Regulatory crackdown, slowed growth, Binance suffers two major setbacks.

Binance faces regulatory crackdown and slowed growth with two major setbacks.Source: Financial Times

Translation: LianGuaiBitpushNews Mary Liu

As 2022 comes to a close, Binance co-founder and CEO Zhao Changpeng (CZ) seems to have the whole world at his feet.

Last November, Sam Bankman-Fried (SBF), co-founder of Binance’s biggest competitor FTX, approached CZ, hoping that the Binance CEO could rescue his exchange. CZ refused, effectively sealing FTX’s fate. On November 10th, the day before the collapse of the crypto empire FTX, SBF tweeted to his competitor, “Well done, you win.”

- DeBank plans to launch Layer2, and the wool party has already taken action?

- Mining myself, mining out a 50% annualized return? Interpreting the Ve (3.3) game hidden behind the emerging star RDNT in the borrowing and lending market

- Cryptocurrency Track Weekly Report [2023/08/14]

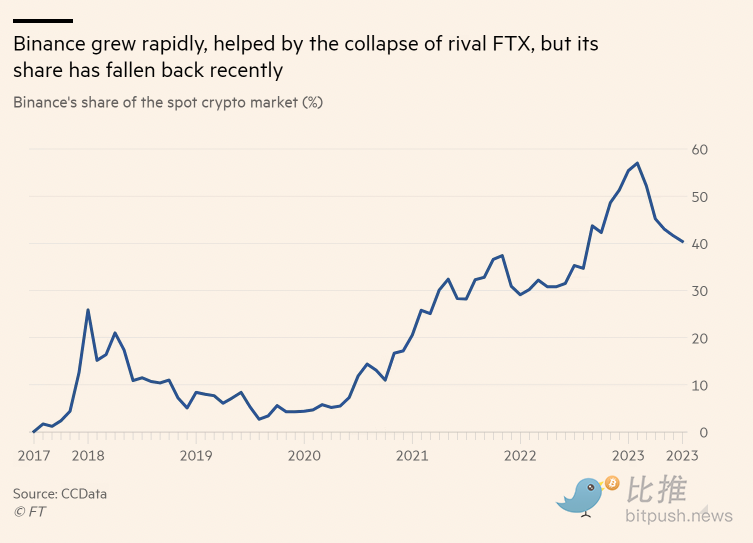

FTX’s collapse made Binance the undisputed leader in the crypto industry, controlling over half of the rapidly growing cryptocurrency market by the end of 2022.

If Binance can weather the regulatory impact following FTX’s collapse, it will become the preferred platform for cryptocurrency trading, and CZ can position himself as the “acceptable face” of cryptocurrencies, even though many still view the market as the wild west.

“Many see SBF as a leader in the industry and someone who can save the industry in front of regulatory agencies,” said Charley Cooper, former chief of staff at the Commodity Futures Trading Commission (CFTC). “When FTX collapsed, everyone saw CZ as a potential savior for the industry’s future.”

