ConsenSys’s zkEVM Linea mainnet goes live, providing an overview of its ecosystem development status.

ConsenSys's zkEVM Linea mainnet launches, showcasing ecosystem development status.ConsenSys’ Ethereum Layer 2 solution, Linea, announced the launch of its mainnet during the ETHCC conference and airdropped related NFTs to participants of the Linea Voyage event. Currently, the Linea official bridge has started a 48-hour zero-fee activity to invite users to experience the Linea mainnet. The cross-rollup bridge project Owlto Finance has also started a 7-day zero-fee activity (ending on July 25th). As a newly launched mainnet project, it is believed that the potential airdrops of mainnet tokens and ecosystem projects will continue to boost the popularity of the Linea network. BlockBeats has compiled a list of projects worth paying attention to or interacting with on the Linea network.

Cross-chain Bridges

Regarding cross-chain bridges, according to official ecosystem information, in addition to the official bridge and well-known bridges such as Celer (already supporting Linea mainnet), Li.Fi, Orbiter, and Stargate, several less common cross-chain bridges will also support the Linea mainnet.

Symbiosis

The multi-chain liquidity protocol Symbiosis completed a $2 million financing round in October 2021, led by Blockchain.com Ventures, with participation from Wave Financial, BTC Inc, KuCoin Labs, Injective Labs, DAO Maker, Primitive Ventures, Kairon Labs, Gate.io, and Richard Dai. The protocol has been launched for a long time but has not gained much traction. According to DefiLlama data, its current total value locked (TVL) is only $3.53 million.

Currently, Symbiosis does not support the Linea mainnet, but it participated in the Linea testnet Galaxy event.

- New U.S. bipartisan bill DeFi projects to be regulated like banks, DeFi investors may be held accountable

- New bipartisan bill in the United States DeFi projects to be regulated like banks; DeFi investors can be held accountable.

- Understanding Synthetix’s New Frontend Project Infinex with One Read

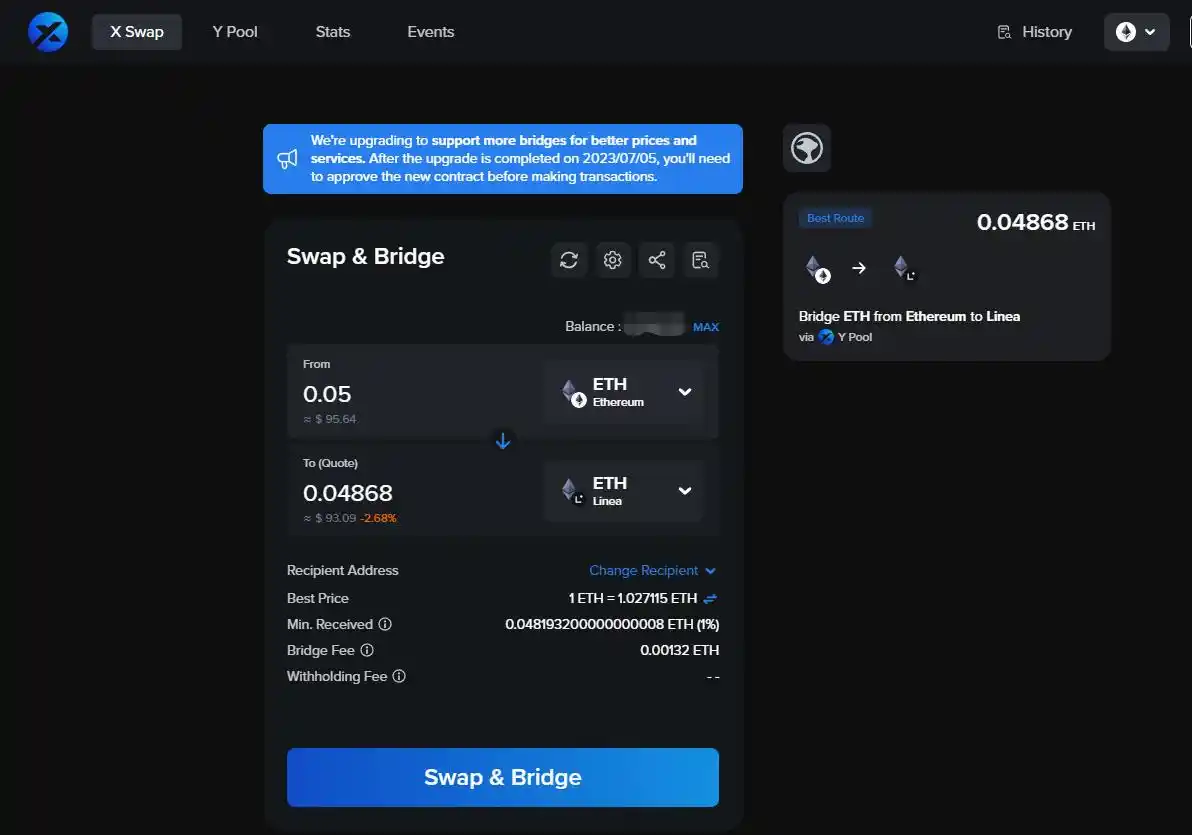

XY Finance

XY Finance, a cross-chain exchange aggregator, completed a $12 million financing round in November 2021, with participation from Circle, Mechanism Capital, Animoca Brands, Yield Guild Games, Infinity Ventures Crypto, Lemniscap, AppWorks, AnySwap, QCP Capital, Morningstar Ventures, Looksrare.vc, LianGuaiNONY, CatcherVC, as well as Ben Chan, Engineering Vice President at Chainlink Labs, Kevin Tai, Co-founder of Linear Finance, Tom Schmidt, Investment Partner at Dragonfly Capital, and Tempo, CEO of Perpetual Protocol.

According to the project’s website, XY Finance is a decentralized cross-chain exchange and liquidity provider aggregator that aims to provide users with efficient cross-chain exchange services at the best prices. XY Finance has two components: X Swap, which provides users with cross-chain transfer and exchange services, and Y Pool (coming soon), which provides liquidity for users. According to DefiLlama data, its current TVL is only $3.14 million.

XY Finance currently supports the Linea mainnet.

Owlto Finance

Owlto Finance is a decentralized cross-rollup bridge that provides a low-cost, secure, and fast asset transfer solution. The smart contracts have been audited by the security company Beosin.

Owlto Finance supports asset transfers between networks such as Ethereum, Arbitrum, Arbitrum Nova, Optimism, StarkNet, zkSync, and Polygon, allowing users to freely transfer assets between different networks. It currently supports MetaMask, Coinbase Wallet, and OKX Web3 Wallet.

