subDAO The New Password for the Expansion of Web3 Projects

subDAO The New Password for Web3 Project ExpansionGrowth is crucial for investment returns. However, in web 3, there are very few projects that can successfully expand into new businesses. Most old projects cannot compete with new projects in their respective industries.

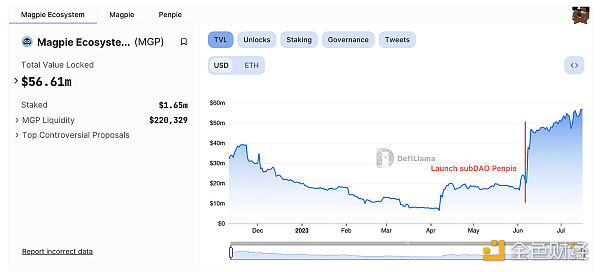

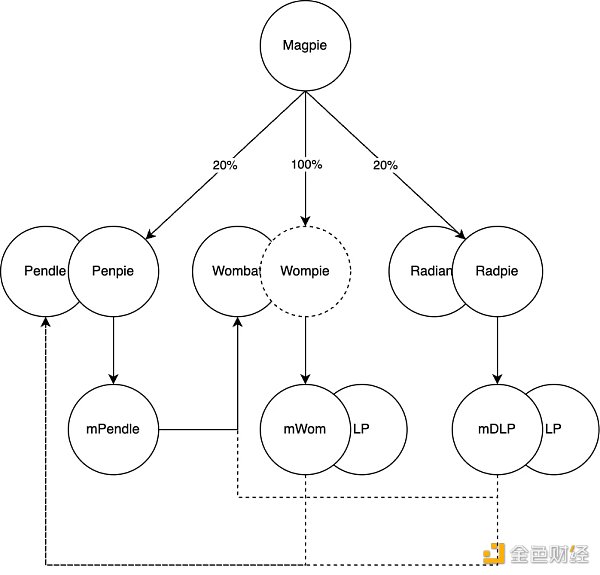

subDAO + execution power may be the answer to this problem. From Pendle’s Penpie to Radiant’s Radpie, Magpie is rapidly expanding through the subDAO model. This thread will use this as an example to analyze the best practices of subDAO.

A. What is subDAO?

Currently, there are examples of unsuccessful subDAOs like MakerDAO’s SLianGuairk, but these projects without independent tokens are still in the incubation stage and are not referenceable. A qualified subDAO should have the following characteristics:

- Base L2 rapid development, which ecological projects are worth paying attention to in advance?

- An Introduction to Pluto, a Virtual Social Project in the Polygon Ecosystem: Supported by the Founder of Polygon and NFT Launch Coming Soon

- Overview of the seven major L2 networks: What are their respective advantages and potentials?

-

subDAO has independent tokens and the ability to expand independently

-

LianGuairentDAO holds a significant stake in subDAO

-

Mutual benefit between LianGuairentDAO and subDAO

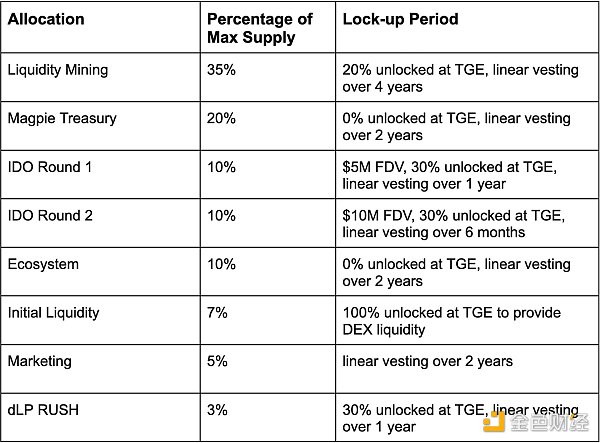

Take Magpie’s subDAO, Radiant’s yield booster Radpie, for example. Radpie will issue $RDP, of which Magpie Treasury holds 20%, and an additional 30% of the IDO allocation will go to MGP. This means:

-

MGP holders can share IDO profits

-

MGP holders will receive “dividends” from $RDP in the future

-

Magpie gains significant control over Radpie and thus has governance rights over Radiant

-

Radpie will leverage Magpie’s team resources for a rapid launch

B. What are the advantages of the subDAO model?

-

Reputation: subDAO inherits the reputation accumulated by LianGuairentDAO, making it easier to launch

-

Growth: Independent tokens allow for sufficient incentive and growth budget

-

Narrative: subDAO tokens follow new narratives, enabling LianGuairentDAO to keep up with new narratives

-

Cycle: subDAO interacts and shares resources within the LianGuairentDAO ecosystem, improving efficiency

-

Leverage: LianGuairentDAO in the governance race can achieve leverage governance through subDAO

B.1 Reputation

One of the biggest concerns for new projects in the crypto industry is rug pull, and LPs often give new projects a high risk discount. However, subDAO can inherit the reputation of LianGuairentDAO, greatly dispelling this concern. Cooperation with KOLs and other project parties will also become much smoother.

