Bear market forces on-chain innovation. Are these newly popular projects worth paying attention to?

Bear market drives on-chain innovation. Are new popular projects worth attention?Author: Day; Plain-language Blockchain

Looking back, it can be seen that most of the industry’s innovations actually occur on the chain, especially when the market is not good. Examples include DEFI, NFT, LSDFI, memes, BRC20, and the ecosystems of various chains, which all first gain popularity on the chain before gradually spreading offline. On the other hand, institutional tokens on top platforms mostly go online with low circulation and high valuation, only to experience significant decline later on. In March and April of this year, there was even a wave of anti-VC token sentiment.

This year, several profitable projects have emerged on the chain. Today, let’s take stock of the representative projects that have appeared on the chain and understand the current innovations on the chain. It should be noted that some projects are currently hot, while others have cooled down. New projects carry higher risks, and the content of this article does not constitute any investment advice.

- ABCDE Why Should We Invest in GRVT (Gravity)

- Interpreting the Future Path and Star Projects of LayerZero’s Cross-chain Innovation

- Analysis of 10 Tips for Web3 Entrepreneurship The period of bonanza for bottom-up project development has passed, and marketing is becoming more important.

01 Social

-

Friend.tech

Friend.tech is a decentralized social application that has recently been widely discussed. Simply put, users register on Friend.tech through X (formerly Twitter), and users can purchase the KEY (shares) of any registered user through Ethereum on the Base chain, gaining the right to chat with them.

During the 6-month testing period, Friend.tech will distribute a total of 100 million points, with distributions occurring every Friday. The distribution of points is related to the value of the held Token KEY (previously Shares, now changed to Keys) and the user’s chat interactions. The value of the holdings accounts for the majority. It can be seen that the official encourages users to hold KEY instead of frequent buying and selling, which is more conducive to the continuous breakthrough of the price of top KEYs.

This model is very beneficial to KOLs with large traffic on X. The official firmly grasps KOLs with traffic in their hands. Recently, the founder of Friend.tech, Racer, had his KEY temporarily close to 7 ETH.

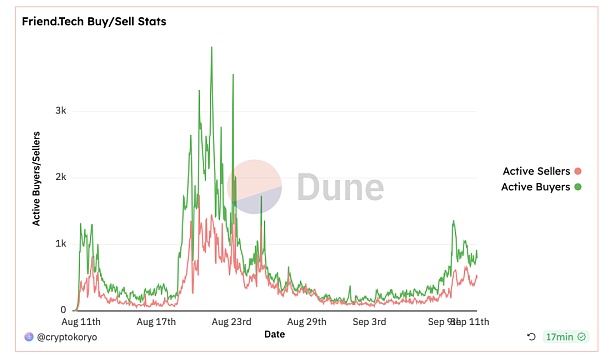

– Friend.tech related data

On the second day of its launch, Friend.tech’s daily trading volume exceeded 4000 ETH and there were over 260,000 on-chain transactions, with Friend.tech invitation codes flooding various communities. Within a few days, media outlets such as Delpha Labs and Bankless even specifically published articles introducing Friend.tech.

Active users of Friend.tech

Active users of Friend.tech

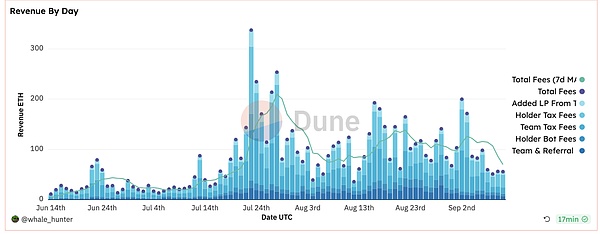

At its peak, Friend.tech ranked second in daily revenue, surpassing leading players in fields such as Lido and Uniswap, and even surpassing Layer1 protocols like Bitcoin. It should be noted that while the income of protocols like Lido and Uniswap is high, most of the earnings are taken away by users. On the other hand, Friend.tech retains half of its tax in its own treasury. In comparison, its short-term profit-making ability far exceeds that of other protocols.

Although after the fomo surge, the returns and the number of active users have dropped more than 90% from their peak, recently there has been some resurgence in popularity due to the recent distribution of points, and Friend.tech has once again flooded the market.

Friend.tech related data, source: dune

Friend.tech related data, source: dune

As of September 11th, Friend.tech has made a total profit of nearly 6.4 million US dollars and has accumulated 3.5 million transactions.