It is worth mentioning that Owlto Finance stated in its official documentation that this Cross-Rollup bridge is different from other Cross-Rollup bridges based on secure Rollup technology. Asset transfers are conducted between the EOA addresses of the “sender” and “liquidity provider” on the “source” and “target” networks, and the “sender” does not interact with smart contract addresses. This design reduces the risk because smart contract addresses may be more susceptible to attacks, while EOA addresses are typically more secure.

Owlto Finance’s current partners include various mainstream trading platforms, as well as mainstream networks and well-known project teams. In addition to the Layer2 Cross-Rollup bridge, the Owlto team will also design and develop cross-token transfers and cross-address transfers to further enhance Owlto’s application value in the cross-chain field.

Note: Due to the frequent occurrence of security incidents with cross-chain bridges, BlockBeats recommends that users primarily interact with official bridges or mainstream cross-chain bridges to reduce risks.

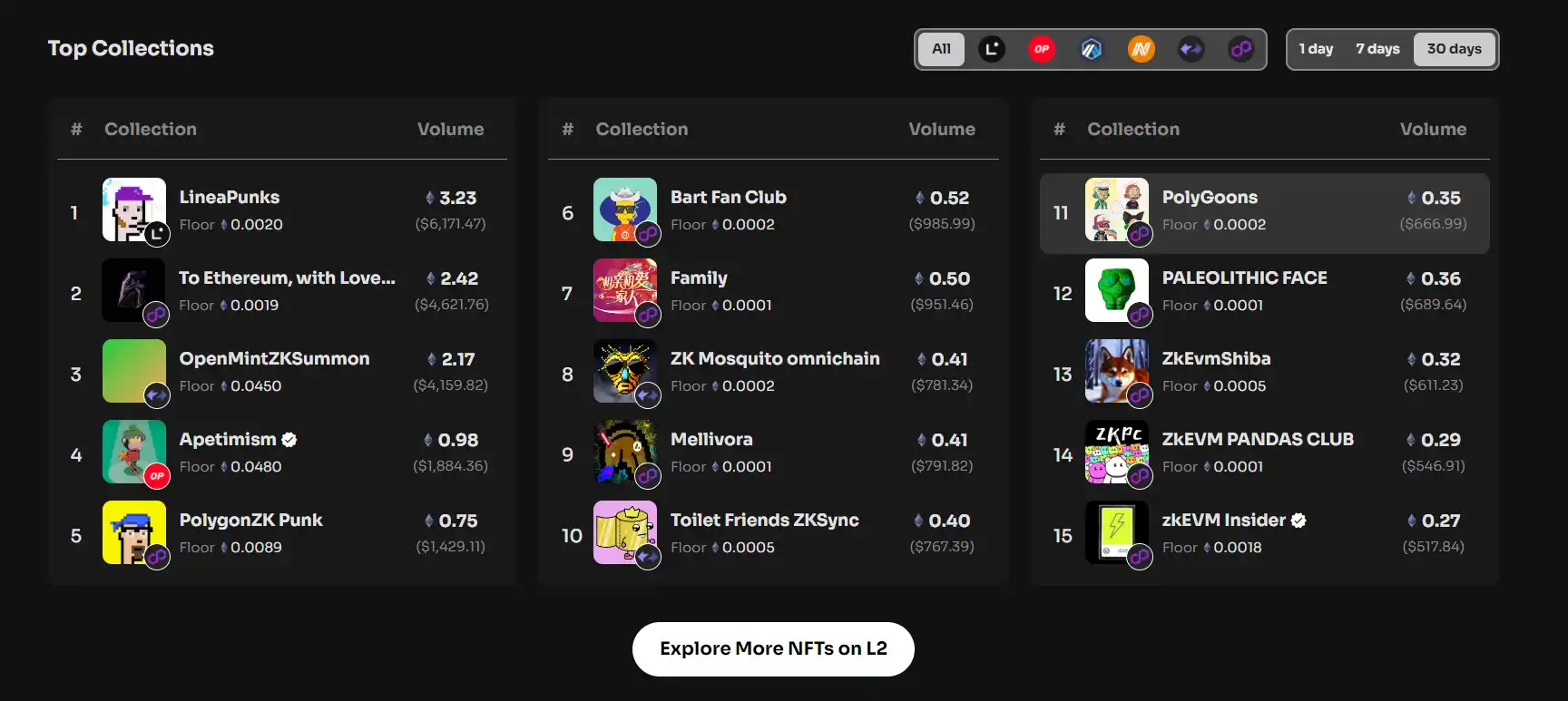

NFT

Zonic

Zonic is the first officially supported NFT marketplace on Linea. Zonic is a lightweight NFT marketplace that supports zkSync, Arbitrum (Nova), Polygon, and Optimism in addition to Linea. Selling NFTs on Zonic is completely free, and the platform charges a 2.5% fee from the sale price upon completion of the sale.