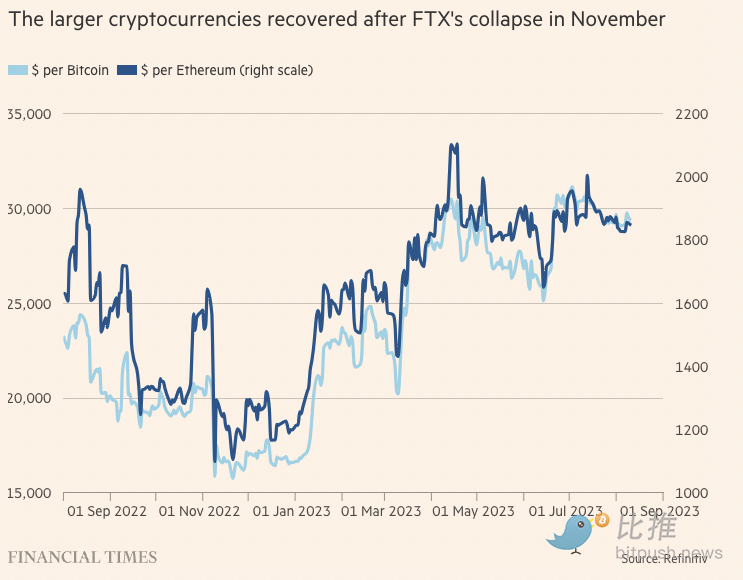

However, despite the stabilization of major cryptocurrencies like Bitcoin after FTX’s collapse, Binance found itself in a predicament. Its massive scale made it a target for regulatory agencies and lawmakers who want to ensure that the broader financial market is never impacted by “too big to fail” cryptocurrency exchanges.

In the US alone, financial regulatory agencies have accused Binance of illegally providing services to US customers, improper control of customer assets, and disregarding compliance and anti-money laundering standards.

The scale of Binance is not just a concern for regulatory agencies. Crypto advocates also believe that in an industry that advocates for decentralized finance, no single participant or entity should have too much influence.

Charles Storry, Head of Growth at DeFi project and on-chain index fund provider Phuture, said, “Binance’s predicament highlights the fundamental challenge facing the crypto industry. The tension between major centralized entities contradicts the industry’s initial ambition to establish a new form of finance based on decentralization, transparency, and fair competition.”

Binance stated that it believes “benign competition” is beneficial to the industry and is committed to its “overall” development.

But whether and how it will solve its future will help determine whether cryptocurrencies become part of mainstream finance or remain a niche industry beloved by those who want to separate currency from the nation-state machine.

Growth at all costs

At the end of 2017, shortly after CZ’s cryptocurrency exchange was born, Zhao sent an internal message to employees: “Everything you do should be aimed at increasing our market share.”

“Profit, revenue, experience, and other factors are secondary. If you have two things you can do right now, ask yourself which one will help our market share more, and then do that,” he added.

Binance said, “Like any startup, the primary task is to expand the business as quickly as possible,” but “today, we see Binance as a small part of a larger financial ecosystem.”

Zhao, a Canadian citizen born in China, studied computer science and made a name for himself at the Tokyo Stock Exchange before turning to cryptocurrency in 2013. “CZ” quickly became a well-known name in the digital asset field.

Under his leadership, Binance quickly became the world’s largest cryptocurrency exchange. According to internal documents seen by the Financial Times, by January 2018, just six months after its establishment, Binance had a 26% market share, and within a year of its establishment, its employees were present in at least 27 countries.

Like many young tech companies, it has a culture of aggressive growth. Internal recordings obtained by the Financial Times show that Zhao announced at an internal meeting held at Binance’s Shanghai office: “We want to spend 2% of the time making decisions and 98% of the time executing. So far, our competitive advantage is that we get things done, we execute, and we do things well. Everything is about doing things well.”

A hiring document seen by the Financial Times wrote, “If you’re just sitting there waiting for someone to tell you what to do, you might be waiting for a long time. In fact, you won’t be here for long because someone will probably tell you to get out of the way.”

Binance did not directly respond to questions about Zhao’s statements or the hiring document, but instead quoted a blog post about the company’s principles and culture.

Zhao has built a loyal following, defending him against “FUD” (fear, uncertainty, and doubt). One key group of followers is the so-called Binance Angels, which the company describes as “volunteers” who support the Binance community and advance the cryptocurrency business.

An insider said that Binance Angels are actually an integral part of the company’s operations. “They translate for us, organize local events, help us understand the law, manage communications, and help order goods from local companies.”

The company told the Financial Times that its “angels” are enthusiastic ambassadors who support the Binance community in various ways.

Similar to start-ups seeking to change the world, Binance’s early development was also very high-profile. In the summer of 2018, Zhao accompanied all Binance employees at the time to Thailand to celebrate the company’s first year.

In the footage of this trip seen by the Financial Times, Zhao stood on the beach, with yachts lined up on the beach, and around 100 Binance employees who unveiled the milestone marker.