– Reasons for its popularity:

1) Attached to X, Friend.tech accounts are strongly associated with X accounts, and X is currently a gathering place for traffic in the industry;

2) LianGuairadigm’s participation, with the expectation of point distribution. It is worth noting that those who participate in LianGuairadigm’s investment cannot escape the distribution of tokens. Since points are distributed every Friday, it will inevitably drive discussions about Friend.tech;

3) Founders of Three Arrows, YC President, and other well-known KOLs on Twitter have joined, and on the other hand, because of the 5% revenue sharing, they are also interested in promoting and speaking positively about it.

The screenshot below shows that the top-ranked account has made a profit of 124 ETH through a 5% tax. In addition, there are also some bloggers in Friend.tech who are not originally KOLs and have no influence, but have become leaders in their own right, leading to a surge in X fans and influence.

Friend.tech account top profit ranking, source: dune

-

Other social projects

Regarding social projects that have gained popularity recently, one is TipCoin, which spreads virally on Twitter and floods the entire Twitter community. This week, it will issue tokens and update the rules for the second round of point distribution on Sunday. Another project that has recently dominated a certain security is CybeConnect, which, apart from generating some buzz after being listed on a certain security, has received a lukewarm response from other aspects. As for the previously highly anticipated Lens Protocol, due to the recent opening of new invitation quotas and occasional user seduction, its level of attention has plummeted.

02 Robots

With the rise of Unibot, the concept of robots has also become a new track. There are hundreds of projects related to robot defense and micro-innovation. Telegram, as a essential social software in the industry, has 800 million monthly active users. Through Telegram Bots, it simplifies the path of encrypted interaction and implements built-in functions such as DeFi, MEV protection, data analysis, whale tracking, and game community governance within the Telegram platform. It has quickly gained popularity due to its easy access, convenience, and wide range of applications.

However, things that grow rapidly often come with doubts and concerns. The hidden security risks and technological maturity of Telegram Bots have also begun to receive attention and discussion.

-

Unibot

Unibot was launched in June and became a phenomenal product in just two months. There are hundreds of robot copycat projects, with a market value of over 200 million US dollars at its peak. However, the recent launch of Banana Gun has squeezed Unibot’s market share, leading to a significant decrease in users and a current market value of around 60 million US dollars. Despite the severe setback, Unibot is still a leader in the robot track.

– Product Overview

Unibot’s features include new project tracking, copy trading, and limit orders. Within Telegram, it can directly track tokens and precisely strike (snipe) at the opening price, with a speed faster than CEX and DEX like Uniswap, improving efficiency. There are many tutorials available for specific usage.

– There are two ways to charge for Unibot:

1) Unibot Robot Service Fee

A service fee of 1% is charged for using Unibot robots, with 40% of the fee allocated to $UNIBOT token holders and the remaining used for team operations.

2) Service Tax for Token $UNIBOT

$UNIBOT has a 5% tax, with 1% of the trading volume distributed to $UNIBOT holders.

Currently, the daily revenue is around 100 ETH, with a peak of over 300 ETH per day.

Source: dune

Total revenue is around 8200 ETH, approximately 13 million US dollars, in the three months since its launch, even in the current unfavorable market conditions. It can be said that it is very good, with a total of about 15,000 users.

-

Banana Gun

Banana Gun is a highly popular project recently, and its appearance has even affected Unibot’s market share. Currently, the total number of users is the same as Unibot, with slightly more active users and a revenue of 650 ETH. Its functionalities are similar to Unibot, but it is stronger in sniping the opening price. Last week, it completed a presale of 800 ETH and opened this morning. For new users, 1 ETH turned into 11 ETH. However, it withdrew liquidity due to contract tax issues and will reopen in the future.

-

Other Robots

Check Token Contracts: In the mixed world of on-chain projects, 9.9 out of 10 projects will run away, so it is important to use on-chain tools to check project information when new projects go online. There are robots that specialize in analyzing information revealed by project contracts, such as whether the pool is locked, whether contract permissions are abandoned, whether it is a mythical beast, and the possibility of rug pull, etc. This greatly reduces the threshold and improves efficiency for non-coders.

Track Smart Wallet Addresses: Similar to Nansen’s smart wallet address function, it provides information on addresses with good winning rates and discloses their specific operations, making it convenient for users to copy trade.

