Market Analysis and Value Insights of the Top 6 Cryptocurrency VC

Top 6 Crypto VC Market Analysis and Value Insights1. Overview

With the rapid development of blockchain technology, the cryptocurrency and decentralized finance industry are growing rapidly, driving the booming growth of the crypto venture capital industry. Crypto Venture Capital (Crypto VC) is a type of venture capital firm that focuses on investing in the cryptocurrency and blockchain sectors. They provide funding and resources to startups and projects to promote the development and innovation of blockchain technology. Crypto VCs are becoming an important force in the venture capital field.

This article will discuss the crypto venture capital industry, with a focus on analyzing six top crypto VC firms, including a16z, Multicoin Capital, LianGuairadigm, Mechanism Capital, Polychain, and Variant Fund. It will explore the following aspects of these firms:

- Overview of each VC firm: This section will introduce the basic information of the six crypto VCs, including their background, team composition, investment strategy, etc., to give readers a holistic understanding of each firm;

- Analysis of investment over the years: This section will provide a detailed analysis of the investment projects of each crypto VC, including investment areas, investment rounds, investment amounts, etc., in order to reveal the investment focuses and trends of each firm;

- Analysis of investment cases: This section will select typical investment cases of each crypto VC, delve into the logic and values behind the investments, and demonstrate the investment capabilities and insights of each firm in different fields;

- Future development predictions: This section will predict the future development direction of the six crypto VCs based on the global crypto market trends, and propose potential market opportunities and challenges, providing references for investors and industry practitioners.

This article aims to provide readers with a detailed understanding of the crypto VC industry through the above content, and offer valuable insights for investors and market observers.

(The selected analysis institutions in this article do not represent any rankings, but only provide reference for the analysis framework and template of the article. Other capital can refer to the above-mentioned template for analysis. In the future, we will also continue to pay attention to the investment strategy changes and strategic development layouts of VCs in the industry.)

- subDAO The New Password for the Expansion of Web3 Projects

- Base L2 rapid development, which ecological projects are worth paying attention to in advance?

- An Introduction to Pluto, a Virtual Social Project in the Polygon Ecosystem: Supported by the Founder of Polygon and NFT Launch Coming Soon

2. Comparative Analysis of the Crypto VC Market

As an emerging and rapidly developing field, the crypto investment industry has experienced rapid growth and changes in recent years. Overall, the industry is in good health, with growing investment scale and innovation activities, providing strong support for the development and innovation in the crypto field.

Among the top 50 cryptocurrency venture capital firms worldwide, the San Francisco Bay Area accounts for 45.2% of the market share in terms of managed capital, with a management scale exceeding 26 billion US dollars, almost equivalent to the sum of all other cities worldwide.

When comparing the data during two bear markets, we can see that the risk capital invested in crypto companies has increased 3.1 times compared to the same period four years ago (January to February 2019). During that period in 2019, the investment amount was 471 million US dollars, while this year’s data has reached 1.45 billion US dollars. This means that even during a deep bear market, venture capital firms are still investing over 25 million US dollars in equity of crypto companies every working day.

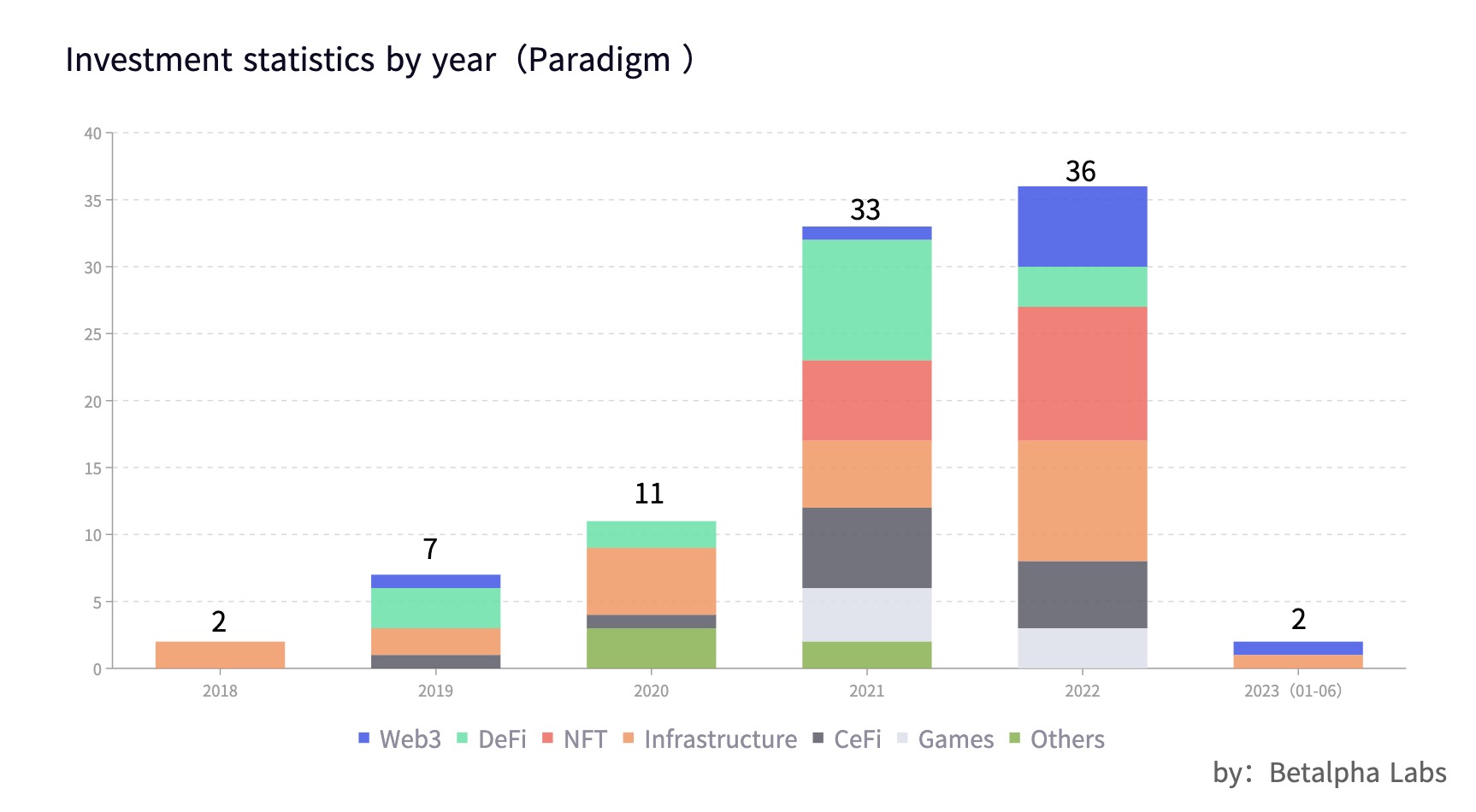

Comparing the investment behavior of the six crypto VCs discussed in this article, it can be seen that compared to the whole year of 2019, the six institutions made a total of 36 investments for the whole year, while they completed 49 investments in the first half of 2023, which also confirms the above fact that the overall crypto ecosystem is improving.

