ABCDE Why Should We Invest in GRVT (Gravity)

Why Invest in GRVT (Gravity)Author: Lao Bai, ABCDE

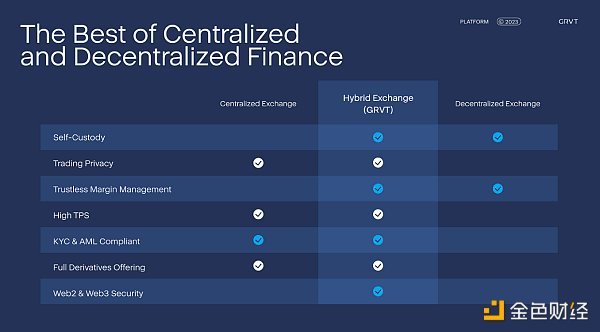

GRVT (Gravity) is a hybrid on-chain exchange – Hybrid Exchange (Hex), combining the user experience of Cex with the fund security of Dex. Gravity will become the leading derivative trading protocol on zkSync, competing with Arbitrum’s gmx, and the well-established Dydx from Starkex. It will be launched on the testnet in Q4.

ABCDE has invested in Gravity during the seed round. Other participating institutions in this round include Sinovation Ventures, Delphi Digital, C² Ventures, and others.

1. The future of on-chain derivatives

- Interpreting the Future Path and Star Projects of LayerZero’s Cross-chain Innovation

- Analysis of 10 Tips for Web3 Entrepreneurship The period of bonanza for bottom-up project development has passed, and marketing is becoming more important.

- Overview of the first six investment projects of the Base Ecosystem Fund

In 2017, during the era of EtherDelta, on-chain spot trading faced a dilemma. Despite waving the flag of decentralization and chanting the slogan “Not your Key, not your Asset,” the reality was that 99.9% of transactions still occurred on centralized exchanges.

Later, Uniswap emerged and revolutionized the AMM paradigm. After several years of development, the trading volume of Dex relative to Cex spot trading has climbed from less than 1% to 10%-20%. This has also established a duopoly of Uniswap and Curve in the Dex market. To break through in the spot trading field, a new Dex might need to seize the opportunity during the early stages of a new chain’s wild period.

Regarding derivatives, compared to the red ocean of spot trading, it is still in a blue ocean turning into a red ocean phase. The market share of on-chain derivative trading on centralized exchanges is only 1%-2%, similar to the starting point of spot Dex during the DeFi Summer period. Although GMX and DYDX seem to dominate a duopoly similar to Uni+Curve, their dominance is incomparable. This can be seen from the recent release of GMX V2 and DYDX V4, which did not bring any changes in token price or trading volume.

So, where is the direction for on-chain derivatives?

The fundamental reason why on-chain derivatives have always been praised but not widely adopted is the inability to provide a differentiated experience from Cex. Uniswap initially relied on “unlicensed imitations” (commonly known as “dog coins”) and liquidity mining to start, while Curve held an absolute advantage in ultra-low slippage stablecoin trading, liquidity pools for bills and collateral assets (such as stETH), and innovative veTokens. These are services and experiences that Cex cannot provide. On the other hand, derivative Dex can only provide futures or options services for mainstream or blue-chip assets due to the nature of derivatives, which cannot truly differentiate from Cex. Under the premise that performance and liquidity experiences are inferior to Cex, ordinary users who are willing to switch from Cex to Dex are few and far between, except for Degen or whales who highly value security and financial autonomy.

In other words, users can come to the blockchain for functionalities that cannot be obtained from Cex and “incidentally” experience decentralization. However, they will not sacrifice the performance and experience of Cex for the sake of “political correctness” of decentralization.

So, why not change the perspective? If, without giving up the performance and experience of Cex, your assets can be made more secure and autonomous through decentralized means, would users be enticed by this? Could this be the possible breakthrough path for on-chain derivatives?

