Attracting 100,000 users in a month and ranking third in terms of protocol income, how much longer can the decentralized social application Friend.tech stay popular?

With 100,000 users in just one month and ranking third in protocol income, how much longer can Friend.tech, the decentralized social application, remain popular?The hype around Friend.tech is in full swing, attracting over 100,000 users’ attention within less than a month of its launch, but how long can this “bullet” fly?

What is Friend.tech?

As a new decentralized social media application backed by LianGuairadigm, Friend.tech has become a hot topic in the crypto community in the past week.

Yuga Cohler, a senior software engineer at Coinbase, explained in a tweet that Friend.tech is a decentralized social media platform for crypto enthusiasts. Its innovative core lies in the use of “shares” as digital assets. Users can tokenize themselves by selling their “shares” to fans, who then become “shareholders” and can send messages directly to the users. These shares symbolize ownership in interactions with crypto enthusiasts.

This concept is similar to the principle of ownership in the stock market, where owning shares is equivalent to holding a stake in a specific company.

- OPNX Development History Tokens soar by a hundredfold, becoming a leading bankruptcy concept?

- Weekly Announcement | OKX platform upgrades KYC process and recommends users to complete advanced authentication; Avalanche (AVAX) will unlock tokens worth approximately $100 million.

- LianGuai Daily | The SEC files a motion for intermediate appeal regarding the Ripple case; friend.tech completes seed round investment, with LianGuairadigm participating.

At first glance, Friend.tech’s basic functions are similar to familiar platforms such as WeChat groups or Telegram groups. However, the unique aspect lies in the process of joining and leaving group chats, which defines the essence of Friend.tech.

Users can choose to join certain groups and earn shares of the selected group by paying a base amount as a participation fee. If users eventually decide to leave the group, they can liquidate their shares in the group.

Another advantage of Friend.tech is its seamless and user-friendly registration process. iOS users can easily access the official website on their devices and add it to their home screens. It is worth noting that this simplified approach eliminates the need for third-party downloads, ensuring smooth access to the application.

To participate, users need to obtain an invitation code and link their Twitter accounts. After completing these initial steps, they also need to deposit at least 0.01 ETH to Coinbase’s new Layer 2 network Base network in order to access the Friend.tech application and its range of features.

How popular is Friend.tech?

The beta version of Friend.tech was launched on August 10th and witnessed over 30,000 transactions and a trading volume of 4,400 ETH (8.1 million USD) within the first 24 hours. Currently, within less than a month of its launch, it has attracted over 100,000 users’ attention. Well-known KOLs Frank DeGods and Gainzy222, trader RookieXBT, and NBA player Grayson Allen have also joined this trend.

According to data analysis from Dune, as of the time of writing, Friend.tech’s total trading volume exceeds 36,260 ETH, equivalent to 60 million USD, involving 1.29 million transactions.

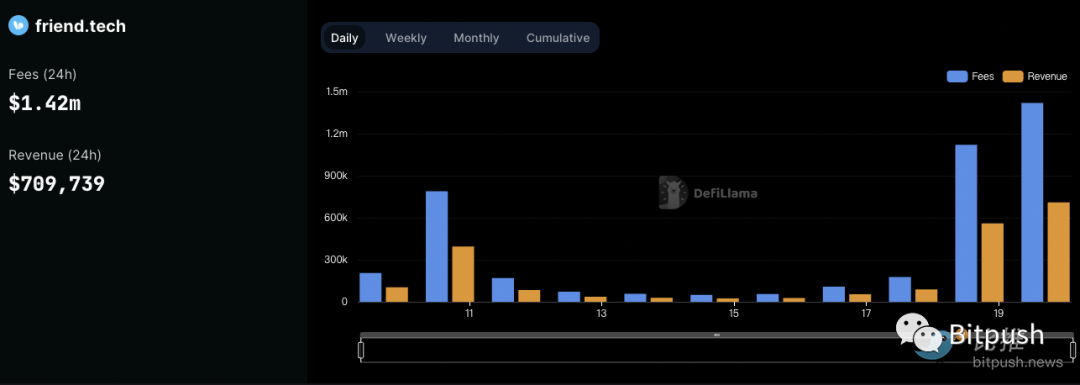

The platform charges a total fee of 10% for each transaction, with 5% going to Friend.tech and the other 5% going to the account holder. DefiLlama data shows that in the past 24 hours, Friend.tech has earned 1.42 million USD in fees and 709,839 USD in revenue, making it the third-largest source of fees and revenue in the entire cryptocurrency field during this period, second only to the Ethereum blockchain and the staking service project Lido.

Controversy surrounding Friend.tech

Despite receiving significant attention in the early stages, many people have doubts about its feasibility due to its lack of privacy policy, the requirement to deposit Ether during registration, and the unclear project roadmap. Although the application does allow people to cash out from the Shares they have earned, the security measures, liquidity structure, and other aspects of its operation are not well-defined.

Friend.tech also reminds people of the former BitClout (later renamed DeSo), which was a decentralized social network that allowed people to buy and sell tokens based on reputation. The network was launched in 2021 and at its peak, the token DESO was listed on Coinbase with a trading price exceeding $180. However, the application got into legal trouble for preloading users onto its platform without permission, and the value of DESO subsequently plummeted. The current trading price of the token is $8.95.

Cryptocurrency detective YazanXBT expressed in a tweet that the structure of the Friend.tech application feels somewhat strange, and the pricing method shows signals of manipulation and dumping.

Another cryptocurrency analyst, Miles Deutscher, shared his opinion that Friend.tech is still far from being perfected. Deutscher stated: “I don’t think Friend Tech is a ‘killer dApp,’ it’s a cool concept – but still far from being perfected, and I think we may see better social tech iterations in the future. However, the speed at which it penetrates the market is fascinating and demonstrates how a good idea with a strong product-market fit can quickly climb the rankings. A dApp that combines this element with a sustainable model will be the big winner in the next bull market (cryptogame projects are an example).”

The early success of Friend.tech indicates that when there is high product-market fit, cryptographic products can penetrate the market at a fast pace. However, despite the promising future of Friend.tech and decentralized social media, there are still regulatory barriers to overcome. Mark Hiraide, a partner at Mitchell Silberberg & Knupp, stated that the Friend.tech model seems similar to the stock market. Just as shareholders of listed companies can receive dividends, crypto influencers can choose to share fees with buyers – many have already provided this benefit to increase trading volume and prices. This provides potential utility to the application, but if it catches the attention of U.S. securities regulators, it may face the risk of being classified as an unregistered security.

Anonymous Web3 marketer Legendary shared his pessimistic prediction about Friend.tech in a tweet. He said, “I think this platform will collapse like BitClout. We are in a bear market, and there is nothing to do. Everyone will seize money-making opportunities, but I think the platform’s hype will fade in the coming weeks to months.”

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Content Marketing Methodology A Required Course for Web3 Startups

- Regulatory crackdown, slowed growth, Binance suffers two major setbacks.

- DeBank plans to launch Layer2, and the wool party has already taken action?

- Mining myself, mining out a 50% annualized return? Interpreting the Ve (3.3) game hidden behind the emerging star RDNT in the borrowing and lending market

- Cryptocurrency Track Weekly Report [2023/08/14]

- Deep analysis of ARB on-chain chips Users continue to increase their holdings, and most large holders are at a loss.

- Exclusive|Interpreting the draft guidance principles of Taiwan’s Financial Supervisory Commission Can’t use the slogan To The Moon anymore?