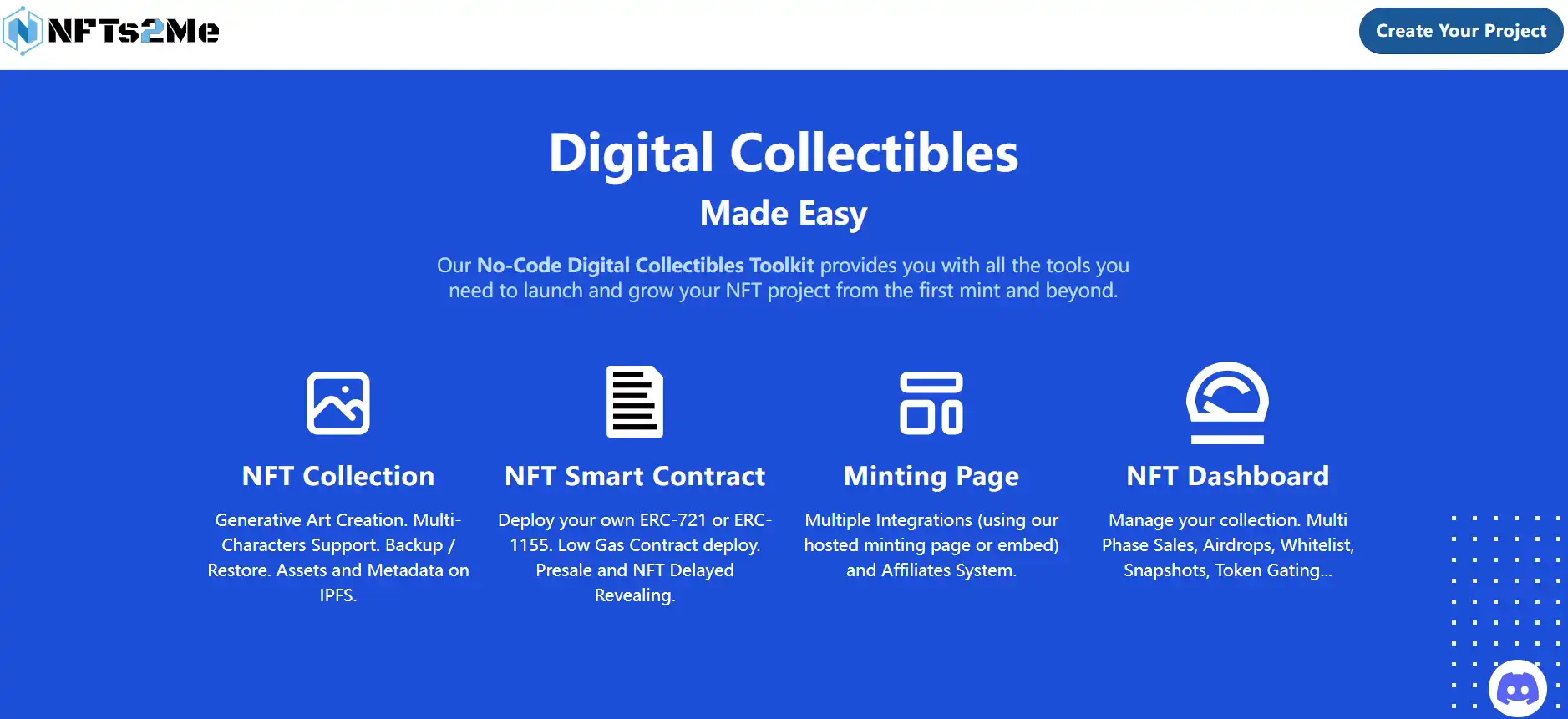

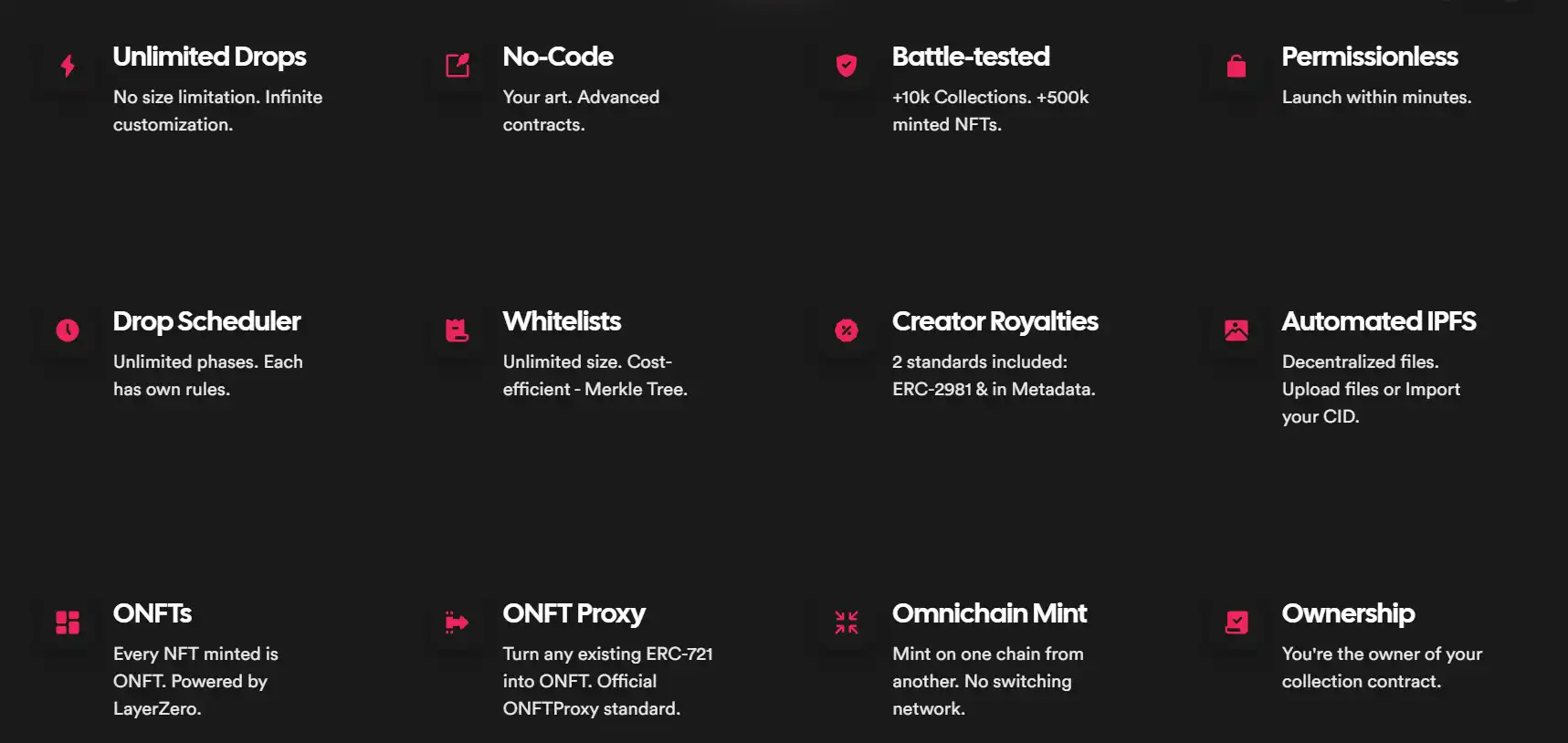

NFTs2Me

NFTs2Me is a free multi-chain platform where users can create, deploy, and manage their NFT collections and communities. It provides a user-friendly interface for creating NFT projects and uploading their digital assets and metadata to IPFS. The platform also offers optimized contract deployment on the blockchain with ultra-low fees and advanced features such as different minting types (sequential, specified, random), minting with any ERC-20 or native coin, walletless and upgradable credit card payment contracts. It manages NFT collections and their communities through custom subdomains, minting widgets, permission lists, whitelists, airdrops, and token-gated content accessible only to holders. Some NFT projects have already been minted and gained attention through NFTs2Me.

Omnisea

Omnisea is a full-chain NFT Launchpad based on LayerZero and Axelar Network. Creators can issue cross-chain NFTs based on LayerZero on the platform. At the same time, the project has issued the token OSEA, and users can stake the token to receive a portion of the platform’s revenue as a reward.

The official Omnisea V2 has been launched, and it has partnered with Zonic for NFT trading and transfers on Zonic.