2. FTX Thunderbolt – An Appropriate Assistance Opportunity

Security issues never receive real attention – until the moment security issues occur

No one could have anticipated that FTX, the world’s second-ranked cryptocurrency exchange and possibly the best overall trading experience, would collapse within days, causing significant losses for numerous users and institutions. The security issue at Cex has finally attracted the attention of users, and the phrase “Not your Key, Not your Asset” has once again sparked discussions.

The derivative field has also finally ushered in a new paradigm – the Hybrid Exchange (Hex).

3. Hybrid Exchange – Gravity

Overall, as a hybrid exchange, Gravity’s positioning leans more towards Cex. However, compared to Cex, it has one key mechanism that sets it apart – Self Custody Trading, which is the funds’ self-custodianship mentioned earlier. For Degen, it is easy to trade using Metamask or Wallet Connect, similar to DYDX or GMX. For users who are familiar with Cex and do not play much on-chain, Gravity provides a user-friendly email registration experience similar to Web3Auth, generating an MPC Wallet experience, eliminating the hassle of mnemonic words and private key management. It minimizes the entry barrier while ensuring the security of self-owned funds.

Compared to common Dexes like DYDX and GMX, Gravity’s differentiators are much more apparent, including several key features:

-

Transaction Privacy – Current on-chain derivatives are basically “transparent,” but Gravity uses Validium technology to ensure that each user’s transactions are not visible to other users on the chain.

-

High-Performance Orderbook – A highly performant off-chain CLOB order matching system that can achieve up to 600KTPS and a 2ms delay, essentially matching the trading experience of Cex.

-

User Portfolio Management – The system provides a series of user panels and management functions commonly seen in centralized derivative exchanges, such as SLianGuaiN analysis, portfolio margining, and cross-market hedging.

-

Simultaneous Provision of Options and Futures – Typically, on-chain derivative options and futures are entirely separate projects. Gravity, however, leans towards the Cex style by offering both options and futures contract trading, creating a one-stop platform for derivatives.

-

Embracing Regulation and Compliance – Strict KYC and AML (Anti-Money Laundering) support

4. Integration of a Professional Finance and Web3 Experience Team

In addition to the product itself, the team and market positioning are also significant factors in our decision to invest in Gravity.

-

The team consists of individuals with backgrounds in traditional finance, such as Goldman Sachs and DBS Bank, as well as Crypto “native OGs” from Bybit and OKX.

-

The team is rooted in South Korea and has a deep understanding of the South Korean market. The trading enthusiasm in the Korean market is noticeably higher than in other countries, making it relatively easier to launch the product and radiate outward from the Korean market.

-

Gravity will be launched on Zk-Sync. For ZK-Sync, it has recently faced challenges such as various “Rug” issues and a lack of original projects, making it in urgent need of an innovative and high-quality project to revitalize the entire ecosystem. GMX achieved this with Arbitrum, and we see the potential for Gravity to lead the Zk-Sync ecosystem.

-

In the previous round of DeFi Summer, spot trading was the focus, and on-chain derivative trading was essentially absent. In the next bull market, on-chain derivative trading, especially innovative hybrid exchanges that combine the advantages of Cex and Dex, will undoubtedly occupy a place in the market.

The team will launch the testnet in Q4 this year and the mainnet in Q1 next year. We are very excited about the hybrid trading experience brought by Gravity. We have taken over the baton from Dydx, who left Starkex, and will become the “new Dydx” on Starkex, bringing new chapters to on-chain derivatives.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- One out of a hundred, taking stock of the first batch of investment projects by the Base Ecology Fund.

- Nima Capital sells tokens and sells luxury homes, previously invested in these 16 projects.

- With 8 years of experience and managing over 540 million dollars, how does CoinFund, a cryptocurrency fund, choose its track and invest in projects?

- Investment institution Rug? Nima Capital sells tokens to sell luxury homes, previously invested in these 16 projects

- APR Winter? A comprehensive analysis of high-yield DeFi projects in the market

- 20 Worth-Watching Unreleased Coin Projects

- What does the SEC action mean by treating NFT projects as unregistered securities for the first time, and what does the related legislation say?