Furthermore, reputation is an intangible asset that can be continuously accumulated. The success of existing projects will pave the way for new subDAOs in a snowball effect.

B.2&3 Growth&Narrative

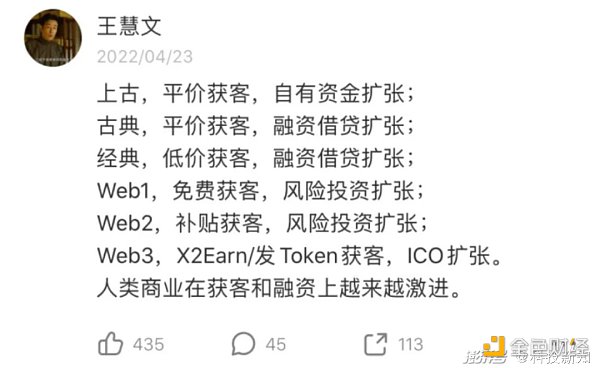

Meituan co-founder Wang Huiwen once commented that Web 3 has a more aggressive customer acquisition and financing model, and Token is the tool to achieve this model. Old projects often find themselves in a dilemma when launching new businesses. If a large number of tokens are issued to incentivize new projects, they will face a price drop. However, if this is not done, it will be difficult to win in the competition.

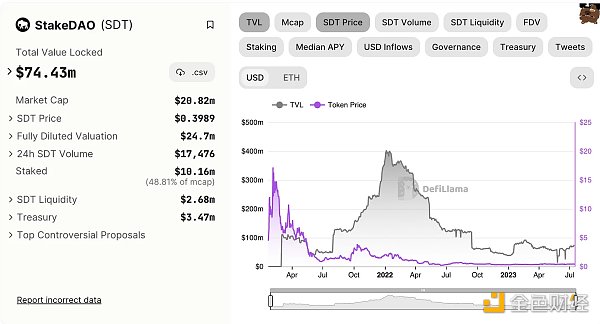

What’s even more frustrating is that due to the large size and lack of clarity of the token market for old projects, the market does not include this token in the core discussion when chasing new narratives. For example, StakeDAO developed governance services similar to Convex in the past year, integrating 10 projects but with limited success. Although it integrated Pendle, it did not gain much popularity from Pendle.

The subDAO model is different. For example, Penpie/$PNP as an independent project not only did not issue any $MGP, but also firmly tied itself to the Pendle narrative. Although the price of $MGP appears unchanged on the surface, MGP is a project started by Wombat, and a similar project WMX has recently fallen by 70%. It is not difficult to imagine what would happen to MGP without Penpie.

B.4 Loop

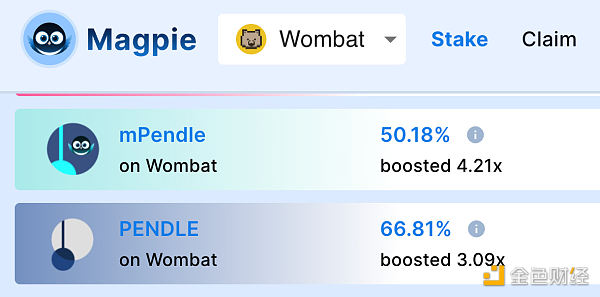

For example, recently mPendle/Pendle has moved to Wombat on the trading pool and is seeking to use Bribe through MGP. In this way, the incentive expenditure of PNP goes to the hands of MGP holders.

Next, can mWOM/mDLP and the LP tokens on both sides also land on Pendle and participate in Penpie’s bribery market using $MGP and $RDP? Although there is no clear information at the moment, it is likely.

The newly issued tokens can either stay within the Magpie system through bribe, which is called internal circulation, reducing external net expenditure. With internal circulation, there is naturally external circulation, achieving resource sharing between multiple projects to reduce costs and increase efficiency. For example, Ankr obtains Wom incentives through Magpie Bribe, and Penpie is also successfully brought in.