Wallet

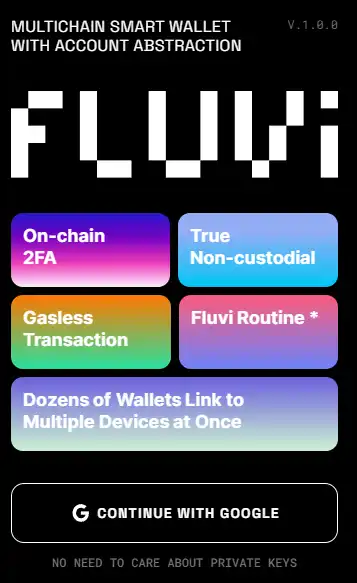

Fluvi Wallet

Regarding wallets, in addition to commonly used wallets such as MetaMask, OKX Wallet, and BitKeep, one wallet worth mentioning is the account abstraction wallet called Fluvi Wallet. This wallet supports logging in with a Google account and supports 2FA authentication. While ensuring security, it reduces the usage threshold for non-encrypted users. In the Linea testnet activity, the Linea project specifically arranged the installation task of Fluvi Wallet and provided it with transaction fee gas “preferential treatment,” indicating that the wallet is highly favored by the Linea project.

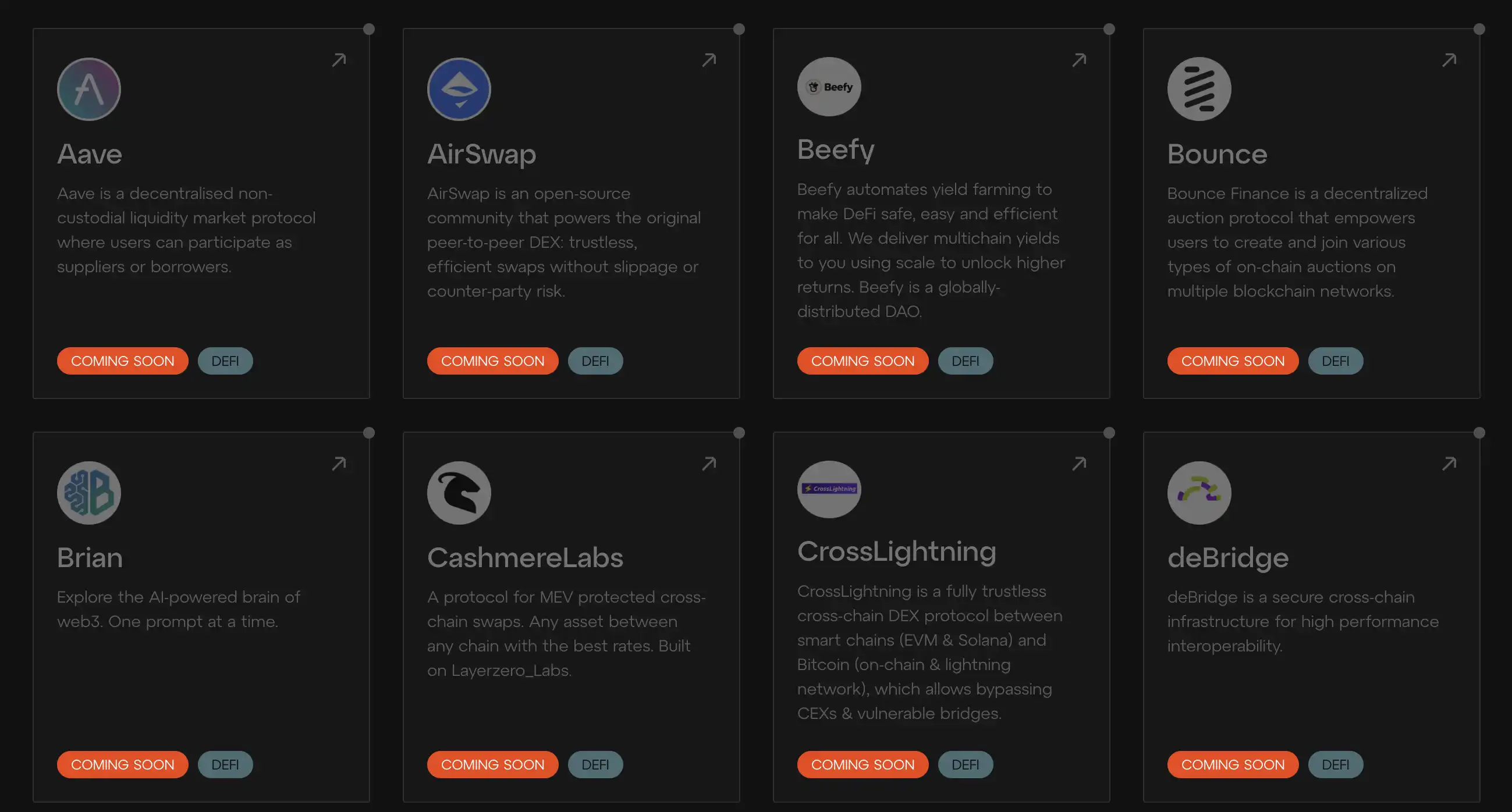

DeFi

Although it has only been online for less than a day, as a Layer2 network launched by ConsenSys, there are naturally many DeFi projects collaborating with Linea. According to its official website, currently there are 35 DeFi projects supported by the Linea ecosystem, as follows:

Aave, Sushiswap, LianGuaincakeswap, AirSwap, Beefy, Bounce, Brian, CashmereLabs, CrossLightning, deBridge, dForce, EchoDEX, FWDX, GrideX Protocol, Horizon DEX, Immunefi, Ionic, iZUMi Finance, Kuma Protocol, Kyber Network, Ledgity, LineaBank, Mendi Finance, MES Protocol, OpenOcean, Orderly, Qi Dao Protocol, rhino.fi, RubyDex, Squid, Tifo.trade, Velocore Dex, WOOFi, ZKEX.com, zkUSD

It can be seen that most of the DeFi projects that support Linea are well-known and familiar old projects, so we won’t introduce them in detail here. The following are some DeFi projects worth paying attention to (new projects and native projects on Linea) that will be launched on the Linea mainnet:

