LianGuai Observation | Explaining why Hong Kong can become the engine of the East Asian Web3 market

Why Hong Kong can be the engine of the East Asian Web3 marketLianGuai Blockchain News on October 3rd Blockchain analysis company Chainalysis recently released a research report on the East Asian cryptocurrency market, which pointed out that Hong Kong is becoming the “engine” driving the progress of the Web3 market in the region.

Data shows that the East Asian region is the world’s fifth-largest active cryptocurrency market, accounting for 8.8% of global cryptocurrency activity from July 2022 to June 2023.

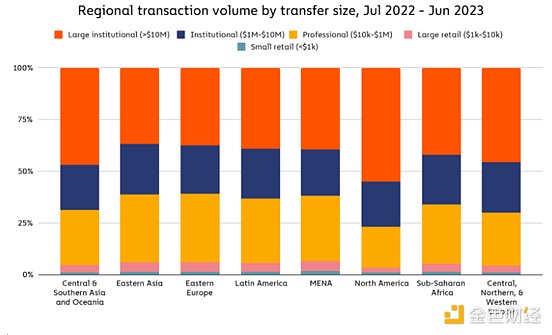

Compared with other larger cryptocurrency markets, the cryptocurrency market in East Asia seems to be less driven by institutional activities. Compared with similar-sized markets in the Middle East, North Africa, and Latin America, East Asia has shown a higher “DeFi inclination”.

- LianGuai Morning News | The supply of Bitcoin on exchanges has decreased from 5.99% since September 1st to 5.73%.

- LianGuai Daily | Bitcoin temporarily stabilizes above $28,000; FTX founder SBF’s trial will begin tomorrow, with jury selection on the first day.

- Analysis Why will the bull market start as early as next year from the perspective of the halving period?

In fact, in 2019, the East Asian region was one of the markets with the highest cryptocurrency trading volume in the world. However, subsequent bans on cryptocurrency in the country led to a significant decline in trading activity and mining market in the following two years.

Data shows that the recovery of cryptocurrency activity in East Asia is mainly driven by Hong Kong. Recently, Hong Kong has introduced a series of friendly cryptocurrency policies and compliance measures, promoting market optimism. In terms of the original transaction volume, Hong Kong is an extremely active cryptocurrency market. From July 2022 to June 2023, the estimated transaction volume of cryptocurrencies in Hong Kong has reached US$64 billion. Although it is still some distance away from the two major markets of Japan and South Korea, both of which have transaction volumes of over 100 billion US dollars, considering factors such as market size and population, the momentum of cryptocurrency trading activity in Hong Kong is still very strong.

The reason why Hong Kong has been able to rise to the top of the East Asian cryptocurrency market in a short period of time is largely due to its highly active over-the-counter (OTC) trading market. These services usually provide large-scale transfer functions for institutional investors and high-net-worth individuals. Analysis has found that:

l Hong Kong has a relatively high market share in institutional-level large-scale cryptocurrency trading activities of $10 million or more.

l South Korea seems to be the market in East Asia that is least driven by institutional trading, which may be due to local regulations making it difficult for financial institutions to engage in transactions (South Korea requires specific types of bank accounts associated with individuals to open cryptocurrency trading accounts, which poses challenges for institutional participants to enter the cryptocurrency market).

l Most cryptocurrency activities in Japan are evenly distributed between centralized exchanges and various types of DeFi protocols. (Note: South Korea has fewer transactions related to DeFi, which may be related to the TerraLuna incident, and local people prefer to engage in activities on centralized exchanges)

Hong Kong’s position as a cryptocurrency hub is increasingly strengthening

As a special administrative region of China, Hong Kong has autonomy in many policy areas, including cryptocurrency regulation. As mentioned above, Hong Kong has become a large local cryptocurrency market driven by over-the-counter trading. But what exactly is driving the adoption of cryptocurrencies in the region, and what does it mean for the future of cryptocurrencies in Hong Kong and the entire region? Merton Lam from CryptoHK and Dave Chapman from OSL Digital Securities provide some insights.

Both of them acknowledge that various use cases are driving the adoption of cryptocurrencies in Hong Kong. Dave Chapman said, “Many institutional investors are optimistic about cryptocurrencies, and the future of digital assets is no longer in doubt. People generally believe that digital assets will not disappear, regardless of whether traditional finance is ready to accept digital assets as a new asset class.”

Merton Lam also stated that international business payments are another important use case for cryptocurrencies in Hong Kong. Cryptocurrency payments can offer more advantages than bank transfers. For many businesses, it is much easier to make payments to suppliers through stablecoin transfers than through banks. SWIFT transactions may take up to three days to settle, and making payments, especially when dealing with trading partners in developing countries such as South Asia and Africa, can be particularly challenging. The use case of international payments also raises another noteworthy factor: the weakening dominance of the U.S. dollar in international trade.

Overall, Hong Kong’s unique cryptocurrency market provides various use cases that are suitable not only for local users but also for foreign users. The series of local regulatory measures may indicate a changing stance towards cryptocurrencies in the East Asian region.

Some content in this article is compiled from Chainalysis.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Wu’s Selection Zhu Su of Three Arrows suddenly arrested, Binance exits Russia, Mixin hacked for 200 million, MicroStrategy continues to buy BTC, and Top 10 news.

- Hong Kong Securities and Futures Commission discloses regulatory list, which crypto company has the highest risk?

- Ethereum transactions decrease, Layer 2 dominating the market in-depth analysis of on-chain activities and trends

- Q3 Eight major hotspots review Ripple, L2, PYUSD

- 2024 Bitcoin Price Prediction Insights from Major Banks and Hedge Funds

- A record of the closure of a rural bank Is encryption beginning to ‘butcher’ the banking industry?

- Interview with Lily Liu, Chair of Solana Foundation Entering the Asia-Pacific market at the right time, Solana may have new moves by the end of the year