The ultimate goal of Magpie should be that all incentive tokens are not directly distributed, but to improve efficiency within the ecosystem through bribe, mutual benefit, and resource sharing through BD, establishing a more competitive bribery market.

In addition, Magpie focuses on the governance rights track, which is a perfect fit with the subDAO model. This track is different from projects like Perp that require continuous cultivation. After the project is built, there is relatively less work in the later stages, and homogenization is high. New projects can basically reuse a large amount of previous work.

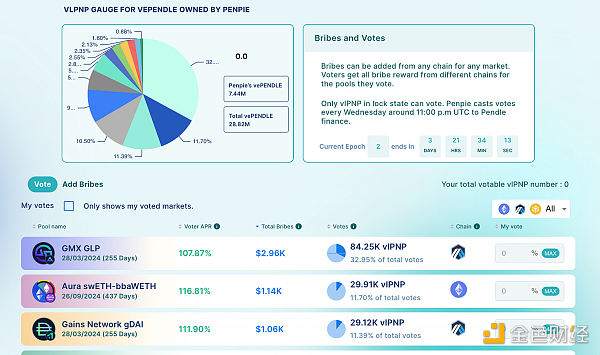

For example, Penpie quickly launched the bribery market. This market is very similar to the one Magpie previously built for Wom, which is also part of the resource recycling.

B.5 Leverage

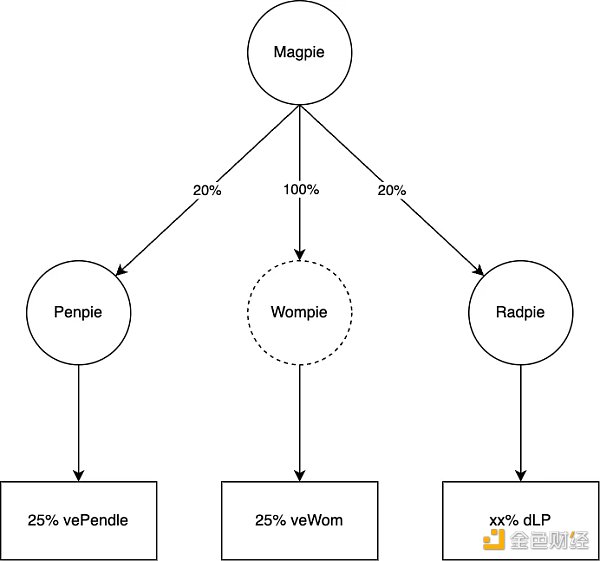

Using Magpie as an example, Magpie nominally controls 20% of Penpie’s governance rights, and Penpie controls 25% of Pendle’s governance rights. On one hand, Magpie enjoys the benefits of 20% x 25% = 5% vePendle, but on the other hand, in terms of protocol governance, the voting of 20% of Magpie will largely determine the voting of Penpie, which means that it actually has nearly 25% of Pendle’s governance rights.

This is what is called leverage. Although subDAO dilutes the general equity portion, it is almost undiluted in terms of protocol governance. In a sense, the entire Penpie is a unified actor, which means a leverage of 1/20% = 5 times.

C. Execution

The idea of subDAO is good, but it still depends on execution to make it happen. SLianGuairk from MakerDAO has been released for half a year but has not shown any progress. After all, it just forked AAVE and there have been no major updates. There is no trace of token economics. It can’t be considered as a subDAO at all, so it still depends on the team’s execution ability.

Summary

subDAO + execution ability pave the way for the growth of web 3 projects. By expanding rapidly through subDAO, there can be sufficient budget for new project growth, keeping up with new narratives, achieving ecological linkage and resource sharing. Of course, all of this is based on the team’s excellent execution ability.

In the past, DeFi was mostly just a module that couldn’t compete with the massive systems of large CEXs. However, if DeFi can expand horizontally quickly and become a system itself, perhaps the singularity is about to emerge.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Inventory of 9 Chain Data Tools Outside of Arkham That Have Not Yet Been Released

- Evening Reading | RWA Track: Progress of Top 10 Projects

- List of 15 projects worth keeping an eye on: Thena, Stargate, Pendle…

- Overview of RWA Tracks: Progress of Top 10 Headline Projects and 20 Early Stage Projects

- What projects has dao5, founded by a former Polychain partner, invested in, as part of their plan to co-build a venture capital DAO with the founder?

- 4 Potential Decentralized Physical Infrastructure Network (DePin) Projects: Hivemapper, Render, Helium, and IoTeX

- A Quick Look at Q2 Cryptocurrency Venture Capital Overview, What Projects is Bankless Paying Attention to?