FWDX

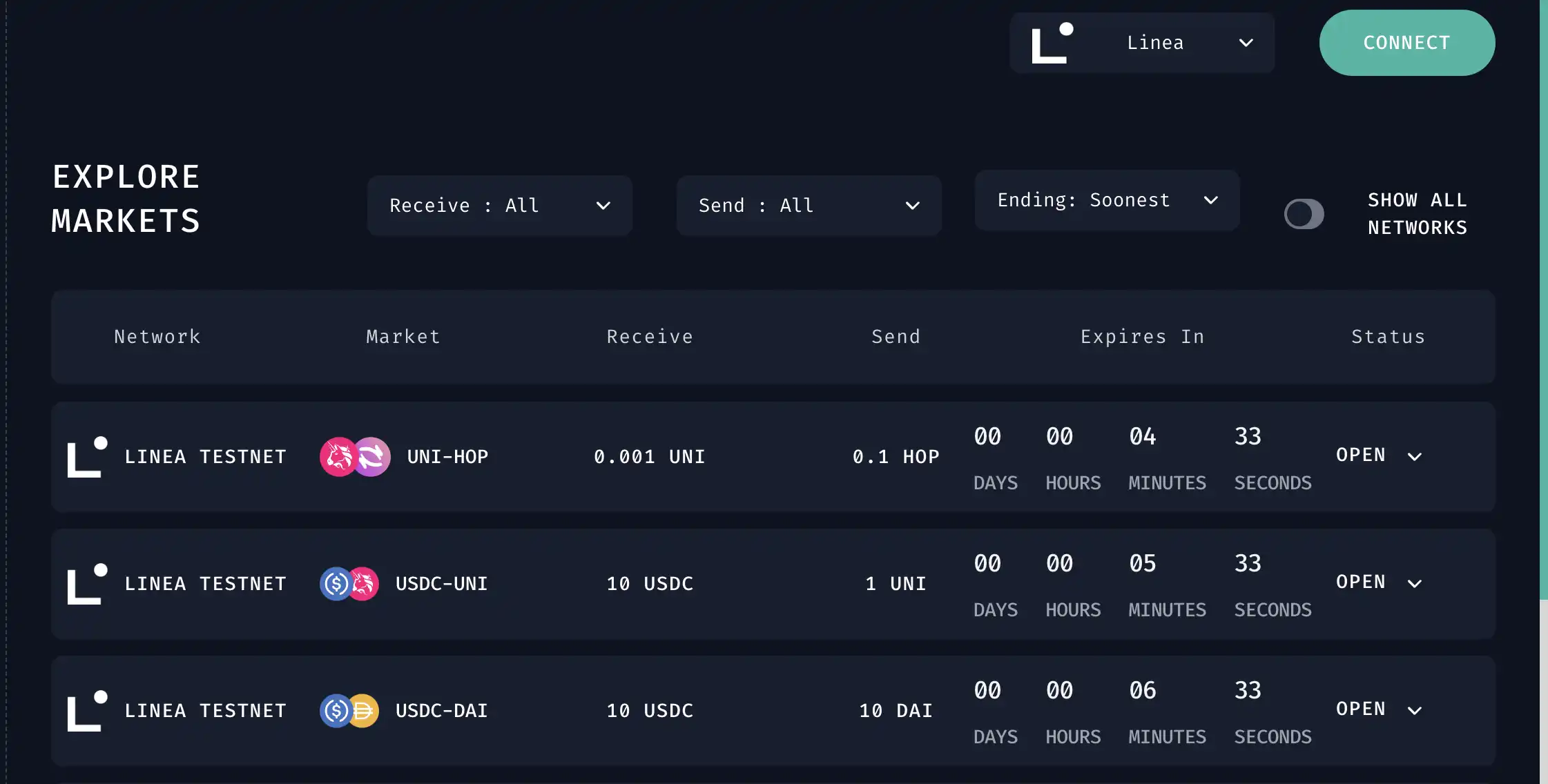

FWDEX is a decentralized P2P swap platform that provides fixed quote and zero slippage swaps, with profits shared by users and their token holders.

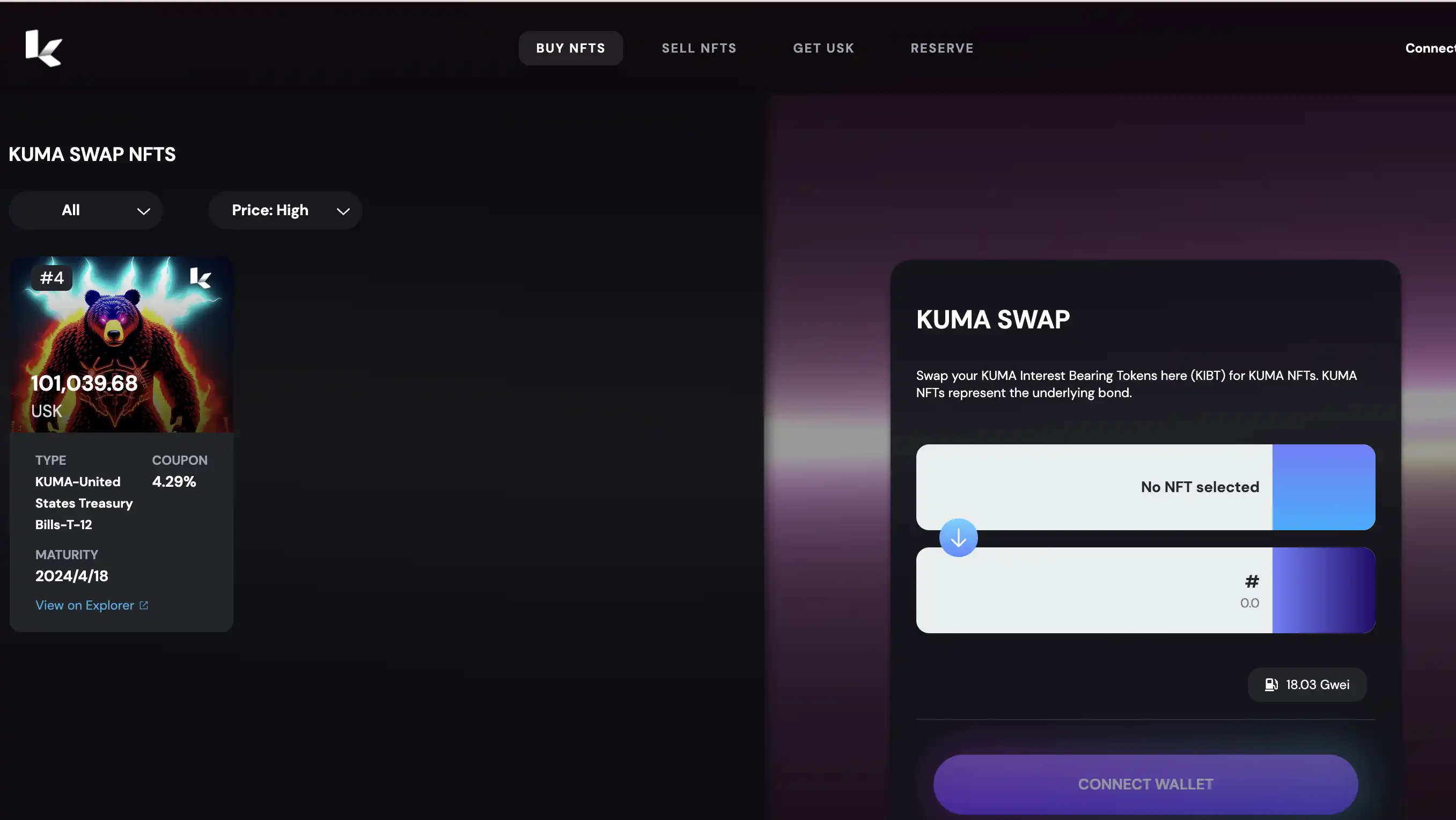

Kuma Protocol

Kuma is a DeFi protocol that issues interest-bearing tokens supported by traditional fixed-income products. Kuma is the result of the work of two different organizations: Mimo Labs and the newly formed Kuma DAO. Mimo Capital AG tokenizes bonds using NFT technology, and the KUMA protocol is a decentralized entity managed by MIMO holders, which utilizes these bond tokens to issue KUMA interest-bearing tokens: converting smaller denomination bonds into tokens supported by KUMA NFTs.