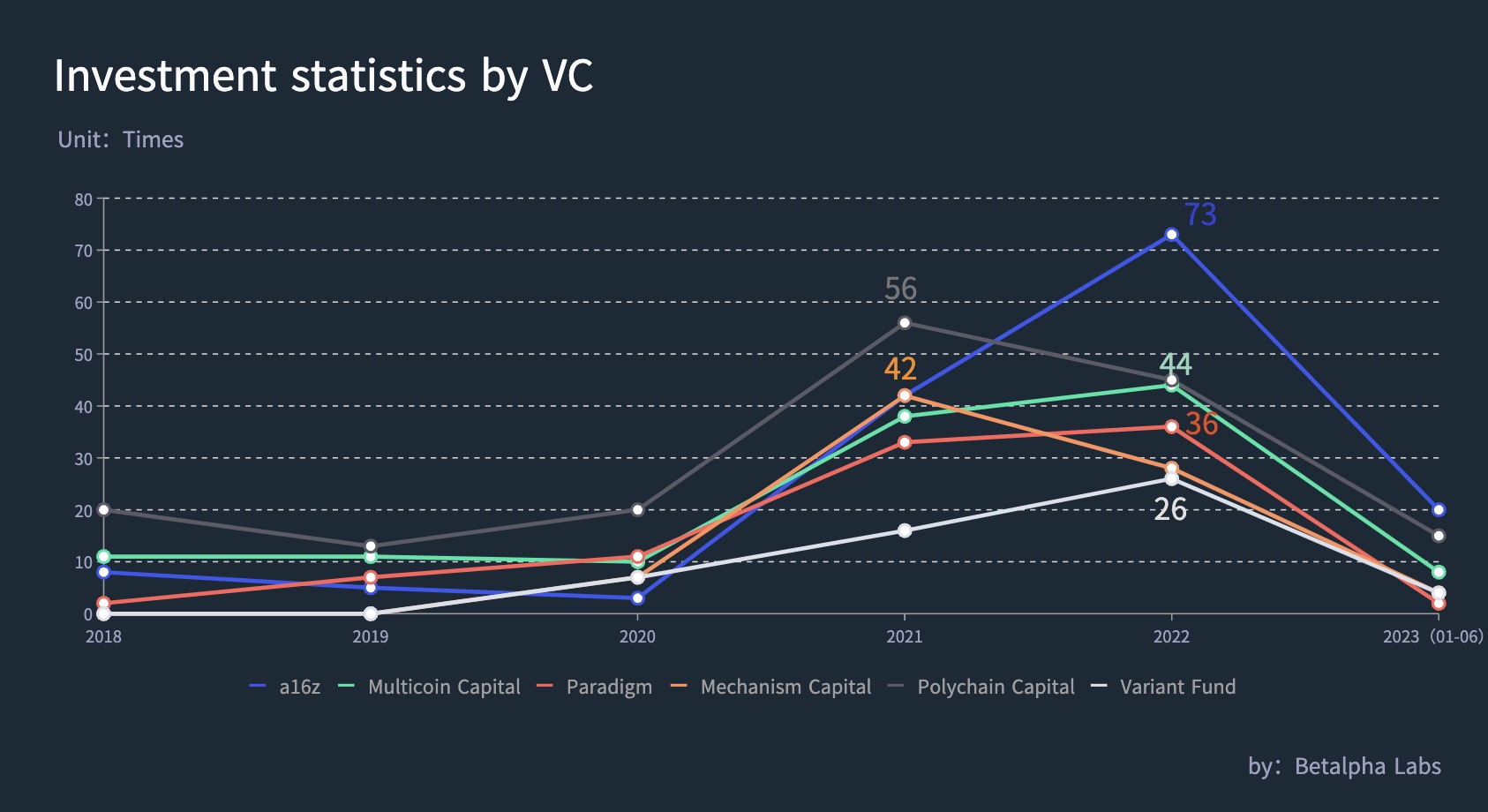

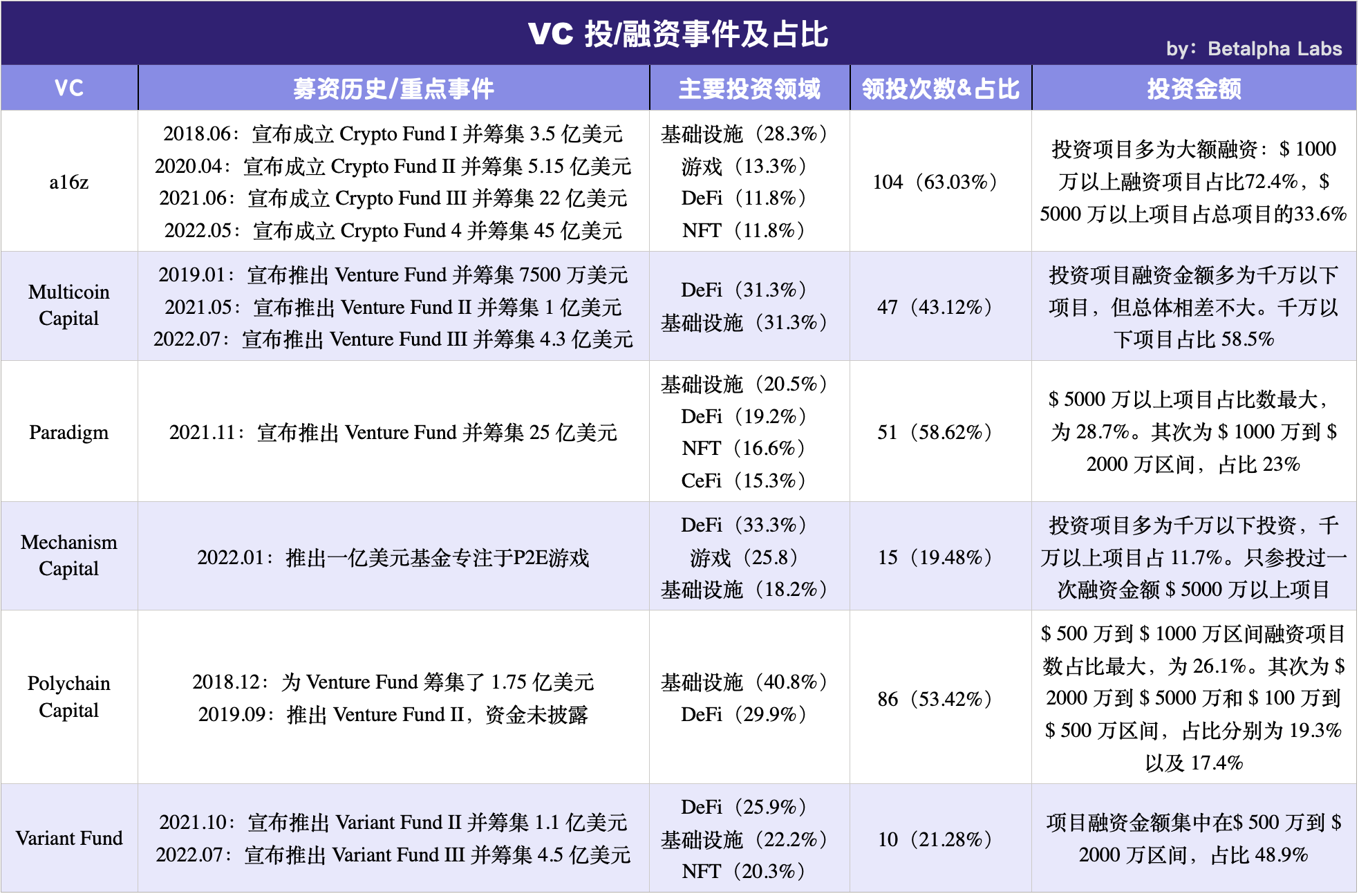

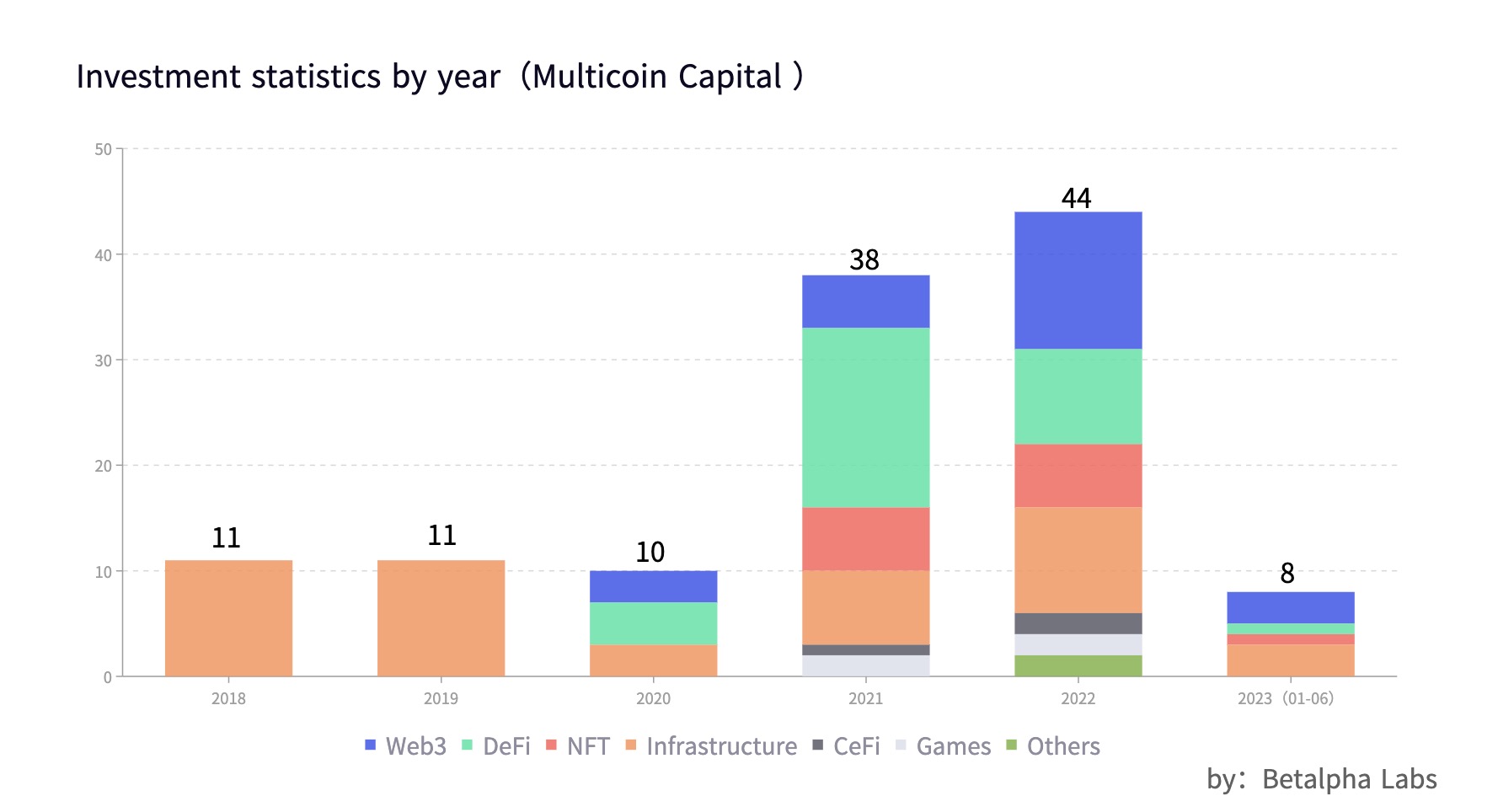

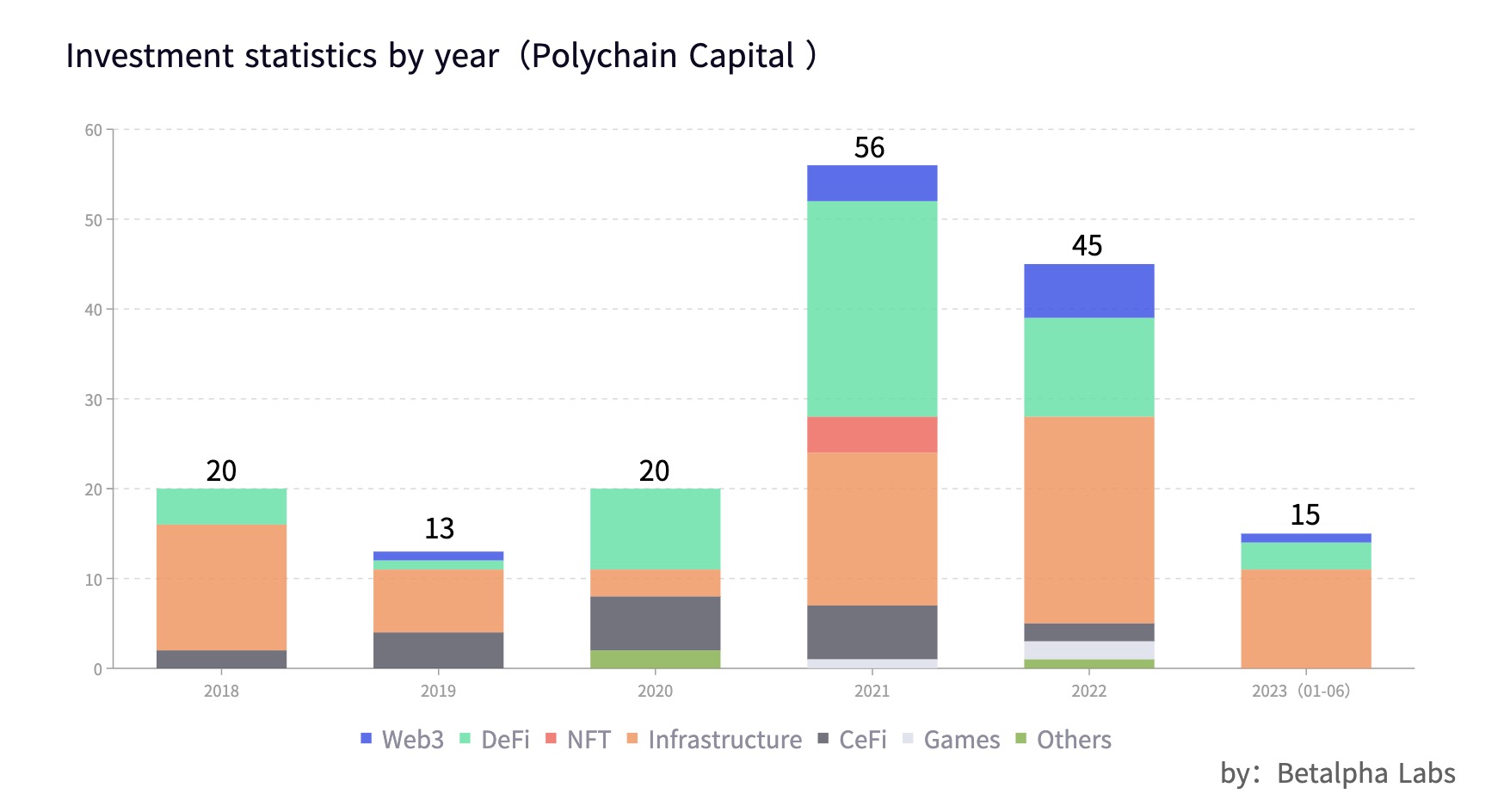

Except for LianGuairadigm and Polychain Capital, the peak number of investments for the remaining four funds occurred in 2022. Among them, a16z is one of the most active investors, with 73 investments. Multicoin Capital, Mechanism Capital, and Variant Fund also achieved high numbers of investments in 2022.

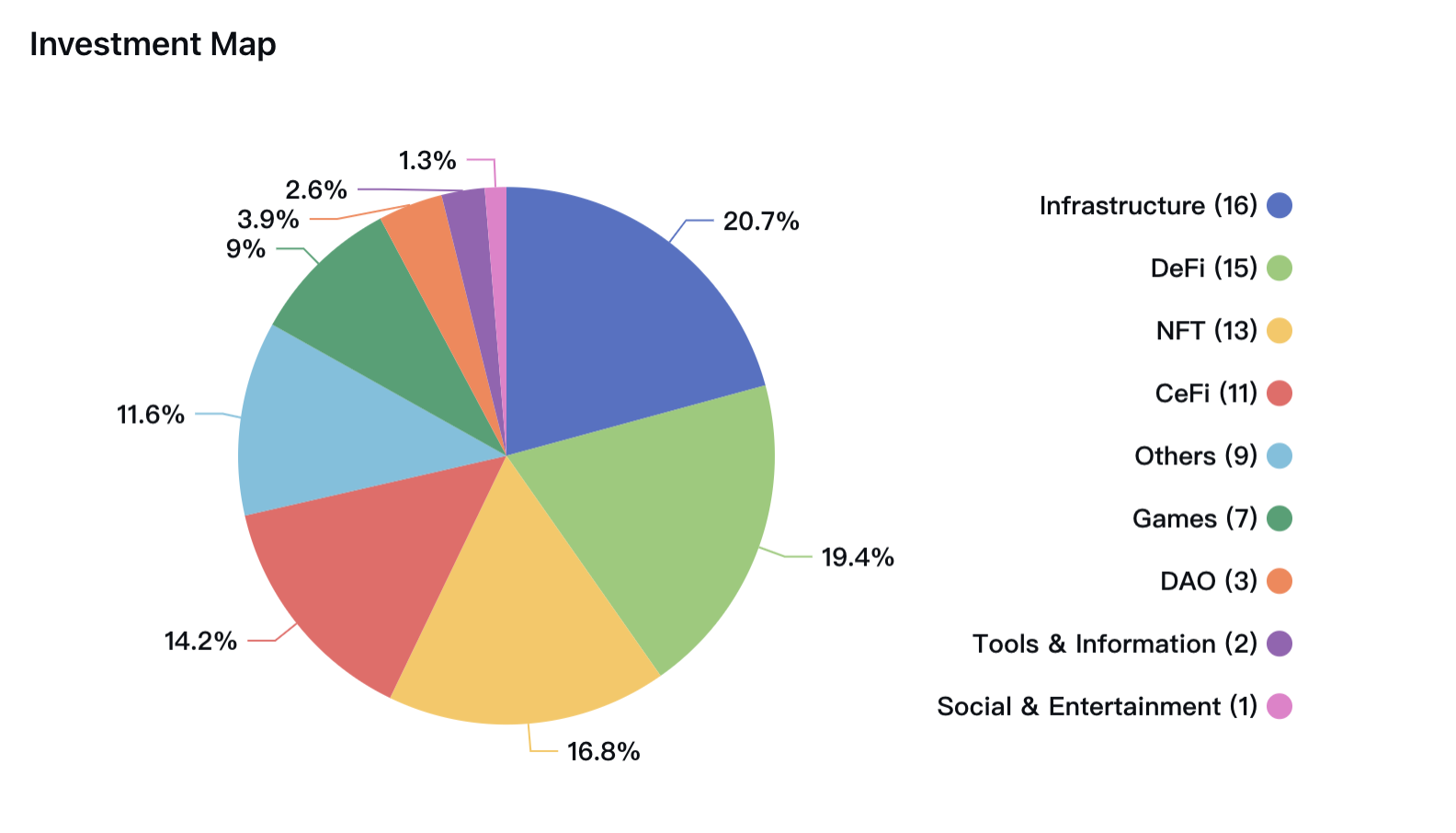

The investment activities of these investment companies in 2022 mainly focused on the DeFi and infrastructure sectors. In comparison, a16z, LianGuairadigm, and Variant Fund also pay more attention to the NFT field. In addition, a16z and Mechanism Capital have also invested in many gaming projects, while LianGuairadigm focuses more on the CeFi field. These investment companies have a wide range of investment areas and directions, covering multiple sectors and sub-sectors in the crypto field, in order to build a healthier crypto ecosystem based on this.

These investment companies also have flexible investment strategies. In addition to investing in start-ups, they also invest in mature crypto companies or cooperate with other investment companies for joint investments. This diversified investment strategy enables them to better grasp market opportunities and risks and achieve better investment returns.

It can be noticed that a16z and LianGuairadigm have relatively high proportions of leading investments, and most of their investments are financing projects with a scale of over $50 million, while Mechanism Capital and Variant Fund may be more involved in early-stage projects, such as seed rounds and angel rounds, so the investment amounts are relatively lower and the investments are more flexible.