Tracking new project token contracts: This is mainly used for sniping new projects when they go live, taking advantage of the opening dividends, and sniping the openings of some well-known projects. Of course, the competition is fierce, and if you’re not careful, you’ll be left behind. The deployment of the code is mainly on the chain, and as long as it’s on the chain, there will be traces left behind. Some robots specifically capture project contract information through on-chain data and then push it to users.

-

Reasons for its popularity:

1) It is one of the most widely used applications in the industry, naturally attracting traffic; 2) Buying and selling is a basic need. It can be seen that all the functions of the robot revolve around buying and selling. Of course, the most important thing is profitability, otherwise, who would use it.

03 meme

Meme can be said to be the category with the most projects on the chain at present. Because it lacks practicality and the cost of launching a project is very low, as the saying goes, a celebrity’s sentence or a picture can be turned into a project. Especially in the current bear market, dozens or even hundreds of memes are born on the chain every day, but most of them leave nothing behind.

-

Bitcoin(HarryPotterObamaSonic10Inu)

Currently valued at $50 million, it was launched in May and reached a peak market value of over $200 million. It ranks sixth among all memes. It is listed here because of its previous impressive performance. As for future performance, it’s hard to say. The purpose of this article is to help everyone understand this track.

Bitcoin was launched in May this year. Its inspiration comes from a backpack found in a store in the Netherlands, covered with unrelated logos and text. It calls itself the “people’s bitcoin” with the stock code “BITCOIN”.

It all started with a backpack:

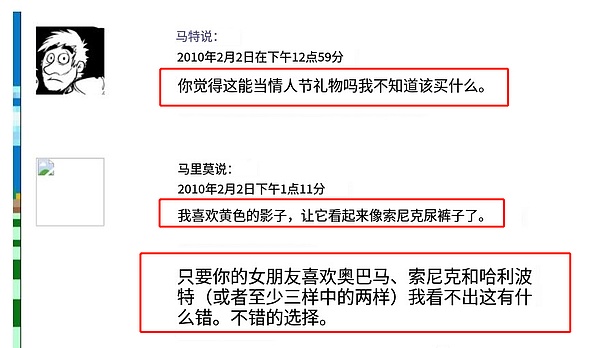

In 2010, a person bought a backpack and posted on the Internet, asking for opinions on whether it could be given as a Valentine’s Day gift to his girlfriend.

Because the backpack had diverse elements, a netizen criticized it, saying, “If your girlfriend likes Obama, Harry Potter, and Sonic who wets his pants (there is a yellow mark below Sonic), then this will be the best Valentine’s Day gift.”

Because of the sharp response from netizens, this became a meme and went viral online. In short, based on this old meme, the project party launched a project, which resonated with a group of foreigners and became popular.

It can be said that it is very simple to create a meme, but to make a meme successful, it depends heavily on the project party’s marketing capabilities. Only with a good team and good meme elements,can a meme project be successful. The popularity of Bitcoin seems to be just because of an inconspicuous meme element, but if you dig through its website and official tweets, you will find that it is not that easy, just like the previous popularity of Pepe.

04 Summary

From the innovative projects on the blockchain, we can see that the core demand of the industry is still buying and selling. Currently, platforms such as Binance, Uniswap, OpenSea, etc. are all focused on trading. Let’s summarize the reasons why these blockchain projects can succeed:

1) By satisfying the interests of a small number of people who already have traffic in the industry, the project can gain FOMO (fear of missing out) and thrive, as this industry is driven by traffic;

2) Profitable projects mainly rely on taxation, making money from retail investors and meeting some of their needs.

Currently, the industry’s infrastructure is saturated, so the next step will inevitably be the development of applications. Web3 applications only need to rely on large platforms with traffic (such as Twitter and Telegram) for development, without needing to start from scratch. Additionally, in the future, various data such as TVL (total value locked) and user count may not be the main focus, but rather the actual profit-making ability. How much money you can earn will determine how high you can climb.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Overview of the first six investment projects of the Base Ecosystem Fund

- One out of a hundred, taking stock of the first batch of investment projects by the Base Ecology Fund.

- Nima Capital sells tokens and sells luxury homes, previously invested in these 16 projects.

- With 8 years of experience and managing over 540 million dollars, how does CoinFund, a cryptocurrency fund, choose its track and invest in projects?

- Investment institution Rug? Nima Capital sells tokens to sell luxury homes, previously invested in these 16 projects

- APR Winter? A comprehensive analysis of high-yield DeFi projects in the market

- 20 Worth-Watching Unreleased Coin Projects