LineaBank

LineaBank is a lending protocol built on Linea, providing privacy protection and scalability. Users have full control over their assets and can access competitive interest rates through a decentralized marketplace that eliminates intermediaries.

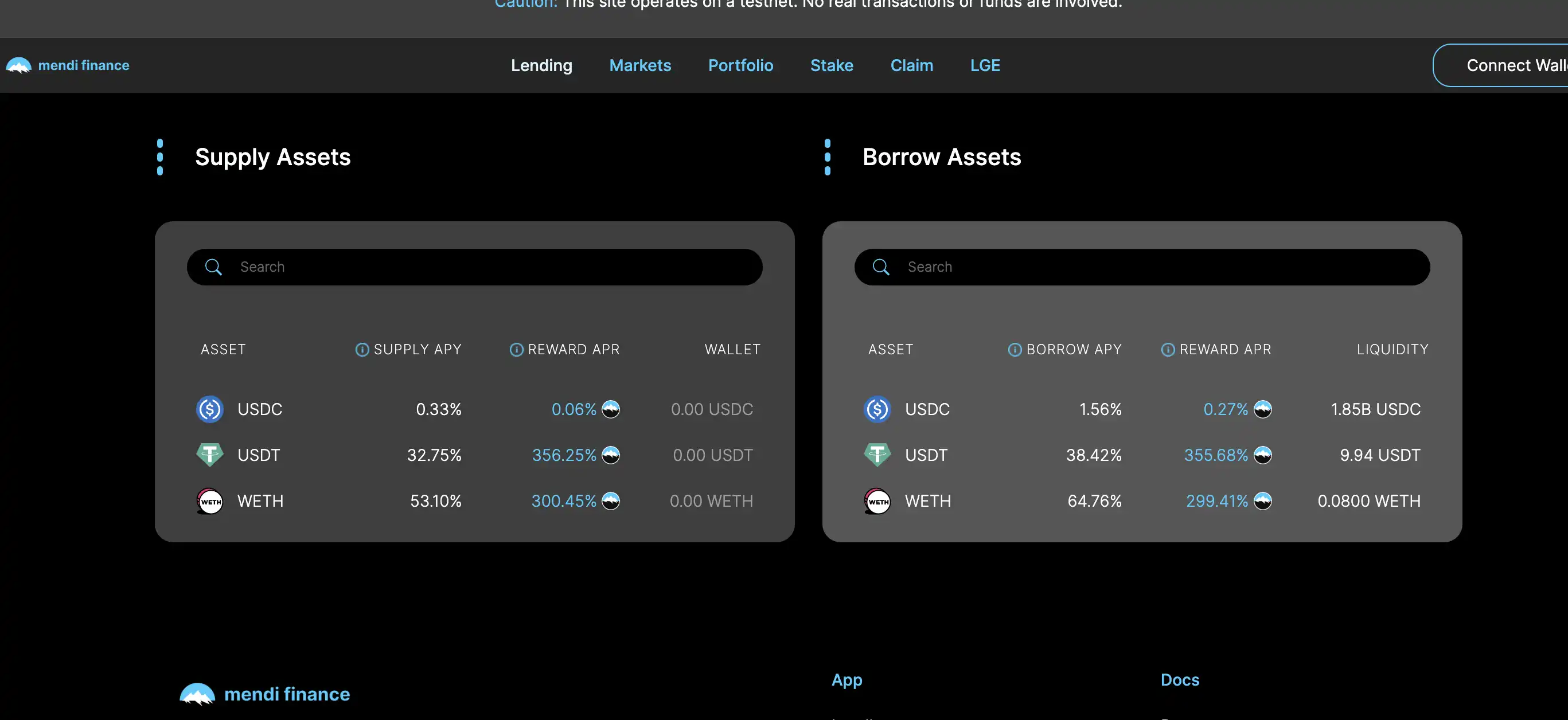

Mendi Finance

Mendi Finance is a decentralized, non-custodial P2P lending protocol on Linea, similar to Aave and Compound, aiming to provide higher liquidity for the Linea network or become the main lending platform on the future Linea mainnet.