It can be noticed that a16z and LianGuairadigm have relatively high proportions of leading investments, and most of their investments are financing projects with a scale of over $50 million, while Mechanism Capital and Variant Fund may be more involved in early-stage projects, such as seed rounds and angel rounds, so the investment amounts are relatively lower and the investments are more flexible.

The difference in investment strategies is mainly due to the investment styles and advantages of different crypto VC companies. Large VC companies like a16z, LianGuairadigm, and Polychain usually have richer resources and experience, and are able to better support mature crypto projects and are more willing to take higher investment risks.

Compared to large VC companies, smaller funds usually have less investment capital and resources, so they tend to focus more on the technology and innovation of projects rather than their scale and market share. These funds are also more willing to take higher investment risks because they believe that their vision and judgment can discover and nurture projects with true potential.

In addition, since smaller funds are usually founded by experienced investors or industry experts, they are more likely to choose investment projects based on their personal preferences and experience. These experienced investors usually have a deep understanding and insight into the crypto market, and can discover and invest in projects that large VC companies may overlook.

It is worth noting that this is just a typical investment strategy for encrypted VC companies and does not mean that they will remain unchanged. With the continuous development and changes in the encrypted market, the investment strategies of different encrypted VC companies will also be continuously adjusted and optimized to better adapt to the needs and changes of the market.

3. Detailed Introduction to the Six Top Cryptocurrency VC Companies

3.1 Andreessen Horowitz (a16z)

- 3.1.1 Basic Introduction

a16z is a venture capital firm headquartered in Silicon Valley, USA. It was founded in 2009 and its full name is Andreessen Horowitz, co-founded by Marc Andreessen and Ben Horowitz.

a16z is characterized by a wide range of investments, innovative investment methods, and also dedicated to providing strategic guidance and resource support to the invested companies to help them achieve long-term development and success. The company’s investment portfolio includes many well-known technology companies such as Airbnb, Facebook, Slack, Lyft, LianGuaigerDuty, Pinterest, etc.

a16z is also one of the important investment institutions in the cryptocurrency field. As early as 2013, it started investing in Bitcoin and blockchain technology. Its early investments in the cryptocurrency industry include Coinbase, Ripple, BitGo, and 21 Inc, etc.

In recent years, a16z has also been paying continuous attention to the development and innovation of the cryptocurrency field, and actively exploring new investment opportunities and strategies based on this. It has invested in many other cryptocurrency projects, such as Uniswap, Compound, dYdX, Solana, Celo, Dfinity, Flow, Arweave, Near, etc. These projects are innovating and breaking through in different directions, providing new ideas and possibilities for the development of the entire cryptocurrency field.

In addition to investment activities, a16z also plays an important role in providing strategic guidance and resource support in the cryptocurrency field. The company has set up a dedicated cryptocurrency fund and hired a group of professionals with rich experience and knowledge in the cryptocurrency field to provide comprehensive assistance and support to the invested companies. In addition, the company regularly publishes research reports and analysis on the cryptocurrency field, providing valuable references and guidance to the entire industry.

- 3.1.2 Comparison of Investment Projects in Recent Years

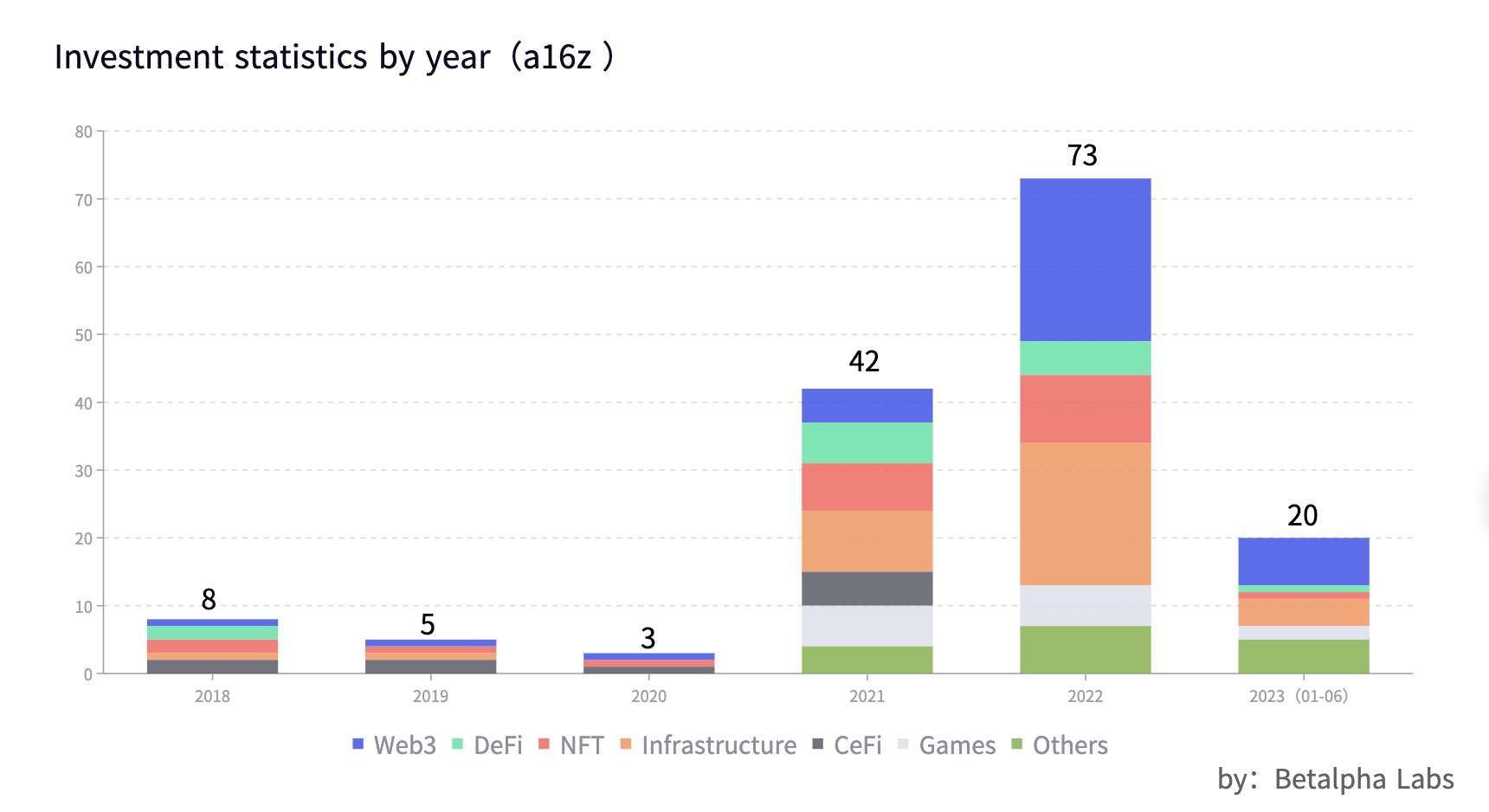

In the past two years, with the entry into the bear market of encryption, the number of investments by many investment institutions has shown a significant decline, and a16z is no exception.

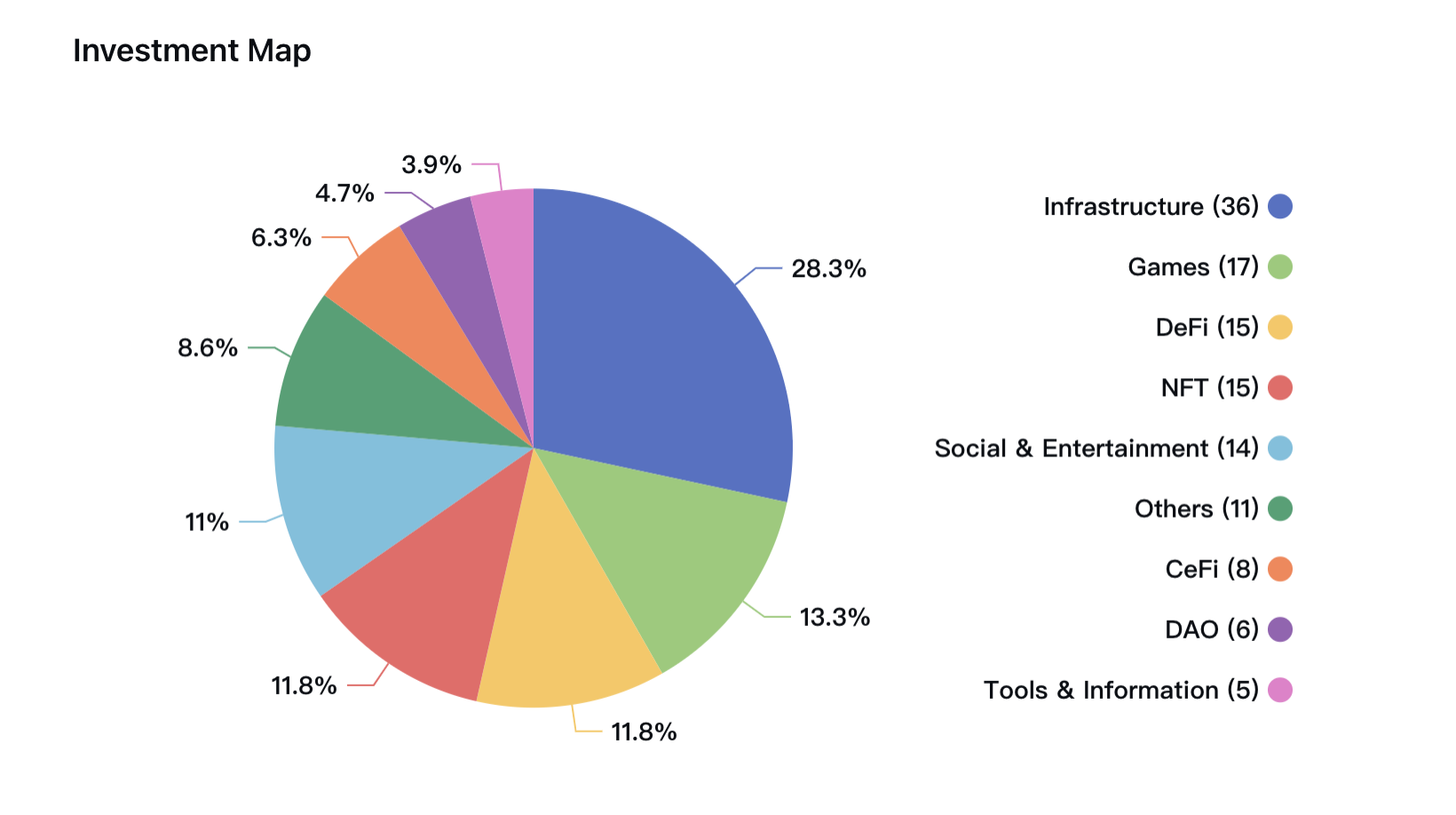

In the early stages of entering the cryptocurrency market, a16z mainly invested in areas such as infrastructure, exchanges, and wallets.

As early as 2013, a16z led the Series B financing of Coinbase, a leading CeFi institution in the market today, and continued to participate in subsequent rounds of financing in 2018. Coinbase has now become one of the largest cryptocurrency trading platforms in the world, with millions of users and billions of dollars in trading volume. In addition, a16z has also invested in many other blockchain and cryptocurrency projects. For example, the DeFi project dYdX in 2017 is one of them. a16z organized and led the seed round of financing for dYdX and made additional investments in 2018. In the new round of Series A financing, it successfully raised $10 million for dYdX, and we can still see a16z’s participation in the Series B financing in 2021. In addition, a16z led the investment in MakerDAO in 2017, and led three consecutive rounds of investment in the cryptocurrency lending project Compound in 2018, 2019, and 2020.

With the development of the cryptocurrency market, a16z has increased its investment in the cryptocurrency field in the second half of 2020 and 2021, and has gradually shifted its focus to emerging areas such as DeFi and NFT.

Due to its pattern of exploring new projects and strategies in the cryptocurrency field and seeking transformation, a16z chose to adopt a token-based investment strategy in Uniswap.

As a whale player in Uniswap, Andreessen Horowitz holds a total of 15 million UNI tokens and has a significant influence in every public vote of the project. Due to the custody settings of its tokens, it cannot participate in heat checks in technical inspections. In other words, players participating in the vote cannot know the voting results of a16z. A spokesperson for a16z confirmed that the company plans to participate in any on-chain voting. Because of its enormous influence in the project, its voting behavior is closely watched. Although there are various voices in the market, it also reflects the influence and position of a16z in the cryptocurrency field, and reminds the entire cryptocurrency community to remain vigilant and avoid any market manipulation.

The peak period of a16z’s annual investment occurred in 2022. In addition to continued attention to the gaming industry and increased investment in infrastructure projects, a16z began to pay more attention to innovative Web3 projects and the NFT field. On the other hand, investments in the CeFi field have declined. In the first quarter of 2022, a16z led the seed round of Yuga Labs, enabling the project to successfully raise $450 million at a valuation of $4 billion, making it one of the highest-funded projects in the NFT and metaverse fields in recent years. In addition, a16z also participated in leading the A and B rounds of fundraising for Opensea, establishing its position in the NFT trading market.

Investment Projects in 2023

In addition to investing in infrastructure and gaming metaverse projects, a16z has also maintained its focus on emerging fields, including the expanding applications of the currently hottest artificial intelligence, and has discovered opportunities for investment.

From the latest two rounds of investment in projects Worldcoin and Gensyn, it is evident that its focus has shifted significantly, with a tendency to shift its focus to the AI field in addition to the continued focus on conventional projects in the traditional cryptocurrency market.

