Analyzing Friend.Tech from First Principles

Analyzing Friend.Tech from First PrinciplesFriend.Tech Timeline:

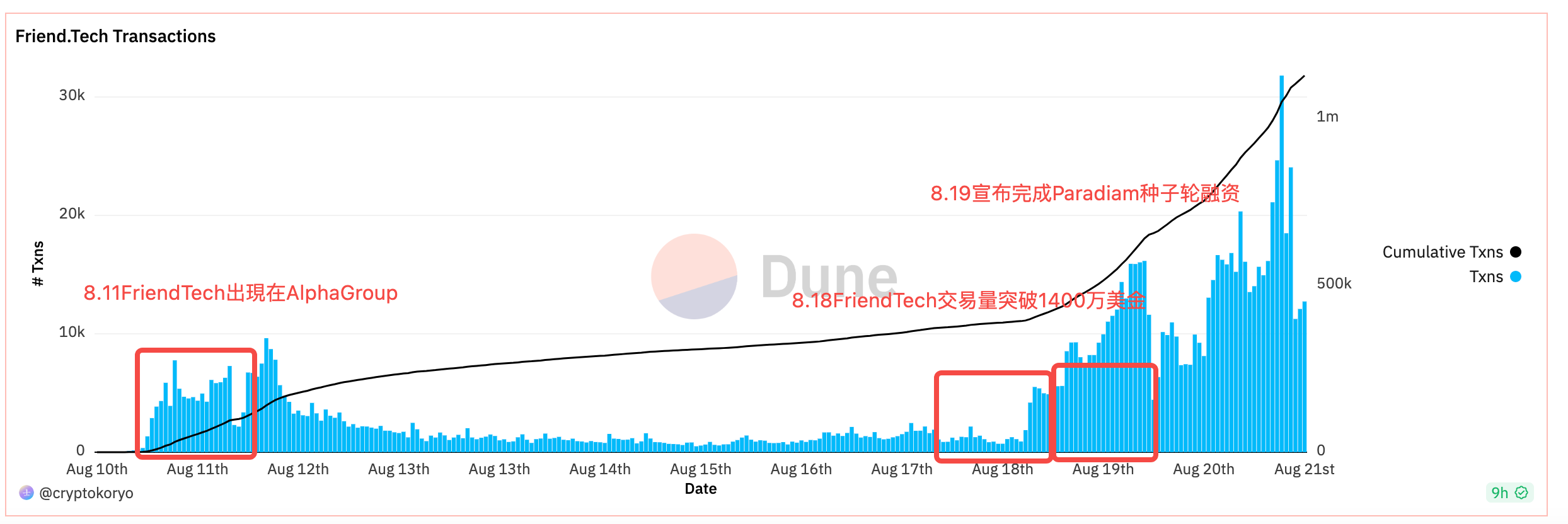

8.11 FriendTech appeared in AlphaGroup. At this time, most people still didn’t understand, but some smart players had already started to request invitation codes and engage in share trading.

8.12 With the FriendTech App crashing and some players getting stuck with their shares, the popularity declined. Most users felt that it was just like that.

8.13-8.17 FriendMEX and other open-source tools appeared in sight.

8.18 Announced the completion of LianGuairadiam’s seed round financing.

- Attracting 100,000 users in a month and ranking third in terms of protocol income, how much longer can the decentralized social application Friend.tech stay popular?

- OPNX Development History Tokens soar by a hundredfold, becoming a leading bankruptcy concept?

- Weekly Announcement | OKX platform upgrades KYC process and recommends users to complete advanced authentication; Avalanche (AVAX) will unlock tokens worth approximately $100 million.

Core Functions:

1. Private Circle: After users purchase shares of KOL, they gain the right to have conversations with them and access their specific content.

2. Share Trading: The pricing of shares is calculated using the following formula: Price in ETH = supply^2 / 16000

Friend.Tech charges a 10% fee for each transaction of group shares, with 5% allocated to KOL and the remaining 5% going to the treasury. As of August 21st, the Friend Tech treasury has received over $2.1 million.