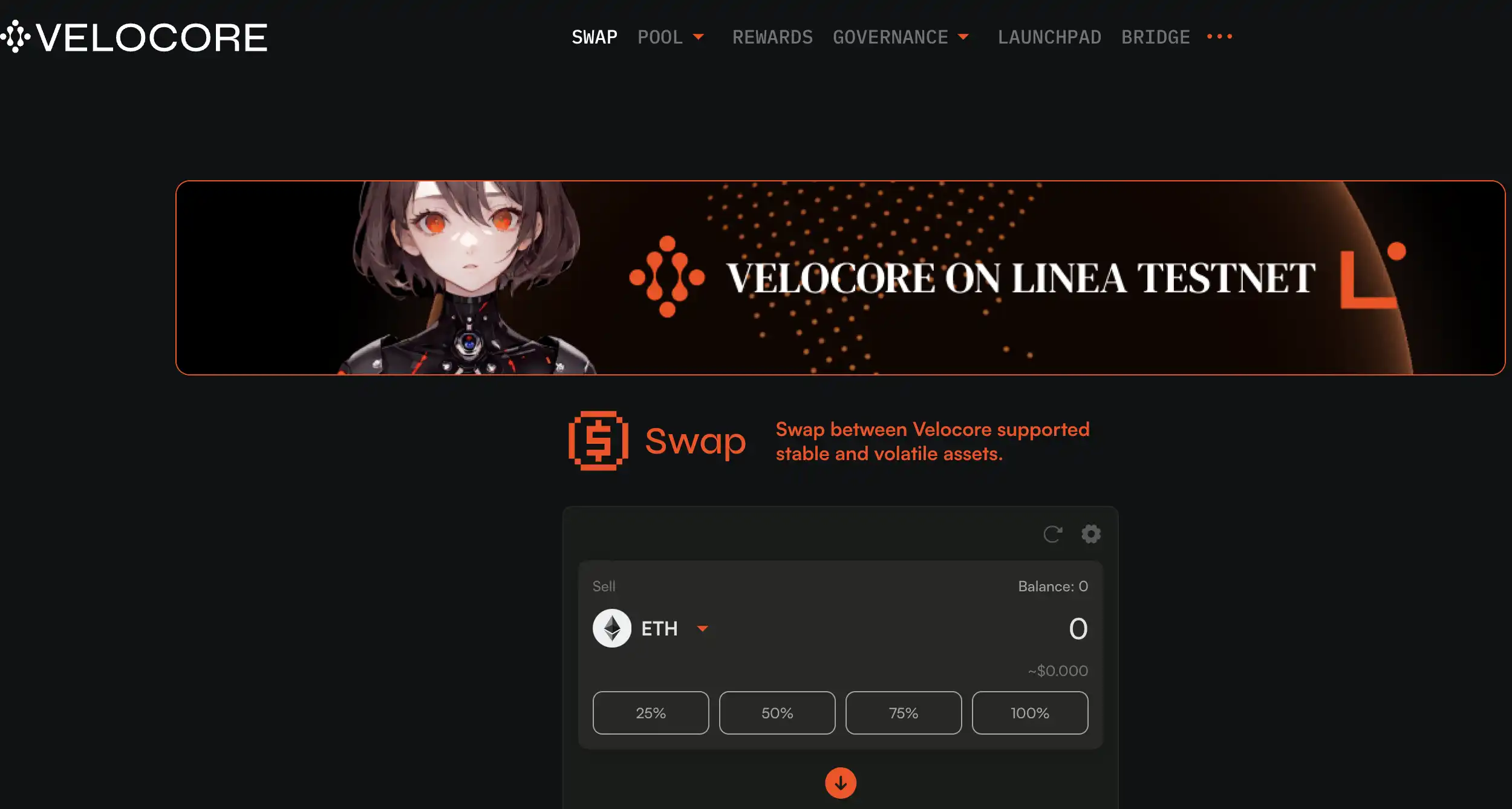

Velocore Dex

Velocore is a Solidity forked DEX based on the Velodrome code and is also a DEX with high TVL on the zkSync Era.

WOOFi

WOOFi is a DEX launched by WOO Network. WOOFi uses a new on-chain market-making algorithm called sPMM, designed for professional market makers to better simulate the price, spread, and depth of order books on centralized trading platforms, providing on-chain liquidity and offering optimal quotes while reducing slippage. At the same time, this mechanism can significantly reduce costs compared to traditional AMM-based DEXs like Uniswap V2. It was previously launched on the BSC chain.

zkUSD

zkUSD is the next-generation DeFi platform that combines collateralized stablecoins with zero-knowledge proofs (zkSNARKs) technology, dedicated to privacy, stability, and cross-chain interoperability in trading.

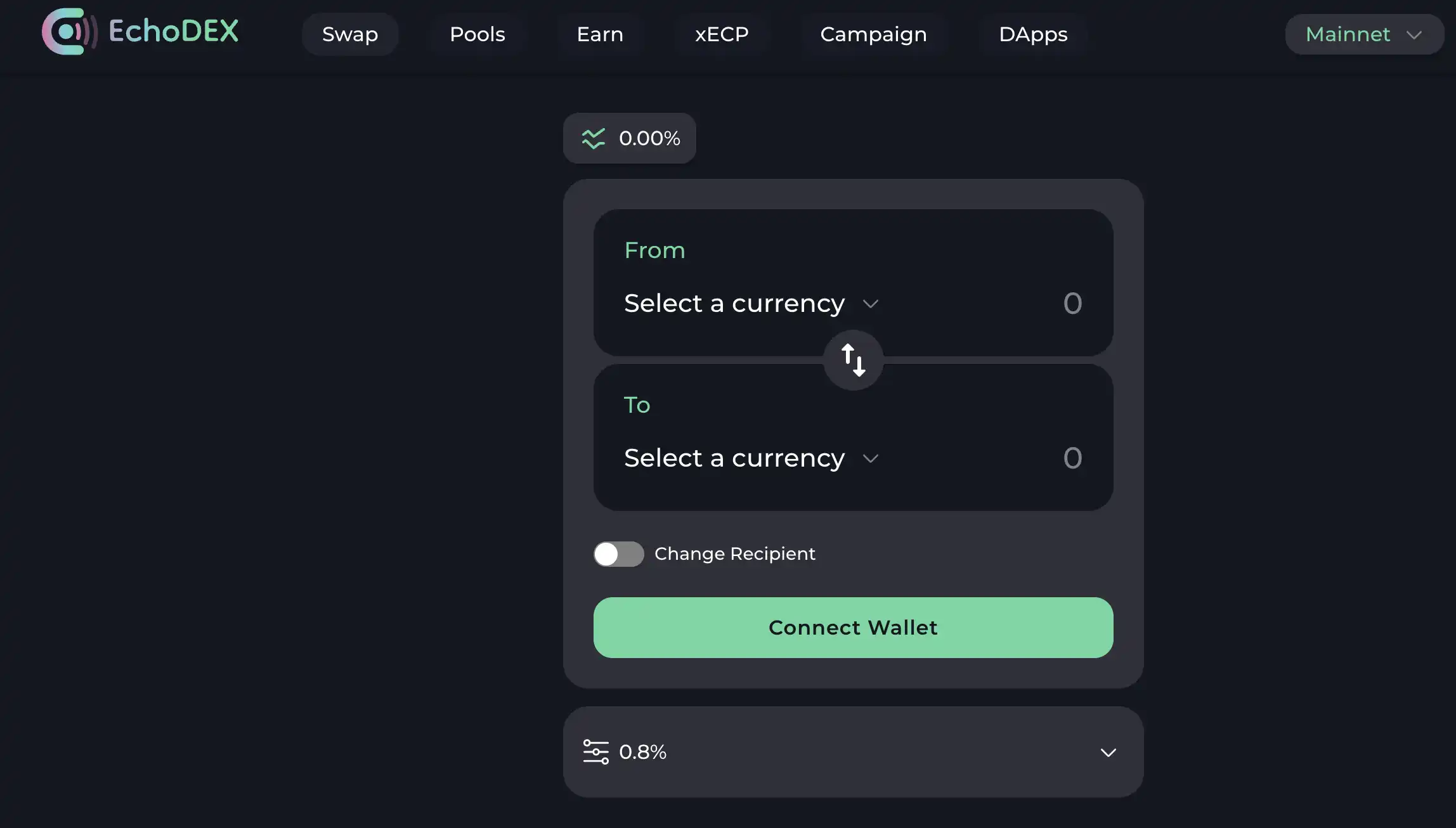

EchoDEX

EchoDEX is the first DEX on the Linea network. Its highlights include low transaction fees, liquidity aggregation, simple interface, high security, and users can also earn token ECP rewards by swapping, mining, or staking tokens on the platform. Previously, users could claim Linea testnet tokens on this DEX.