Worldcoin

Worldcoin is a crypto project founded by Sam Altman, the co-founder of OpenAI. As most people worldwide currently cannot verify their identities digitally, Worldcoin’s vision is to build the world’s largest and fairest digital identity and currency system, in order to help everyone access the global financial system. In addition to a16z, well-known investment institutions such as Coinbase, Multicoin Capital, and 1confirmation have participated in the investment. The founder of LinkedIn, SBF, the founder of Mirror, multiple Ethereum projects, Polkadot, and the Web Foundation have all participated in the angel round investment. The two rounds of fundraising amount to a total of $125 million, and it is currently seeking another $100 million in financing.

Gensyn

Gensyn is a decentralized AI computing network that utilizes blockchain technology to verify the completion of deep learning tasks and trigger payment through tokens. The goal of this network is to provide more efficient, secure, and reliable computing resources for AI model training.

a16z invested in Gensyn because they believe that this project has tremendous potential and can solve some existing problems in the field of artificial intelligence. For example, traditional cloud computing models often require a significant amount of time and resources to complete AI training, while Gensyn leverages the advantages of blockchain technology to efficiently allocate and utilize computing resources. Gensyn also has the advantage of decentralization, which means that its computing network is not affected by single points of failure and can provide higher security and reliability. These factors make Gensyn a very promising project and align with a16z’s criteria when seeking investment opportunities.

- 3.1.3 Future Investment Directions

Compared to other VCs, a16z continues to pay attention to the development of the cryptocurrency market even in bear markets and actively invests in this field. They announced a new cryptocurrency fund in 2022, aiming to support emerging blockchain projects and cryptocurrency innovations. The fund of $1.5 billion will be dedicated to seed investments in Web3 startups.

This fund will provide funding and resources to startups to help them establish sustainable crypto ecosystems. In addition to financial support, a16z will also offer business advice, technical support, and marketing assistance to these companies.

a16z’s past investments in the cryptocurrency field have covered various aspects, including decentralized finance, digital identity verification, cryptocurrency exchanges, and mining, among others. These investments not only drive the development of cryptocurrencies and blockchain technology but also bring substantial returns to a16z itself. Artificial intelligence is currently one of the hottest technology fields, with widespread applications in healthcare, finance, manufacturing, and other sectors. By combining blockchain technology with AI technology, more innovative applications and business models can be created, which also brings more investment opportunities to the crypto VC industry.

a16z’s investments in the AI field also include other projects, such as Suki.AI, which provides AI solutions for enterprises, and Freenome, which utilizes machine learning technology to improve healthcare efficiency.

Overall, a16z has completed 13 investments this year, indicating that they have been consistently paying attention to emerging technologies and trends and seeking potential projects for investment. They believe that these fields will become important trends in the future and will continue to contribute to their success. a16z’s investments and actions in the crypto field not only bring substantial returns to the company itself but also inject new vitality and momentum into the entire industry. In the future, a16z will continue to focus on the development and innovation in the crypto field, actively explore new opportunities and strategies, and contribute to the long-term development of the entire industry.

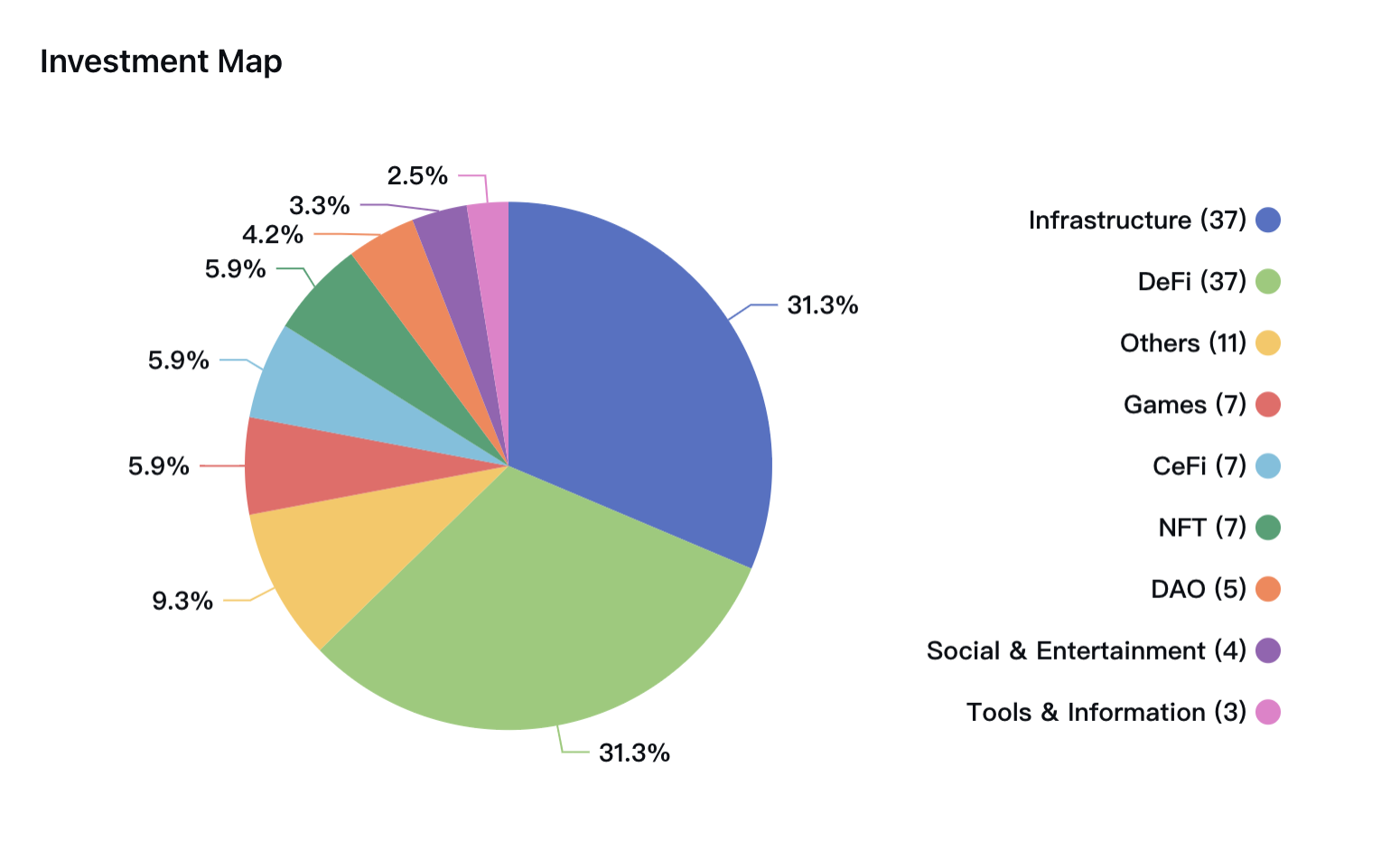

3.2 Multicoin Capital

- 3.2.1 Basic Introduction

Multicoin Capital was founded in 2017 by three founding partners. It focuses on researching and investing in blockchain technology, cryptocurrencies, decentralized applications, and emerging technologies and trends related to them.

Multicoin Capital’s investment strategy is based on in-depth industry research and analysis, as well as keen insights into emerging technologies and trends. They believe that the cryptocurrency and blockchain industry is a long-term investment opportunity. Therefore, the company emphasizes a long-term investment strategy, holding and supporting companies and projects that have a leading position in technology and the market.

In addition, they also pay attention to the values and social impact of investment projects. The company prioritizes projects that have social significance and values, and avoids investing in projects that may have negative social and environmental impacts. At the same time, the company also attaches great importance to the quality and abilities of the team and management to ensure the success of investment projects.

Multicoin Capital’s investment portfolio is very diverse, covering various fields, including infrastructure, applications, protocols, decentralized finance, games, artificial intelligence, etc. However, most of their investments are still focused on infrastructure and DeFi projects. Some of their well-known investment projects include Solana, The Graph, Portals, Arweave, StarkWare, etc.

In addition to investments, the organization is also committed to providing investors with the latest information and insights on cryptocurrencies and blockchain technology, as well as advice and guidance on investment and trading. Multicoin Capital regularly publishes reports and articles covering various topics, including market trends, technological innovation, investment strategies, etc., to provide investors with effective advice and guidance.

- 3.2.2 Yearly Investment Project Comparison

In the early years of joining the cryptocurrency industry, Multicoin Capital mainly focused on infrastructure investments. They participated in the seed round investment of Solana in 2018 and led the A round financing of Solana in 2019. Solana is a project aimed at improving blockchain scalability and user-friendliness. In addition, Multicoin Capital also participated in the A round financing of StarkWare, which focuses on improving blockchain privacy and scalability. In 2019, they also led the seed round financing of The Graph, a protocol for distributed network querying and indexing.

Multicoin Capital has demonstrated a high level of professionalism and keenness in infrastructure investments. They saw the potential in these projects and injected capital to support their development. These investments have not only brought high returns to Multicoin Capital but also made important contributions to the development of the entire cryptocurrency market.

Over time, Multicoin Capital’s investment direction has gradually expanded and upgraded from infrastructure investment to more diverse areas such as decentralized finance, artificial intelligence, gaming, and Web3. Whether it is infrastructure investment or investment in other fields, Multicoin Capital has always maintained a high level of professionalism and insight, making important contributions to the development of the entire cryptocurrency market.

For example, starting in 2020, Multicoin Capital increased its focus and investment in the DeFi field and made 17 investments in related areas in just one year in 2021. These include investments in projects such as Perpetual Protocol, Oxygen, Beta Finance, and more.

In addition to the DeFi field, Multicoin Capital has also made important investments in areas such as artificial intelligence, gaming, and Web3. For example, they have invested in projects such as Alethea AI, Portals, Metaplex, and Fractal.

In addition, the organization was once an investor in FTX and FTX US. Multicoin Capital’s investment in FTX and the related Solana ecosystem did suffer losses. Especially for FTX, as one of the largest CEXs at the time and a key project that Multicoin Capital paid attention to and invested in, the sudden bankruptcy event was unexpected by everyone.

2023 Investment Projects

In the first half of this year, Multicoin Capital invested in a total of 6 projects, mainly in infrastructure and Web3 projects. Among them, four projects were led by Multicoin Capital, including wallets, security solutions, DeFi (MEV), and DAO solutions. These projects are all applications based on blockchain technology, covering multiple areas such as cryptocurrencies, DeFi, security, DAO, etc. They have high technical content and market potential, and Multicoin Capital’s investment strategy in the crypto VC industry is gradually taking shape.

- TipLink

TipLink is a project co-led by Multicoin Capital and Sequoia Capital, with participation from Solana Ventures, Circle Ventures, LianGuaiXOS, and others. As a lightweight wallet, TipLink aims to make transferring digital assets as simple as sending a link. The non-custodial wallet allows users to have full control over their assets by connecting their Gmail account or Solana wallet. Users who own cryptocurrencies can create this wallet and send the link to anyone through any platform (text, Discord, email, etc.). In this application, the link is the wallet.

Currently, TipLink can only be used on the Solana network. TipLinks can generate and hold SOL, SPL tokens, NFTs, and SFTs. Once generated, new or local blockchain users can receive digital assets and have full control over them through the link. Using TipLinks and Solana LianGuaiy, you can establish direct relationships with customers through peer-to-peer payments. There is no need to worry about transaction fees, frozen funds, or refunds.

- 3.2.3 Future Investment Direction

With the continuous development of the cryptocurrency market and the expansion of application scenarios, Multicoin Capital’s investment direction is also changing. They are beginning to focus more on building the Web3 ecosystem, especially projects that can improve efficiency, reduce costs, and enhance security. They have also started to pay attention to projects in areas such as artificial intelligence and gaming, and have made important investments in these fields. Whether it is infrastructure investment or investment in other areas, Multicoin Capital has always maintained a high level of sensitivity and insight, making significant contributions to the development of the entire cryptocurrency ecosystem.

Although Multicoin Capital has indeed slowed down its investment pace in the cryptocurrency field this year, it does not mean that they have given up their attention and focus on this field. On the contrary, they continue to seek new investment opportunities and adjust their investment strategies and portfolios to reduce risks and achieve better investment returns. For example, they have shifted their focus back to the infrastructure field and started looking for Web3 projects that may have a greater impact on the entire industry. Multicoin Capital believes that Web3 is the future of the next generation of the Internet and will have a profound impact on the industry in the next decade. Therefore, they are actively looking for promising Web3 projects and providing funding and support for these projects.

Of course, Multicoin Capital may continue to focus on the infrastructure field, as they believe that infrastructure projects will continue to have a profound impact on the entire industry in the next decade.

3.3 LianGuairadigm

- 3.3.1 Introduction

LianGuairadigm was founded in 2018 by Fred Ehrsam, co-founder of Coinbase, Matt Huang, former partner at Sequoia Capital, and Charles Noyes, former partner at Paradigm. LianGuairadigm’s mission is to contribute to the global promotion and popularization of cryptocurrency and blockchain technology.

The company’s investment philosophy is long-term investment and strategic investment, that is, investing funds in projects with long-term potential and establishing close cooperation with these projects to jointly promote the development of the entire industry.

Unlike other VCs, after investing in projects, LianGuairadigm actively participates in and supports the construction of the cryptocurrency and blockchain technology community and ecosystem, providing strategic guidance, technical support, and business expansion support to projects, helping these projects achieve commercialization and sustainable development.