Binance said such activities are now less likely: “When the company was smaller, it was easier to take such trips.”

Its rapid growth in the crypto field was shrouded in secrecy. In the summer of 2018, a security alert instructed employees to be mindful of their social media language, to disable geolocation on their electronic devices, and to avoid disclosing personal information to uncontrolled audiences.

The warning stated, “Reserve your social media space for family and friends. Check for suspicious individuals on your Facebook, Twitter, LinkedIn, and Instagram accounts.”

Binance stated that it has made it clear to employees that personal social media profiles “increase the risk of targeted phishing and other social engineering attacks.”

Binance co-founder He Yi once described the company as a “007 organization” in internal messages. A Binance spokesperson said, “As with anything, background is everything.”

A former Binance employee said that the company’s onboarding process included “a specific PPT that tells you that if you claim to be a Binance employee on social media, you will be fired.”

The company denied this claim.

The source added, “Government agencies are the only place I can think of where you can’t disclose your position—in financial institutions, I’ve hardly encountered this situation.”

An onboarding document instructs new hires to “install a VPN on all devices, computers, or phones.” Binance told the Financial Times that it considers security “vital” and that VPN adds an extra layer of security for mobile employees.

Regulatory “encirclement”

Binance’s early rapid growth benefited from regulatory uncertainty surrounding the new phenomenon of cryptocurrencies. Zhao described himself as “freedom-driven” during the Shanghai conference, and he told a group of employees that he didn’t like “a lot of rules” and leveraged the controversies that still exist in the cryptocurrency industry to achieve this goal.

He said at the same conference, “What is cryptocurrency? Is it a security, a commodity, or something else? I ignore many interpretations of different countries on this, although some of them may be considered legal.”

When asked about these comments, a Binance spokesperson said that the company acknowledges that it made mistakes in the early days, but after investing heavily in talent, processes, and technology, “today we are a very different company in terms of compliance.”

This young cryptocurrency startup encountered regulatory troubles just a few months after its establishment. At that time, Beijing banned initial coin offerings and described the issuance and sale of tokens as “unauthorized illegal public financing.” This effectively ended any possibility of the exchange operating legally in China.

Binance subsequently expanded to Japan without obtaining permission from Japanese regulatory authorities. Internal communication channels instructed employees not to use Binance email addresses when communicating with entities in Japan.

The company stated that it has taken measures to ensure the highest level of compliance in Japan and acquired a licensed exchange there in November.

Just three years after the Binance team vacationed on a beach in Thailand, the Thai Securities and Exchange Commission filed a criminal lawsuit against the exchange, accusing it of operating a digital asset business without a license. Binance stated that a joint venture called Gulf Binance has now obtained a license and is regulated in Thailand.

As Binance grew, the list of conflicting regulatory agencies continued to grow. In August 2021, the UK Financial Conduct Authority stated that it “lacked the ability” to adequately regulate Binance after the exchange allegedly failed to respond to basic inquiries.

A month later, the Monetary Authority of Singapore added Binance to its list of investor alerts, warning consumers that the exchange is not regulated or licensed in Singapore. The Dutch regulatory authority also imposed a fine of over 3 million euros on Binance last year.

A former employee of Binance said, “We felt like rebels disrupting the financial system and being kicked out of the country.” The company responded by saying that it had made some mistakes initially but has since corrected them while experiencing rapid growth.

The conflicts between Binance and financial regulatory agencies have made it difficult for the company to establish a long-term base, and Zhao often claims that the company does not have a formal headquarters.

However, in May 2022, French regulatory authorities allowed a subsidiary of the exchange to act as a registered digital asset service provider. Zhao said that the country will at least serve as its regional headquarters.

A former employee said, “When I went to the office in Paris, it was clear that this was (Binance’s) most important office. Zhao didn’t really come to the office, but he was in Paris multiple times. It felt like they were promoting their Paris office, and that feeling was very obvious.”