The First Principles behind Friend.Tech:

When you are developing an innovative product, you will find yourself faced with numerous choices. Let’s take Friend.Tech as an example:

1. What services should our product provide to users?

A. A content social experience that is superior to Twitter.

B. Users can speculate on KOL shares with us, which is not available on Twitter.

2. Should we first attract ordinary users or KOL?

A. Ordinary users are most important as they have a large user base. We want users.

B. KOLs are the main producers of content.

3. Should each user’s share be priced freely or follow a bonding curve?

A. Freely priced, so that users have the motivation to produce content and grow themselves.

B. Using a curve equation to determine the price may make it easier for share buyers to accept.

Then, how should the liquidity of each person’s share be resolved?

A. Provide liquidity freely, and KOLs should incentivize their own shares.

B. Lock the liquidity, allowing people who have purchased shares to sell them at any time without being “Rugged”.

It is obvious that Friend.Tech has done everything right so far. Friend.Tech prioritizes the interests of KOLs and allocates 5% of the transaction fee from each share to KOLs themselves. This means that as long as KOLs manage their communities well, maintain community activity and turnover, they will receive continuous income. The criticism of the Bonding Curve is that the share price rises too quickly. As long as 200 people buy in, the share price will reach a staggering 2.2 ETH (but from the perspective of the author, this is not an excessive price. The current price of the NFT of the well-known alpha community LaserCat is around 4 ETH). However, the benefit is that KOLs are happy to see their own value skyrocket. Who wouldn’t want to have a high value?

Grabbing the most important users and making them work for you continuously with real financial benefits is the first principle of web3 social products.

Current speculative sentiment:

As of August 21st, what the members of various alpha communities are most looking forward to is the launch of prominent CT KOLs (especially popular are overseas KOLs of the trading type, especially those with bitclout original leather KOLs), such as @Banks. It skyrocketed to 2.4 ETH shortly after its launch yesterday, and many members were able to catch this golden opportunity. The most common sentence among the members is still: What do you think of this account?

Currently, Friend.Tech has not yet launched the function of sending pictures, so there are not many influencer bloggers on board. Once this feature is opened, I believe that influencer bloggers will bring a wave of new transaction volume to Friend.Tech.

Derivative products:

FriendMex: It is a front-end interface of Friend.Tech developed by renowned MEV researcher @_anishagnihotri, which has the following functions:

1. Trading shares without registering with FriendTech

2. Viewing data such as the K-line of trading shares

This project has been open-sourced. Here is the GitHub link: https://github.com/Anish-Agnihotri/friendmex

Share splitting contract: @0xfoobar, a well-known developer, has developed a feature called WRAPPED FRIENDS, which allows account shares to be packaged into ERC20 tokens for trading on Uniswap. The problem solved by this product is that some blue-chip KOL shares exceed 2 ETH, which affects the trading experience of some retail investors. Therefore, splitting into ERC20 tokens helps retail investors trade blue-chip shares with less chips, making it an index product.

RealFriend.Tech: RealFriend.Tech is a Friend.Tech share snatching tool developed by @iam4x. Its use case is as follows: if you have a KOL that you are confident in, you can use this tool to keep an eye on him and then buy his shares in advance once he registers with Friend.Tech. Currently, this product can only be used if you have bought shares from this guy. It’s really smart of him.

Product website: https://www.realfriend.tech/

Summary:

In most cases, it is much more difficult to create a popular product than to build infrastructure. I believe that Friend.Tech has also found its first principle after countless attempts. Putting aside economic incentives, the whole process can be seen as an interesting one, like planning a show. Who are my audience? What do they like to see? How do I get them to buy tickets? How do I keep them from leaving early?

Although I admire the team behind this product, in the end, whether your network is your net worth or someone else’s net worth, let’s wait and see!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- LianGuai Daily | The SEC files a motion for intermediate appeal regarding the Ripple case; friend.tech completes seed round investment, with LianGuairadigm participating.

- Content Marketing Methodology A Required Course for Web3 Startups

- Regulatory crackdown, slowed growth, Binance suffers two major setbacks.

- DeBank plans to launch Layer2, and the wool party has already taken action?

- Mining myself, mining out a 50% annualized return? Interpreting the Ve (3.3) game hidden behind the emerging star RDNT in the borrowing and lending market

- Cryptocurrency Track Weekly Report [2023/08/14]

- Deep analysis of ARB on-chain chips Users continue to increase their holdings, and most large holders are at a loss.