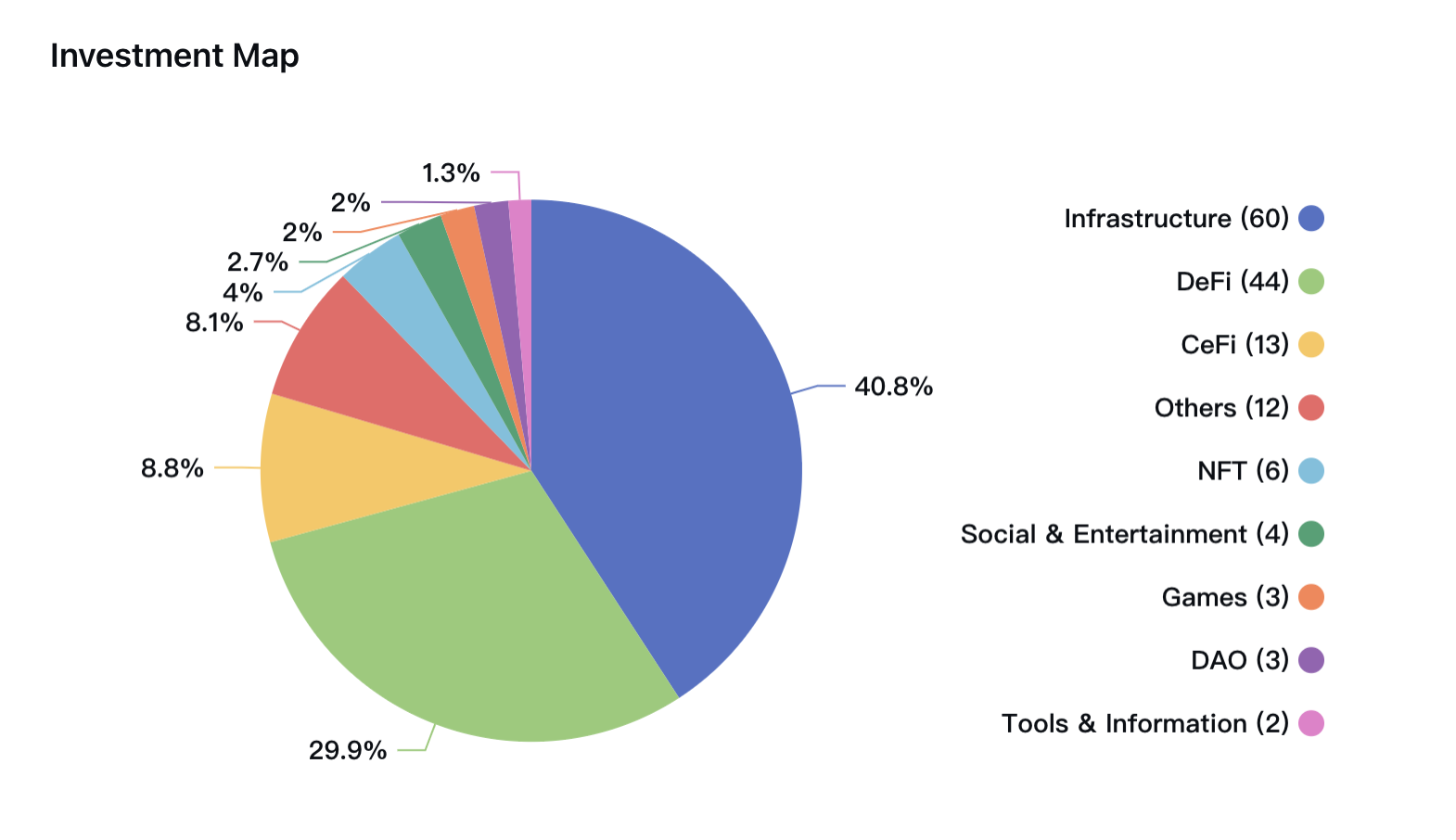

LianGuairadigm has made many investments in the fields of infrastructure, DeFi, NFT, and CeFi. The institution continues to pay attention to the development of various industries in the cryptocurrency field and is committed to providing technological and financial support and operational assistance to new projects.

- 3.3.2 Comparison of Investment Projects Over the Years

After entering the encrypted ecosystem, LianGuairadigm focused on the infrastructure and DeFi fields. After leading the investment in StarkWare’s Series A financing, it continued to lead the Series B and Series C financing rounds and continued to pay attention to its development. The same goes for Uniswap. Since leading the investment in Uniswap in 2019, it has been monitoring the project’s development and has participated in its subsequent two rounds of financing in 2020 and 2022. This is also one of LianGuairadigm’s successful cases.

In addition to these, LianGuairadigm has also discovered and long-term invested in a series of leading crypto ecosystem projects, such as Optimism, Cosmos, Argent, Reflexer, Yield Protocol, and Axie Infinity. The development of these projects fully demonstrates LianGuairadigm’s long-term investment philosophy and strategic investment strategy.

Since 2021, LianGuairadigm has begun to increase its focus and investment in the fields of DeFi, NFT, CeFi, and gaming, gradually expanding its investment scope in the crypto ecosystem. In addition to investments, LianGuairadigm actively participates in the construction and promotion of the blockchain ecosystem, providing corresponding assistance to these projects.

For example, in the CeFi field, LianGuairadigm led the Series A financing for Coinswitch in 2021 and participated in the Series D financing for Bitso. Coinswitch is currently the most popular cryptocurrency application in India, while Bitso is the largest cryptocurrency exchange in Latin America. These were LianGuairadigm’s first two participations in the financing of cryptocurrency exchanges after entering the encrypted ecosystem. In the same year, LianGuairadigm also participated in some NFT, DeFi, and gaming projects, such as Opyn, Synthetix, dYdX, Zora, Royal, and Axie Infinity.

In 2022, LianGuairadigm continues to have a positive outlook on infrastructure and NFT-related fields and begins to explore new Web3 projects. They hope to explore new ways for the entire crypto ecosystem and insist on continuous construction. First, they continue to invest in NFT projects such as Opensea, Magic Eden, and Limit Break, all of which are institutions and companies with significant positions and influence in the NFT ecosystem. They also invested in Argent and Phantom, two crypto wallet projects that have a leading position in cryptocurrency storage and management. In addition, in order to give more new projects opportunities, they have also invested in many new Web3 innovative ideas. For example, Jambo is an education-related industry, and these new projects may play an important role in promoting the application of cryptocurrencies and blockchain technology in the future.

Investment Projects in 2023

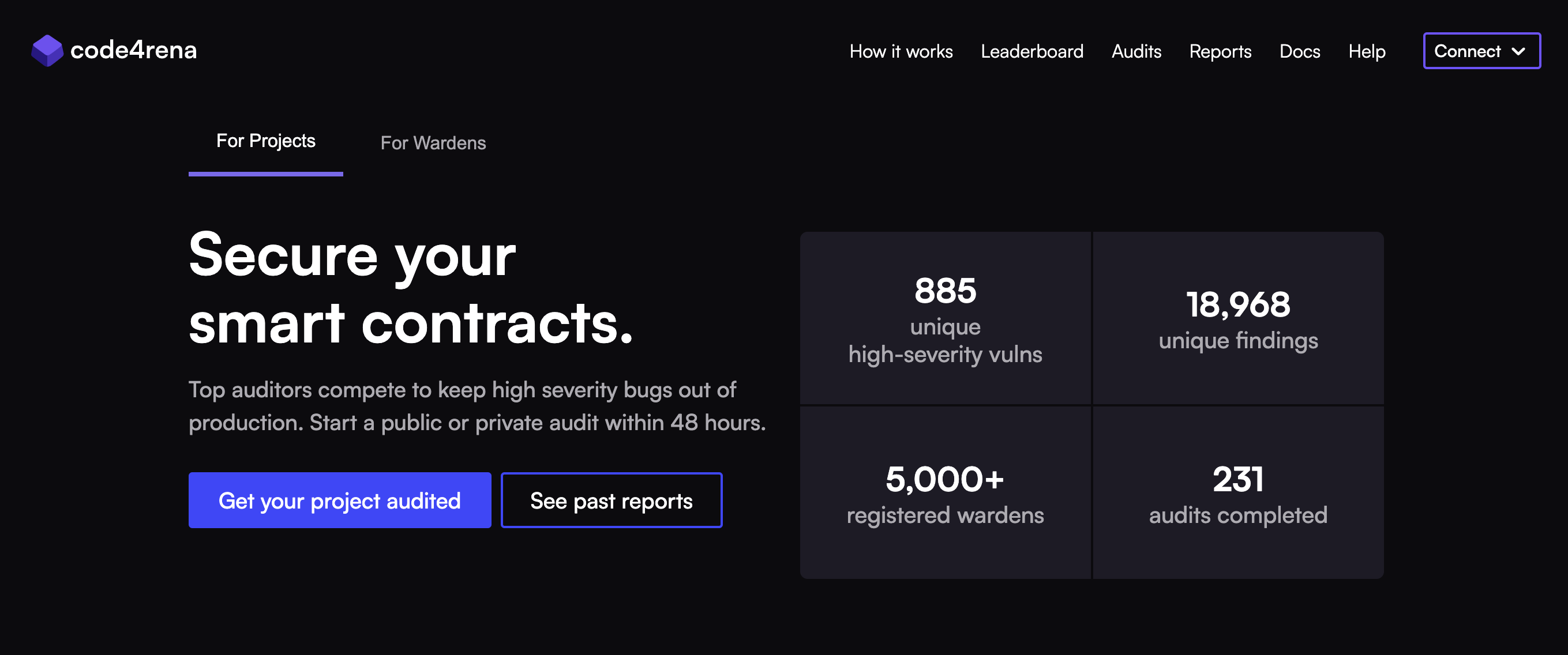

In the first half of 2023, LianGuairadigm only participated in and led two projects – the security solution Code4rena and the infrastructure platform Conduit. In the bear market of the cryptocurrency market, LianGuairadigm changed its previous diversified investment layout and adopted a more conservative investment strategy. They chose to concentrate their investments in the infrastructure field to reduce the error rate and made small investments. The current financing amounts for these two projects are 6 million and 7 million US dollars, respectively.

- Code4rena

Code4rena is a web3 security audit platform. Security audit contests differ from traditional audits and bug bounties by providing broader coverage and guaranteed payment for participants. The participants in the arena include Guardians, who protect the DeFi ecosystem by auditing code; Sponsors, who create prize pools to attract wardens to audit their projects; and Judges, who determine the severity, validity, and quality of investigations and rate the performance of wardens. As a competitive audit platform, Code4rena can uncover more high severity vulnerabilities faster than any other audit method.

Code4rena is built by a leading team of industry experts and aims to protect projects and communities by providing opportunities for the world’s best security researchers and smart contract experts.

- Conduit

Conduit is a native crypto infrastructure platform designed to support and accelerate builders in the crypto space. Its first product enables teams to scale their applications by about 100x, allowing them to launch production-grade aggregators built on the OP Stack quickly. Infrastructure professionals manage, launch, and scale application-specific aggregators on Conduit, so teams can focus on creating products that users love. DeFi protocols, gaming companies, NFT platforms, and other on-chain providers can easily and rapidly scale their applications using Conduit, providing a better user experience and unlocking new use cases previously hindered by network congestion.

- 3.3.3 Future Investment Direction

The timely adjustment of LianGuairadigm’s investment strategy reflects its keen insight and ability to respond to market conditions, as well as its fundamental judgment of the current ecosystem. Despite the downturn in the market, the development of infrastructure remains an important factor in maintaining the stability and healthy growth of the crypto ecosystem, and it is also a manifestation of LianGuairadigm’s long-term investment philosophy.

In the future, LianGuairadigm may also explore new areas to seek new investment opportunities and promote the development of the entire crypto ecosystem. For example, the currently discussed artificial intelligence (AI) industry, which integrates blockchain technology and AI technology, is likely to become a focus of LianGuairadigm’s attention. In the past few years, the application of AI technology in various industries has become a trend. With the continuous development and application of blockchain technology, the integration of AI and blockchain technology has also become a new research focus and investment direction. For example, some blockchain projects are exploring how to use AI technology to improve the efficiency and security of blockchain systems, as well as how to apply blockchain technology in the field of AI.

LianGuairadigm likes to engage in long-term investment and innovative project discovery. The artificial intelligence sector is in the early stage of development, which aligns with LianGuairadigm’s investment philosophy and also allows them to easily participate in project communities and ecosystem construction, providing timely assistance.

LianGuairadigm may seek opportunities in these emerging fields and provide technical support, business development, and strategic guidance to these projects, helping them achieve commercialization and sustainable development. In this way, LianGuairadigm may further promote the development of the cryptocurrency ecosystem and gain more returns in future investments.