Social

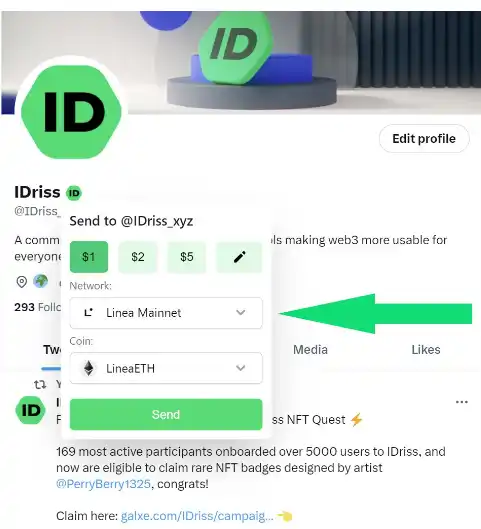

IDriss

IDriss is a Web3 social app plugin. By installing this plugin, users can make transfer transactions to other users who have also installed this plugin on Twitter. After sending the transaction request, users need to confirm the transfer on the plugin wallet (such as MetaMask). Currently, this plugin supports Linea mainnet, Ethereum, Polygon, BNB Chain, and zkSync Era network.

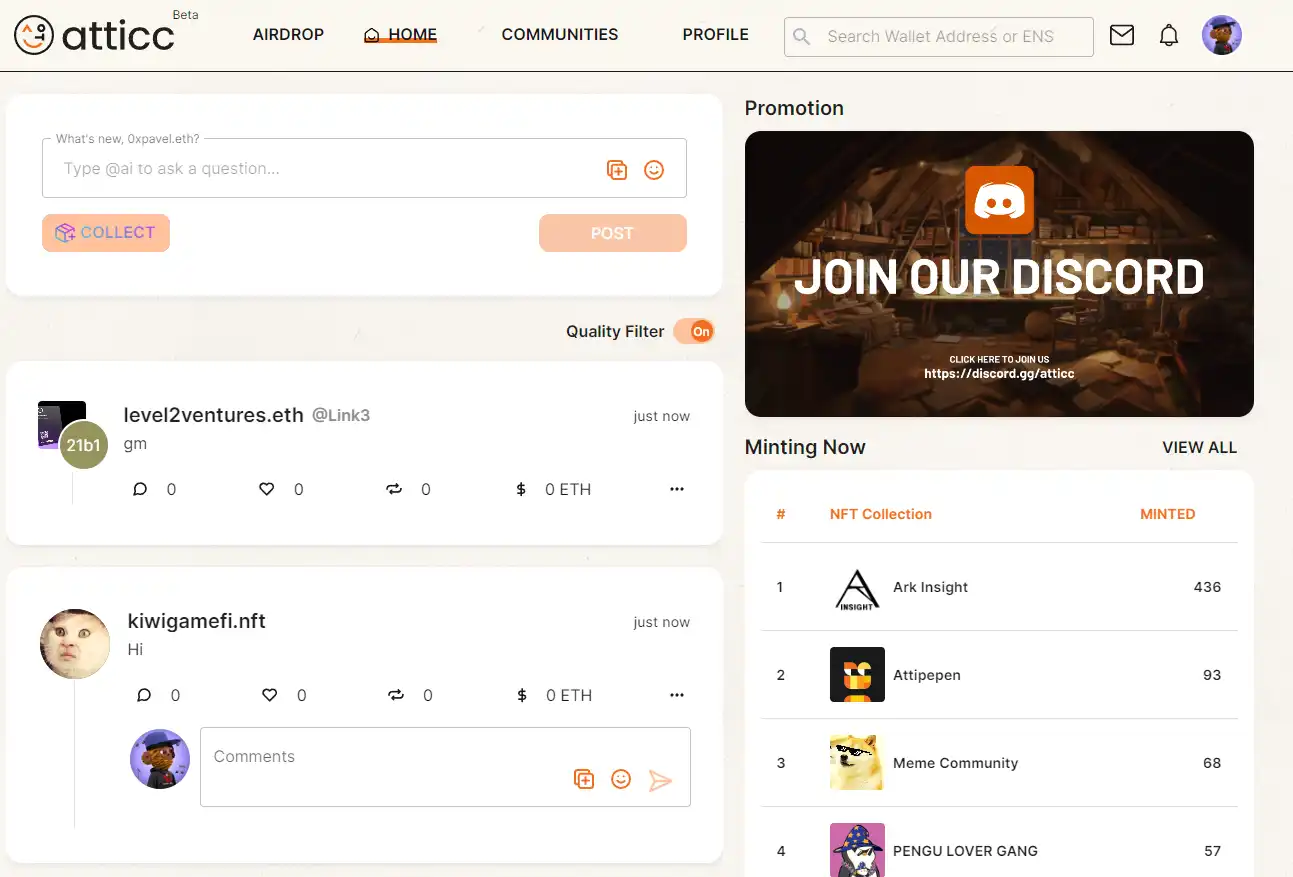

Atticc

Atticc is a Web3 social platform similar to Lenster. In addition to ordinary social functions, users can also use this platform for reward transfers, NFT minting, and NFT trading. The platform has released early bird NFTs, Atticc Early Adopter LianGuaiss, on the Ethereum mainnet. Users can stake this NFT on the platform to earn platform tokens ATT.

Linea Name Service

Linea is a third-party domain name project in the Linea ecosystem, which has been launched on the Linea mainnet. The project is initiated by Star Protocol, a comprehensive domain name service provider. As of the time of writing, the project only supports domain name registration with a length of 10 to 20 characters.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Long Push 7 Cryptocurrency Gaming Projects That Could Generate Hundredfold Returns in the Next Bull Market

- Market Analysis and Value Insights of the Top 6 Cryptocurrency VC

- subDAO The New Password for the Expansion of Web3 Projects

- Base L2 rapid development, which ecological projects are worth paying attention to in advance?

- An Introduction to Pluto, a Virtual Social Project in the Polygon Ecosystem: Supported by the Founder of Polygon and NFT Launch Coming Soon

- Overview of the seven major L2 networks: What are their respective advantages and potentials?

- Inventory of 9 Chain Data Tools Outside of Arkham That Have Not Yet Been Released