However, in June of this year, French authorities launched an investigation into the exchange, accusing it of illegally promoting its services to consumers and failing to conduct adequate checks to prevent money laundering. Binance stated that it operates legally in France and is cooperating with local authorities.

Crackdown by US Regulatory Agencies

The good days for Binance after the collapse of FTX didn’t last long. In early 2023, the U.S. Securities and Exchange Commission (SEC) opposed Binance’s plan to acquire assets of the bankrupt cryptocurrency lending company Voyager for $1 billion, and the deal subsequently fell through.

In February of this year, the New York Department of Financial Services ordered the suspension of BUSD, a cryptocurrency token under the Binance brand that is designed to track the price of the US dollar. At one point, it accounted for about one-fifth of Binance’s trading volume.

In March of this year, the Commodity Futures Trading Commission (CFTC) filed a lawsuit against the cryptocurrency exchange, alleging that it had illegally accessed US customers and that the company’s reported trading volume and profitability mostly came from “extensive solicitation and access” to US customers.

In the lawsuit, the CFTC alleged that a Binance executive said in 2020 that certain customers, including some from Russia, “came here to commit crimes.” It was reported that an employee replied to a colleague, “We have seen the dark side, but we closed our eyes.” Binance previously described the lawsuit as “unexpected and disappointing.”

Three months later, the Securities and Exchange Commission (SEC), which regulates the US stock and bond markets, filed 13 civil charges against Binance-related companies, including Binance US and CZ himself.

SEC Chairman Gary Gensler accused Binance of involvement in a “wide-ranging network of deception, conflicts of interest, lack of disclosure, and intentional evasion of the law.”

Binance’s offshore trading platform expressed disappointment and frustration with the SEC’s actions, while its US subsidiary called the lawsuit “baseless.”

Latest data shows that as the official scrutiny of Binance intensifies, its market share in the cryptocurrency spot market has dropped to 40% after six consecutive months of decline.

The regulatory challenges that Binance continues to face are also reflected in the demands on its employees. Some believe that the organization’s fanatical culture has been replaced by a more ruthless one.

The company responded, “We know Binance is not for everyone. We even wrote a blog post about reasons not to join Binance, cultural fit is important.”

A former employee said, “Despite their attempt to showcase Binance as a community, it’s not a company that truly makes you feel respected or valued.” Another departing employee said, “I was told I was fired, and then immediately received a message from HR saying they would send someone to collect my laptop and phone.”

Binance stated that it strongly disagrees with the description that “employees feel disrespected or undervalued,” but added that retrieving company equipment from departing employees is done to limit risks.

This summer, the company plans to go through a round of layoffs, affecting about 8,000 employees at the time. The exchange stated that this round of layoffs “is not a situation of appropriate scale,” but a source familiar with the matter responded that it is clear that market forces have compelled the company to restructure its resources.

Facing regulatory intervention and losing market share, Binance’s dilemma is not just Zhao’s problem alone. The entire cryptocurrency industry was hoping for a period of stability, but now it is caught in even more turbulence. For former CFTC executive Cooper, this is not surprising.

He said, “The idea that the most scrutinized cryptocurrency companies will become the industry’s saviors is foolish. If you are in this industry for long-term development and are seeking stable long-term participants, you will find that Binance is definitely not one of them.”

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Deep analysis of ARB on-chain chips Users continue to increase their holdings, and most large holders are at a loss.

- Exclusive|Interpreting the draft guidance principles of Taiwan’s Financial Supervisory Commission Can’t use the slogan To The Moon anymore?

- Depth Latest analysis of asset risk assessment for stablecoin TrueUSD (TUSD)

- Analyzing the Unique Aspects of Puffer Finance’s Design from the Perspective of Node Validation Rights

- In-depth Analysis of Base Standing on the shoulders of giants, emerging in the fiercely competitive Layer2 race.

- How can Base chain without tokens start Onchain Summer?

- Interpreting US Cryptocurrency Taxes General Taxation, Cryptocurrency Taxation, and Future Development Trends