3.4 Mechanism Capital

- 3.4.1 Introduction

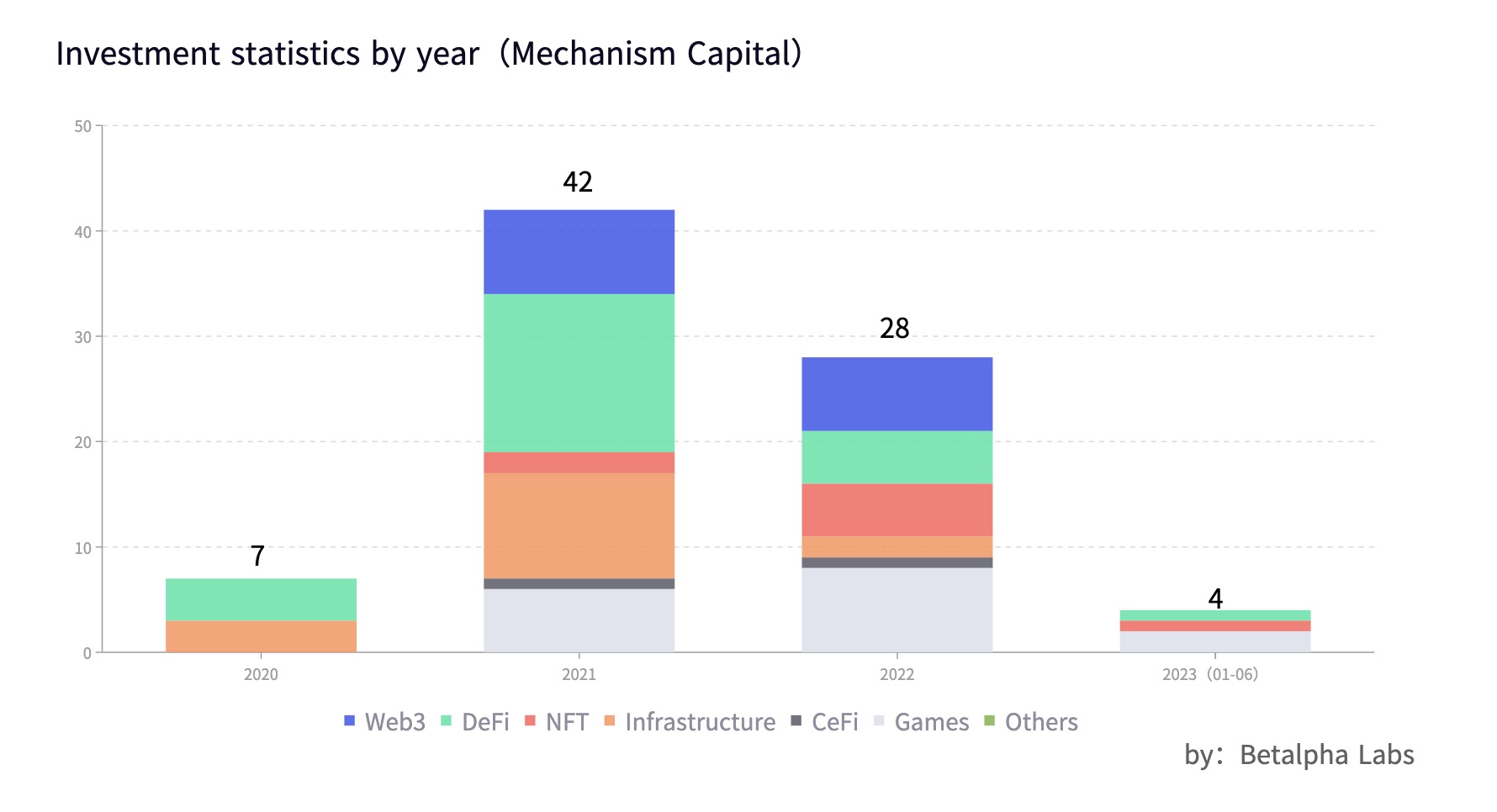

Mechanism Capital is an investment company focused on cryptocurrency and blockchain technology, established in 2018. As an emerging VC, Mechanism Capital is more flexible and innovative, and primarily focuses on small amount financing. They not only pay attention to the quality and growth potential of investment projects but also focus on the overall development of the blockchain ecosystem, actively promoting industry innovation and development.

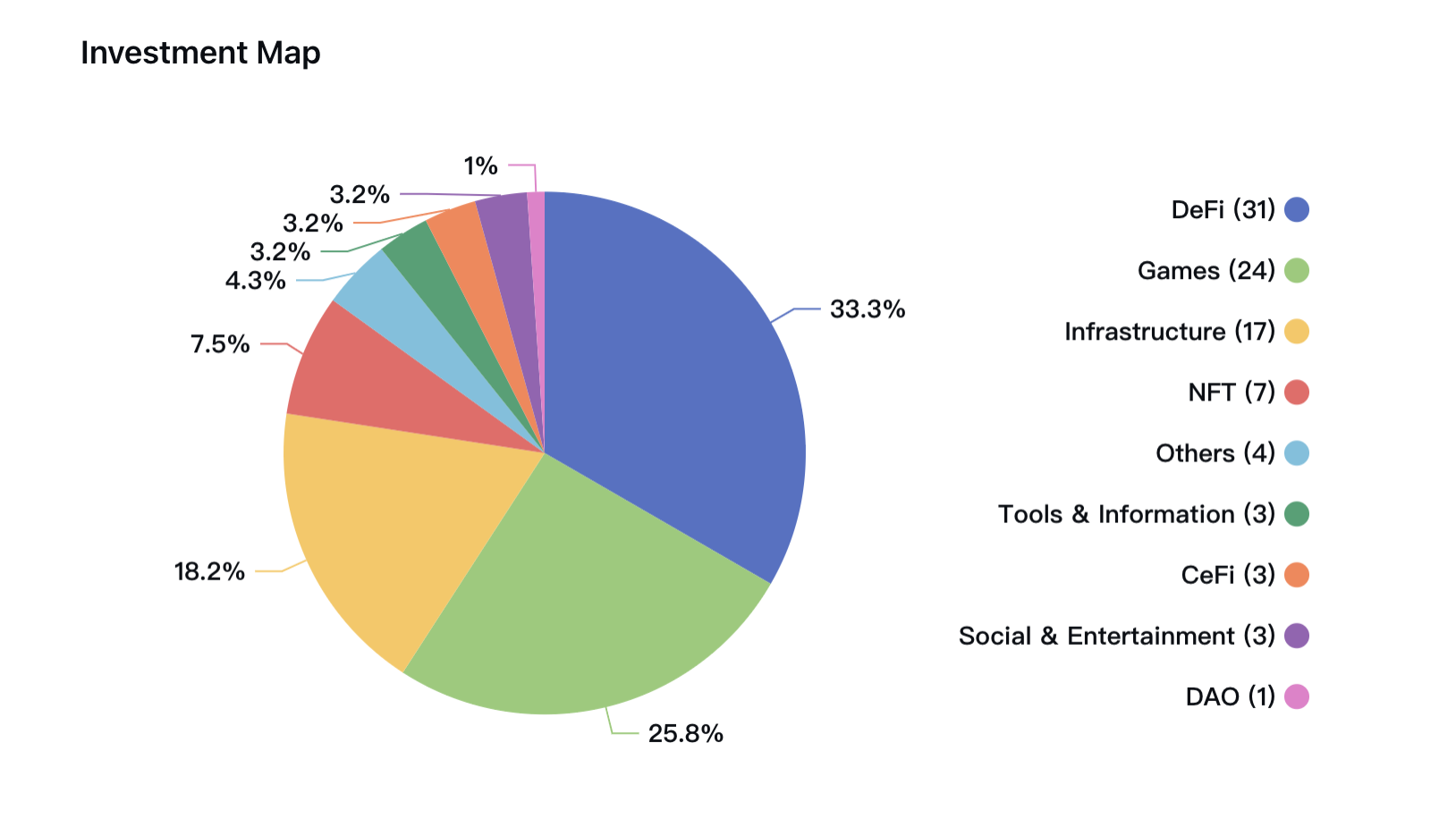

The company stated on its official website that although they are interested in various aspects of the cryptocurrency ecosystem, their initial focus is on the DeFi and infrastructure sectors. After several years of stable operation, they gradually expand their investment scope to include the gaming and NFT fields. For example, they raised $100 million in early 2022 to establish a gaming fund, enabling more comprehensive track investment and layout. This can also be intuitively reflected in their investment layout over the years. They hope to help support the construction of new financial systems and applications on public chains and enhance the industry’s understanding of the value acquisition, incentives, and mechanism design of cryptographic assets through their own participation.

The team members have a strong technical background and rich industry experience. They are committed to contributing to the development and innovation of the blockchain ecosystem, helping promising projects achieve commercialization and sustainable development through investment and support.

One of the founders, Andrew Kang, previously served as the Director of Investments at Bitcoin investment company Ledger Capital, responsible for the management and strategy of blockchain and cryptocurrency investment portfolios, and also served as an advisor and investor for multiple cryptocurrency projects. Another founder, Vance Spencer, has worked at multiple well-known financial institutions such as Goldman Sachs and JPMorgan Chase, with a deep financial and investment background. He is also a co-founder of blockchain investment company Framework Ventures.

Mechanism Capital stated that they are less influenced by external investors, allowing them to flexibly invest in non-traditional project concepts and have the ability to continuously invest financial and human capital to support the ecosystem from the first day of investment.

- 3.4.2 Yearly Investment Project Comparison

Mechanism Capital is more inclined to make small investments, a style that has emerged since they entered the cryptocurrency market in 2020. Throughout 2020, the highest amount of funding they participated in was the seed round of financing for SifChain, totaling $3.5 million, while the funding amounts for other projects ranged from $1.2 million to $3.1 million. Although there were many projects with large funding during the same period, Mechanism Capital did not participate in those financings. They prefer to diversify risks across multiple projects and sectors through small investments and increase investment amounts when necessary.

In 2021, Mechanism Capital began to focus its investments on DeFi projects, which is consistent with their statements on their official website. During that year, they invested in 15 DeFi projects, most of which were through participation in financing. Among these projects, asset management platform Set Protocol received the highest amount of funding, reaching $14 million, followed by cross-chain aggregator project XY Finance, which received $12 million in financing. In addition, infrastructure projects also received favor from Mechanism Capital, with a total of 10 infrastructure projects receiving funding throughout the year, including leading the Series A round of investment for XDEFI, leading the investments for projects Nameless and Biconomy, and multiple participations in Burnt. These investment activities indicate that Mechanism Capital is gradually establishing its investment direction and seeking potential projects for investment.

In 2022, in addition to continuing to focus on the DeFi sector, the area with the highest number of projects invested in by Mechanism Capital is the gaming sector. That year, they invested in a total of 8 gaming projects, including the MMORPG game Tatsumeeko, which can be played on Discord, the metaverse game MetaverseGo, the MMO strategy game Heroes of Mavia, where players can earn money while playing, and the AAA-level first-person shooter game SHRAPNEL, among others. In addition, they participated twice in the NFT project UpShot and led the strategic round of financing for reNFT, raising $5 million in funding. In terms of infrastructure, they participated in the Layer 1 protocol NEAR Protocol, which was also the highest funded project for Mechanism Capital after entering the crypto ecosystem. In the DeFi sector, they participated in the seed round of financing for the lending protocol Morpho and made three consecutive investments in the stablecoin protocol Hubble Protocol. Hubble Protocol is a decentralized finance (DeFi) protocol built on Solana, with its core product being USDH, a decentralized stablecoin that allows users to borrow against their crypto assets.

Investment Projects in 2023

In the first half of this year, Mechanism Capital invested in a total of four projects, two of which are in the gaming sector, and the remaining two are in the DeFi and NFT sectors respectively. The project with the highest funding was Avalon, a metaverse project led by Mechanism Capital, which raised $13 million in a financing round, while the remaining projects secured funding ranging from $1.5 million to $5.5 million.

- Avalon

Avalon is a company headquartered in Orlando, Florida, that is building a gaming platform aimed at creating an interoperable universe using virtual universe technology. The company was founded by leaders from games such as “Endless Quest,” “Call of Duty,” “Diablo,” “God of War,” “Assassin’s Creed,” and “Elden Ring.”

Avalon’s gaming platform will connect technologies such as game engines and blockchain to build a virtual universe. CEO Sean Pennoque stated in an interview with GamesBeat that while the company does not refer to its platform as a “metaverse,” they envision a future where people collaborate using tools that allow for easy world building and experiencing these dreams, creating something similar to a virtual universe.

Avalon’s goal is to change the digital world and ensure that these changes are beneficial for creators and players. Pennoque stated that engagement is driven by gameplay, creativity, and connections between people, which are critical elements that most self-proclaimed virtual worlds severely lack. Therefore, Avalon aims to create a more real and interactive virtual universe by integrating technology to build the virtual world from gaming.

Mechanism Capital’s investment in Avalon, a metaverse gaming platform, may be based on optimism about the prospects of the metaverse gaming market, recognition of Avalon’s leaders and team members, and understanding and awareness of blockchain technology applications.

- 3.4.3 Future Investment Direction

According to their official website, Mechanism Capital may continue to focus on the DeFi and gaming sectors in the future. The organization has relatively rich experience and in-depth understanding in these fields. The DeFi sector is one of the most popular sectors in the cryptocurrency market, offering numerous innovations and opportunities to provide users with more secure, transparent, and open financial services. Additionally, it is one of the sectors with the highest daily participation and most stable user base in the crypto ecosystem. Mechanism Capital may continue to invest in projects that provide innovative solutions in the DeFi sector, such as decentralized lending, prediction markets, insurance protocols, which were the original intentions behind establishing the fund. The organization has also established a dedicated fund for the gaming sector in preparation for future investments.

Furthermore, considering that both investors have financial backgrounds, Mechanism Capital may continue to focus on projects that combine traditional finance with the cryptocurrency market. These projects can bring better efficiency and transparency to the traditional financial industry while also providing more opportunities and liquidity to the cryptocurrency market.

In addition to the DeFi field and financial-related projects, Mechanism Capital has also been paying attention to emerging areas with potential, such as blockchain infrastructure, DAO, and Web3. Due to the flexibility of its investment funds, Mechanism Capital is able to invest more flexibly in these emerging areas.

Overall, Mechanism Capital will continue to focus on promising projects and areas in the cryptocurrency market, including the DeFi field, financial-related projects, blockchain infrastructure, DAO, Web3, etc. Regardless of the field, Mechanism Capital will provide funding and technical support for these projects, and help them achieve better development through human capital investment and active participation in ecosystem governance.

3.5 Polychain Capital

- 3.5.1 Basic Introduction

Polychain Capital is a venture capital firm specializing in cryptocurrencies and blockchain technology. It was founded in 2016 and is headquartered in San Francisco, USA. The company’s founder is Olaf Carlson-Wee, a former engineer at Coinbase and a well-known figure in the cryptocurrency field.

