, every bitcoin (and bitcoin address) is treated the same in the bitcoin network. If the signature is valid, the transaction is valid and will be added to the blockchain (provided the transaction fee is paid). If the signature is invalid, the network will refuse to accept it. These have nothing to do with the strength of the participants. It verifies only the private key and signature. Although some people can prioritize their transactions by paying higher transaction fees, all transactions are based on the same set of consensus rules. Miners sort based on profitability and nothing more. If the profitability of the transaction is the same, it will prioritize the transaction according to the chronological order.

But it is important that the mining function is to process transactions, which is separate from ownership. Bitcoin ownership is controlled by a private key, and each Bitcoin transaction is evaluated on the network based on the same criteria. It is either valid or invalid. In order for bitcoin to be effective, each bitcoin must be aligned with the 21 million bitcoin supply plan. This is why user-controlled private keys are so important in Bitcoin.

Bitcoin is very scarce, and the private key is the gatekeeper who transfers every bitcoin. As the saying goes, you don't own Bitcoin without having control of your private key.如果第三方控制你的私钥,例如银行,这样的实体控制你对比特币网络的访问,在这种情况下,限制访问或占用资金变得容易。

尽管很多人选择信任银行这样的实体,但比特币的安全模型是独特的。不仅是每个用户控制自己的私钥,而且用户还可以以无须许可的方式访问其资金并转移给世界上任何地区的任何人。这只有在用户控制其私钥的情况下才有可能实现。总的来说,用户控制私钥分散了对网络经济价值的控制,从而提高了网络整体的安全性。

对网络的分布式访问越多,就越难对网络进行破坏。此外,通过持有私钥,个人的资金很难被限制访问或被没收。在流通中的每个比特币都由私钥保护,矿工和节点确保2100枚比特币的永远存在,但是有效比特币最终由私钥控制和保护。

比特币与其他形式的货币

总言之,比特币的供应由网络共识机制控制,矿工执行PoW工作量证明,将比特币的安全以物理世界基础支撑。作为安全功能的一部分,矿工生成区块以获得报酬,它们会验证历史交易,并清理待处理的比特币交易。如果矿工试图给自己补偿跟比特币固定供应计划不一致的比特币数量,网络的其余部分会拒绝接受其工作。

The money supply is integrated into Bitcoin's security model, and in order to be compensated, miners must consume real-world energy. However, every node in the network verifies transactions performed by miners, and no one can cheat without being punished. Bitcoin's consensus mechanism and verification process ultimately manages the transfer of network ownership, but the ownership of the network is controlled and protected by users who hold private keys in the network.

Put aside the preconceived notion of what money is. Imagine a currency system with scarcity and a fixed supply. Anyone in the world can access their network without permission and send transactions to anyone anywhere in the world. Everyone can independently and easily verify the money supply and ownership of the entire network. Imagine the global economy, where billions of people are scattered all over the world, can trade through a common decentralized network, and everyone can reach consensus on network ownership without the coordination of a central agency.

How valuable is this network? Bitcoin is valuable because it is limited, and at the same time, it is limited because it is valuable. The network's economic incentives and governance models promote each other, and the cumulative effect is a distributed, trustless currency system whose fixed supply is global and accessible to anyone.

Because Bitcoin has inherent and emerging monetary properties, it is different from any other digital currency. Although the supply of bitcoin remains fixed and limited, the Fed has had to expand its monetary base to maintain its traditional system. Bitcoin will become an increasingly attractive option because more market participants believe that the next round of quantitative easing is not only a tool for the central bank, but also a necessary function to maintain alternative and suboptimal options. Before Bitcoin, everyone had to opt in to the system by default. With the advent of Bitcoin now, there are viable options. Every time the Fed maintains its credit system through more quantitative easing, more individuals will find the superiority of Bitcoin's currency attributes.

Is A better than B? This is the test. In the global competition of currencies, Bitcoin has the inherent monetary attributes that the fiat currency system lacks. In the end, Bitcoin is supported by something, which is the only thing that supports any currency: the credibility of its currency attributes.

Risk warning: All articles of Blue Fox Note can not be used as investment advice or recommendations. Investment is risky. Investment should consider personal risk tolerance. It is recommended to conduct in-depth inspection of the project and make good investment decisions.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Does the popularity of Bitcoin depend on emoji? They initiated a petition

- Babbitt Column | "Digital Fiat War": Britain's Buddies "Break Out" Fed, Harvard Think Tank Simulates War

- Babbitt launches 丨 Industrial blockchain heats up, cloud elephant receives tens of millions of yuan A ++ round of financing

- Exploration of Domestic Practice of STO——Generation and Circulation of Account Receivable Electronic Voucher (1)

- Data Monthly Report: Cryptocurrency price trend correlation A shares> US stocks Guangdong has the most blockchain companies in the country

- Taobao sells hardware wallets, "currency ban" is still on

- Qingdao Daily Special Edition | Grab the scene of the "window period", Qingdao blockchain industry in progress