Polychain Capital focuses its investments on projects in the cryptocurrency and blockchain technology field, including infrastructure, protocols, applications, ecosystems, etc., such as Avalanche, Arbitrum, Uniswap, Coinbase, Connext, SLianGuaiCE ID, etc.

Polychain Capital’s investment philosophy leans towards early-stage and risk investments. Most of the projects they invest in also have large amounts of funding. They often invest in the early stages of projects to gain higher returns. Early-stage investments also help them better understand the projects and establish close partnerships with them. In addition to high returns, they also believe in discovering projects that are unique, practical, and innovative, and they believe in their investment vision and the great development potential of these projects.

In addition to investments, Polychain Capital actively participates in the construction and promotion of the blockchain ecosystem. They provide support in areas such as technical support, business development, and strategic guidance to help these projects achieve better commercialization and sustainable development. They also actively participate in the construction of the blockchain community and industry, supporting and promoting the application and innovation of blockchain technology.

- 3.5.2 Comparison of Investment Projects Over the Years

Since its establishment, Polychain Capital has shown a clear inclination towards investments in the infrastructure and DeFi fields, with most of the investment amount allocated to these two directions. The projects that Polychain Capital has invested in the infrastructure field include blockchain operating systems, distributed storage, cross-chain protocols, etc. These projects are critical to providing support and infrastructure for the entire cryptocurrency market. At the same time, the projects in the DeFi field are also outstanding, including decentralized exchanges, stablecoin protocols, lending protocols, etc. These projects can provide users with more secure, transparent, and open financial services.

As early as 2017, Polychain Capital led the investment in MakerDAO, the leading stablecoin protocol, and decentralized exchange dYdX. It also participated in cross-chain protocol Polkadot and decentralized trading infrastructure project 0x.

In 2018 and 2019, Polychain Capital continued to allocate most of its funds to the infrastructure sector, investing in a series of projects such as Avalanche, Celo, Nervos Network, and Dfinity. In addition, it also participated in Coinbase’s Series E financing.

In 2020, Polychain Capital did not accelerate its investment process. However, unlike its previous investment focus, due to the rise of decentralized finance (DeFi), the number of DeFi project investments accounted for 45% of the total investments for the year, followed by the CeFi sector. Investments in infrastructure projects were put on hold, with only three projects receiving funding from the organization for the whole year.

In 2021 and 2022, the organization returned to its previous investment style, with a focus on the infrastructure sector, followed by the DeFi sector. In terms of infrastructure, it led investments in many projects such as Solana, Connext, Avalanche, Scroll, AltLayer, EigenLayer, and Celestia. For most investment projects, the organization participated as the lead investor, and it also participated in well-known projects such as Arbitrum, Evmos, and Gauntlet. In the DeFi sector, it is also a leader in projects like Uniswap.

2023 Investment Projects

From 2023 to the end of June, Polychain Capital invested in a total of 15 rounds, maintaining its consistent style, with a focus on infrastructure investments. Among the 10 projects, it led the investment and mainly participated in seed rounds, Series A, and strategic rounds. However, unlike other investment institutions, Polychain Capital did not immediately shift its focus to the AI field and its derivatives. It still mainly invested in traditional related fields of the industry, including blockchain (EigenLayer, Berachain), cross-chain communication protocols (Connext), decentralized finance, derivatives (Thetanuts Finance, Coral Finance), data privacy (Webb), and more.

- Berachain

Berachain is an EVM Layer-1 blockchain built using the Cosmos SDK. It focuses on DeFi and is compatible with EVM. It is supported by Proof of Liquidity, a liquidity consensus mechanism.

The development team of Berachain recognizes that one of the common problems with L1 is liquidity. Therefore, they have designed a Proof of Liquidity mechanism to attract and retain assets. Users can pledge whitelisted assets such as BTC, ETH, and stablecoins into the validator insurance pool and receive a portion of the DeFi protocol’s income and BERA as rewards.

Berachain uses a three-token economic model, including BERA, BGT, and HONEY. BERA is the gas token of Berachain, used as a medium for pricing and execution. BGT is the governance token of Berachain, used for voting on new whitelisted assets. HONEY is the USD stablecoin of Berachain, used as a payment method for protocol income. This economic model, called “Tri-Token” by the development team, aims to encourage long-term user engagement and maintain consistent on-chain liquidity. Berachain’s Proof of Liquidity and three-token economic model contribute to providing fast transaction speed, low transaction costs, immediate finality, and rich liquidity for DeFi on Berachain.

Berachain completed a financing of $42 million at the end of April this year, led by Polychain Capital, with participation from Hack VC, dao5, Tribe Capital, Shima Capital, Robot Ventures, Goldentree Asset Management, and OKX Ventures.

- 3.5.3 Future Investment Direction

As a relatively large investment institution with a stable investment strategy, Polychain Capital may make some adjustments to its investment direction in the cryptocurrency field in the future, but the overall investment strategy and direction may not change significantly. It will still focus on infrastructure and DeFi.

Of course, in order to have a better business model and future development, Polychain Capital may pay more attention to the early value and sustainability of a project, and look for projects with good business prospects and development models to ensure a higher return on investment.

Diversification of the investment portfolio may be their focus going forward. Although Polychain Capital has achieved many successful investments in its familiar field, they are also aware that portfolio diversification is key to maintaining competitiveness in a rapidly changing market. Therefore, Polychain Capital may seek investment opportunities in other fields related to the cryptocurrency field, such as artificial intelligence, big data, and the Internet of Things.

Although Polychain Capital is not currently showing special interest in the field of artificial intelligence, the combination of artificial intelligence and blockchain technology is an area of great interest, and almost all investment institutions are paying close attention to this track and investing in promising projects. These projects may include artificial intelligence applications that use blockchain technology to protect data privacy and Internet of Things applications that use smart contracts to manage the supply chain.

Big data analysis is also an important field, and there is great development potential for projects that use big data analysis to improve the efficiency and accuracy of cryptocurrency transactions. These projects may include using big data analysis to predict market trends and trading strategies, and using blockchain technology to protect data privacy and security.

In summary, diversification of the investment portfolio is key to maintaining competitiveness. Polychain Capital may focus more on investment opportunities in other fields related to the cryptocurrency field, providing more choices for portfolio diversification and risk control while maintaining a stable investment attitude.

3.6 Variant Fund

- 3.6.1 Introduction

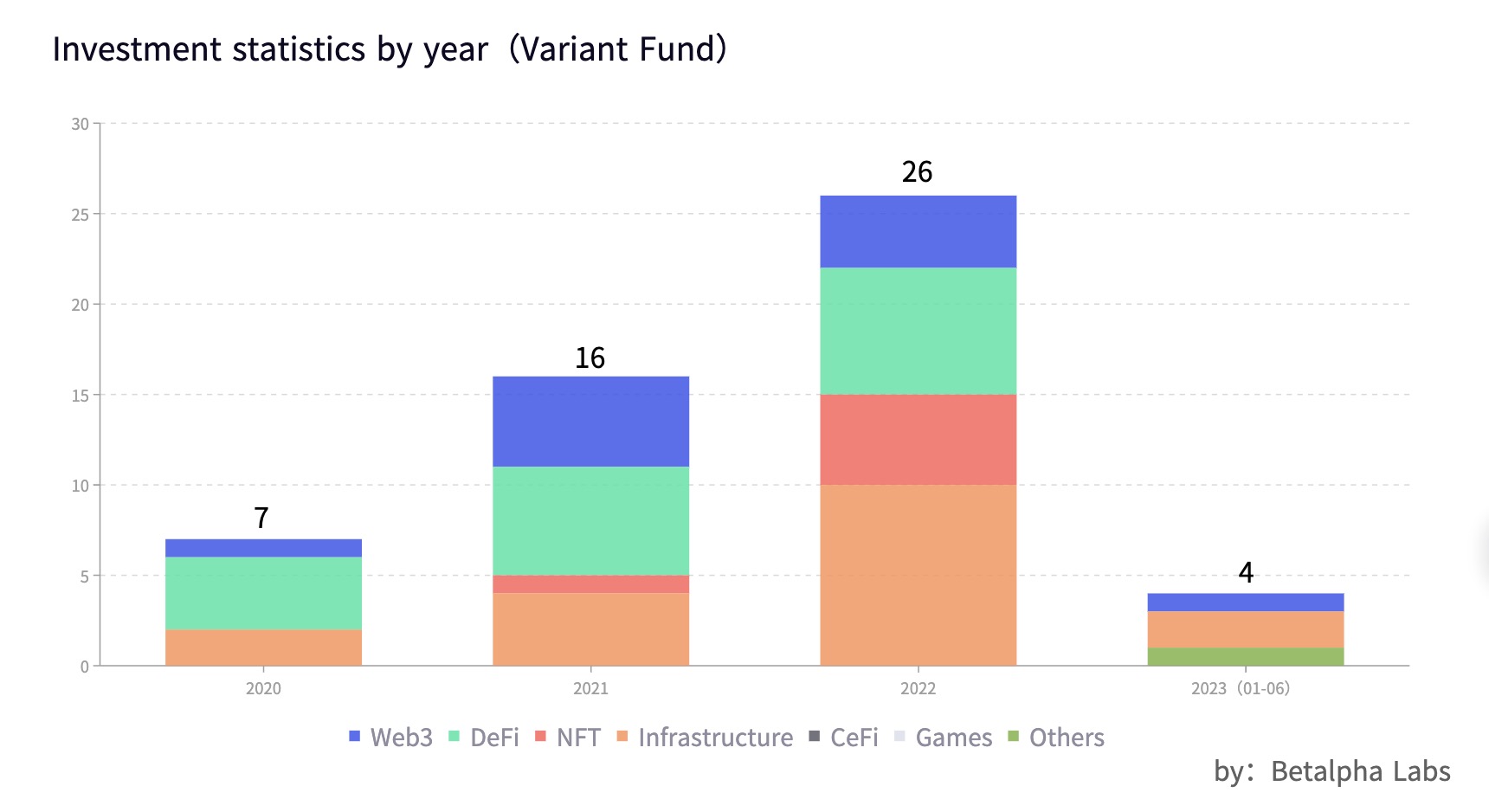

Variant Fund is an early-stage cryptocurrency investment fund that focuses on investing in and supporting innovative cryptocurrency and blockchain projects.

The company was founded in 2020 by Jesse Walden and Li Jin, both of whom are experienced investors in the cryptocurrency and blockchain field. Jesse Walden was the investment partner of a16z’s first cryptocurrency fund, and later led the twelve-week accelerator “a16z Crypto Startup School” initiated by a16z crypto. It is understood that Jesse led Variant’s investments in projects such as Uniswap, Phantom, Mirror, Flashbots, and Foundation. Variant’s other co-founder, Li Jin, also comes from a16z, but belongs to the consumer investment team. The two founders have little overlap except in the internet creator and online platform areas. In 2020, Li left a16z and founded Atelier Ventures, which is dedicated to the passion economy and has invested in cryptocurrency projects such as Yield Guild Games and DAO platform Syndicate.

In July 2022, when the cryptocurrency market entered a cold winter, Variant Fund announced the launch of a fund with a capital size of up to $450 million. This is the third fund launched by Variant Fund since its establishment in 2020. From the $2.25 million fund announced at the first appearance to the $110 million early-stage fund launched in October of the following year, each fund launched has a scale more than four times that of the previous fund, and the company’s growth rate is remarkable.

Variant believes that cryptocurrencies will become the foundation of the network owned by users, where products and services will transform their users into owners. The focus of the investment team’s professional research direction also indicates the vertical segments that they are concerned about in the crypto industry.

In addition to investments, Variant Fund also shares industry dynamics, trends, and investment insights through the Variant Newsletter to help increase transparency and understanding in the industry.

-

3.6.2 Comparison of Investment Projects over the Years

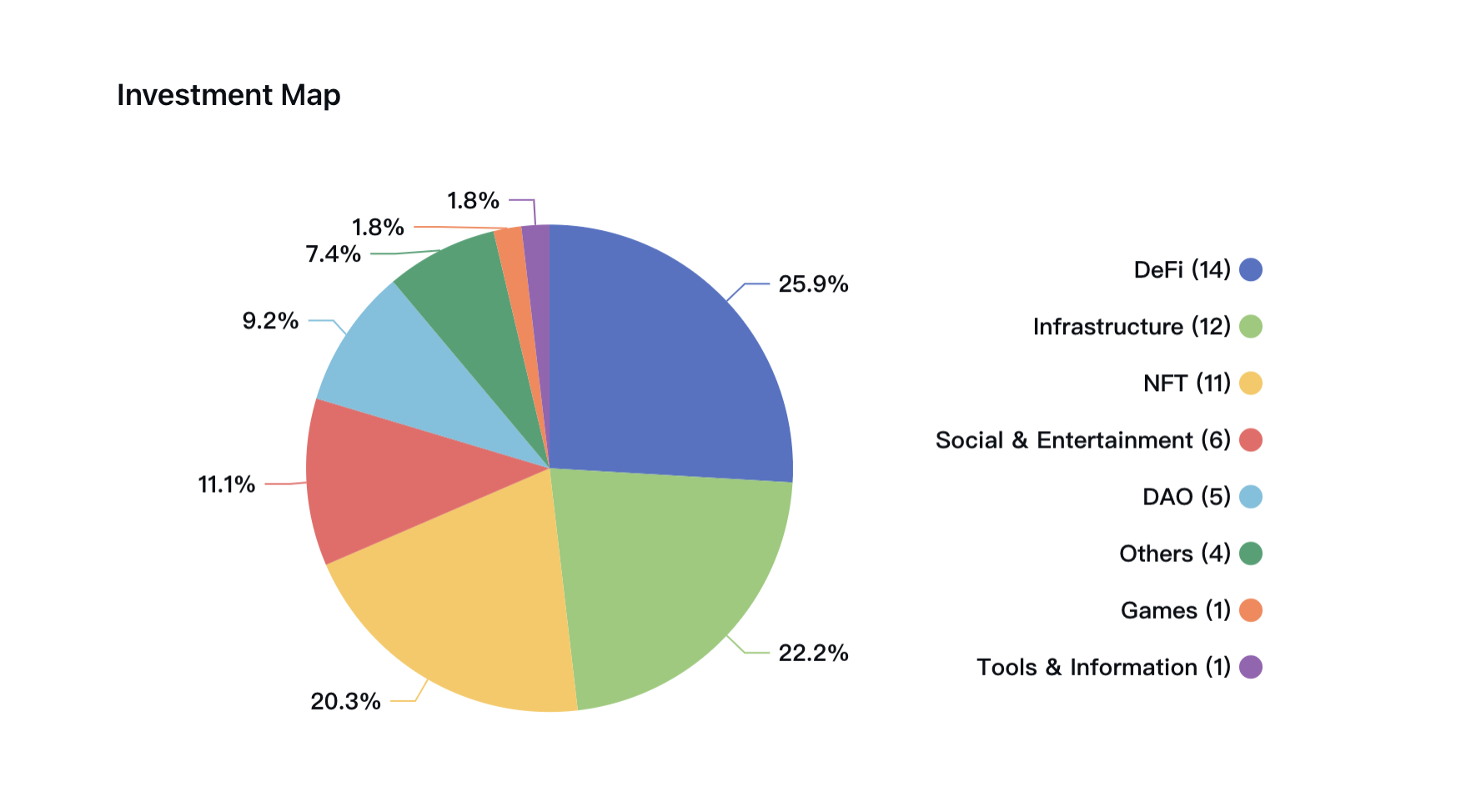

According to data from the Variant Fund official website, the institution has now invested in 54 crypto projects. The number of invested projects is relatively small, and the ratio of leading investments is low, at about 18%. The investments are evenly distributed in areas such as infrastructure, DeFi, and NFT, and there are many well-known projects in various vertical fields, including Aptos, Foundation, Polygon, Mirror, Phantom, Uniswap, and Magic Eden.

In 2020, Variant Fund, which had just been established, immediately participated in the Series A financing of Uniswap, and participated in the Series B financing of Uniswap in 2022, demonstrating the institution’s keen insight and investment vision for high-quality projects. In that year, it mainly invested in the DeFi sector and also invested in projects such as Reflexer, Union Finance, and Cozy Finance.

In 2021, Variant Fund continued to focus on infrastructure, DeFi, and emerging Web3 projects, investing in multiple projects such as Fei Protocol, Aleo, Yield Protocol, Phantom, Syndicate, Burrata, and Aztec Network, all of which have achieved impressive achievements and influence in their respective fields.

In 2022, NFT projects received a large amount of financing. Variant Fund led investments in projects such as NiftyApes, Koop, and Formfunction, and also participated in excellent projects such as Magic Eden and Oncyber. In the same year, it also participated in multiple leading infrastructure projects in the industry, including zkSync, Aptos, Ceramic Network, and Polygon.

2023 Investment Projects

In the first half of this year, Variant Fund invested in four projects, mainly in some basic fields. Except for the project Botto, which is related to the hottest field of artificial intelligence, no significant investment actions or directional changes have been made.

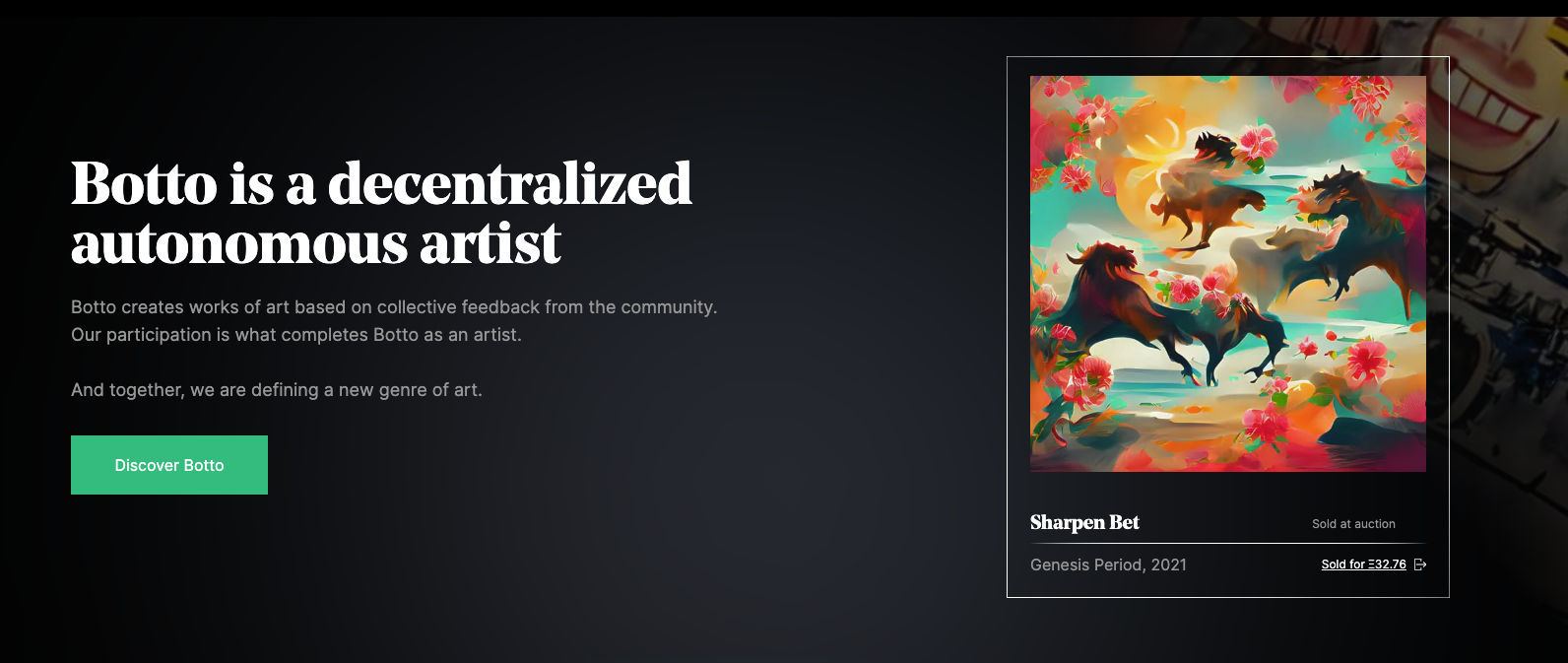

- Botto

Botto is an artificial intelligence artist who draws inspiration from excellent works in art history and uses artificial intelligence to generate new artworks. At the beginning of its creation, Botto airdropped governance tokens to NFT creators and collectors on various platforms. Botto community members can vote for the 350 artworks created by Botto each week to decide the final artwork and the artistic style of the AI. Through this method, community members can participate deeply in the art creation process in a relaxed manner.

The performance of Botto’s works in the market is also very impressive. At the beginning of 2022, its transaction volume on SuperRare exceeded one million US dollars.

Botto has been online in the field of crypto art for some time, but has never publicly received financing. Although Variant Fund may have been somewhat influenced by the recent AI frenzy, it sees the potential of Botto in the AI and blockchain fields. However, its innovation and artistic characteristics are the reasons why Botto has high investment value in the field of crypto art.

3.6.3 Future Investment Direction

Variant Fund focuses on the younger generation of entrepreneurs. From June to August this year, they will launch the first accelerator program “Variant Founder Fellowship” aimed at early-stage Web3 founders, selecting 20 founders or teams to provide support for them in the early stages. “Variant Founder Fellowship” is an important initiative launched by Variant Fund, aiming to support early-stage Web3 founders and provide them with more opportunities and resources in the early stages. The launch of this accelerator program fully reflects Variant Fund’s attention and support for the crypto field, as well as its support and encouragement for young entrepreneurs.

In addition, the Variant Fund team has supported dozens of leading projects in the industry, which have now formed their Variant Network. The establishment of the Variant Network is another important initiative of Variant Fund, through which the founders and leaders in their investment portfolio are connected, enabling them to build and learn together. In this way, Variant Fund injects more vitality and motivation into the innovation and development of the crypto field, and provides more opportunities and resources for young entrepreneurs.

In the crypto field, which is a new and rapidly developing industry, domain experts are often the builders at the forefront of innovation. Variant Fund advocates a network-based peer learning model, believing that this is the most effective way to interpret the “excellent examples” that emerge in the construction process of Web3, and through the Variant Network, it effectively promotes learning in topics such as product design, token strategies, and regulatory issues. We believe that Variant Fund will continue to drive the development and innovation of the crypto field, providing more opportunities and support for young entrepreneurs.

Overall, Variant Fund’s investment strategy remains relatively conservative while adhering to its open, collaborative, and innovative investment philosophy, committed to providing funding and support for high-quality projects in the crypto field and promoting the development and application of crypto technology.

4. Summary

In this report, we have conducted in-depth research on some key players in the crypto VC industry, including a16z, Multicoin Capital, LianGuairadigm, Mechanism Capital, Polychain, and Variant Fund. They have adjusted their investment strategies to adapt to the ever-changing market and technological trends, such as:

- a16z has rich investment experience and a wide-ranging portfolio. They have long focused on emerging blockchain projects and cryptocurrency innovations, and support seed investments in startups. They will continue to value the long-term value of projects and may continue to lay out in the AI field;

- Multicoin Capital, as a paper-driven investment company, has extensive investment experience in major cryptocurrencies such as Bitcoin and Ethereum. In the future, they may pay more attention to the construction of the Web3 ecosystem. In the volatile market, they will turn their attention back to the infrastructure field and look for innovative projects with disruptive potential, such as AI and gaming projects;

- LianGuairadigm, although recently established, has made a name for itself. The company is committed to long-term investment and innovative project discovery. In the future, they will continue to collaborate with developers and entrepreneurs to provide technical support, business development, and strategic guidance for investment projects, helping these projects achieve commercialization and sustainable development;

- Mechanism Capital will continue to focus on the DeFi and gaming fields. In the future, they may focus on projects that can combine traditional finance with the cryptocurrency market, bringing more opportunities and liquidity to the cryptocurrency market;

- Polychain Capital, as a large and leading cryptocurrency investment company, will continue to have a steady investment strategy in the future. Based on this, they will diversify their investment portfolio to diversify risks and maintain competitiveness in the market;

- Variant Fund, which has emerged, focuses on early-stage cryptocurrency asset investment and emphasizes technical strength and market prospects. In the future, they will focus on the younger generation of entrepreneurs and continue to establish close cooperation with experts and entrepreneurs in the field.

In the future, we will continue to pay attention to and track the continuous development and investment strategies of cryptocurrency funds, not limited to the six institutions mentioned in this article, in order to provide valuable insights for investors and participants in the cryptocurrency ecosystem.

Overall, many cryptocurrency VCs will pay more attention to projects that help build the blockchain ecosystem and return to the infrastructure field. Seed investments and investments in emerging projects (such as AI) are still important, but stability and risk aversion are particularly important for larger funds, and continuous development is their theme. Of course, long-term investment, innovative project discovery, and technical support are essential for a good project, which will help them achieve commercialization and sustainable development, and can also bring greater returns for VCs.

However, the cryptocurrency VC industry also faces challenges such as market risks, technological instability, and uncertain regulatory environment. Therefore, cryptocurrency VC companies still need to maintain flexibility and keen insights to respond to market changes and opportunities. Correspondingly, with the improvement of regulatory environment and the increasing acceptance of cryptocurrency assets by investors, the cryptocurrency VC industry will further mature and develop.

Understanding the investment direction and trends of cryptocurrency VCs is crucial for both investors and entrepreneurs. We look forward to seeing these VCs continuously create value in the cryptocurrency and blockchain fields and make greater contributions to the development of the cryptocurrency ecosystem.

List of investments by 6 major investment institutions in the past year (2022.06-2023.06):

https://www.notion.so/betalpha/VC-42196768f0e947469feef27fb7a1e749?pvs=4

References:

https://dune.com/shogun/perpetual-dexs-overview

Placeholder is a highly thesis-driven VC.

Their stance on Solana was firm even at $8.05 despite the FTX collapse.

Here's what other projects @placeholdervc is looking at in Q1 2023

— Surf (@0xsurferboy) June 5, 2023

There are so many projects in the crypto space.

It’s hard to find the 100x ones early.

Here are 9 promising projects in which VCs have invested.

A thread🧵 pic.twitter.com/1F7RbZtyXj

— MooMs (@Moomsxxx) June 7, 2023

https://www.rootdata.com/

https://www.coincarp.com/

https://www.theblockbeats.info/news/37009

https://www.odaily.news/post/5186632

https://coinstack.substack.com/p/the-crypto-vc-list-2023

https://foresightnews.pro/article/detail/32433

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Overview of the seven major L2 networks: What are their respective advantages and potentials?

- Inventory of 9 Chain Data Tools Outside of Arkham That Have Not Yet Been Released

- Evening Reading | RWA Track: Progress of Top 10 Projects

- List of 15 projects worth keeping an eye on: Thena, Stargate, Pendle…

- Overview of RWA Tracks: Progress of Top 10 Headline Projects and 20 Early Stage Projects

- What projects has dao5, founded by a former Polychain partner, invested in, as part of their plan to co-build a venture capital DAO with the founder?

- 4 Potential Decentralized Physical Infrastructure Network (DePin) Projects: Hivemapper, Render, Helium, and IoTeX